It’s Infrastructure Week and Money is on the Table for Existing Pipeline Companies

Originally published November 10, 2021

What’s the issue?

President Biden was finally able to get his infrastructure bill passed by Congress late last week.

Why does it matter?

The bill authorizes the expenditure of over $16 billion for projects that could include grants and loans to incumbent pipeline companies that choose to participate in the authorized programs, which include carbon capture and storage and the creation of hydrogen hubs.

What’s our view?

Some of the timelines for participating in these programs will expire within 180 days following the date the president signs the bill. Therefore, incumbent companies in the natural gas industry, which are generally not familiar with federal grant and loan programs, may need to start their plans now if they want to participate in these programs.

President Biden was finally able to get his infrastructure bill passed by Congress late last week. We previously looked at the scope of the spending authorized by the bill in Senate Infrastructure Bill Offers Opportunities for Incumbent Energy Companies. But now that the bill is finally a reality, today we look at some major programs in the bill in which incumbent companies may want to participate. The bill authorizes the expenditure of over $16 billion for such projects. However, some of the timelines for participating in these programs will expire within 180 days following the date the president signs the bill. Therefore, incumbent companies in the natural gas industry, which are generally not familiar with federal grant and loan programs, may need to start their plans now if they want to participate.

Spending on the Energy Evolution

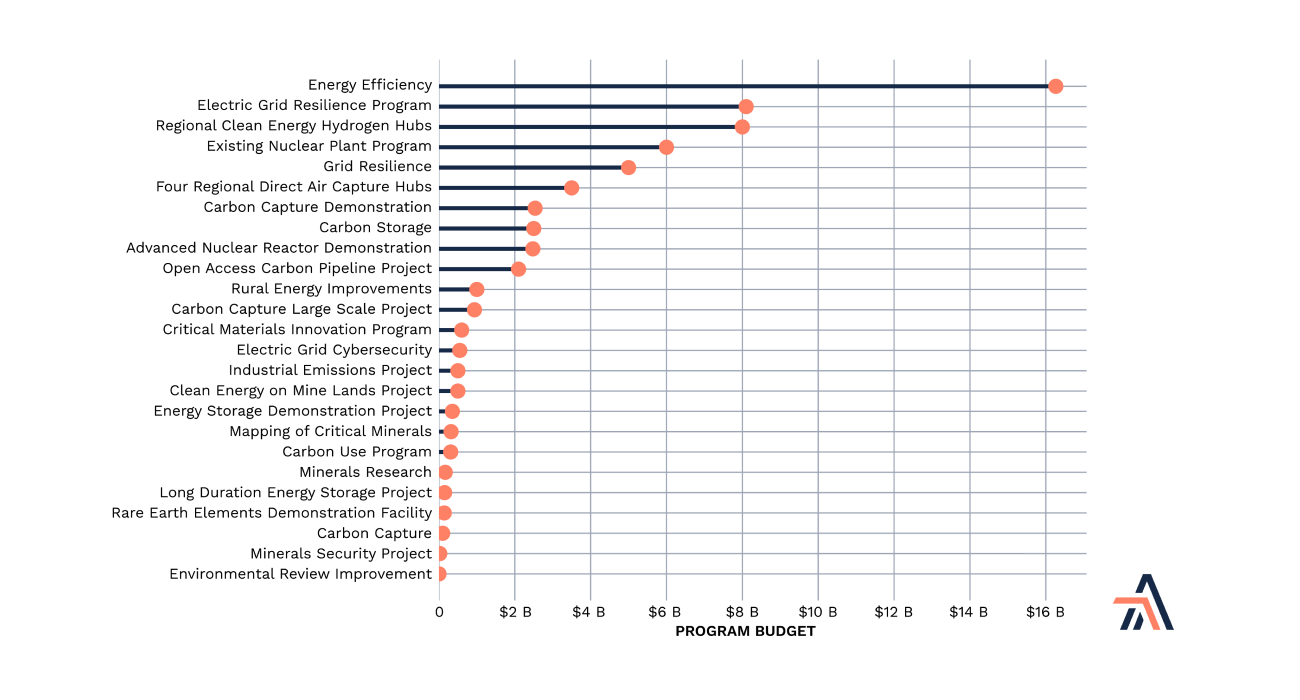

In our prior article, we noted that over $60 billion of the almost $500 billion newly allocated money in the bill is for what we referred to as the “energy evolution.” We further broke this spending down into the actual programs authorized under the bill.

Today we look at four of the larger expenditures in the bill that promote programs that incumbent energy companies may be especially qualified to participate in. As we discuss below, some of these programs have very short deadlines, but some of the programs have qualification criteria (which we have bolded in our descriptions) that would favor participation by incumbent companies.

Regional Clean Hydrogen Hubs - $8 Billion

Within 180 days following the president signing the bill, which is expected to be next week, the Secretary of Energy is to solicit proposals for at least four regional clean hydrogen hubs that can demonstrate the feasibility of producing, processing, delivering, storing, and using clean hydrogen and that will facilitate the development of a clean hydrogen economy. Within one year after the proposals are submitted, the Secretary is to announce which proposals have been accepted. The $8 billion authorized by the bill is to be awarded in the form of grants to those projects selected to accelerate the completion of those projects.

The bill has some very specific selection criteria that will certainly favor one project over another. In particular, at least two of the selected projects are to be in regions of the U.S. with the greatest natural gas resources. In addition, the bill directs that the selected projects exhibit a diversity among the feedstock for the clean hydrogen, in that at least one project shall be required to use the following feedstocks: (1) fossil fuels; (2) renewable energy; and (3) nuclear energy. Similarly, the end uses of the clean hydrogen to be produced are to be diverse as well, with at least one project designed to provide hydrogen for the following uses: (1) electric power generation; (2) industrial processes; (3) residential and commercial heating; and (4) transportation.

Regional Direct Air Capture Hubs - $3.5 Billion

Within 180 days following the president signing the bill, the Secretary of Energy is to solicit applications for funding for eligible projects designed to develop four regional direct air capture hubs. The $3.5 billion authorized by the bill is to be awarded in the form of grants to those projects selected to accelerate their completion. Such hubs must be able to capture and sequester, utilize, or sequester and utilize at least 1,000,000 metric tons of carbon dioxide from the atmosphere annually. Each such hub should be a network of direct air capture projects, potential carbon dioxide utilization off-takers, connective carbon dioxide transport infrastructure, subsurface resources, and sequestration infrastructure located within a region. In addition to these basic criteria, at least two of the chosen hubs are to be located in economically distressed communities in the regions of the U.S. with high levels of coal, oil, or natural gas resources.

Large Scale Carbon Storage Commercialization - $2.5 Billion

The Secretary of Energy is to develop an application process to solicit proposals for funding for the development of new or expanded commercial large-scale carbon sequestration projects and associated carbon dioxide transport infrastructure, including funding for the feasibility, site characterization, permitting, and construction stages of project development. Priority for funding is to be given to projects (1) with substantial carbon dioxide storage capacity; or (2) that will store carbon dioxide from multiple carbon capture facilities.

Open Access Carbon Dioxide Transport Loan Program - $2.1 Billion

The Department of Energy’s Office of Fossil Energy and Carbon Management, in consultation and coordination with the Department of Energy’s Loan Program Office, is to oversee a new loan program designed to facilitate the creation of common carrier carbon dioxide transportation infrastructure. The operator of such infrastructure would be required to publish a publicly available tariff containing the just and reasonable rates, terms, and conditions of nondiscriminatory service and provide transportation services to the public for a fee. Projects that qualify for the program could include pipeline, shipping, rail, or other transportation infrastructure and associated equipment that will transport or handle carbon dioxide captured from anthropogenic sources or ambient air.

To qualify under the program, the anticipated project costs should equal or exceed $100 million. The program should give priority to projects that (1) are large-capacity, common carrier infrastructure; (2) have demonstrated demand for use of the infrastructure by associated projects that capture carbon dioxide from anthropogenic sources or ambient air; (3) enable geographical diversity in associated projects that capture carbon dioxide from anthropogenic sources or ambient air, with the goal of enabling projects in all major carbon dioxide-emitting regions of the United States; and (4) are sited within, or adjacent to, existing pipeline or other linear infrastructure corridors, in a manner that minimizes environmental disturbance and other siting concerns.

The Path Forward

While there may already be a number of projects that are qualified under the criteria set out in these various sections of the bill, there is also still time for project developers to identify and plan projects that meet the bill’s requirements. However, many of the projects are not single company projects, but, rather, would require coordination among a number of participants. Given the short 180 day proposal period in the first two programs, work would likely need to begin immediately, if a project hopes to submit a timely application. Many of these projects need to move forward or the incumbent asset owners risk being bypassed by solutions that do not include the use of their assets. So it would certainly be in the interests of the incumbent asset owners to ensure that a sufficient number of proposals are submitted in each of these programs to fully utilize the expenditures authorized under each program.

If you would like information on these or other programs funded in the infrastructure bill, please contact us.