Eight Billion Reasons for a Bit of Bipartisanship

Originally published for customers March 16, 2022.

What’s the issue?

The infrastructure bill passed last year included $8 billion for the creation of at least four hydrogen hubs around the country.

Why does it matter?

The Department of Energy has released a request for information regarding how it should award the money, and the Senate Committee on Energy and Natural Resources held a hearing in February on the same topic.

What’s our view?

During the Senate hearing almost every member of the committee, both Republicans and Democrats, were essentially pitching their states for the site of at least one of the four hubs, and Senator Mark Kelly even suggested that there needed to be more than just four. This represents a great opportunity for existing infrastructure companies, including natural gas pipelines, to participate in the creation of these hubs and to aid the Department of Energy in developing criteria that will benefit incumbents.

The infrastructure bill passed last year included $8 billion for the creation of at least four hydrogen hubs around the country. The Department of Energy has released a request for information regarding how it should award the money, and the Senate Committee on Energy and Natural Resources held a hearing in February on the same topic.

During the Senate hearing almost every member of the committee, both Republicans and Democrats, were essentially pitching their states for the site of at least one of the four hubs, and Senator Mark Kelly even suggested that there needed to be more than just four. This represents a great opportunity for existing infrastructure companies, including natural gas pipelines, to participate in the creation of these hubs and to aid the Department of Energy in developing criteria that will benefit incumbents.

What the Infrastructure Bill Did

We last discussed the infrastructure bill in It’s Infrastructure Week and Money is on the Table for Existing Pipeline Companies, soon after it was passed by Congress last year. One of the key elements we discussed then was the provision of the bill that authorized the expenditure of $8 billion for at least four regional clean hydrogen hubs that can demonstrate the feasibility of producing, processing, delivering, storing, and using clean hydrogen to facilitate the development of a clean hydrogen economy. The bill requires the Secretary of Energy, within 180 days following the president signing the bill, May 16, 2022, to solicit proposals for at least four regional clean hydrogen hubs. Within one year after the proposals are submitted, May 16, 2023, the Secretary is to announce which proposals have been accepted. The $8 billion authorized by the bill is to be awarded in the form of grants to those projects selected to accelerate the completion of those projects.

The bill included some very specific selection criteria that will certainly favor one project over another. In particular, at least two of the selected projects are to be in regions of the U.S. with the greatest natural gas resources. In addition, the bill directs that the selected projects exhibit a diversity among the feedstock for the clean hydrogen, in that at least one project shall be required to use the following feedstocks: (1) fossil fuels; (2) renewable energy; and (3) nuclear energy. Similarly, the end uses of the clean hydrogen to be produced are to be diverse as well, with at least one project designed to provide hydrogen for the following uses: (1) electric power generation; (2) industrial processes; (3) residential and commercial heating; and (4) transportation.

Department of Energy’s Request for Information

On February 15, 2022, the Department of Energy (DOE) issued a request for information (RFI) seeking public input regarding the solicitation process and structure of a DOE Funding Opportunity Announcement (FOA) to fund regional clean hydrogen hubs. The RFI includes some preliminary terms of a potential FOA and seeks comment on a broad range of issues, with a deadline for submissions of Monday, March 21, 2022.

The proposed FOA appears to stretch, if not outright violate, the statutory deadline of awarding the full $8 billion within eighteen months following the signing of the bill. First, it breaks the funding into three phases, with the first phase being only for $4 to $5 billion and not making any final awards until up to 27 months after the announcement is issued, which is much longer than the 12 months required by the statute. The second phase, which would be for $2 to $3 billion, would stretch out a full 45 months after the issuance of the FOA, which would be beyond the end of the Biden administration. Finally, there is a third phase that is expected to use up $1 to $2 billion of the total $8 billion and will only be given to the existing hubs once they are operational.

It also appears that the DOE is planning to adopt a suggestion made by Senator Kelly of Arizona during a hearing last month before the Senate Committee on Energy and Natural Resources (ENR Committee), in that it intends to spread the $8 billion among more than four hubs. The RFI states that the ultimate goal is to make awards to a total of six to ten projects with a range of awards from $500 million to $1 billion.

Potential Locations of Hubs

In early February, the ENR Committee held a hearing on clean hydrogen. Those testifying before the committee included Dr. Sunita Satyapal, the Director of the DOE’s Hydrogen and Fuel Cell Technologies Office, Dr. Glen Richard Murrell, the Executive Director of the Wyoming Energy Authority, Mike Graff, Chairman and CEO of American Air Liquide Holdings, Incorporated, and Brian Hlavinka, a Vice President for the Williams Company, New Energy Ventures. While not all members of the committee attended the meeting, those who did seemed intent on promoting their states as hosts for one of the hydrogen hubs, and a number of states were promoted either by the witnesses or the senators themselves.

.png?width=458&name=Blog%2003162022%20(2).png)

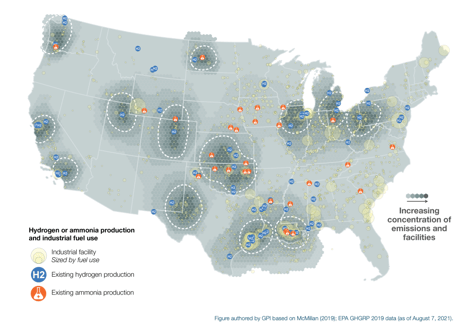

As seen above, many more states than just four are interested in hosting a hydrogen hub. The opportunity to host a project that will bring part of an $8 billion fund to a senator’s home state is something that clearly crosses party lines. In addition, also in February, the Great Plains Institute (GPI), which describes itself as a nonpartisan, nonprofit organization working to transform the energy system to benefit the economy and environment, issued what it described as an atlas of carbon and hydrogen hubs. That atlas provided the following map of likely locations for such hubs.

There is substantial overlap between these two maps and therefore, those areas that have both the needed infrastructure and the political support would seem to have a lead on other areas of the country.

Private Companies Are Moving Ahead

While the DOE may be moving slower than the legislation would suggest it should, private companies appear to be joining together to promote a number of hubs around the country. In his testimony to the ENR Committee, Mr. Graff from Air Liquide described Air Liquide as being an active partner in several early stage hub discussions, including hubs in the Gulf Coast to decarbonize its existing assets; hubs in California to expand the hydrogen transportation sector to include heavy-duty vehicles; and hubs in the Northeast to help decarbonize industry and enable better grid resiliency. Similarly, Mr. Hlavinka discussed Williams’s Wyoming Clean Energy Hub that is designed to integrate renewable power, hydrogen, captured carbon dioxide, and methanation into Williams’s existing natural gas assets that originate in Wyoming. In addition, he noted that Williams is working with Ørsted, the international renewable energy developer, to identify ways to leverage their renewables and hydrogen expertise, including the exploration of a large-scale wind energy co-development in western Wyoming where Williams owns more than a million acres of land, as well as significant natural gas infrastructure. He also noted that Williams is working on hydrogen hub efforts in the Rocky Mountain region, the Gulf Coast, the Southeast, the Mid-Atlantic (Carolinas) and a region that includes Oklahoma, Arkansas and Louisiana, as well as any other hydrogen hub that coincides with Williams’s existing infrastructure. Other recent announcements by developers include the following:

- Hy Stor Energy announced a green hydrogen production and storage complex project in Mississippi.

- A joint venture including EQT Corporation, Equinor, GE Gas Power, Marathon Petroleum, Mitsubishi Power, Shell Polymers and U. S. Steel to develop a low-carbon and hydrogen industrial hub in Ohio, Pennsylvania and West Virginia.

- Southern California Gas has announced its Angeles Link, which would create green hydrogen from 100% renewable electricity and then deliver it into the Los Angeles region by pipeline, which it says would significantly reduce greenhouse gas emissions from electric generation, industrial processes, heavy-duty trucks, and other hard-to-electrify sectors of the Southern California economy.

We will continue to watch as these programs develop and report on the actual projects submitted once the DOE issues its FOA on or before May 16.