REPORT

Most power generation projects are delayed, but predictive models sharpen capacity addition forecasts

For completed projects, our preliminary models when run on historical data forecast within 3% of the actual capacity that went into operation each month on average — a vast improvement on the 30% margin of error in developer estimates.

What's the issue?

Power generation projects that entered operation in the past five years have been about five months behind developer expectations on average; that constitutes 100,000 MW of delayed capacity and 65% of the total capacity during this time period.

Why does it matter?

These projects are an important aspect of America’s evolving energy landscape, and their operational dates impact commodity markets with rippling effects throughout the value chain.

How can Arbo help?

Arbo is developing solutions to align expectations with reality when it comes to capacity additions. For completed projects, our preliminary models when run on historical data forecast within 3% of the actual capacity that went into operation each month on average — a vast improvement on the 30% margin of error in developer estimates.

Background: Arbo’s Project Data Expertise And Data Engineering Capabilities

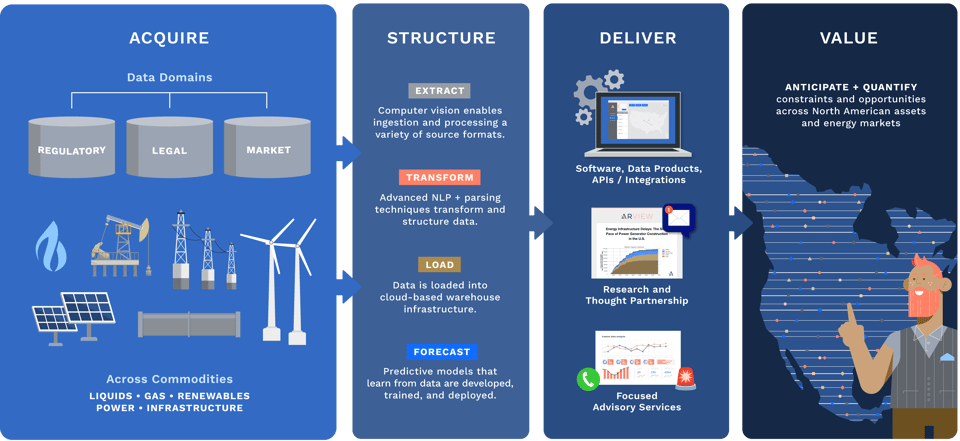

Arbo leverages almost a decade of data and software engineering experience in the energy domain to automate the extraction, structuring, and storage of critical data from public sources. This eliminates the need for our customers — project teams, commodity traders and marketers, and energy regulatory bodies — to manually compile and parse data from federal and state government websites, legal filings, company press releases, and other disaggregated sources.

Arbo’s data acquisition system extracts new and historical project information spanning more than two decades, standardizes data points and structures from the various sources, imputes missing data, and identifies essential parameters. The collected data is stored in our cloud-based data warehouse to enable internal analysis by in-house subject matter experts, predictive modeling by our data scientists, and seamless integration with third-party entities via API.

Assembling A Generation Project Dataset

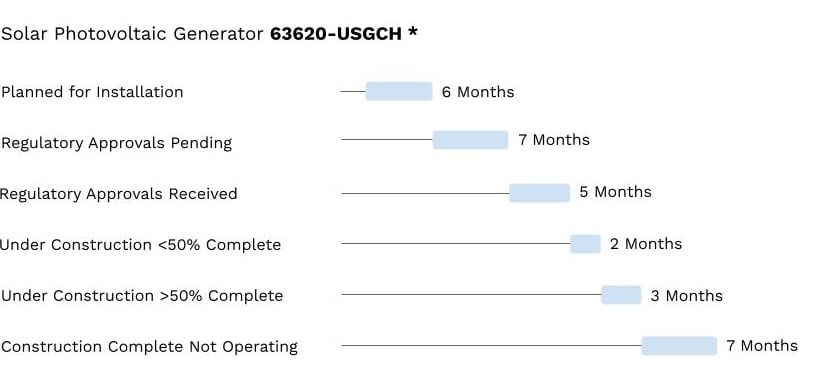

Arbo engineers systematically analyze each iteration of relevant regulatory filings submitted by power generation project developers and derive uniquely identifying project attributes in order to join data from new and historical filings.

Once assembled, this data allows us to visualize regulatory, permitting, and construction timelines of each project planned in the past two decades.

* Unique generator identifier as extracted from EIA filings

The aggregation of timelines for a subset of completed and in-progress projects allows for the statistical analysis of low, median, and high phase durations as seen in the sample graph below.

-1.jpg?width=785&height=393&name=Power%20Generation%20Model%20(1)-1.jpg)

Arbo can perform these aggregate analyses on any subset of projects, sliced by one or many parameters, such as location, balancing authority, nameplate capacity, and technology.

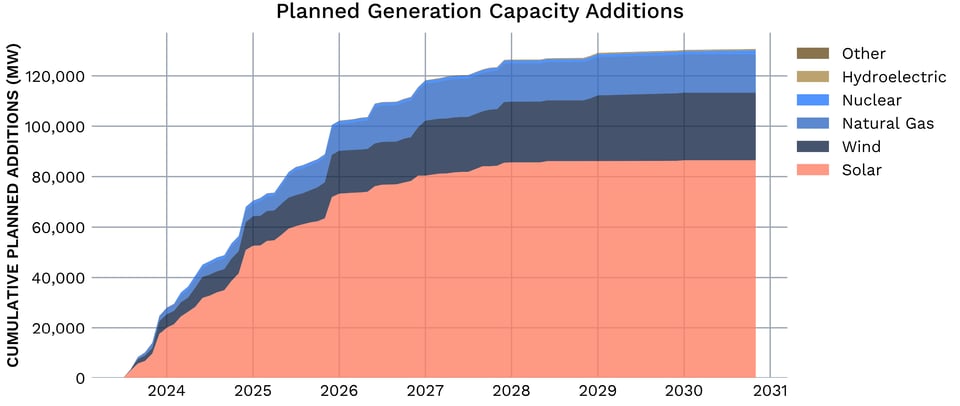

Project developers are required to file estimated operational dates for planned power generators at electric power plants with at least 1 megawatt (MW) of combined nameplate capacity. By factoring in reported nameplate capacity, the expected timing of cumulative capacity additions can be visualized.

Data Shows Projects Are Delayed

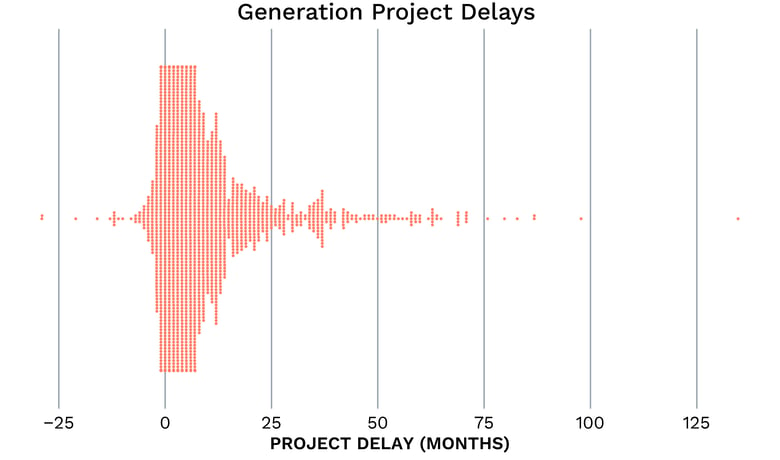

While historical project timelines and developer-provided estimates offer a useful starting

point for operational date forecasting, they often fail to represent realistic timelines that can be impacted by factors such as regulatory, market, and litigation events. An examination of operational dates of projects completed in the past five years demonstrates this disconnect and illuminates the disparity between estimated and actual operational dates. As shown in the below chart, projects are now delayed an average of five months when compared to their initial developer-provided estimates.

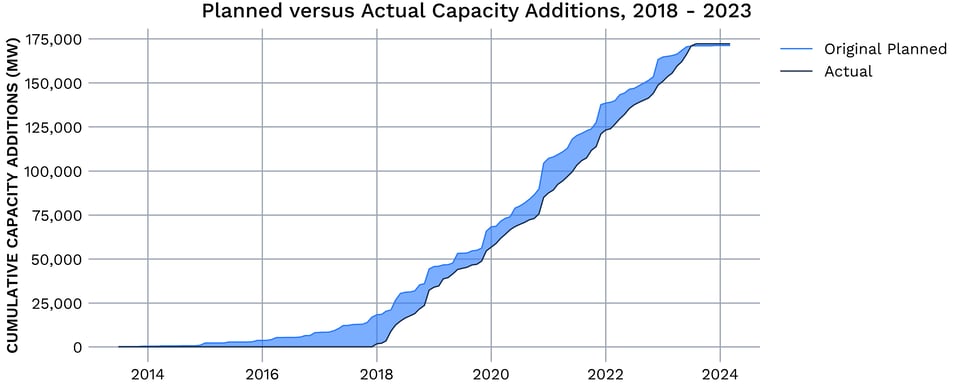

Layering in the nameplate capacities of these projects, we can see the cumulative effect on the nation’s power generation capabilities.

The shaded blue section above highlights the cumulative generation capacity that remained non-operational beyond estimated operational dates. A staggering 100,000 MW of generation capacity that has gone into operation since the beginning of 2018 was delayed by a month or more, constituting a substantial 65% of the total capacity additions for that period.

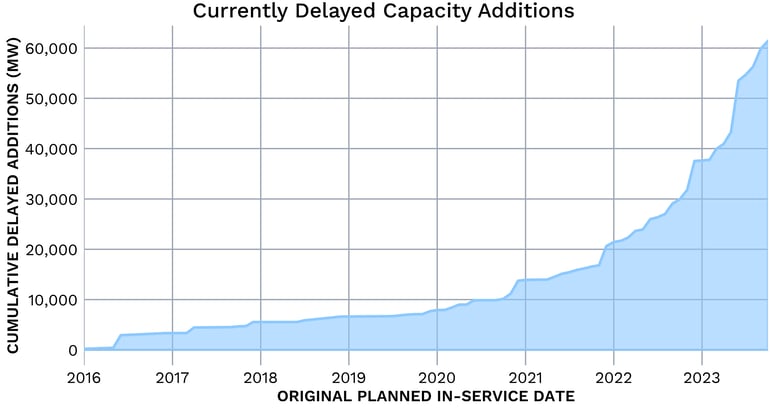

This graph doesn’t account for 60,000 MW of capacity represented by the many delayed projects that were supposed to be in operation today, but are not yet — shown in the visualization below.

Predictive Models Align Expectation to Reality

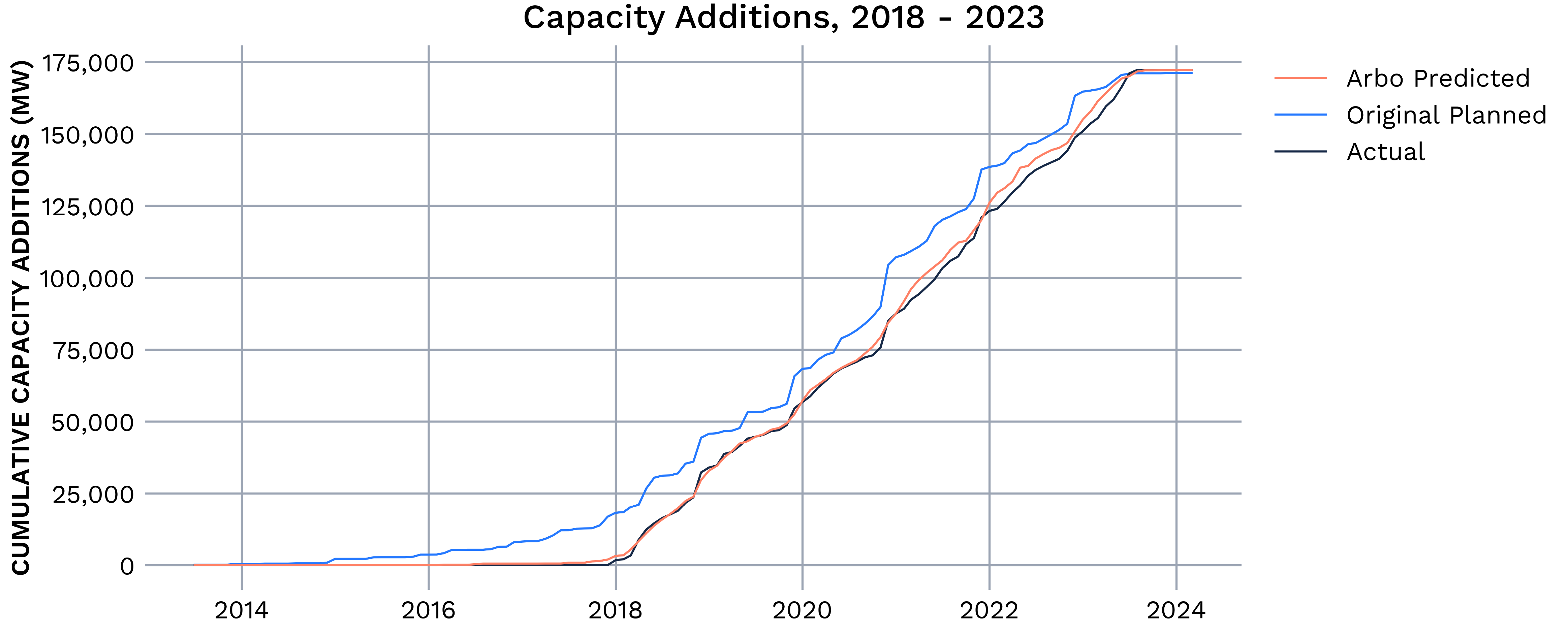

Arbo’s predictive models utilize all of this historical project timing data to increase accuracy of operational date forecasts for currently planned generation projects and cumulative monthly capacity additions. By using a series of regression models, we were able to accurately predict the difference between the original planned and actual in-service dates on a project-by-project basis for historic planned generation facilities going into service from 2018 forward. That difference was then aggregated across all projects to arrive at Arbo’s predicted capacity buildup. Our analysis revealed project developers estimated an average of 30% more monthly capacity going into operation than actual, but our model comes within 3% for the same dataset.

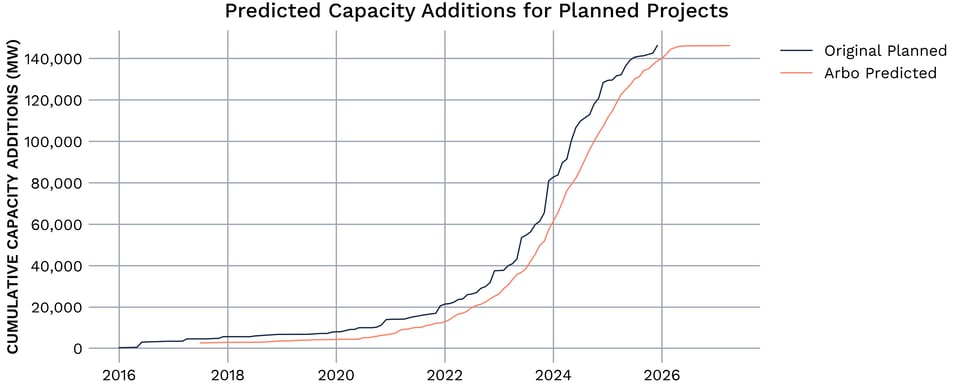

We can now apply this model to forecast commercial operation dates for projects that are currently planned, but not yet in operation. Preliminarily, we are projecting less capacity coming online on a monthly basis than the project developers have forecasted, which closely follows the trend seen in our data analysis and the model’s associated prediction of historic capacity additions.

Conclusion

The ability to build power generation infrastructure is critical to net zero goals, and accurate capacity addition timing is critical to energy commerce — so project delays are of concern to Arbo and many of our customers throughout the value chain.

Our preliminary predictive model has demonstrated a vast improvement on developer in-service estimates for historical project data, and we’ve now begun to forecast in-progress projects to support these clients.

If you enjoyed this article, subscribe to Arbo’s blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.