REPORT | July 2021

Subtraction with addition

What will equal zero?

The pathway identified in the IEA's recent Net-Zero by 2050 report has many implications and imperatives for U.S. infrastructure investment. Arbo's in-depth analysis covers key takeaways by commodity.

.png)

Provide your email address to download a PDF.

The full report text is available below.

SUBTRACTION WITH ADDITION:

What will equal zero?

Imperatives and implications of U.S. infrastructure investment along IEA’s path to net-zero by 2050

ArboIQ | July 30, 2021

What's the issue?

Last month, the International Energy Agency (IEA) released a report that highlighted that most plans to reach net-zero carbon emissions by 2050 are not nearly aggressive enough.

Why does it matter?

The IEA makes it clear that the path to net-zero is a narrow one and requires immediate action by all nations. As for private companies, it notes that the path is one rich with opportunity for investment growth, as the “radical transformation of the global energy system required to achieve net‐zero CO2 emissions in 2050 hinges on a big expansion in investment” — the global annual investment in energy grows, on average, from just over $2 trillion over the last five years to almost $5 trillion by 2030 and to $4.5 trillion by 2050.

What's our view?

Worldwide, the IEA projects that energy usage in advanced economies will essentially stay flat between now and 2050, but that the mix of the energy generated will change dramatically. The report is designed to close the “commitment gap” between various countries’ pledges to reduce emissions and the actual plans that can achieve the pledged goal. But even if that gap can be closed, it must be followed with swift, tactical planning and an increase in infrastructure projects needed to meet the new commitments.

Last month, the International Energy Agency (IEA) released a report demonstrating that most plans to reach net-zero carbon emissions by 2050 (NZ50) aren’t nearly aggressive enough to meet that goal. The report makes it clear the path to net-zero is a narrow one and requires immediate action by all nations. For private companies, the IEA notes this path is rich with opportunity for investment growth, as the “radical transformation of the global energy system required to achieve net‐zero CO2 emissions in 2050 hinges on a big expansion in investment.”

The energy evolution described in the report creates tremendous opportunities — but also tremendous risks. Both aspects can be best highlighted by two short statements in the report. First, the global annual investment in energy needed to stay on track will grow from an average of just over $2 trillion (over the last five years) to almost $5 trillion by 2030, and to $4.5 trillion by 2050. But, “no oil and gas company would be unaffected” by the energy evolution and “all parts of the industry need to decide how to respond.”

The opening paragraph of the report is fairly blunt:

“We are approaching a decisive moment for international efforts to tackle the climate crisis – a great challenge of our times. The number of countries that have pledged to reach net‐zero emissions by mid‐century or soon after continues to grow, but so do global greenhouse gas emissions. This gap between rhetoric and action needs to close if we are to have a fighting chance of reaching net-zero by 2050 and limiting the rise in global temperatures to 1.5°C.”

As the report describes in much greater detail, the current trajectory of plans adopted around the world falls far short of reaching such a goal. It unequivocally states potential paths to reaching NZ50 are quickly winnowing down to just a few; the specific path the IEA lays out in detail, while aggressive, is the one it views as “most technically feasible, cost‐effective and socially acceptable.” But even this path requires all stakeholders – governments, businesses, investors and citizens – to take action this year and every year thereafter so the goal doesn’t slip out of reach.

The pathway identified in the report discusses many aspects of energy demand and supply, and the changes needed for both if the goal is to be achieved.

Coal

We begin our analysis with the report’s call to replace all coal-fired electric generation plants in advanced economies by 2030 unless they are equipped with carbon capture and sequestration capabilities (and to similarly replace all gas-fired electric generation by 2040).

How aggressive is this goal? The U.S. Energy Information Administration (EIA) recently released data on the state of the electric industry in the U.S. as of EOY 2020. This report allows us to see how we’ve progressed over the last five years, where we are today and how much change will be required to meet the IEA’s stated goals for advanced economies like ours.

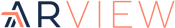

In the last five years, the use of coal to generate electricity in this country has continued an inexorable slide downward. As seen in the chart on the following page, the installed capacity of coal-fired power dropped by over twenty percent and is now less than half of the installed capacity for natural gas-fired facilities.

Natural Gas

Some observers of this data will take heart to see that natural gas-fired capacity grew nicely, by almost ten percent, over that time. However, the IEA report calls for natural gas as a source for electric generation to follow coal’s curve, just about ten years behind.

The report suggests the installed capacity of natural gas-fired facilities will continue to increase between now and 2030, which will help accelerate a global decline in the use of coal. But from 2030 on, the IEA calls for a rapid retirement of gas-fired facilities if they are not accompanied by some type of carbon capture and sequestration capability.

The report calls for no new oil or gas exploration, starting immediately, on the path it proposes. It calls for natural gas consumption to decline by 55% to 1,750 billion cubic meters (bcm) and notes that “fossil fuels that remain in 2050 are used in the production of non‐energy goods where the carbon is embodied in the product (like plastics), in plants with carbon capture, utilization and storage (CCUS), and in sectors where low‐emissions technology options are scarce.” On this path, more than half of that natural gas is actually used to produce hydrogen in combination with CCUS.

Hydrogen

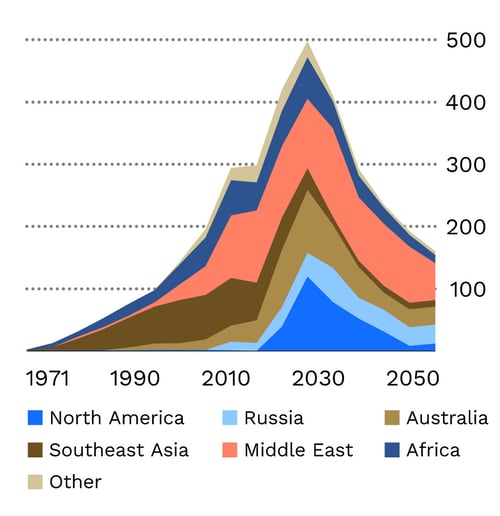

The IEA calls for global hydrogen use to expand from less than 90 metric tonnes (Mt) in 2020 to more than 200 Mt in 2030, and to more than 500 Mt in 2050. The report notes that the large level of hydrogen and biomethane means that the “decline in total gaseous fuels is more muted than the decline in natural gas,” presenting an opportunity for existing pipeline companies.

Europe is Already Planning its Hydrogen Pipeline Network

A consortium of European natural gas transmission companies has already announced a plan for building a “European Hydrogen Backbone” which by 2030 would consist of an initial 7,200-mile pipeline network and would grow to a total length of almost 25,000 miles by 2040. The building cost is expected to range from $51 to $97 billion.

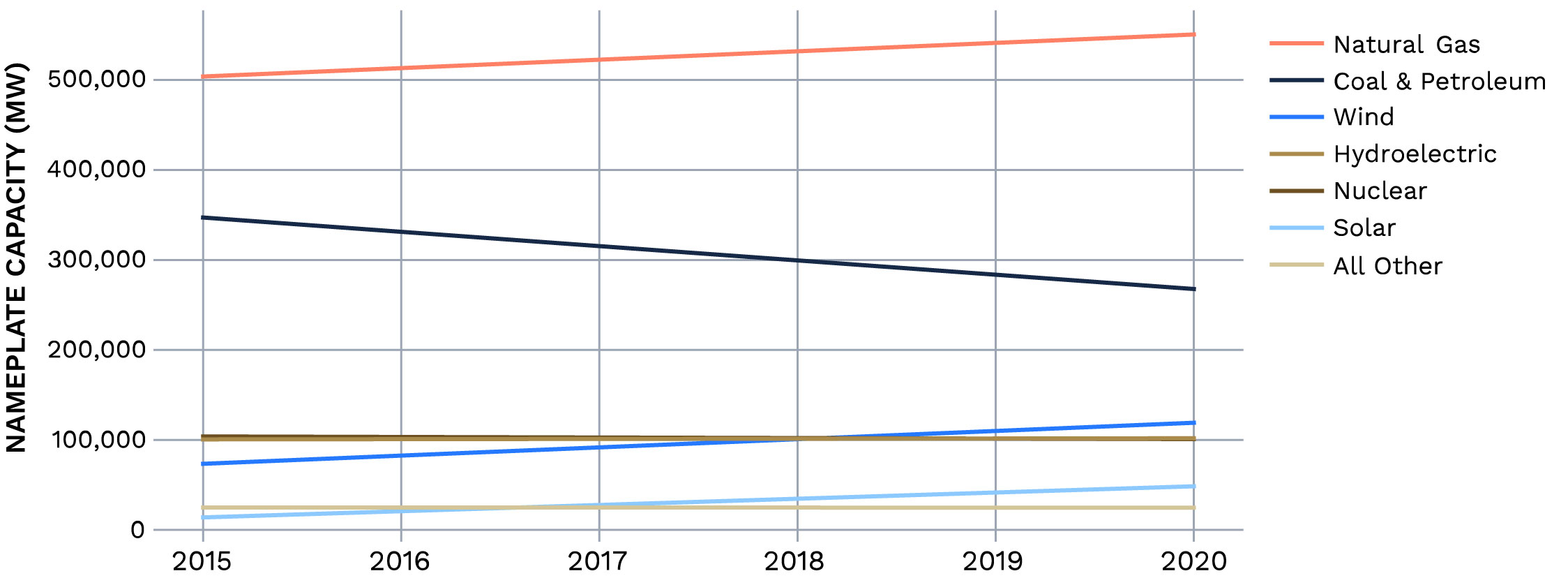

As shown in the chart below, the cost of converting an existing natural gas pipeline for hydrogen use is substantially lower than building a new pipeline, ranging from about 10% to as high as 30%. In the European plan, the total cost estimate assumes 69% of the pipeline network will be repurposed natural gas pipelines and 31% will be new construction.

The U.S. Needs a Plan

The U.S. does not currently have a similar plan for the development of a hydrogen pipeline network, but existing gas pipeline companies could benefit from the development of one, even as they seek approval of new natural gas projects.

In its recent application for its Regional Energy Access Expansion Project, Williams’s Transcontinental Gas Pipe Line noted the project was designed and would be “constructed in a manner that is adaptable to green hydrogen” which would allow it to be part of the “critical infrastructure needed to meet clean energy demand for generations to come.” Interestingly, the Sierra Club in its intervention and comments dismissed this statement, asserting that “hydrogen is not cost-effective” and there is no “economically viable scenario that would include transporting hydrogen through this pipeline.”

It is opinions like this, if broadly accepted, that could lead the U.S. down a path toward adoption of a purely renewable energy system reliant on massive new, expensive and difficult infrastructure development - primarily to transport electricity interstate over long distances. The natural gas pipeline industry is already facing a skeptical FERC that views a 16,500 dth/day project as an environmental catastrophe. Therefore the ability to show that hydrogen is not only essential to a low-carbon future, but that pipelines are now being developed to accommodate that future, may be critical to getting those pipelines approved.

A plan similar to the European Hydrogen Backbone project will fit within a system that allows for hydrogen to meet the future needs of this country on its quest for net-zero, and the IEA’s proposed pathway recognizes a substantial role for existing natural gas pipeline networks.

Different Economies; Different Pathways

The IEA suggests different energy paths for advanced economies and developing economies, where the need for basic energy infrastructure is currently lacking. In particular, with respect to coal and natural gas-fired power plants, the IEA is calling for all advanced economies to retire all coal-fired power plants that are not equipped with carbon capture and sequestration by 2030, and to retire all natural gas-fired plants by 2040. Essentially, the IEA is calling for all of those retired plants to be replaced with wind and solar power. So what would that look like here in the U.S.?

Solar and Wind

As seen in the chart above, the amount of wind and solar power in this country has grown substantially over the last five years. In 2015, those two sources represented less than 8% of the total installed capacity, but had grown to more than 14% by 2020. While that number is substantial, installed capacity growth needs to increase tremendously between now and 2040 to meet the IEA’s goal of essentially retiring all coal and gas-fired facilities.

For simplicity’s sake, in the following analysis we will accept the IEA’s assumption that there will be no increase in energy demand by 2050 due to increases in efficiency, and we’ll ignore the fact that, due to the intermittent nature of wind and solar, more nameplate capacity must be installed for such plants than for coal and natural gas plants.

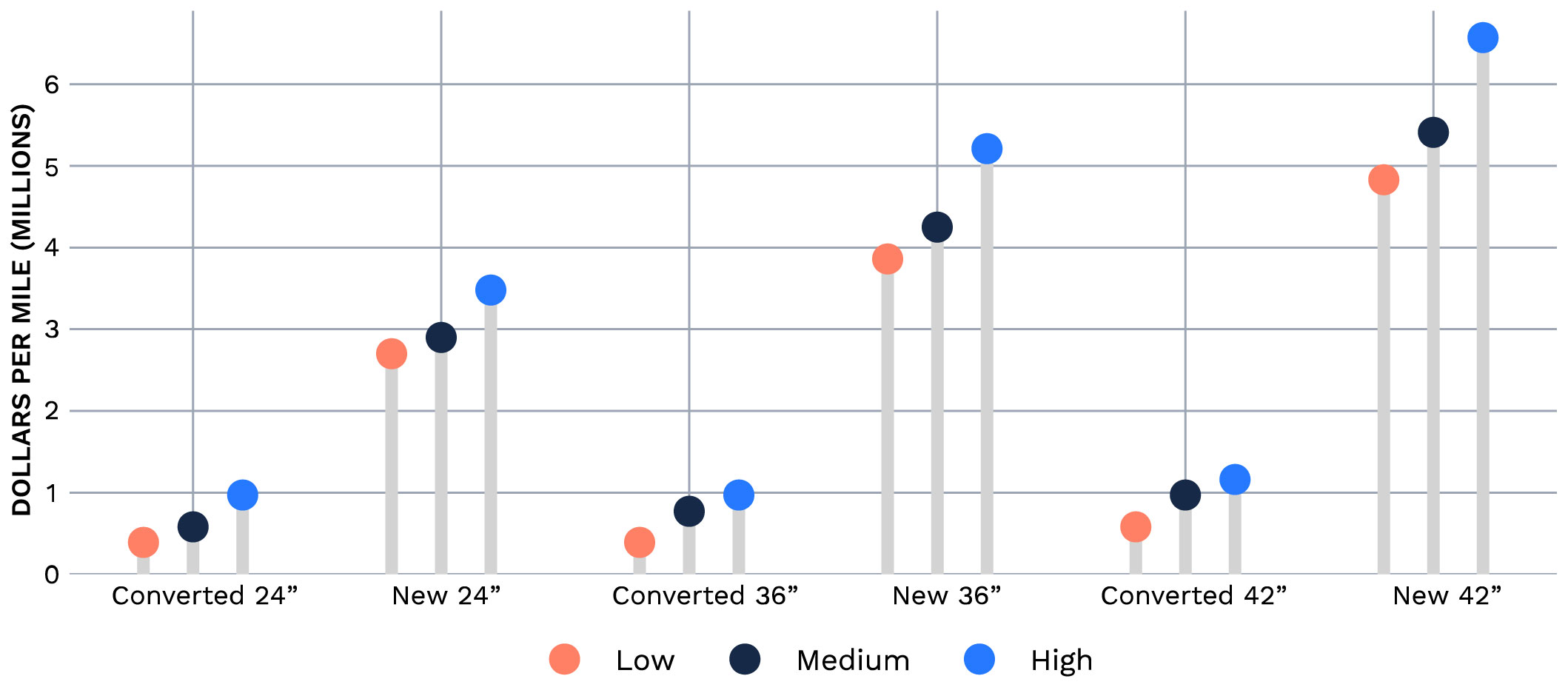

Capacity is Needed to Meet IEA Targets

To phase out all coal plants by 2030, the annual wind and solar additions would need to grow from their average over the last five years of 16,000 megawatts (MW) to more than 26,000 MW. Then, between 2030 and 2040, in order to retire the gas-fired plants that exist today, the solar and wind additions would need to increase to more than 55,000 MW annually. Currently, proposed additions this year exceed that amount, with over 33,000 MW being proposed for commercial operation in 2021. A key question is whether this increase in additional power generation can be sustained as the wind and solar industry is required to build facilities in less productive areas. Equally important are the related questions surrounding whether and when electric transmission will be able to keep pace.

As seen in the chart above, such a massive buildout will also require a significant number of individual facilities, as these are typically much smaller than a fossil-fuel-fired power plant.

Check out these recent blogs if you need a primer on wind and solar issues:

Which States Will Fail to Meet Their Offshore Wind Goals? ▶

Solar Power is Growing – But Not at the Rate Developers Often Project ▶LNG

The IEA report expects LNG exports to grow until 2025 but then projects, by 2050, that U.S. exports will fall to 2012 levels — from before the U.S. was even in the export business. The EIA’s Annual Energy Outlook 2021 projects similar growth between nowand 2025, but expects that growth to continue, or for levels to at least remain flat through 2050.

The Need for LNG on the IEA’s Path to Net-Zero

The IEA report shows the need for LNG to grow almost exponentially between today and 2025, but then suffers almost as much of a decline in the following five years.

The IEA summarizes its projection by stating that the global LNG trade will increase from 420 bcm in 2020 over the next five years, but it will then fall to around 160 bcm in 2050. The report states bluntly that none of the LNG liquefaction facilities currently under construction or at the planning stage will be needed to meet projected growth between now and 2025.

There are a large number of planned LNG export facilities chasing a limited supply of buyers, and projections like this may account for the delays these projects are experiencing in reaching a final investment decision. There is a growing desire of buyers for a lower-carbon LNG, and the IEA report suggests this could be leveraged as a competitive advantage. It predicts LNG demand will drop by 60% between 2020 and 2050, and the remaining demand will be met by the lowest cost and lowest emissions producers.

The Energy Information Agency’s Forecast is More Optimistic

Addressing LNG exports, the EIA Outlook provides (1) a base case (or reference case), (2) a high oil and gas supply case, and (3) a low oil and gas supply case. While all three cases essentially agree with the IEA projections showing substantial growth in LNG exports between now and 2025, the cases begin to diverge from that point on.

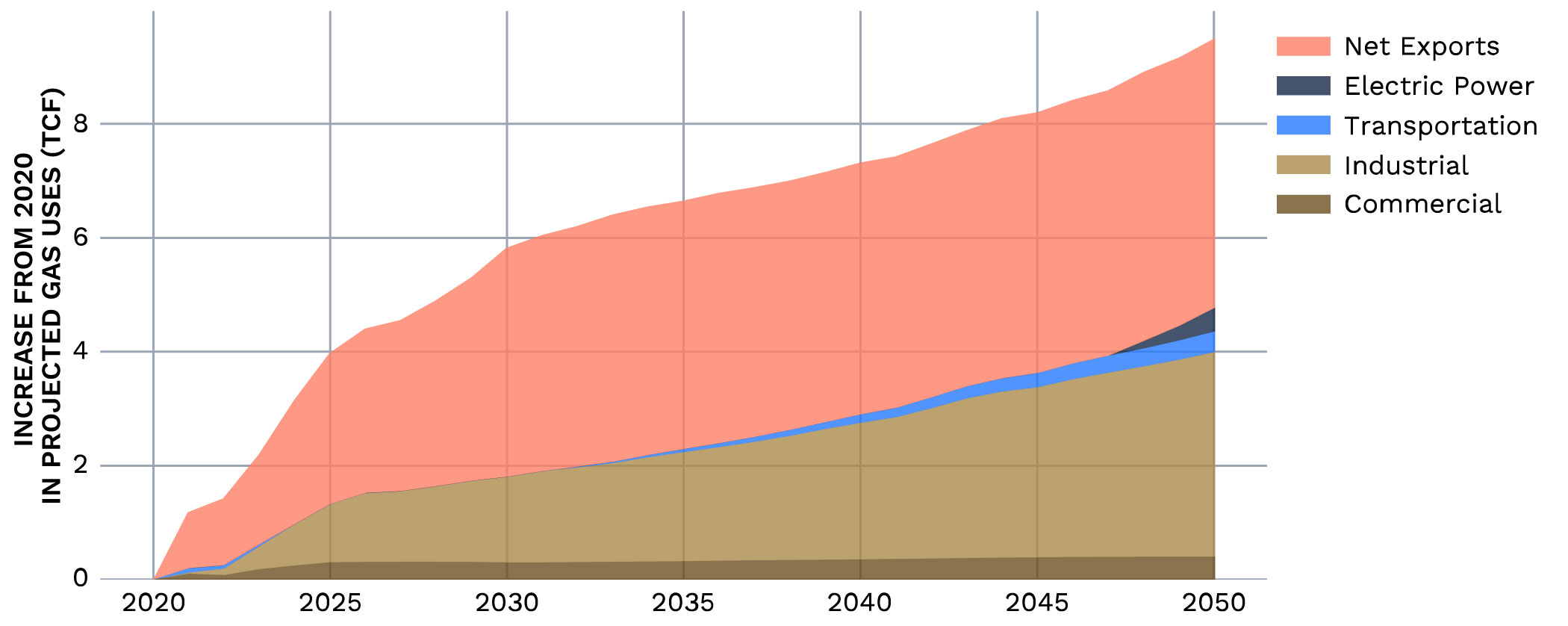

As the chart below shows, in the low oil and gas case, LNG exports in 2050 would amount to less than half the exports in the high oil and gas case. But none of the scenarios show LNG exports returning to 2020 levels, let alone to 2012 levels, as the IEA report calls for. Even in the EIA’s worst-case scenario, LNG exports in 2050 will be 40% higher than they were in 2020.

Market Impacts

Accurate projections of LNG export growth could also impact the prices of domestic gas because, if producers are counting on LNG to be the growth engine for demand, its importance is magnified.

As shown above, in the EIA’s reference case, the growth of the LNG export market is a key component of the demand growth for natural gas produced in this country, representing over 50% of the total growth between now and 2050. If that growth in demand doesn’t materialize, it would have a tremendous impact on demand and prices paid for U.S. production, and may require a very different strategy for producers. Similarly, if that demand does not materialize, the value for capacity on pipelines designed to deliver gas to these export terminals will likely be much lower.

Policy Changes Would be Impactful

The key difference between IEA and EIA projections is the policy assumptions that underlie them. The IEA forecast is a projection of the results that can be achieved if a number of interlocking changes in behaviors, policies and practices are all pursued and implemented on an admittedly aggressive schedule. Conversely, the EIA projection assumes no changes in current policies. Neither of those assumptions is likely to be correct, but it’s clear from a comparison of the EIA’s “worst-case scenario” that the situation could be far worse for the U.S. LNG market if the world can close the commitment gap highlighted in the IEA report.

Although projections are seldom ultimately accurate, evaluating the best and worst cases allows those responsible for long-range plans to adopt strategies that would optimize results in all scenarios. In this case, we may know sooner rather than later, as many U.S. LNG projects are seeking buyers whose commitments for LNG from those facilities determine whether they move forward. If such projects, approved by FERC but still awaiting a financial investment decision, are canceled or further delayed, that could be viewed as confirmation of the IEA’s prediction that none of them are needed.

Conclusion

Any feasible path to NZ50 will require significant changes to the commodity mix. Thoughtful and calculated plans are needed for efficient utilization, expansion and evolution of existing infrastructure, as well as for building additional projects across the commodity spectrum.

Arbo is working with our customers as they negotiate the net-zero evolution, and we believe their skill sets and assets will enable them to thrive from the scale-up of renewables and decarbonization technologies. With global investment in energy, commercial opportunities abound for infrastructure owner-operators.

To help integrate renewables into North American energy systems, ArboIQ’s expert team conducts custom research, data acquisition and analytics, visualizations, and legal and regulatory analysis for operating and planned hydrogen, solar, off/onshore wind and biofuel projects. This specialized renewables offering helps leading commercial teams identify opportunities for evolutionary growth that tracks towards sustainability goals.

To learn more, visit www.goarbo.com/arboiq.

If you enjoyed this article, subscribe to Arbo’s blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.