CASE STUDY

Global commodity traders mitigate risk with Arbo’s in-service analysis

June 2023

Overview

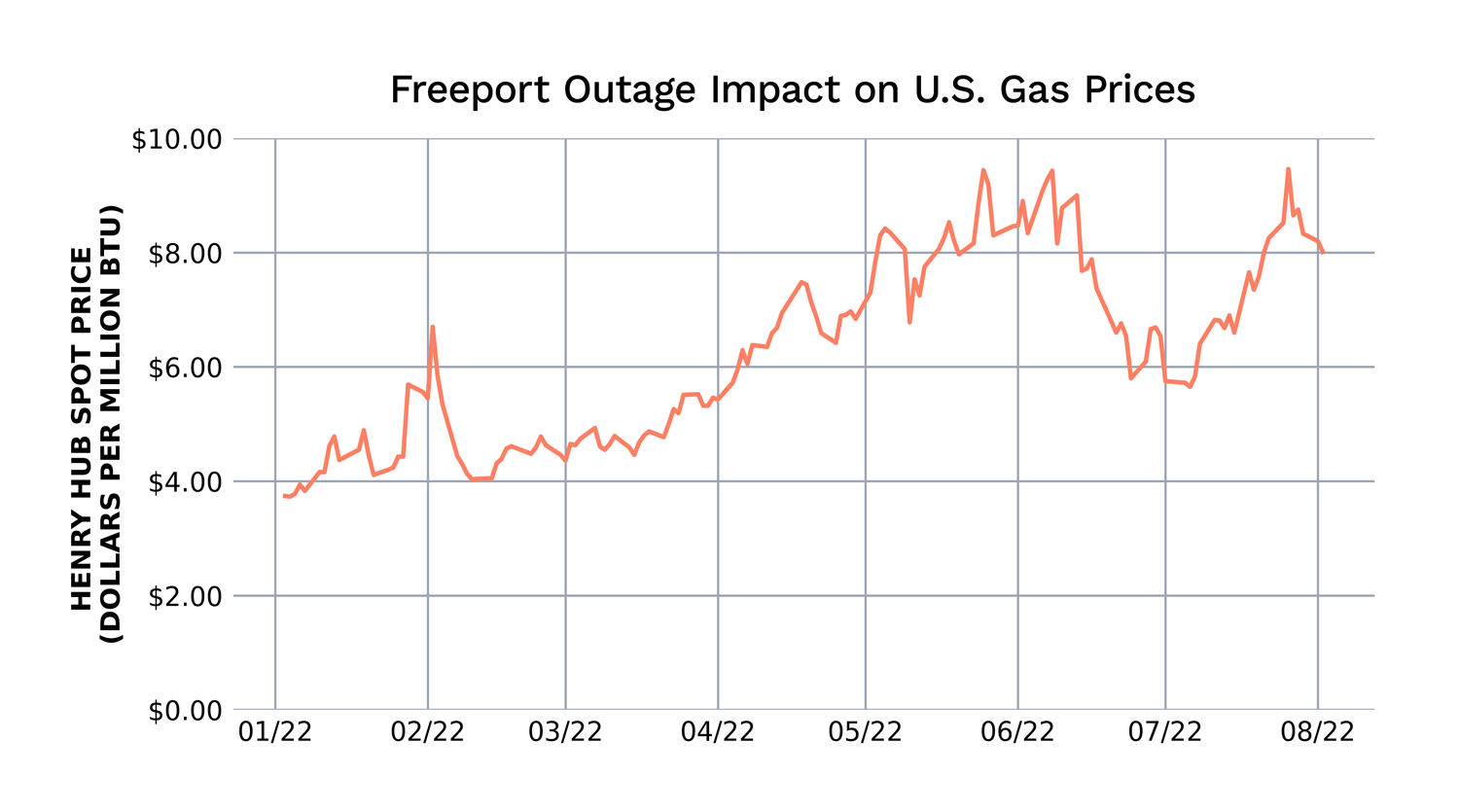

An operational incident occurred at the Freeport LNG Terminal that required the facility to shut down. The market impact was immediate, as natural gas prices in the U.S. fell and LNG prices in Europe rose. Power prices were also impacted, because Freeport uses electricity for its liquefaction process.

Later the same day, Freeport indicated it would be down for at least three weeks. It would ultimately issue at least seven (consistently inaccurate) revised timing projections for partial and full re-start by the time it was authorized to resume service — eight months later.

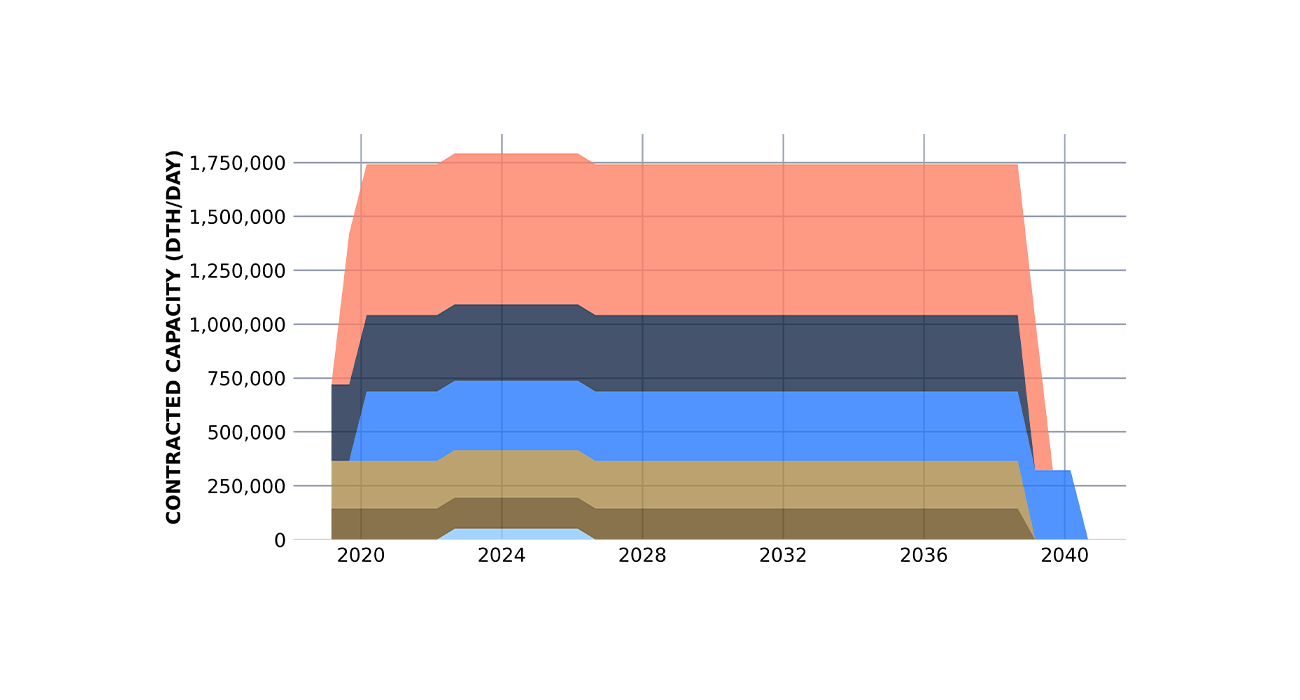

Throughout this extended period, a global trading house and Arbo client with a significant volume of LNG export contracts required objective assessment and verification of official timing announcements. The client engaged the ArboIQ team for its regulatory expertise and data analysis to review regulatory documents, assess possible progress, and forecast realistic next-phase and in-service dates. The accurate and rapid-response analyses from Arbo significantly enhanced the trading desk’s ability to mitigate risk and more importantly — provided timely trading signals.

The Problem

Knowing the duration of Freeport downtime was critical to inform our client’s strategic response.

The trading team immediately began sourcing gas for liquefaction at other terminals to fulfill contracts but needed to know how far out in the future to buy. They also had a critical need to communicate a realistic expectation of any product delivery delays, to preserve their reputation and relationships.

The Pipeline and Hazardous Materials Safety Administration (PHMSA) and the Federal Energy Regulatory Commission (FERC) are jointly responsible for the safe operation of LNG terminals. Given the possible impacts of the outage, the client’s analyst team needed to understand the agencies’ respective authority and roles as quickly as possible and add bandwidth to continuously monitor relevant regulatory filings and responses — many of which needed expert interpretation.

Meeting these urgent needs required the relevant data access capabilities and regulatory expertise, as well as overlays and knowledge of market and asset operational procedures likely to impact the restart timeline and what Freeport might or might not communicate to the public.

The Solution

The ArboIQ data acquisition system is engineered to acquire, parse, structure, and quality check massive amounts of energy regulatory filings including those filed with PHMSA and FERC.

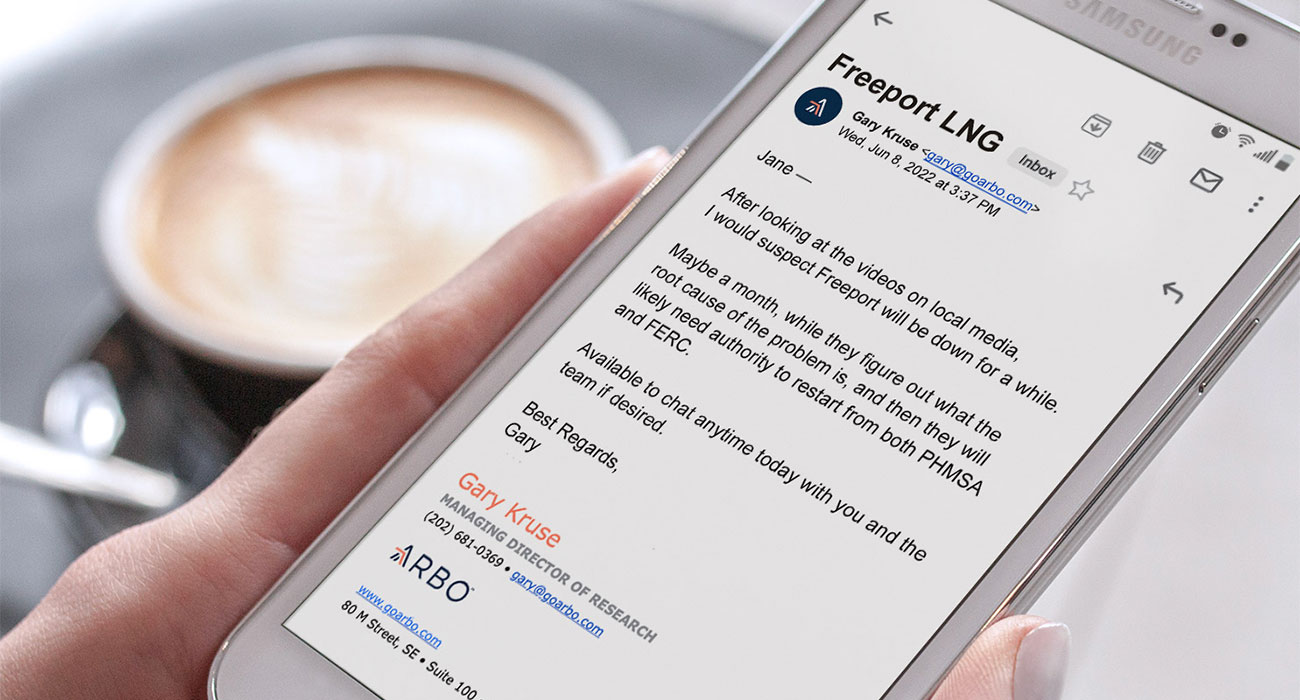

The team was alerted to any filing related to Freeport almost instantaneously and applied decades of regulatory expertise to quick-turn analysis of any impacts to timing implied by detailed technical language or mention of regulatory processes and milestones. Our ability to pull historical data from other operational incidents with involvement by PHMSA and FERC provided a means to further benchmark the expected time between each required restart milestone.

Arbo was able to confidently show timelines announced by Freeport were consistently aggressive and also establish most likely alternative scenarios. This information was then translated into visualizations of process and timing that could be easily shared and understood by any stakeholder on the client team (and updated as the situation evolved).

One such visual demonstrated phases processes required by FERC and PHMSA, in certain order, with indications as to Freeport's progress toward each and likely timing based on historical data and factoring in an assessment of complexity according to the ArboIQ team's industry experience.

The Impact

This risk-exposed client needed to augment its analytics ASAP, and Arbo was at the ready.

Our expertise and continuous alerts on the market-moving Freeport event mitigated many risks of missing or mis-interpreting critical details buried in official documents. ArboIQ provided proactive forecasts within hours of each development over the course of eight months, and on-demand expert counsel for lots of questions in between.

The extreme volatility in this year’s markets produced record profits for global commodity trading firms, which are necessarily secretive about their positions and exposures. We never truly know how much money we help make or save for these valued customers, but judging by the levels of urgency in the requests for assistance and the after-action gratitude, we’re confident it’s a lot.

Subscribe to Arbo’s free blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.