CASE STUDY

Arbo Sharpens Permian and Haynesville In-Service Forecasts for Marketers & Traders

Overview

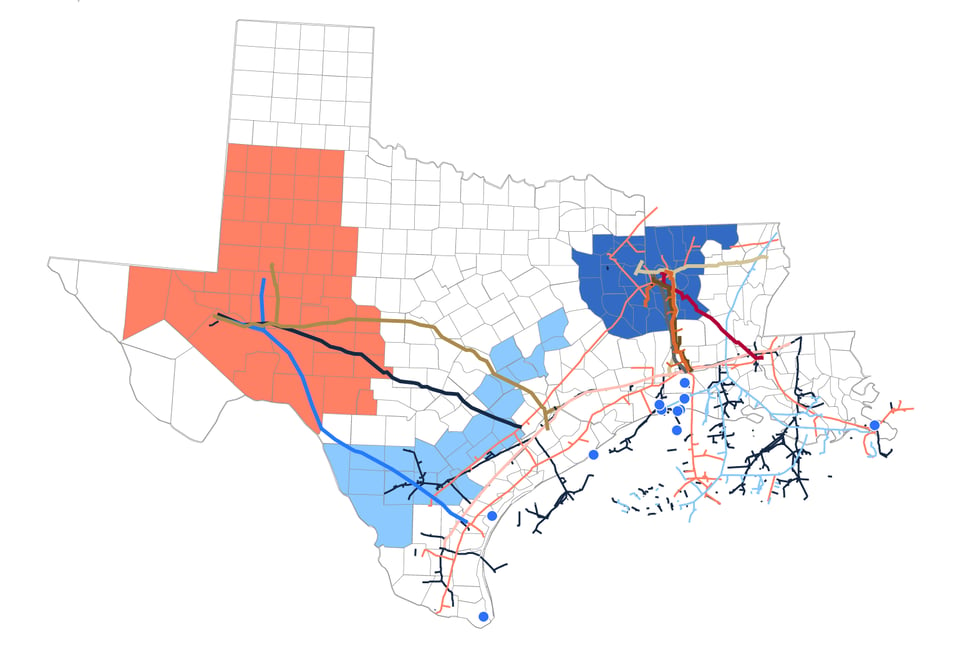

As a multitude of LNG terminals are planned and constructed along the Gulf Coast, many new gas pipeline projects have been announced — both interstate system expansions and greenfields.

Commodity markets are impacted by the timing of capacity changes; consequently Arbo’s trading and marketing customers rely on our predictive modeling of project in-service dates developed by systematically ingesting, structuring, and visualizing vast repositories of historical data to enable precision trending and benchmarking.

With over 25 projects vying to meet the need for gas egress from the Permian and Haynesville, a unique solution was needed to track progress and forecast in-service dates — since the majority of these pipelines would be outside the jurisdiction of FERC (the regulatory body that requires public filings by interstate project developers).

Arbo’s research team identified the many disparate sources of state and local data relating to pipeline projects in Texas and Louisiana. We then identified sources of data that are leading indicators of progress.

The resulting product was a customized periodical Permian and Haynesville Project Tracker, which includes over 15 project characteristics, and updates on the myriad discrete regulatory and construction milestones in the development process — and ultimately, an accurate data driven in-service forecast.

The Problem

Ever-increasing regulatory uncertainty creates acute blind spots for infrastructure developers and adds expensive execution risk to development timelines. These uncertainties impact all stakeholders, including would-be shippers.

Company filings, regulatory requests, third party opposition, federal and state permits/certificates, and hundreds of other common attributes yield necessary inputs to construct objective statistically-significant trends and correlations, and Arbo’s Gas Asset Analytics Software has long been a source of truth for interstate pipeline costs and schedules. The platform’s machine learning methodology detects subtle patterns in these historical input data points and yields real-time forecasts for projects still undergoing the regulatory process. Our predictive model forecasts major milestones, including regulator approval and project in-service dates, and our expert Advisory Services team layers on qualitative analyses such as nuances of politics and policy development and judicial precedent and emerging case trends.

But in contrast to the FERC process, the usual series of gates and milestones through which an intrastate project passes aren't necessarily in the same order or may not exist at all. Due to non standard reporting requirements and enforcement, there is limited publicly available data at the state level, and what can be acquired is disaggregated and unstructured. Satellite imagery and flyovers of the right-of-way can only illuminate a part of the picture.

The Solution

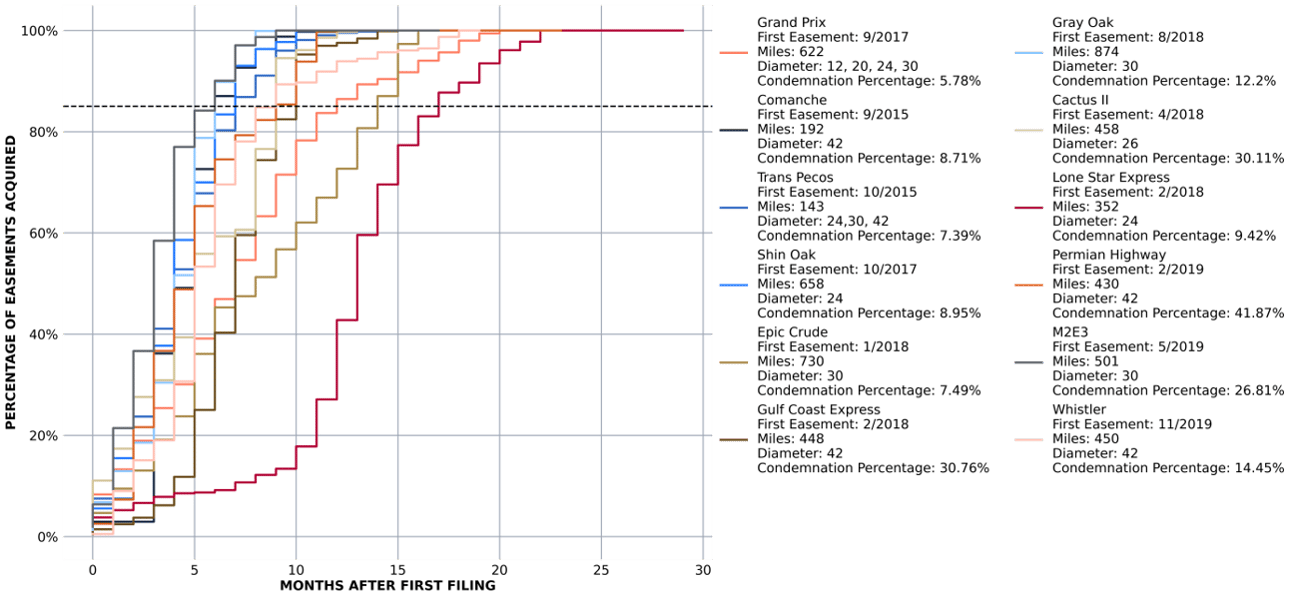

During the original Permian buildout, we systematically extracted, structured and normalized a repository of intrastate project data, which allows us to benchmark the progress of 25+ pipeline projects now planned or under construction in Texas and Louisiana.

Relevant data sources range from regulatory, permitting and land record documents at local government agencies and public records departments, to SEC filings and press releases originating from project developers. While some information is easy to find online, getting other key data points requires public information requests, for which the process varies by state.

Our analysis demonstrated particularly consistent trends indicating nearness to in-service for two significant phases of development — land acquisition and hydrostatic testing.

- The first financial commitment a project developer makes is typically to acquire rights of way, and a curve can be established for the timing of a typical project from the first indication of acquisition to the project’s actual in-service date.

- Because pipeline developers will not send out crews until they have contiguous rights of way for the work, construction of the pipeline itself usually needs to wait until most of the land is acquired. However, compressor station construction often can start sooner, as the associated land typically is purchased outright and acquisition can be completed much more quickly, which we can trend from our warehouse of FERC compression-only project timing.

- Pressure tests are required for safety and are usually conducted on segments of the pipeline as construction progresses. In Texas, applications for these tests are filed with state regulators to allow the pipeline to discharge the water used to pressure test the pipeline once it is constructed. Our historical data for intrastate projects provides the average time between the first hydrotest permit application and in-service date.

The Impact

Given the extreme volatility in gas markets, the potential for significant profits is on the line when decisions are made around in-service forecasts.

Our customers needed reliable intrastate project analytics as a key input to hedging and trading strategies, and Arbo delivered an edge.

Since some of our clients are necessarily secretive about their positions and exposures, we never truly know how much money we help them make or save — but the level of urgency in their requests and the ensuing gratitude would suggest it’s a lot.

Subscribe to Arbo’s free blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.