CASE STUDY

How Arbo Helped a Major Natural Gas Shipper Accurately Anticipate Rate Case Impacts

Overview

In order to change an existing tariff rate, an interstate natural gas pipeline company must file a rate case through the Federal Energy Regulatory Commission (FERC). If a shipper on the pipeline does not have a negotiated rate contract, it will be subject to the subsequent rate change for the remaining duration of its transportation contract.

A longtime Arbo customer (and major U.S. physical gas shipper) recently found itself subject to a rate increase for one pipeline on which it held firm transportation capacity.

The Problem

Rate case outcomes aren’t predictable based on the financial figures in regulatory filings but historical data on settlements is valuable to determine risk exposure. Unfortunately for shippers, this data isn’t readily available.

The pipeline of interest to our customer sought to raise its rates by close to 50 percent. Requested rate increases are typically aspirational and pipelines often settle for significantly less. This customer needed a quantitative risk assessment of the case — an estimated actual rate increase.

Our customer was considering future transport options and would likely need to decide on a contract renewal during the period of the rate case, so a data-backed projection of the settlement date was also important.

This client had a short runway — lacking the time and regulatory expertise to assemble a dataset that could help answer these questions.

The Solution

Arbo’s team of data engineers, scientists, and energy regulatory experts leveraged our extensive and proprietary rate case dataset to provide a quick-turn risk analysis for the pipeline of interest and an ultimate rate change projection.

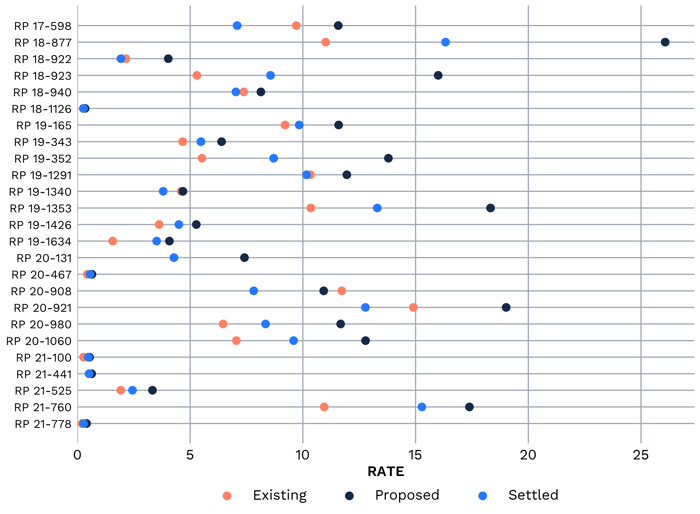

The final deliverable was the result of an extensive quantitative and qualitative historical benchmarking analysis of key rate case features, which included:

- Overall Rate of Return

- Proposed Return on Equity

- Cost of Debt

- Onshore Depreciation Rate

- Proposed Rate Increase

- and more…

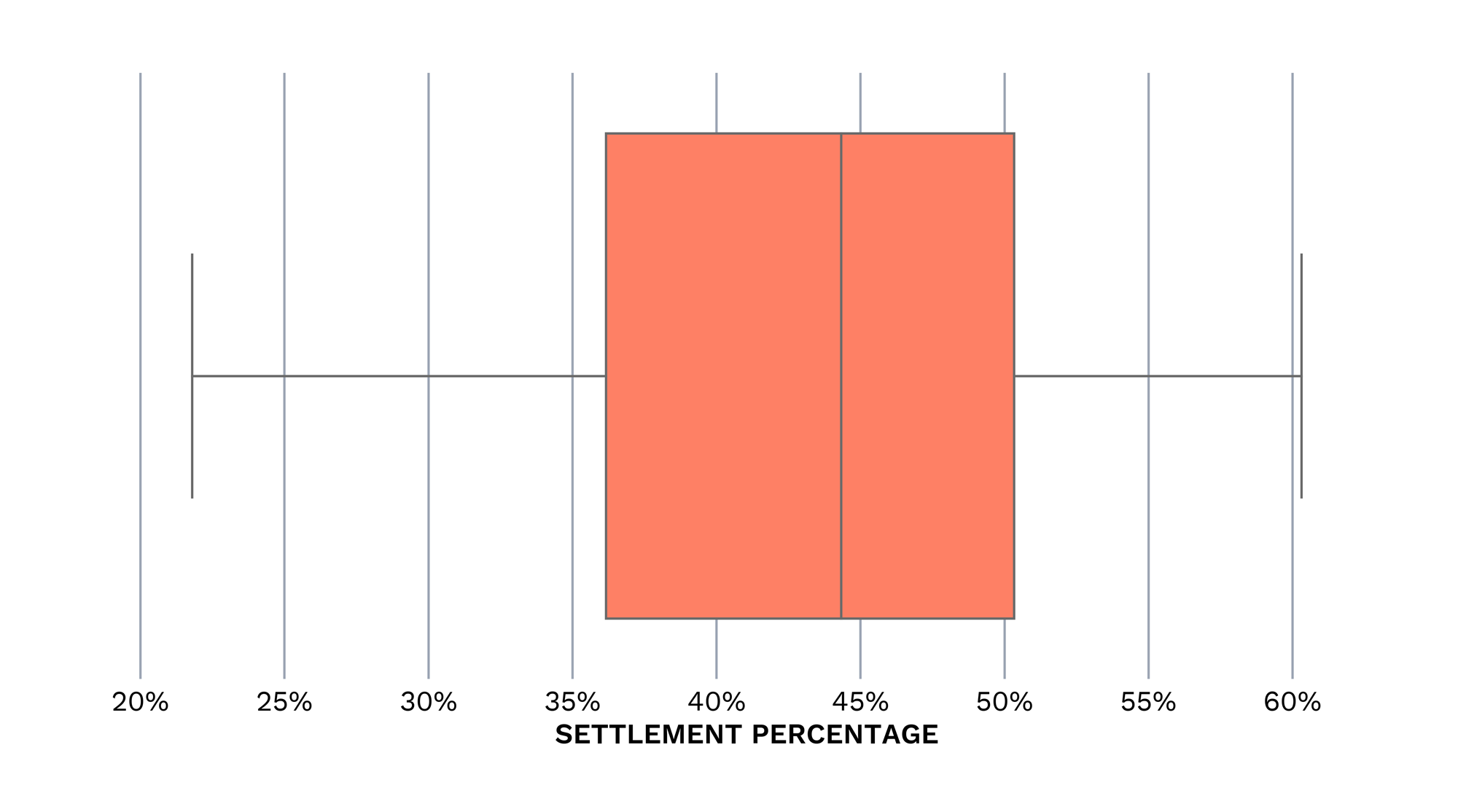

The final settled rate for cases since 2017 typically falls between the existing and the proposed, and almost always was significantly less than the proposed.

Arbo concluded that the pipeline would settle in the third quartile of historical cases (~50% of the requested 42% increase = 21% final rate increase).

Our findings also suggested the rate case would settle in early summer 2023 and the most likely rate change for our customer would be 21%.

The Impact

Arbo’s analysis allowed our customer to accurately anticipate the settlement date and rate increase more than six months in advance and enabled a data-driven evaluation of future firm transportation options.

We were especially pleased to find our benchmark was dead on; the customer’s tariff rate ultimately increased by exactly 21%.

Subscribe to Arbo’s free blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.