REPORT

How can natural gas pipeline and storage operators capitalize on the growth of hydrogen as fuel?

Many non-technical obstacles need addressed to capture this growth opportunity. Arbo's analysis reveals ways the industry can accelerate hydrogen adoption and the energy evolution.

Provide your email address to download a PDF.

The full report text is available below.

Opportunities and obstacles

for hydrogen as a net-zero fuel

HOW CAN NATURAL GAS ASSET OPERATORS CAPITALIZE?

ArboIQ | July 23, 2021

What's the issue?

The skill sets and assets possessed by the operators of natural gas infrastructure could be used to facilitate the use of hydrogen on a path to net-zero.

Why does it matter?

According to the IEA, a radical transformation of the global energy system is needed to facilitate this path which, for private companies, is rich with opportunities for investment growth. But when it comes to hydrogen, there are significant risks and challenges outside the scientific and technical realm.

What's our view?

A myriad of non-technical obstacles stand in the way of the United States’ network of privately-owned pipelines and storage assets’ ability to accept and transport hydrogen as a fuel. The pipeline industry should begin by cooperatively developing a plan to demonstrate how existing and proposed projects will fit within a system that allows for hydrogen to meet the future energy needs of this country. Those who seize this opportunity today will be in the best position to profit from a developing hydrogen market.

Both government and market forces are driving towards a net-zero carbon economy by 2050 (NZ50). Regardless of changing winds in Washington, D.C., as companies commit and investors demand a strategy for achieving that or very similar goals, our nation’s existing 200,000 miles of gas pipeline infrastructure could be well-positioned to play an integral role.

Hydrogen Overview

One aspect of President Biden’s energy plan was to create a demand for hydrogen as a fuel. The stated goal was to use “renewables to produce carbon-free hydrogen at the same cost as that from shale gas.” Unlike natural gas, which can simply be extracted from the ground and used as a fuel, pure hydrogen must first be created. There are many types of hydrogen (a few of which we will describe below) and only one is carbon-free.

Gray Hydrogen

As indicated by the statement in the Biden energy plan, the lowest-cost method currently used to create hydrogen is to separate it from natural gas. The Hydrogen Council (a consortium of major corporations, including major oil and gas producers such as BP and Shell, and end-users like Toyota, GM, Microsoft and Airbus) refers to hydrogen produced this way as “gray hydrogen,” which they admit is better as a fuel stock than natural gas, but not much more beneficial overall because of the emissions needed to create it.

Clean or Blue Hydrogen

The Hydrogen Council refers to hydrogen created with natural gas and then combined with carbon capture and use, or carbon capture and sequestration, as “clean hydrogen.”

But the goal under the Biden plan is “green hydrogen.”

Green Hydrogen

The gold standard is hydrogen produced from water and electricity generated by renewables like solar or wind, which otherwise would be wasted because it’s not needed at the time it is produced. The process is emissions-free and allows renewable energy to be stored in the form of hydrogen, for later use as a fuel stock when the wind doesn’t blow and the sun doesn’t shine.

Around the time Biden announced his energy plan, the CEO of NextEra stated on an earnings call that the company would propose construction of a hydrogen pilot project at Florida Power & Light. The $65 million pilot is planned for an in-service date of 2023 and would use solar energy to produce 100% green hydrogen through a roughly 20-megawatt electrolysis system. The hydrogen produced would then be used to replace a portion of the natural gas that is consumed by one of the three gas turbines at the Okeechobee Clean Energy Center.

Hydrogen’s Benefits

As explained by NextEra’s CEO, wind, solar and battery storage will be hugely disruptive to the country’s existing generation fleet, but to achieve an emissions-free future, other technologies will be necessary. NextEra is “particularly excited about the long-term potential of hydrogen” and they are not alone.

In its 2020 hydrogen strategy, the European Union noted that hydrogen is enjoying renewed and rapidly growing attention because it can be used as a feedstock across the industry, transport, power and buildings sectors. “Most importantly, it does not emit CO2 and [produces] almost no air pollution when used. It thus offers a solution to decarbonise industrial processes and economic sectors where reducing carbon emissions is both urgent and hard to achieve.”

Current Hydrogen Infrastructure

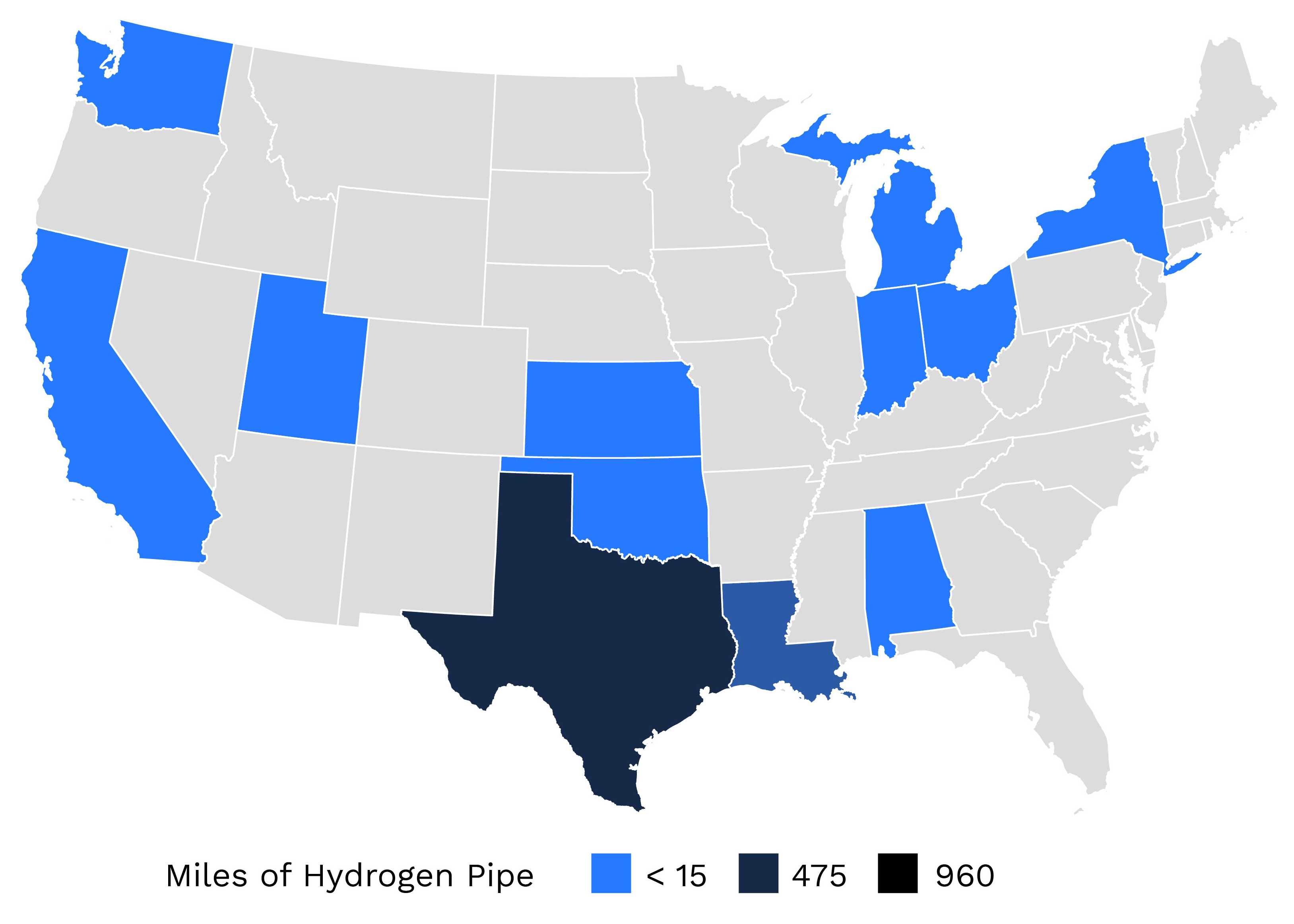

Similarly to natural gas, hydrogen can be transported and distributed by pipelines. The Pipeline and Hazardous Materials Safety Administration (PHMSA) regulates hydrogen pipelines and its reports show where these pipelines currently exist in the United States.

The International Energy Agency (IEA) recently released its Net-zero by 2050 report detailing the “most technically feasible, cost‐effective and socially acceptable” pathway to net-zero carbon emissions by 2050. Its plan calls for global hydrogen use to expand from less than 90 metric tonnes (Mt) in 2020 to more than 200 Mt in 2030, and to more than 500 Mt in 2050. But compared to the natural gas system in this country, the existing hydrogen pipeline network is tiny; it’s just over 1500 miles total and, as shown in the chart on the previous page, the vast majority of it is in Texas and Louisiana. By comparison, Northern Natural Gas alone reported having over 14,000 miles of interstate pipeline in service in 2019, and the twelve largest pipeline companies had over 100,000 miles of pipe in service in 2019.

The IEA’s proposed pathway recognizes a substantial role for existing natural gas pipeline networks — because a large amount of hydrogen and biomethane means the “decline in total gaseous fuels is more muted than the decline in natural gas.”

Firstgas, New Zealand’s gas transmission company, actually detailed a plan this year to evolve by enabling the country’s conversion to hydrogen — recognizing as the transmission pipeline, it can play a central role in preserving the need for pipeline infrastructure by diversifying its vision beyond delivering only natural gas. It also recognizes that the plans must commence “straight away.” We suggest U.S. pipelines can play a similar role in this country.

RECOMMENDED READING:

Decarbonization: Applying New Zealand’s Hydrogen Pipeline Strategy to the U.S.

Utilizing Natural Gas Infrastructure For Hydrogen

If hydrogen is to grow as a fuel stock, there are opportunities at each stage of its growth for the existing natural gas assets to play a role.

Gray Hydrogen Blending

Natural gas will likely maintain its price advantage as the demand market grows, and one of the least expensive ways to introduce hydrogen into existing pipelines is to blend it into the natural gas stream. It is estimated that a blend of 85% natural gas and 15% hydrogen could be used as a fuel stock without changes to the natural gas transmission or distribution systems and could be used by existing appliances. Above that level, there are safety concerns as hydrogen gas reacts differently with the materials used in typical natural gas pipelines, which could make them more susceptible to degradation and failure.

A spokesperson for the U.S. affiliates of National Grid recently noted that hydrogen will be playing a major role in the company’s future including producing and blending it into its existing gas network. Similarly, the Vice President of Energy Strategy & Policy for Eversource recently stated a key component of decarbonizing the existing gas grid is blending hydrogen into the existing distribution system.

HISTORY OF HYDROGEN BLENDING

A study by the National Renewable Energy Laboratory (NREL) noted that delivering blends of hydrogen and methane by pipeline has a long history dating back to the origins of today’s natural gas system, when manufactured gas produced from coal was first piped to streetlamps, commercial buildings and households in the early and mid-1800s. The manufactured gas products of the time, also referred to as town gas or water gas, typically contained 30%–50% hydrogen. The use of manufactured gas persisted in the United States into the early 1950s, when the last manufactured gas plant in New York was shut down and natural gas had displaced all major U.S. manufactured gas production facilities.

Clean Hydrogen

Thoughtful utilization of clean hydrogen requires the market to develop uses for the captured carbon and improve methods of sequestration. According to the Hydrogen Council, hydrogen could be used together with captured carbon to replace fossil fuels as feedstock for the chemical industry and to produce methanol and derivatives. Hydrogen can also be converted into methane through a process called methanation. This requires a CO2 source and energy for the conversion and results in substitute natural gas or SNG. SNG is pure methane, which makes it fully compatible with the existing natural gas networks and storage infrastructure, as well as all appliances. These combinations of CO2 and hydrogen create compatibility between the production of green hydrogen and the captured CO2 created by clean hydrogen; the existing pipeline systems could then move the created SNG to the end-users. Similarly, carbon sequestration is usually targeted for depleted production basins which would have pipelines previously used to take the production away, and could likely be converted to carry properly processed CO2 back to the depleted fields for sequestration.

Green Hydrogen

The key feature of green hydrogen is its use of electric energy that would otherwise have to be curtailed due to lack of demand at the time of electricity generation. This use of excess renewable energy allows green hydrogen to act as an energy storage device created from and used when intermittent renewable power is not available. If sufficient quantities of green hydrogen could be stored, then, unlike batteries which run out in hours, it could last for days or weeks.

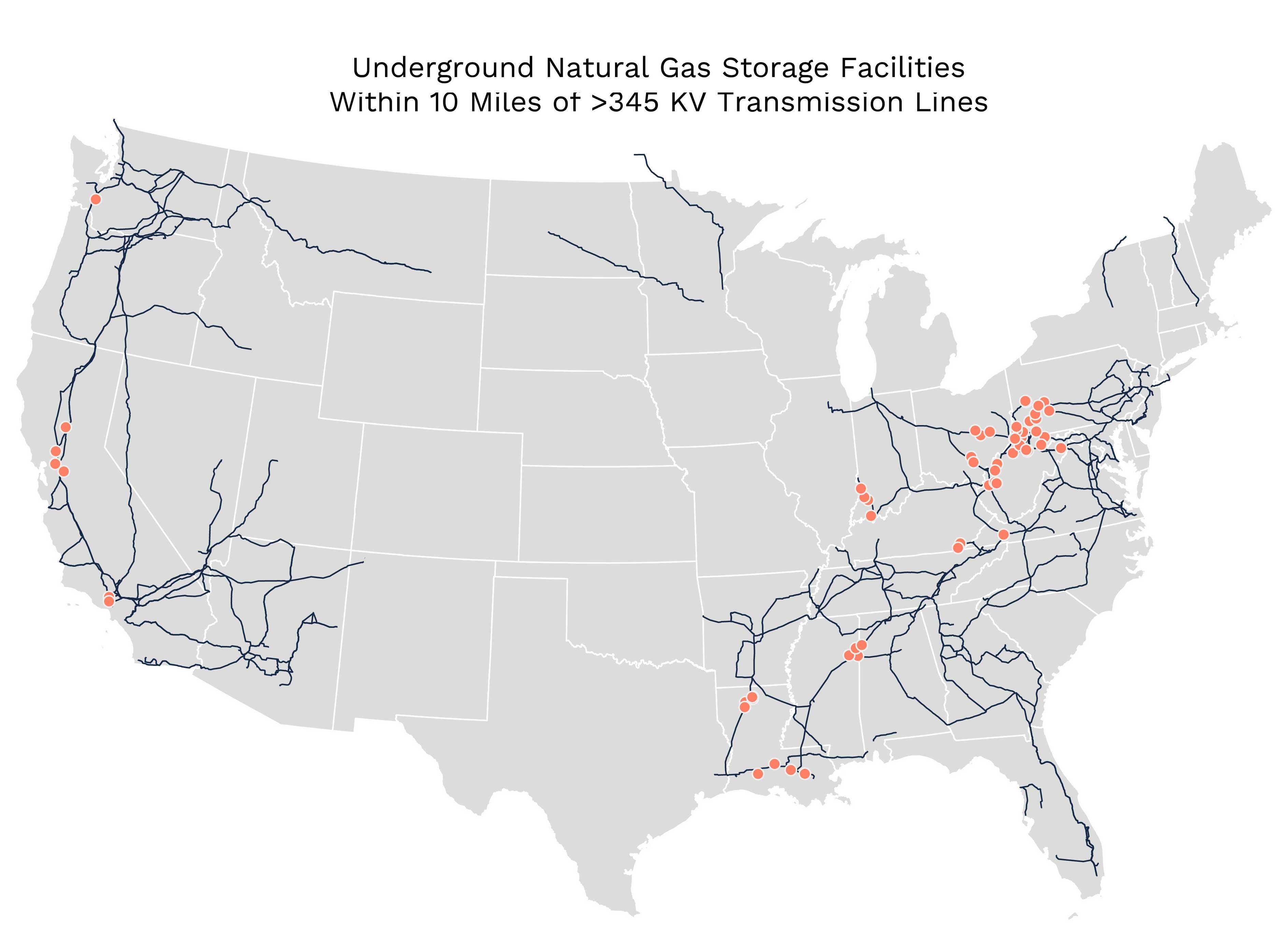

While hydrogen would be best stored in salt caves or domes, depleted production fields can also be used, according to the U.S. Department of Energy. A large network of those fields in the Northeast may be able to provide a hydrogen service that is not much different than what they currently provide for natural gas supply.

We looked for storage fields within ten miles of high voltage electric transmission lines, to identify sites which could access electricity needed to create the hydrogen and also a connection to the grid for supplying power when renewable sources are unavailable.

As seen above, there are over 50 such existing storage fields, owned by some of the biggest energy companies in the country — with Sempra, Berkshire Hathaway Energy, Kinder Morgan, TC Energy and Enbridge all at the top of the list.

Planning For An All-Hydrogen Pipeline Network

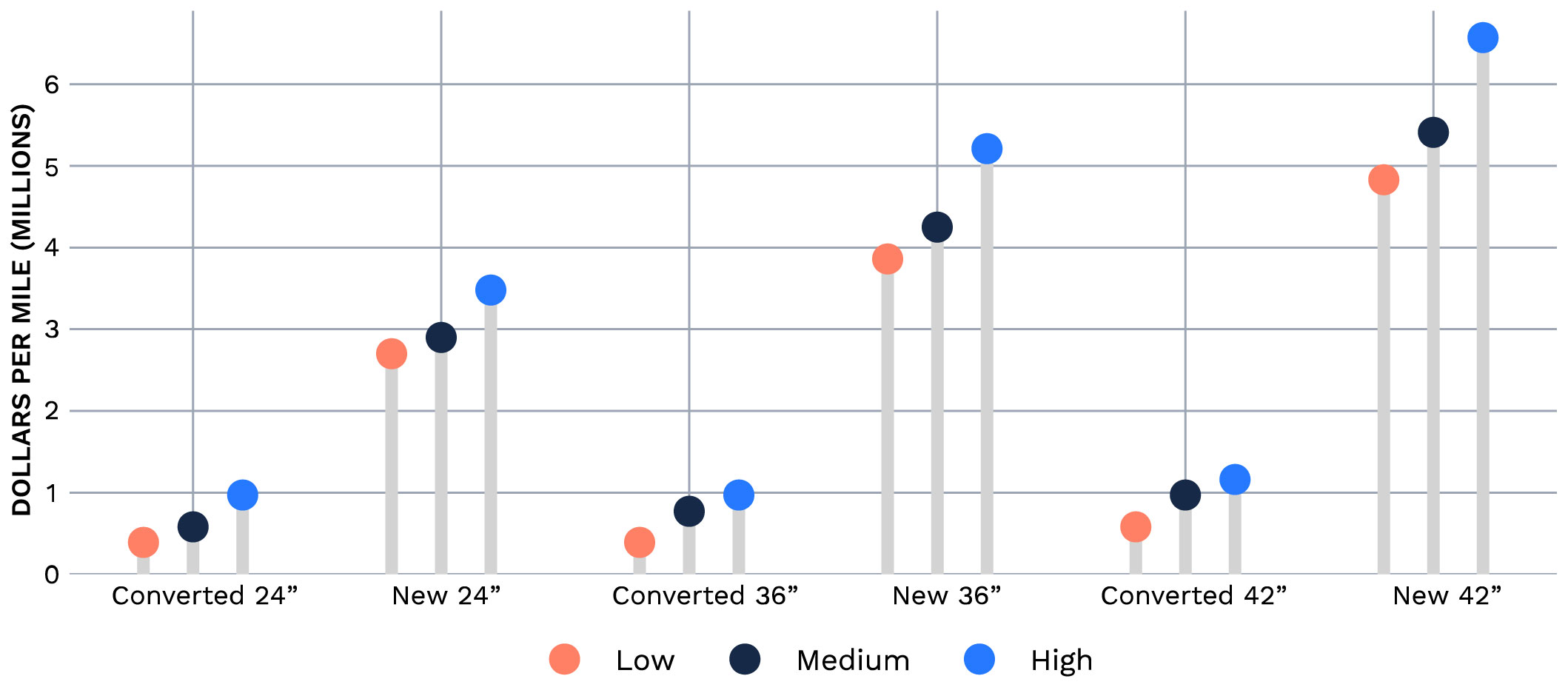

A consortium of European natural gas transmission companies has already announced a plan for building a hydrogen pipeline backbone throughout Europe. Under this proposed plan, the “European Hydrogen Backbone” by 2030 would consist of an initial 7,200-mile pipeline network and would grow to a total length of almost 25,000 miles by 2040. The cost of building this 25,000-mile network is expected to range from $51 to $97 billion. Costs used to create this estimate vary based on the diameter of the pipeline and whether it is newly built or is created through the conversion of existing natural gas pipelines.

As shown in the chart above, the cost of converting an existing natural gas pipeline for hydrogen use is substantially lower than building a new pipeline, ranging from about 10% to as high as 30%. In the European plan, the total cost estimate assumes that 69% of the pipeline network will be repurposed natural gas pipelines and 31% will be new construction.

The U.S. Must Begin to Act Now

Here in the U.S., the private ownership of natural gas assets can hamper the ability of the industry to mount a coordinated response. The lack of a coordinated response in this case, though, could lead to a hydrogen-based solution being completely bypassed for a much riskier and more costly model that relies completely on renewables and complete electrification. It is in the industry’s interest to get out in front of this issue. a better chance of winning approval.

Challenges For Existing Owner-Operators

Existing natural gas pipeline companies possess skill sets and assets that can be leveraged on a path to net-zero. But this path is not without a myriad of obstacles.

Activism

In its recent application for its Regional Energy Access Expansion Project, Williams’s Transcontinental Gas Pipe Line noted that the project was designed and would be “constructed in a manner that is adaptable to green hydrogen” which would allow it to be part of the “critical infrastructure needed to meet clean energy demand for generations to come.”

Interestingly, the Sierra Club in its intervention and comments dismissed this statement out of hand, asserting that “hydrogen is not cost-effective” and there is no “economically viable scenario that would include transporting hydrogen through this pipeline.” It is opinions like this, that if allowed to become accepted, could lead the U.S. down a path that leads to the adoption of a purely renewable energy solution to a low-carbon economy, with the attendant added costs and increased risks from such a solution. The natural gas pipeline industry is already facing a skeptical FERC that views a 16,500 dth/day project as an environmental catastrophe. The ability to show that hydrogen is not only essential to a low-carbon future, but that pipelines are now being developed to accommodate that future, may be critical to getting those pipelines approved. A plan similar to the European Hydrogen Backbone proposed for Europe could be used to rebut unsupported objections like those made by the Sierra Club.

State and Regulatory Opposition

A key argument used recently against new pipelines to New York and New England is that the states should not approve new fossil fuel infrastructure given their respective emissions goals. However, by designing a pipeline that would one day be capable of transporting pure hydrogen, a developer could potentially gain some advantage.

Recently, two New York power plants seeking permits to convert their fuel source to natural gas have promoted the idea that their plants could, in the future, be converted for hydrogen, once that fuel source becomes readily available. Given the current needs in New York City for natural gas and National Grid’s promotion of a hydrogen future, a project in conjunction with that utility may be an obvious choice. In fact, Williams’s Northeast Supply Enhancement project ran into very similar issues about the need for the project, given National Grid’s future plans. Perhaps a similar project that could be used in the interim for natural gas, but which is designed to carry hydrogen in the future, would have a better chance of winning approval.

Storage

The ability to implement a green hydrogen storage strategy as previously described is probably a decade away. However, advance planning of such an approach is critical today in order to be properly prepared as hydrogen innovation escalates.

For instance, the Tennessee Valley Authority (TVA) is currently undertaking a study of three alternatives to replace the coal-fired Kingston power plant. The leading option is to build a gas transmission line to the current site and replace the coal-fired power with gas-fired power. (Environmental groups naturally oppose this option.) The second is to build gas-fired power plants in other regions, but those would require upgrading the transmission lines to the region where the Kingston plant is located. The third is to replace the Kingston plant with renewable energy projects, but that would also require substantial upgrades to the transmission grid and is expected to be more costly due to the intermittency of renewable energy.

What is apparently not under consideration is how renewable power could be paired with power plants that have potential to convert to hydrogen by being colocated near an underground storage field. Yet, there are four storage fields (shown in the chart) on the Mississippi/Alabama border that could easily integrate with renewable sources to provide a more balanced approach to replacing the lost generation. Long-range plans like this one at TVA are why a hydrogen strategy needs to be considered now or these storage fields risk becoming irrelevant if environmental groups dominate the discussions.

Tariffs

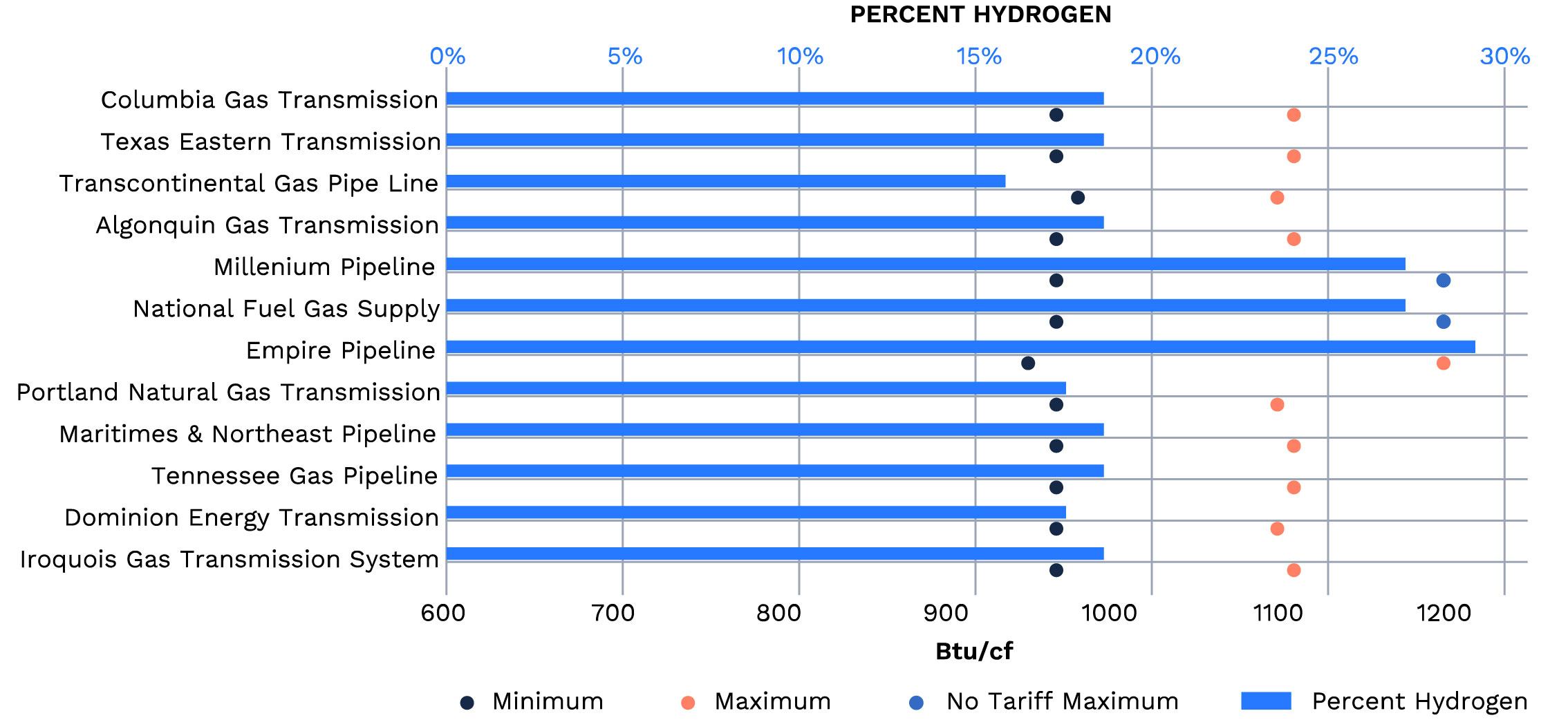

When it comes to blending, one issue beyond technical constraints is whether increased concentrations of hydrogen could be accomplished within the current tariff structure of the natural gas pipelines. These tariffs typically provide specifications for gas that can be transported within the pipeline, called “gas quality” because they limit impurities allowed along with the primary constituent of natural gas—methane.

Because of the previously mentioned interest expressed by both National Grid and Eversource in this blending concept, we looked at the gas quality provisions in the tariffs of pipelines serving New York and New England. One key measure found in all of the tariffs was a minimum btu content of gas tendered for transport. The lowest limit in those tariffs was 950 btu/cf on Empire Pipeline.

There are other restrictions in some of these tariffs that could further limit blending of hydrogen. For instance, a number of pipelines have a provision similar to Algonquin’s tariff that defines gas as a combustible gas consisting wholly of, or a mixture of: (a) natural gas of the quality and composition produced in its natural state; (b) gas generated by vaporization of liquefied natural gas; and (c) manufactured, reformed, synthesized, or mixed gas consisting essentially of hydrocarbons of the quality and character produced by nature in the petroleum, oil, and gas fields with physical properties such that when such gas is commingled with natural gas, the two become indistinguishable. Also, Maritimes & Northeast has a provision in its tariff that prohibits the transport of any gas containing more than four percent, by volume, of a combined total of non-hydrocarbon gases.

Risks to the System

An oft-referenced study by NREL notes that a key risk of introducing hydrogen into the natural gas stream is that some metal pipes can degrade when they are exposed to hydrogen over long periods of time, particularly with hydrogen in high concentrations and at high pressures. Therefore, the study notes that this is a particular concern if “hydrogen is injected at high concentrations into existing high-pressure natural gas transmission lines.”

For this reason, pipelines may now want to begin preparing their tariffs to assure that they provide a specific limit for the introduction of hydrogen at a level that the company has determined is safe for the types of pipe used in their systems and the pressure present in those systems. In any event, while the natural inclination of a pipeline company may be to introduce gas quality conditions that are protective of the pipeline, a company may be able to promote its financial and climate resilience by considering the future of hydrogen and modifying its tariff to expressly accommodate blending, and by designing future projects to allow for the transport of a wider diversity of fuels, including up to pure hydrogen.

FERC

Along with hydrogen, renewable natural gas (RNG) is viewed by many as a fuel of the future. Local distribution companies and pipelines would like to attract the green features of RNG, but they worry that its differences from traditional geological natural gas could cause issues with their systems, and have made efforts to create additional protective control measures.

FERC recently refused to allow Berkshire Hathaway Energy’s Eastern Gas Transmission to make changes to its tariff that it claimed were designed to promote use of RNG, but also to protect its own pipeline and downstream users from any harmful aspects of this new source of gas. In the face of opposition by the RNG industry, FERC refused to allow the tariff change to be implemented, primarily because EGT had not shown the harm the new source of gas might cause, nor how its proposed change would actually protect its system from that harm. A lesson from this particular case may be the need for pipelines to adopt universal standards for all gas flowing on their systems, rather than focusing on new sources.

RECOMMENDED READING:

RNG Industry Fights Against Pipeline Tariff Changes

Conclusion

On any feasible path to NZ50, the natural gas pipeline industry must reimagine its role, as providing a resilient transportation corridor that is applicable to a broader array of users and molecules.

Scientific and technical innovation is moving us toward greater availability and applicability of hydrogen as a fuel. In parallel, the U.S. must resolve a myriad of non-technical issues before any of the roles discussed herein could become reality for existing natural gas asset operators.

Arbo is working with our customers as they negotiate what we call the energy evolution. (Many feel that the “energy transition” moniker doesn’t quite capture the long-term role that existing infrastructure must play in our world’s pathway to net-zero.) We see them charting a path leveraging their companies’ skill sets and assets to enable them to thrive from the scale-up of renewables and decarbonization technologies.

If you enjoyed this article, subscribe to Arbo’s blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.

The PJM Power Surge: FERC’s Co-Located Generation Query and PJM’s Fast-Track Gamble

Forecasting with ArView Project Intelligence: Plaquemines LNG

Still reading? How 'bout some video...

ARBO'S GARY KRUSE AT THE FIRST ELEMENT CONFERENCE

Watch and listen to the video presentation for more on the hurdles and imperatives to facilitate hydrogen adoption.