CASE STUDY

Arbo Conducts Tariff Revenue Optimization for Major U.S. Gas Pipeline Company

Overview

FERC’s practice of cost-of-service ratemaking ensures interstate gas transport rates are “just and reasonable” based on a pipeline's cost of providing service and inclusive the opportunity for the pipeline to earn a reasonable return on its investment.

While this process sets the maximum rate, pipelines often negotiate rates for services on an individual customer basis and employ a variety of discounts and complex tariff structures to increase competitive position and optimize revenue.

When the commercial team at a top 5 U.S. pipeline company was asked to complete an optimization project to increase revenue, they turned to Arbo for a comprehensive evaluation of the company’s existing tariffs and its peers’ tariff structures — and recommended modifications sensitive to market conditions.

The Arbo team identified a set of relevant industry peers and competitors based on technical characteristics and leveraged its data acquisition system to query comparable tariffs and contracts. With this valuable data in hand, the team could effectively design and complete a benchmarking analysis. The analysis included evaluating pricing models, terms, language, incentives, and more, to uncover revenue and market capture opportunities. Actionable data and recommendations delivered to the client included:

- documentation and interpretation of specific tariffs and embedded language referenceable for future implementation and filings.

- identification of peer rates for similar services in key competitive market areas to drive market share capture targets.

- contextual information, such as operational and safety standards needed to manage execution risk of additional services.

The Problem

Our client’s commercial optimization group historically focused on identifying new project opportunities for growth but was asked by senior leadership to find additional revenue opportunities within their existing footprint. To succeed, the team needed to shift the attention of their typical analysis toward the activities of their peers. They needed to access and analyze competitive tariffs and contracts, and ultimately to illuminate the landscape of differentiated services in the marketplace.

While this data is publicly available, it’s fragmented, non standard in structure, and nuanced in language. Assembling, normalizing, and structuring tariff-based data to complete a benchmarking project is a challenging effort — particularly for teams unable to focus on it full time.

The Solution

Arbo put its data acquisition system and experienced energy regulatory analysts to work on a custom-scope project that met the customer’s need for in-depth analysis and data-driven decision making.

Step one was to query and refine data to establish a relevant peerset. Through an iterative process with our client, Arbo identified companies with similar pipeline infrastructure, geographical reach, and customer segments. This ensured benchmarking would provide meaningful and comparable data.

We then analyzed the tariff structures, pricing models, contract terms and language, and incentive programs — which included distance-based tariffs, volume discounts, peak and off-peak pricing, and commodity indexing, to name a few. (More on tariff structures here.)

Additionally, by layering in contract analysis to evaluate the competitors' performance metrics — such as revenue per mile, customer retention rates, and market share, the team identified best practices and successful strategies employed by the customer’s peerset.

This provided insight to actionable modifications, including innovative tariff structures, pricing methodologies, customer segmentation approaches, and value-added services.

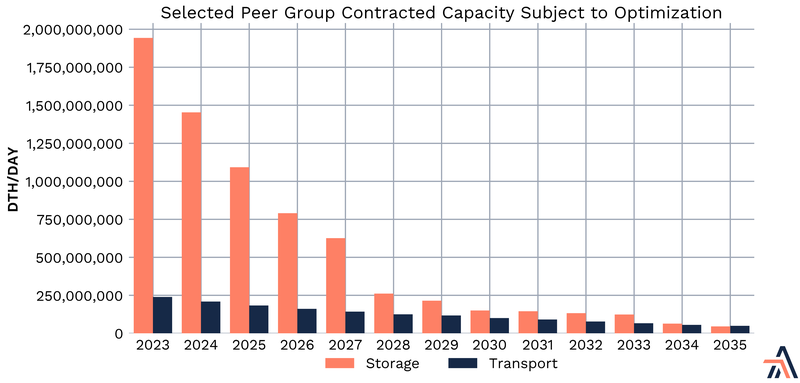

The chart above highlights the opportunity in one of the five key market areas analyzed based on contract volume through 2035. This provides a high level visual of opportunities across both storage and transport volumes, and was followed by drill down analysis on a contract-level basis.

Our customer was particularly interested in how its peers were using hourly operational flow orders (OFOs) or accelerated flow service, which focused our analysis specifically on off-peak pricing. To implement this service, it would be necessary to follow best practice to mitigate any pushback from customers on filing approval while ensuring revenue maximization. So we looked at the language used to describe those provisions within other tariffs in our refined dataset, and extrapolated standard terminology, key phrases, and a few anomalies.

The Impact

A slight variation in the language or nuanced structure of these tariffs can mean leaving millions of dollars in revenue on the table. Oftentimes it can come down to a single sentence in a hundreds-of-pages-long document filed with FERC.

Without Arbo’s support, the client team would have spent countless hours on data acquisition, structuring, and analysis, only to then need significant cross-functional input from regulatory experts.

Our benchmarking and optimization engagement for this natural gas pipeline customer was delivered in one month and spanned the entire footprint (encompassing five key markets), along with quantified modification suggestions to mitigate risk, capture additional market share, and most importantly, to realize millions of dollars in potential incremental annual revenue.

The customer’s Arbo advisory services subscription also allowed for continued monitoring, analysis and reassessment to the reaction of its peers in the marketplace after tariff modifications were implemented.

Subscribe to Arbo’s free blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.