How reliable is energy infrastructure?

Dakota Access Case Study

A POTENTIAL PIPELINE SHUTDOWN (DAPL)

WARNS OPERATORS TO FIND OPTIONS.

Provide your email address to download a PDF.

The full report text is available below.

CASE STUDY:

How reliable is energy infrastructure —

DAPL Pipeline Case Study

ArboIQ | April 1, 2021

What's the issue?

Many aspects of marketing, moving, and trading energy are increasingly challenging due to changing industry fundamentals, policy and investor sentiment aimed at accelerating fossil fuel alternatives, and persistent opposition to energy infrastructure development and operations. The possible shutdown of the critical Dakota Access Pipeline (DAPL) illuminates these issues.

Why does it matter?

Despite uncertainties, energy shippers and traders must be able to:

- Access and analyze all the contractual, regulatory and routing data needed to maximize returns or minimize costs for transportation;

- Find optimal origins, destinations, and pricing for commodity transportation; and;

- Obtain optionality to rapidly respond to events such as a major pipeline shutdown.

What's our view?

In the near term, DAPL will continue to operate, but industry stakeholders should be increasingly proactive to maintain flow assurance. Modernizing the workflows used to compare shipping rates, routes, and costs will improve risk management and efficiency across the value chain.

Energy marketers, traders, business developers, and executives make big business decisions every day. From serving customers, to sourcing products, to capitalizing on arbitrage opportunities, these decisions depend on large amounts of data, precise calculations, and constructive counterparty negotiations — all in the context of rapidly changing market fundamentals. The next generation of professionals powering energy value chains need innovation targeting commercial business processes. Moving molecules is frustratingly siloed and lacks modern digital technology to drive increased efficiency, ecosystem collaboration, and transparent transactions. Arbo is innovating for these individuals who ensure America’s energy independence. Its new map-based liquids commerce platform enables data integration, team collaboration, and critical calculations needed for finding the best routes-to-market and midstream infrastructure. It’s like Kayak for energy!

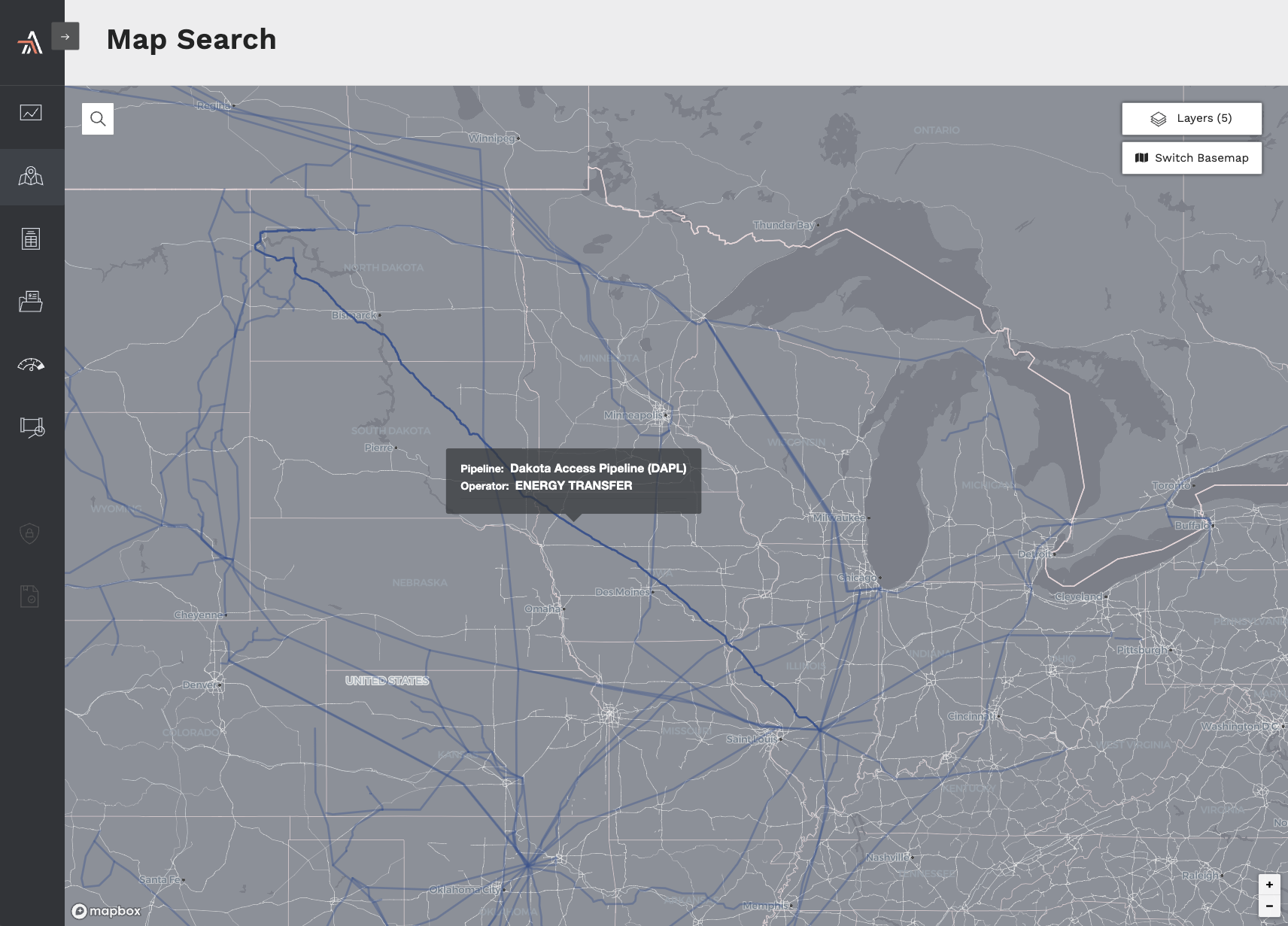

Flow Assurance Use Case: Dakota Access Pipeline

Hundreds of billions of dollars of new midstream infrastructure was constructed in North America over the past decade. In most basins, takeaway capacity meets or exceeds producers’ needs to economically transport their products to market. Over this same period of time, opposition to infrastructure emerged with ever increasing resources and sophistication. Infrastructure developers increasingly faced problematic permitting challenges and lengthy litigation. A strongly contested oil pipeline project was the Dakota Access Pipeline (DAPL) — constructed to take 570,000 bbl/pd from the Bakken to Patoka, Illinois and on south to Nederland, Texas via connection to the Energy Transfer Crude Oil Pipeline. DAPL was announced in June 2014, began construction in June 2016, and entered service in June of 2017. Opposition to its operations and associated litigation continues to this day.

Background

But over the 45 months since being placed into service, DAPL has provided reliable and needed takeaway capacity to the 2nd largest shale oil producing region in the U.S. This transportation route is in jeopardy of being shut down based on a court decision that an easement was granted by the U.S. Army Corps of Engineers without an Environmental Impact Statement required by the National Environmental Protection Act. It is very rare to shutdown a fully in-service pipeline such as DAPL. The possibility considerably increases the operational risks to shippers and marketers utilizing this critical infrastructure, including increasing the likelihood that this could occur for other assets. Proactively planning for these types of “flow assurance” risks and evaluating and securing other routes-to-market requires:

- Researching route suitability of other transportation options, rates and availability. In this example, other pipelines could include Kinder Morgan Double H, True Company’s network or Enbridge pipeline systems. More expensive and less safe options would be rail and truck.

- Accessing all tariffs documenting pricing and terms such as committed vs uncommitted rates and nomination procedures.

- Choosing different transportation and buying and selling strategies for barrels, such as selling at the lease to marketers or others with existing capacity commitments on alternative pipelines.

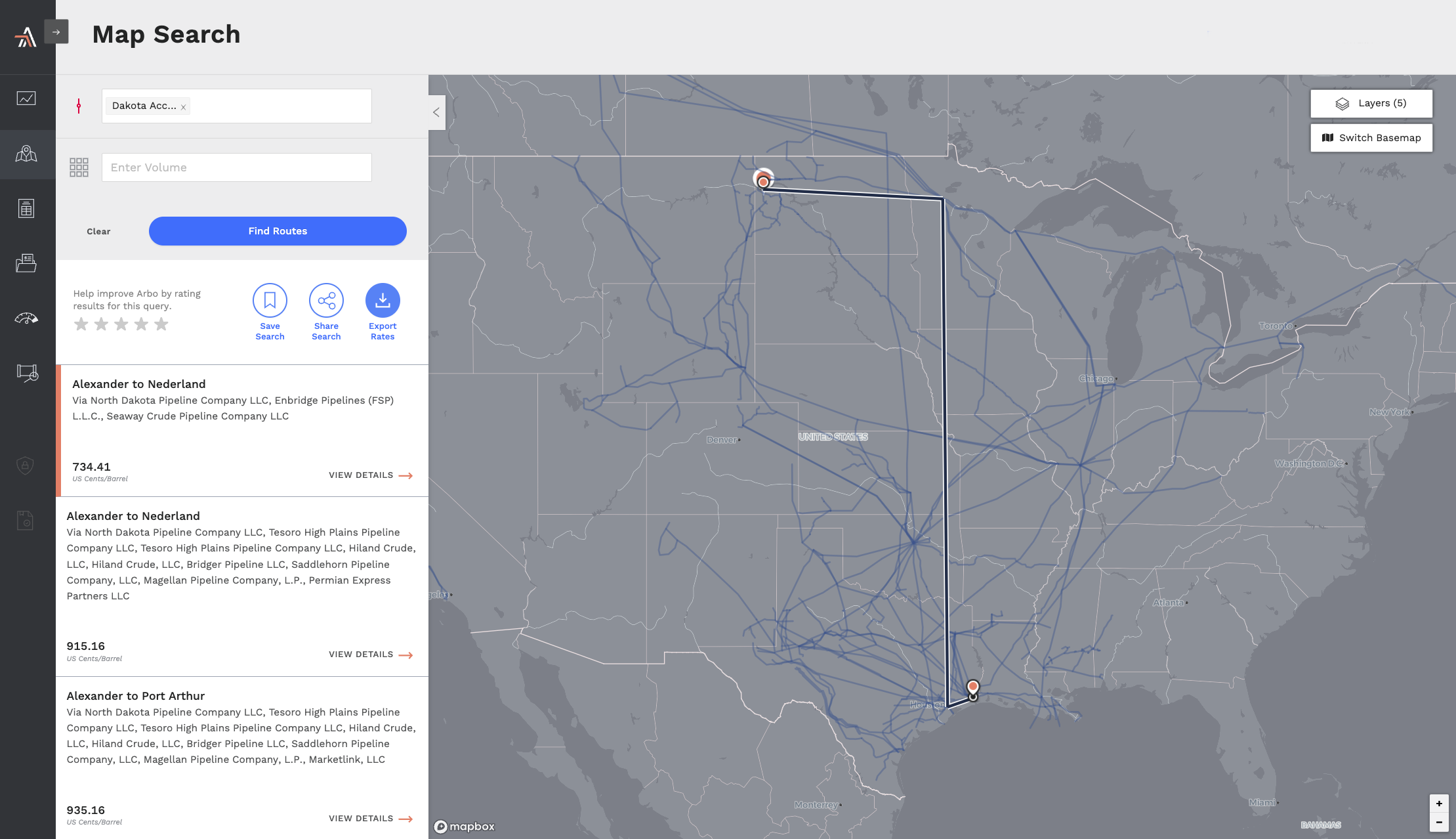

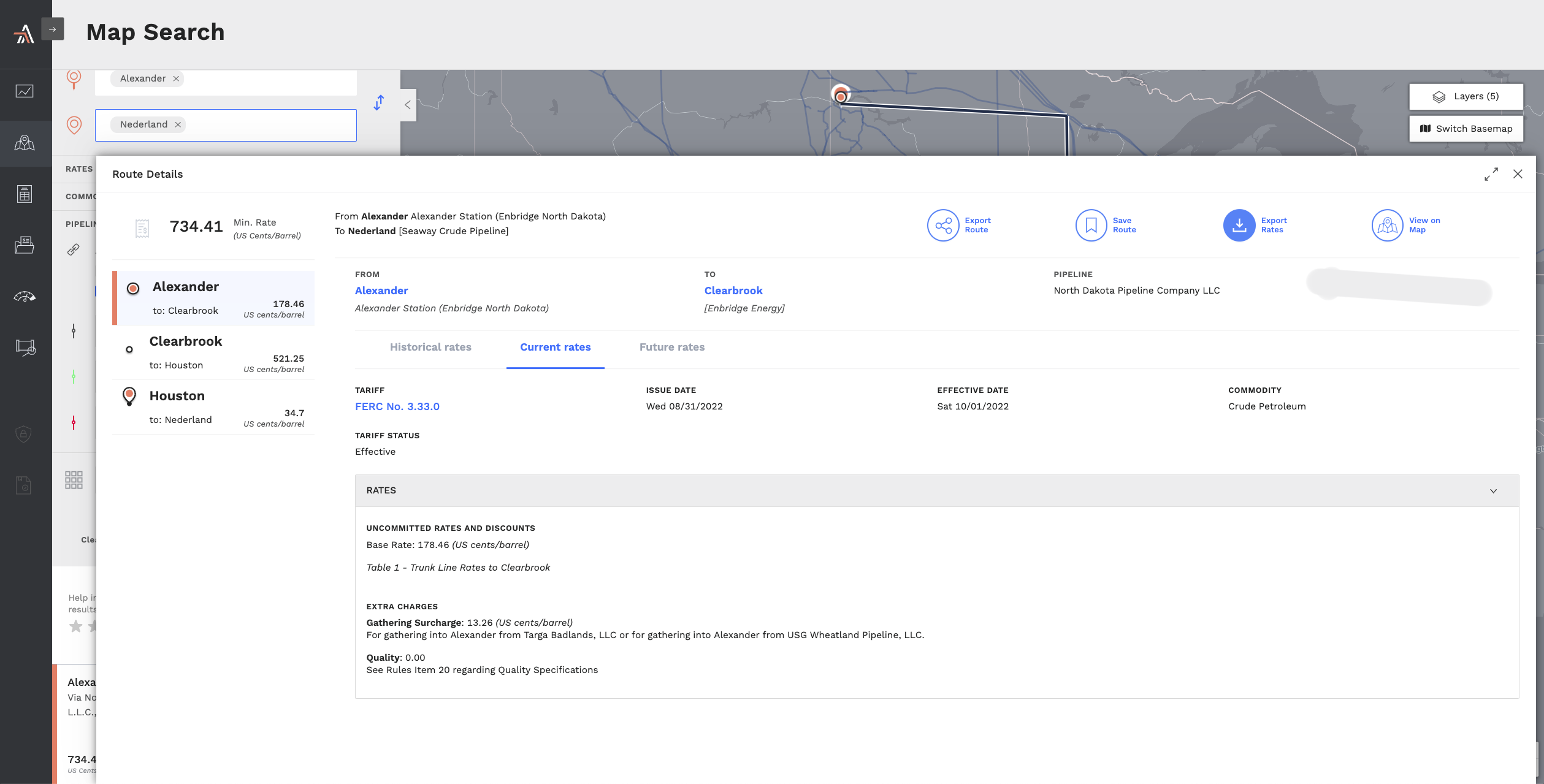

The following section demonstrates access and analysis of the aforementioned data in the Arbo liquids commerce platform. Below figures show the uncommitted rate for the most cost effective DAPL alternative: Enbridge North Dakota/Flanagan South/ Seaway pipelines to Nederland via Clearbrook.

Route Comparison Example

Using Alexander in McKenzie County, ND as a common origin point and Nederland as a destination, options range from $8.76 to $12.04 for walk-up rates but can vary significantly for incentive rates and shipper status. The Seaway Crude Pipeline, which runs from Cushing to Houston and on to Nederland (the final leg for many North Dakota barrels making their way to the Gulf Coast), is a prime example of how much incentive rates can vary from uncommitted base rates, and also demonstrates how often this analysis can change. The current uncommitted rate for Seaway moving light crude from Cushing to Nederland is 300 US cents/Barrel; the temporary volume incentive rate for moving 30,000 barrels per day or more is 45 cents/Barrel. The incentive rates on Seaway have changed twice over the past six months, and are due to increase on February 1, 2021 and March 1, 2021 as future tariffs become effective, making any one month’s costs different from the next.

Background reading:

The Future of Energy Infrastructure

The example depicted could happen anywhere and have a profound impact on the future of midstream infrastructure.

The recent polar vortex blackouts in Texas shows what can happen when the intersections of gas, oil, renewables, and transmission infrastructure are unreliable or unavailable. While that catastrophic event may influence public and policy maker opinions on the need for more robust infrastructure, the trends make new and maintenance infrastructure projects very difficult. These difficulties won’t just impact pipeline projects.

Similar opposition will emerge to oppose renewable and related electric transmission projects as well, because all infrastructure development will have environmental impacts. In the near term, project work will likely be focused on modernization programs as most of the pipelines with at least one thousand miles of pipe have a substantial amount of older pipe that could be due for replacement. The total midstream capacity available today is likely what we’ll have for at least the next decade. If it is too little or too much depends on geography.

Shutting down DAPL would leave the Bakken with too little oil pipeline capacity. There aren’t many good options for where there is too little midstream infrastructure. Where there is too much, industry consolidation is well underway and will continue. This will help decrease some of the extreme price competition being driven by the extended pandemic supply shock.

Conclusions

This pandemic year has focused businesses everywhere on enabling individuals to do much more with technology that is always on, accessible anywhere, and integrated with teams and customers. Business relationships that depend on in-person interactions need digital alternatives. Arbo integrates in a single map-based platform the only comprehensive source of liquids transportation costs with other critical data, such as calculated netbacks and proprietary rates and routes users can securely upload. Customers benefit from improved “flow assurance,” stronger business development intelligence and a new rapid response capability to reduce operational risks. The uncertainty on future operations of DAPL provides a great use case.

Arbo solves for urgent needs described by commodity market participants.

FLOW INTELLIGENCE

Find the best origins, destinations and

pricing for commodity transportation.

BUSINESS DEVELOPMENT

Harness all the contractual, regulatory and routing data needed to market, transact, or capture long term transportation.

Operational risk management

Enable rapid response and alternatives analysis to events such as a major shutdown.

If you enjoyed this article, subscribe to Arbo’s blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.