Threat of DAPL Shutdown Grows

What’s the issue?

Last Friday, the U.S. Army Corps of Engineers (USACE) was required to report to the U.S. District Court for the District of Columbia on any restrictions on the operations of the Dakota Access Pipeline (DAPL) it intended to implement while it prepares an Environmental Impact Statement (EIS) with respect to an easement it had granted DAPL.

Why does it matter?

The court had previously ordered the pipeline to shut down while the EIS is prepared but was directed by the appeals court to give the USACE an opportunity to propose protections for the plaintiffs, Native American Tribes, while the EIS is prepared. After the USACE requested a 58-day delay in its report to the court, the court was clearly expecting that the USACE would be prepared to provide the court with an answer, but it was not.

What’s our view?

The refusal of the USACE to even address the question presented appears to make it more likely that the court will once again order the pipeline to shut down until the EIS is completed, which the USACE reported is not expected to occur until March 2022. Such a shutdown order could come as early as next Tuesday. While DAPL will undoubtedly appeal any such order by the court, the mere threat of the shutdown will result in market changes for the crude industry in North Dakota.

Last Friday, the U.S. Army Corps of Engineers (USACE) was required to report to the U.S. District Court for the District of Columbia (DC District Court) on any restrictions on the operations of the Dakota Access Pipeline (DAPL) that it intended to implement with respect to the easement it had previously granted to DAPL while the USACE prepares an Environmental Impact Statement (EIS). As we discuss more fully below, the USACE disappointed the court by essentially declining to address the question presented, leaving it up to the court to act to modify -- or even halt -- DAPL's operations while the EIS is prepared. After listening to the responses of the other parties and the judge to the USACE’s presentation, we think it is more likely than not that the judge will once again order a shutdown of the pipeline as early as next Tuesday.

The USACE’s reluctance to halt or modify the pipeline’s operations may be an attempt by the Biden administration to avoid the same negative political ramifications that resulted from its earlier revocation of a key permit for the Keystone XL pipeline in the first days of the administration. Because the plaintiffs have a motion pending before the court for a permanent injunction to halt the pipeline’s operations while the EIS is prepared, the USACE’s refusal to act means the judge is expected to rule on that motion, which he appeared ready to do during the conference on Friday. Granting the motion will shut down the pipeline, but also allow the administration to claim that it had no role in the outcome. While DAPL will undoubtedly appeal any such order by the court, as we saw last summer, the mere threat of the shutdown will result in market changes for the crude industry in North Dakota, and contingency planning is most likely already underway.

Where the Case Stood Last Thursday

Last summer, the DC District Court issued an order that: (1) required the USACE to prepare an EIS to support its grant of an easement to DAPL; (2) vacated (or voided) the original easement that had been granted; and (3) halted the flow of oil in the pipeline until a new easement could be granted. DAPL and the USACE appealed those decisions to the U.S. Court of Appeals for the District of Columbia Circuit (DC Circuit), which earlier this year upheld the first two decisions, but reversed the third for essentially two reasons. First, it found that the DC District Court should have allowed the USACE an opportunity to propose modifications to the operation of the pipeline following the easement being vacated. Second, the court should have applied the established standards for granting an injunction before ordering any modification to the pipeline’s operations.

Anticipating the second reason for overturning its decision, the court ordered the parties to fully brief the question of whether an injunction stopping the flow of oil was appropriate, and that briefing concluded last November. Following the appellate court decision in January, the DC District Court ordered the USACE to come into court and report whether it intended to require any changes in operations by DAPL pending its completion of the EIS. The USACE had requested a 58-day delay of the court conference scheduled for February so it could fully brief the new Biden administration. The court granted that delay with the tacit understanding that it would give the administration time to formulate its position on whether to impose any operational restrictions, as the USACE had been arguing since last September was its right.

Last Friday’s Conference

At last Friday’s hearing, the USACE spent a great deal of time explaining the supposed progress it had made since last September in the preparation of the EIS, but indicated it was still a year away from finishing that job, and estimated it would not be done until March of 2022. It also reported to the court that it would not be appealing or seeking rehearing of the DC Circuit decision that essentially upheld most of the DC District Court’s prior orders in the case. However, the USACE did not report on its decision with regard to imposing restrictions on the pipeline’s operations until pushed by the court. The USACE’s attorney then indicated essentially that it was a complex question with competing interests, and that the USACE was continuing to monitor the pipeline’s operations, which meant that the USACE had not made a decision and could not tell the court when it would be able to make a decision or if it ever would make such a decision.

The Likelihood of a Court Injunction Grows

As a result of the failure by the USACE to make any progress, whether from a lack of decisiveness or as a matter of political strategy, the court is left with a pending motion for an injunction to stop the flow of oil while the EIS is prepared. After expressing his surprise with the USACE’s lack of a decision, the judge initially indicated that he was prepared to rule on the injunction motion, but asked all the parties if they felt it was ripe for a decision. Only DAPL requested a delay, for two reasons. First, it wanted a two-week delay to allow it to update the court on the market impacts that such a shutdown order would have, which is likely to be the key factor in the court’s injunction decision. Second, DAPL said it would be seeking an en banc rehearing of the DC Circuit’s decision and suggested that the court lacked any authority to rule on the injunction motion until that request for rehearing was resolved.

The court responded by giving DAPL until this coming Monday, April 19, to file any supplemental information, and said the other parties should indicate after they see that filing whether they want to file anything in response. He also said he would consider whether the rehearing request limits his ability to issue an injunction. We think that, given this exchange, it is very likely that the judge will issue an injunction soon after DAPL files its supplemental information on April 19. We would expect that any such order will likely not be effective for at least ninety days -- not only to allow for an orderly shutdown -- but also to allow for an appeal by DAPL. However, any such order, even if under appeal, is likely to have an impact on the markets, based on the history from last summer and the statements made by shippers on the pipeline.

Contingency Planning

When the judge ordered DAPL to shut down last summer, we now know how at least one shipper and DAPL responded. In a lawsuit filed by ExxonMobil’s subsidiary, XTO Energy (XTO), late last month, XTO explained that, following last summer’s shutdown order, it was in an impossible situation with a significant portion of its Bakken production for the coming month of August committed to DAPL, which appeared to be under an order requiring it to shut down by August 5. If XTO did nothing, it would risk having to shut in its production, and finding alternatives is not “as easy as flipping a switch.” Despite this fact, XTO was able to redirect about 40% of its August volumes, but then the court’s shutdown order was stayed. XTO immediately nominated the remaining 60% of its August volumes on DAPL. The lawsuit, however, is over the fact that DAPL then charged XTO for failing to nominate its full volume for the month -- and so XTO was left paying to move 40% of its volume on other carriers while still owing DAPL a deficiency payment for the volumes it did not move on DAPL.

We can expect a similar process to occur this time if the court orders a shutdown. However, the planning period may be somewhat more orderly as we expect that the court will make the effective date of the order about 90 days out from when it is issued. However, from public statements of other producers, it is clear that contingency planning is going on across the industry. For instance, Oasis Petroleum has noted that it regularly uses DAPL, and to mitigate the risks associated with a potential shutdown, it has proactively arranged for portions of its production to be sold at alternative outlets at fixed differentials to NYMEX WTI. DAPL competitors are also preparing to provide alternatives. Crestwood has indicated that, at its COLT Hub, rail loading volumes have increased as shippers began to increase utilization of crude-by-rail assets in light of the ongoing uncertainty around DAPL. Similarly, Tallgrass Energy’s and True Company’s subsidiaries, Seahorse Pipeline and Bridger Pipeline, respectively, announced an open season for joint tariff transportation service from the Williston Basin to Midcontinent and Texas destinations beginning on June 1, 2021.

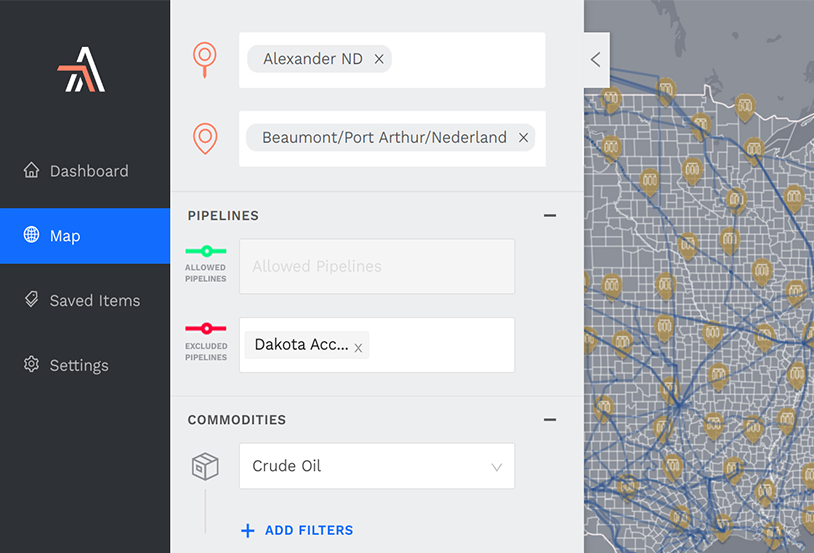

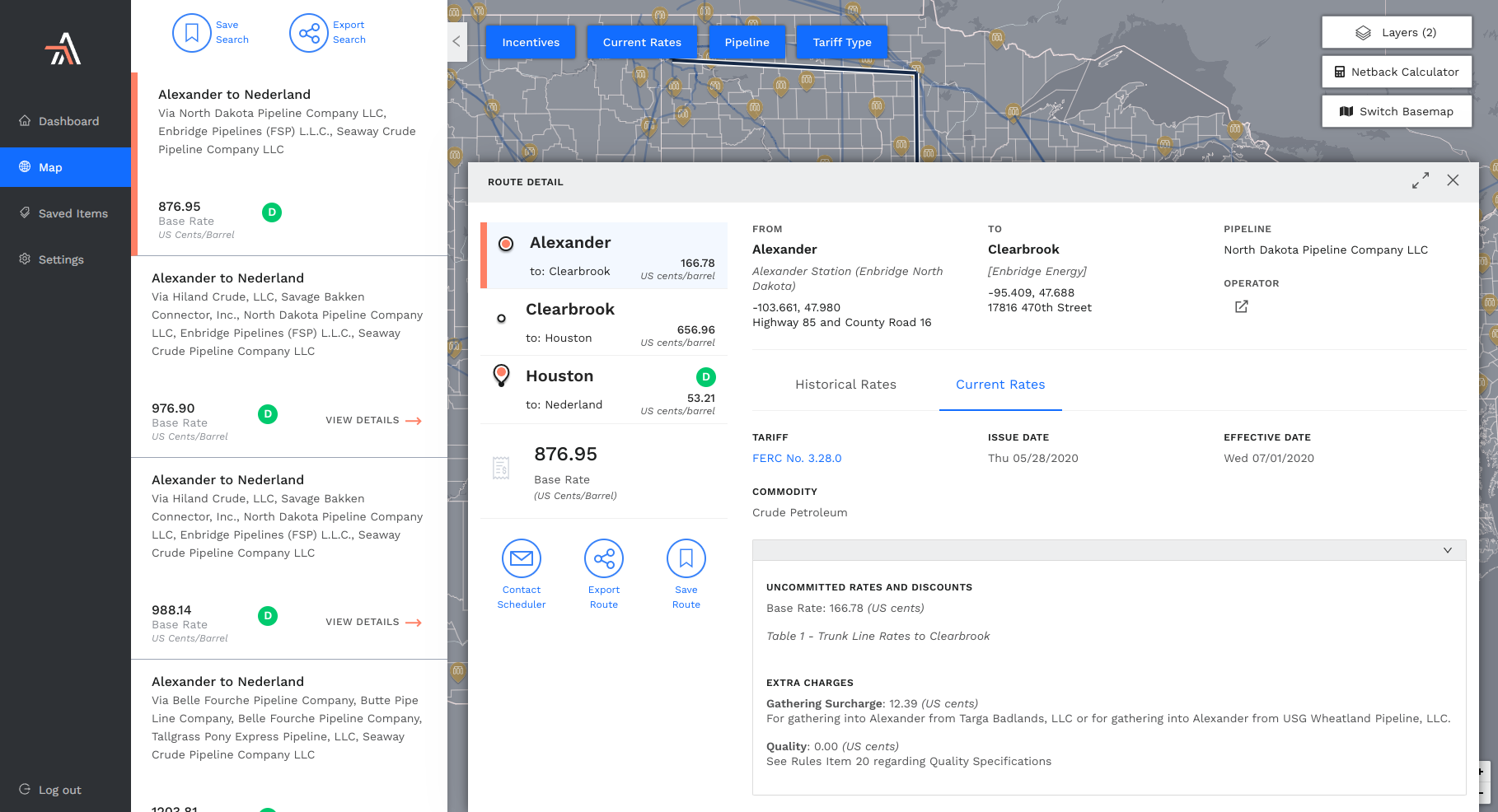

By using our new, FREE Arbo liquids commerce platform, including our FERC alerting service and our OPTM, DAPL shippers can search for alternative routes and keep up to date with other services that become available.