CASE STUDY

Arbo Helps Leading Pipeline Company Maximize ROE for a Billion Dollar Project

Overview

A leading energy company with $100 billion in assets needed to simultaneously evaluate a large new opportunity and an emerging competitive challenge.

The opportunity was a new project in the Northeast region. To take an investment decision required benchmarking comparable projects to their planned project and assessing it against existing infrastructure.

The challenge was to an existing in-service pipeline that needed to remain competitive amongst its peers and avoid any risk of future rate proceedings.

The company engaged the ArboIQ team for further analysis of the technical regulatory issues impacting the planned project and the potential risks to returns on equity of the existing asset. Our multidisciplinary team utilized its data acquisition and research capabilities combined with industry knowledge to support the client’s project planning and competitive analysis.

The Problem

Our client needed to understand highly technical regulatory information to inform their strategy and quantify their competitive advantages on cost and time-to-market.

With their project soon to be filed, they sought to validate their estimates and assumptions for the regulatory filing process and anticipate any potential delays in an area with heavy opposition that could ultimately lead to cost overruns and in-service delays.

While planning the massive undertaking of a new pipeline project, they were also trying to keep existing customers happy with competitive rates — in line with industry norms and viewed as “fair and reasonable” by the regulator. (The project was an interstate natural gas pipeline regulated by the Federal Energy Regulatory Commission — FERC.)

They needed a team with fast access to all the relevant data and the analytical, legal, and industry expertise to select, model, and interpret the correct comparables for both the new project benchmarks as well as existing competitors’ rates.

The Solution

The ArboIQ data acquisition system is engineered to continuously crawl, acquire, parse, and quality check vast numbers of energy regulatory filings including those filed with FERC. Because of its accuracy, comprehensiveness, and ease of use, most industry leaders use Arbo gas asset analytics software as their system of record instead of relying on the FERC e-library system.

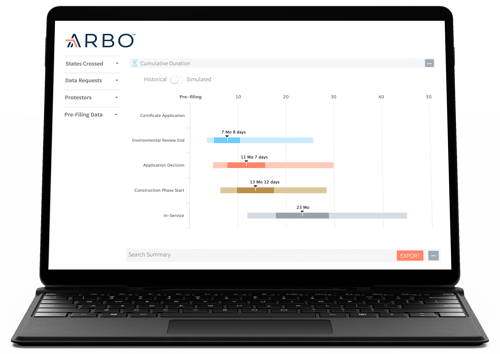

The ArboIQ team quickly assembled and reviewed hundreds of projects and tens-of-thousands of regulatory documents using the natural language processing algorithms powering the Arbo software platform. This enabled the team to construct a model based on all projects with the most similar characteristics on variables, such as size, cost, length, and geography and to provide the following forecasts for the customer’s pipeline project:

Asset Analysis & Project Schedule

The analysis identified 87 targeted projects with similar characteristics by project phase. In addition, the likelihood and type of opposition group involvement was assessed using a proprietary methodology for assembling and categorizing individual comments from docket filings allowing the ability to better anticipate and manage opposition risk.

The resulting deliverable provided data-driven, independent, and unbiased validation of internal estimates for project completion and identification of previously unknown issues.

Existing Infrastructure Competitive Benchmarking

ArboIQ identified a mix of competitors operating infrastructure within the geographic region and compiled a comprehensive benchmark survey that included their rate structures and pricing mechanisms.

The survey outlined and clarified the legal complexities of the associated rate structures and provided data visualizations that told a clear story and path forward for setting a competitive rate for their asset.

The Impact

Instead of having to piece together disparate data sources and manually assemble thousands of pages of regulatory filings over months, the customer had answers in days to their most impactful business problems. Without ArboIQ, this asset and competitive benchmarking project would have taken months to complete and risked missing critical data and insights Ultimately, the independent third-party analysis provided by our team revealed significant risks to the planned project, which the client chose not to go forward with. Our customer saved hundreds of millions of dollars in misallocated capital and maintained a competitive rate structure to provide future returns and less regulatory risk.

Subscribe to Arbo’s free blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.