An Emerging Rainbow of Opportunity — DOE’s Hydrogen Hubs

What’s the issue?

On October 13, 2023, the Department of Energy (DOE) announced the winners of $7 billion in federal funds to establish regional hydrogen hubs, which signifies a major milestone in advancing hydrogen technologies.

Why does it matter?

This initiative presents substantial opportunities for the energy storage and pipeline industries.

What’s our view?

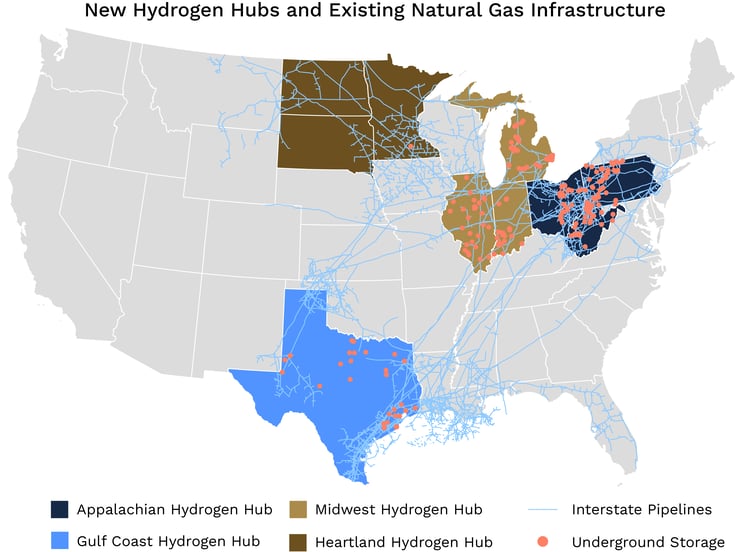

Hubs producing blue hydrogen present the greatest opportunity because they involve a trifecta of substances — hydrogen, natural gas, and carbon dioxide — all requiring transportation and storage. Because DOE’s hydrogen hubs aim to take advantage of existing regional infrastructure, those hubs to be located in the Appalachian, Gulf Coast, Midwest, and Dakotas regions will produce the most blue hydrogen, where significant storage and pipeline infrastructure exists.

On October 13, 2023, the Department of Energy (DOE) announced the winners of $7 billion in federal funds to establish regional hydrogen hubs, which signifies a major milestone in advancing hydrogen technologies. This initiative presents substantial opportunities for the energy storage and pipeline industries.

Hubs producing blue hydrogen present the greatest opportunity because they involve a trifecta of substances — hydrogen, natural gas, and carbon dioxide — all requiring transportation and storage. Because DOE’s hydrogen hubs aim to take advantage of existing regional infrastructure, those hubs to be located in the Appalachian, Gulf Coast, Midwest and Dakotas regions will produce the most blue hydrogen, where significant storage and pipeline infrastructure exists.

Although hydrogen is the most abundant element in the universe, it has only recently emerged as a potentially viable energy carrier. This is because on our planet, hydrogen is usually attached to other molecules and historically has not been thought to exist alone in large reservoirs, making other energy sources like natural gas and coal far more economical. However, climate change has made hydrogen more attractive as its combustion results only in water emissions as opposed to greenhouse gasses from more traditional sources.

Hydrogen also has relatively low volumetric energy density — it may contain more energy generation potential than other conventional fuel sources pound for pound, but it also takes up more space (volume). When compared to natural gas, one pound of hydrogen provides 2.5 times more energy. But after factoring in hydrogen's lower density, three times the volume of hydrogen is required as compared to natural gas to get the same amount of energy. Hydrogen is also a smaller molecule, which increases the potential for leakage, changing the requirements for safe pipeline transportation and storage.

This all adds up to innovations needed in transportation, storage and delivery. Sound familiar? Clearly the energy storage and pipeline industries are well positioned to help advance this market. DOE’s hydrogen hubs and massive funding injection aim to advance hydrogen production and transportation technologies across a variety of end uses, focused by region, and with an eye towards lowering greenhouse gas emissions. But to understand the hubs, one must understand current production methodologies.

Hydrogen’s Colorful Production Methods

Only recently has hydrogen shown potential to exist in large reservoirs, but the geology is not yet well understood and exploration is in its early stages. Unlike natural gas, which has well-established extraction, transportation, and fuel uses, at present, most pure hydrogen must be produced by detaching it from other molecules. Excluding extraction, there are four main methods for commercial production of hydrogen:

- Steam methane reformation — Steam and methane (from natural gas) are heated together at high pressure over a catalyst like nickel, resulting in a mixture of carbon monoxide and hydrogen known as “syngas.” Syngas is further treated to produce more hydrogen and carbon dioxide through a water-gas shift reaction.

- Partial oxidation — Methane is mixed with sufficient oxygen or air to produce syngas, which can be further treated to produce more hydrogen and carbon dioxide.

- Gasification — Carbon-rich materials like coal or biomass are heated under pressure in the presence of air/oxygen and steam to produce syngas, then further treated to extract hydrogen.

- Electrolysis — Water is split into hydrogen and oxygen by using electricity in a unit called an “electrolyzer.”

- Honorable mention — methane pyrolysis — an emerging technology where methane is heated to a high temperature (around 900°C) in the absence of oxygen, causing it to break down into hydrogen gas and solid carbon.

The industry has separated hydrogen production technologies by color based on production methodology, energy source, and related emissions. New colors are added as additional production methods are discovered. We will describe a few of these below.

Gray Hydrogen — the cheapest and most common current form of hydrogen production. It involves separating hydrogen from natural gas using steam reformation. This process accounts for nearly all commercially produced hydrogen in the United States and about 70% globally.

Brown and Black Hydrogen — produced through the gasification of brown or black coal, an established process used in many industries accounting for roughly 30% of global hydrogen production, mostly in China.

Blue Hydrogen — gray hydrogen (steam reformation of natural gas) combined with carbon capture and storage technologies.

Green Hydrogen — currently the gold standard for hydrogen production. It is produced from water electrolysis using electricity generated by renewables like solar or wind, which otherwise would be wasted because it’s not needed at the time it is produced. The process is emissions-free and allows renewable energy to be stored in the form of hydrogen, for later use as a fuel stock when the wind doesn’t blow and the sun doesn’t shine.

Pink Hydrogen — sometimes referred to as purple or red hydrogen, is produced through electrolysis provided by nuclear energy.

White Hydrogen — naturally occurring, geological hydrogen found in underground deposits and created through fracking. While hydrogen historically has not been thought to exist abundantly alone in large reservoirs, just this year, two scientists discovered a massive reservoir of hydrogen in the northeast of France, setting off a slew of new start-up hydrogen wildcatters. If large hydrogen reservoirs are discovered, white hydrogen has the potential to revolutionize the energy sector.

Turquoise Hydrogen — produced through methane pyrolysis and resulting in the production of solid carbon. This is a new entry in the hydrogen color charts but it may hold future value as a low-emission hydrogen if the high energy requirements can be solved with renewables. Solid carbon can also be marketed and more easily stored.

DOE’s Hydrogen Hubs

President Biden’s Bipartisan Infrastructure Law included an $8 billion allocation for hydrogen development. A significant portion of this funding was dedicated to DOE’s Regional Clean Hydrogen Hubs (H2Hubs) program, which aims to select six to ten hydrogen hub projects for up to $1.25 billion in federal funding for each project. The funding is not just a blank check; each H2Hub must provide a minimum of 50% non-federal cost share. The recent funding winners are not guaranteed final approval. Selection for funding kicks off a negotiation period with DOE retaining the right to cancel negotiations and rescind selections.

These hubs intend to create regional networks for clean hydrogen production, storage, and distribution. The goal is to speed up clean hydrogen adoption across sectors, cutting carbon emissions and fostering economic growth. Each hub utilizes local resources like renewable energy or natural gas for environmentally friendly hydrogen production.

The Appalachian, Gulf Coast, Midwest, and Hartland hubs will all produce the blue hydrogen. The current energy storage and pipeline resources in these regions were a major factor in determining the locations of these hubs, and as shown in the map below, the regional footprint of these resources is substantial.

Because blue hydrogen involves natural gas, hydrogen and carbon, all of these elements will need to be transported and stored. And as we discussed in The Problems of CO2 Versus Natural Gas Pipelines, projects like Tallgrass’s recently approved pipeline abandonment and planned repurposing for carbon transportation represent a real opportunity to rely on existing infrastructure to provide new services with a reduced footprint. Additionally, those energy storage and pipeline companies that have expansive land rights could have an advantage from a co-location perspective.

Here's a brief overview of each blue-hydrogen producing hub:

Appalachian Hydrogen Hub: $925 million awarded to ARCH2

- Location: West Virginia, Ohio, and Pennsylvania.

- Production: Blue

- Description: This hub aims to leverage the region’s ample access to low-cost natural gas to produce clean hydrogen and store associated carbon emissions. The hub will focus on replicable projects to eventually reduce technology costs and enable scaled production.

Gulf Coast Hydrogen Hub: $1.2 billion awarded to HyVelocity

- Location: centered in Houston but will stretch across the Texas coast.

- Production: Blue, Green

- Description: This hub will focus on large-scale hydrogen production by leveraging the region’s existing hydrogen storage and pipeline network and abundant natural gas and renewable energy resources to drive the cost of hydrogen down, especially in distribution and storage. To this end, the hub plans to develop salt cavern hydrogen storage, a large open access hydrogen pipeline, and multiple hydrogen refueling stations. The hydrogen produced at this hub will be used for fuel cell electric trucks, industrial processes, ammonia, refineries and petrochemicals, and marine fuel (e-Methanol).

Midwest Hydrogen Hub: $1 billion awarded to MachH2

- Location: Illinois, Indiana, and Michigan, with the potential to expand to other Midwestern states.

- Production: Blue, Green, Pink

- Description: this hub will focus on decarbonization of key sectors with high carbon footprints — steel and glass production, power generation, refining, heavy-duty transportation, and sustainable aviation fuel.

Heartland Hydrogen Hub: $925 million awarded to HH2H

- Location: North Dakota, South Dakota, and Minnesota.

- Production: Blue, Pink

- Description: this hub focuses on generation, reducing carbon emissions from fertilizer production, and heating in an area known for cold winters.

While the Mid-Atlantic Hub ($750 million awarded to MACH2) will only use green and pink production, it does plan to repurpose oil infrastructure for renewable hydrogen production using existing rights-of-way, so the Tallgrass pipeline could be an important model in this region. The California ($1.2 billion awarded to ARCHES) and Pacific Northwest ($1 billion to PNW H2 Hub) hubs both focus on green hydrogen production from renewables. California will also use biomass and aims to decarbonize transportation, ports, and power generation.