IRS Seeks to Define Clean Hydrogen – There Will Be Winners and Losers

Originally published for customers May 5, 2023

What’s the issue?

The Inflation Reduction Act of 2022 created a tax credit for “clean hydrogen” produced after 2022 at a qualified clean hydrogen production facility during the 10-year period beginning on the date the facility is originally placed in service. The clean hydrogen credit varies based on the lifecycle greenhouse gas emissions rate for the process used to produce the clean hydrogen. The Internal Revenue Service (IRS) has solicited comments on how to determine whether a specific process qualifies and how to calculate the carbon intensity of a specific process.

Why does it matter?

The methodology used to calculate the carbon intensity of a process is not as clear cut as many would presume and how the IRS drafts its regulations will likely determine whether certain processes for creating hydrogen have any hope of benefitting from the tax credits. In the worse case, if the IRS were to side with the environmental extremists, there would likely be almost no production of hydrogen that would qualify.

What’s our view?

It is likely that the IRS will choose a path that allows multiple processes to qualify for the tax credit, but it certainly appears possible that steam methane reforming, which uses natural gas, may end up with a better tax credit than most electric driven processes, even though electrolytic hydrogen is typically considered the greenest way to produce hydrogen.

The Inflation Reduction Act of 2022 created a tax credit for “clean hydrogen” produced after 2022 at a qualified clean hydrogen production facility during the 10-year period beginning on the date the facility is originally placed in service. The clean hydrogen credit varies based on the lifecycle greenhouse gas emissions rate for the process used to produce the clean hydrogen. The Internal Revenue Service (IRS) has solicited comments on how to determine whether a specific process qualifies and how to calculate the carbon intensity of a specific process. The methodology used to calculate the carbon intensity of a process is not as clear cut as many would presume, and how the IRS drafts its regulations will likely determine whether certain processes for creating hydrogen have any hope of benefitting from the tax credits. In the worse case, if the IRS were to side with the environmental extremists, there would likely be almost no production of hydrogen that would qualify.

It is likely that the IRS will choose a path that allows multiple processes to qualify for the tax credit, but it certainly appears possible that steam methane reforming, which uses natural gas, may end up with a better tax credit than most electric driven processes, even though electrolytic hydrogen is typically considered the greenest way to produce hydrogen.

The Rainbow Colors of Hydrogen

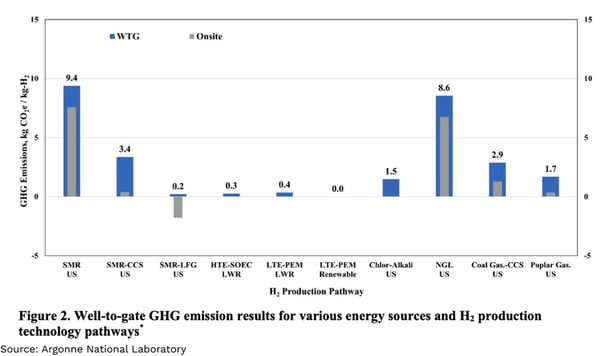

Last October, the Argonne National Laboratory released a report that discussed the methods for creating hydrogen and described the carbon intensity of each in the following chart.

The carbon intensity of SMR, or steam methane reforming, which uses natural gas as its main source of hydrogen, was measured using three different methods. One is the current form without any carbon capture, shown as SMR (gray hydrogen), one was with carbon capture, SMR-CCS (blue hydrogen) and one was assuming the source of the gas was not geologic natural gas, but instead was landfill gas, SMR-LFG (green hydrogen). The carbon intensity of the other common method for producing hydrogen, electrolysis, was also measured in three scenarios. The first scenario assumes the use of a solid oxide electrolysis cell, HTE-SOEC-LWR, which is a fairly new technology and for measurement purposes was paired with a nuclear light water reactor (pink hydrogen). The second and third methods considered use of the more common proton exchange membrane (PEM) technology, and paired it with either a nuclear light water reactor, LTE-PEM-LWR, (pink hydrogen) or renewable sources like wind and solar, LTE-PEM-Renewable (green hydrogen).

When looking at this chart, it is important to keep in mind two key thresholds. First, to qualify for any tax credit, the carbon intensity of the process must be below 4 kg CO2e/kg H2, and to qualify for the maximum credit, the process must be below .45 kg CO2e/kg H2. So on its face, the chart above would lead one to believe that steam methane reforming with CCS can qualify, but not for the highest level of credit, unless landfill gas is the source. Similarly, it appears that all forms of electrolysis using either nuclear or renewables would qualify for the highest level of credit. Game over, renewables and nuclear win. But the real world is not so simple.

Accounting Games

Most commenters to the IRS would agree with the electrolysis measurements calculated by Argonne, if, and this is a big if, the hydrogen facility was directly tied to the source of the electricity and that the power plant was newly built to provide power exclusively to the new plant. But that is not how most plants that are being planned intend to get their power. Instead they intend to purchase power and have it delivered through the grid and may even use current power plants as their source. And that is where the debate begins.

A comment submitted by Princeton University’s Zero-carbon Energy systems Research and Optimization Laboratory (ZERO Lab) notes that the Argonne measurements do not work for grid-provided power. As the comment notes, the “current average emissions rates on the U.S. grid are far too high to enable hydrogen production meeting even the minimum [4 kg] standard.” They also correctly assume that hydrogen facilities sourcing power from the grid will seek to demonstrate compliance with the carbon intensity standard through the use of accounting methods that show the power was sourced from a low carbon power source. The ZERO Lab’s comments urge the IRS to limit such accounting methods to be used only if such accounting methods demonstrate equivalency to a direct connection by meeting three additional standards:

- Temporal matching, which the ZERO Lab defines as proof that the source of electricity was generating at the same hour as the hydrogen facility was using power.

- Additionality, which the ZERO Lab defines as proof that the power source was either built within eighteen months of the hydrogen facility or that it would have been retired if the hydrogen facility was not built.

- Deliverability, which the ZERO Lab defines as proof that grid connection between the power source and the hydrogen facility exists and was uncongested at the time the power was used by the hydrogen facility.

But What if Right Is Wrong?

ZERO Lab’s study and conclusions are almost certainly correct, in that getting power from an existing clean source or one not connected via an uncongested grid path at the time the power is used will almost certainly just result in additional power demands on the current system and that the marginal power required to meet the rest of the grid’s needs will be a fossil fuel plant. Thus, no matter what the accounting says, the real world result of the hydrogen facility running will be a carbon intensity far above the standard needed to qualify for even the minimum credit. The IRS received a large number of comments pushing back against all three of these additional conditions for the use of market methods to demonstrate compliance with the life cycle carbon intensity standard.

The real risk is that if the IRS adopts all three requirements, there simply will not be any electrolysis plants that can qualify for the credits. That would certainly not facilitate the country’s pursuit of a hydrogen market, but would certainly appease the environmental purists, who see hydrogen as essentially a trojan horse for the fossil fuel industry. While groups like Earthjustice provided what appear to be thoughtful comments on the IRS proposal, the true goal of such comments is best expressed on the group’s website, where it states openly that we “should follow through on the transition to clean electricity and modern electric vehicles and appliances, rather than get distracted by the fossil fuel industry’s hydrogen gamble.”

Opening for Natural Gas

Given the open hostility to the natural gas industry, one unintended beneficiary of the ZERO Lab’s strict accounting rules would be the natural gas industry. As Argonne shows, steam methane reforming with carbon capture can meet the minimum threshold for the tax credit. However, there are some interesting assumptions that are built into Argonne’s calculation.

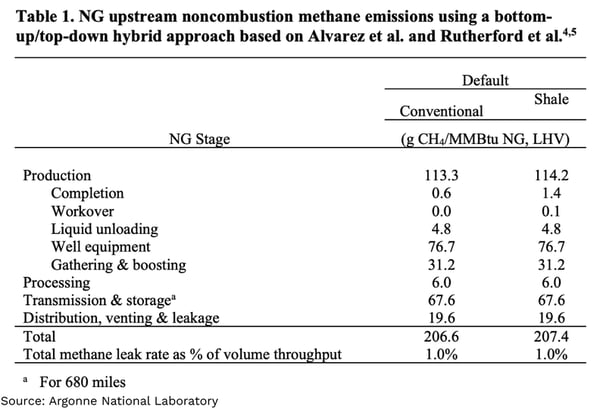

Argonne notes that because GHG emissions along the natural gas supply chain are not mitigated by carbon capture at the facility, the upstream burdens of the NG supply chain play a critical role in calculating the carbon intensity of steam methane reforming. In fact, in the chart above, almost all of the carbon intensity is upstream of the facility. To the extent that leakage rates can be shown to be lower than what is assumed in the Argonne measurements, the performance of steam methane reforming with carbon capture could move up to a higher level of credit. Argonne sets forth how it calculates its assumed leakage rates, which means if a facility could demonstrate its source of gas is better than these assumptions, it should be able to claim a lower carbon intensity.

The IRS expects to release its draft rule this summer and a final rule by August.