Traditional Energy Industry Engagement in Government Programs

Originally published for customers March 1, 2023.

What’s the issue?

The Infrastructure Investment and Jobs Act (IIJA) and the subsequent Inflation Reduction Act (IRA) represent once-in-a-generation funding programs for building infrastructure and have begun providing billions of dollars of incentives in the form of lending programs, direct investment, and tax credits.

Traditional energy companies that historically access private capital markets to fund projects may not have much exposure to the dynamics of these programs making it difficult to assess if they are on strategy, and if so, to successfully capture funding either individually or with other corporate, government, or non-profit entities.

Why does it matter?

Owner-operators of long life cycle assets, such as pipelines, need a clear vision of the future to sustain and add the right mix of assets that can meet cash and earnings expectations of investors and shareholders over coming decades.

Investing alone in uncertain technologies, such as hydrogen, often involves unacceptable risk profiles for today’s mature, widely held energy infrastructure companies. Participating in government funded programs designed to bear part of and spread early stage technology and market development risks could help improve the outlook for future returns of the traditional fossil-based energy sector.

What’s our view?

Engaging directly with government program offices and officials to understand relevance, requirements, timelines, and eligibility for direct investment, tax credits, and loan subsidy programs is the most efficient way to find and evaluate government funded opportunities in the energy sector.

The Infrastructure Investment and Jobs Act (IIJA) and the subsequent Inflation Reduction Act (IRA) represent once-in-a-generation funding programs for building infrastructure and have begun providing billions of dollars of incentives in the form of lending programs, direct investment, and tax credits.

Much has been written about these enormous programs and their goals, which are detailed in a comprehensive White House document — Building a Clean Energy Economy: A Guidebook to the Inflation Reduction Act’s Investments in Clean Energy and Climate Action. The goals are succinctly:

- modernize the grid

- build a nationwide EV charging network

- strengthen supply chains

- expand public transit and rail

- invest in clean energy and emissions reduction

- improve resilience

- clean up pollution

- lower energy costs

- accelerate private investment in clean energy

- create jobs

We charted the spending directed by the IIJA or Bipartisan Infrastructure Law (as it’s since been rebranded) after it passed the Senate in August 2021 in Senate Infrastructure Bill Offers Opportunities for Incumbent Energy Companies. Our takeaway then was the IIJA creates opportunities for proactive infrastructure companies interested in evolving existing assets to leverage government funding programs — primarily in hydrogen and carbon sequestration. (For hydrogen, see Eight Billion Reasons for a Bit of Bipartisanship. For carbon, see DOE Launches Loan Program for CO2 Pipelines.)

Traditional energy companies that historically access private capital markets to fund projects may not have much exposure to the dynamics of these programs making it difficult to assess if they are on strategy, and if so, to successfully capture funding either individually or with other corporate, government, or non-profit entities.

In our view, being proactive means engaging directly with government program offices and officials to understand relevance, requirements, timelines, and eligibility for government funding in the form of direct investments, tax credits, and lending programs.

Why Engage Government Programs:

Owner-operators of long life cycle assets, such as pipelines, need a clear vision of the future to sustain and add the right mix of assets that can meet cash and earnings expectations of investors and shareholders over coming decades. This future depends on a vision of the energy industry that is not clear and is increasingly policy driven as governments seek to achieve what BP calls the “trilemma” of secure, affordable and lower carbon energy.

Investing in assets to support objectives that may be more policy than market driven is risky — even more so, when needed assets are based on uncertain technologies. These risk profiles are often unacceptable for mature widely held energy infrastructure companies. Participating in government-funded programs designed to bear part of and spread early stage technology and market development risks could help improve the outlook for future returns of the traditional fossil-based energy sector. Some of these relevant new programs, such as hydrogen hubs, are now well underway.

How to Engage Government Programs:

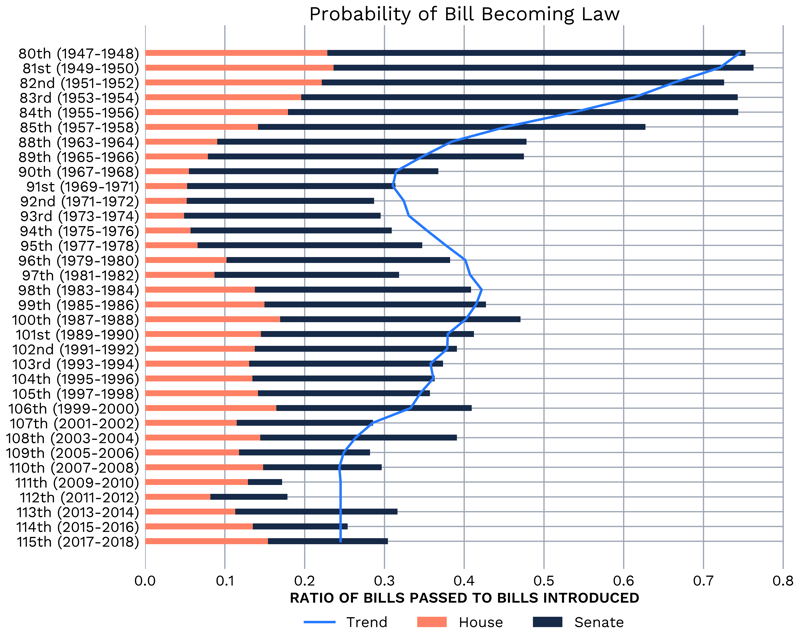

The commercial business sector spends a lot of time and money on lobbyists to influence Members of Congress which often leads leads to unfulfilled promises. To propitiate business constituents and their donations, Members hold hearings to generate sound bites and have staffers draft legislation with low probabilities of ever even being voted out of committee. Bills that do get introduced are increasingly less likely to become law. (The below graph shows the downward trend of congressional productivity represented by the percentage of bills that actually become laws.)

Data Source: Brookings Institute Vital Statistics on Congress - Legislative productivity in Congress and Congressional workload: https://www.brookings.edu/multi-chapter-report/vital-statistics-on-congress/

Instead, industry should spend its time and much less money developing relationships with the government officials and program directors who are really willing, and need to understand existing infrastructure and emerging technologies and who actually develop requirements, program investments, underwrite loan programs, etc.

When a Funding Opportunity Announcement (FOA) or Request for Information (RFI) is released for a program, there are often interested parties influencing their program specifications and ready to respond. It can be too late for new participants to promote their capabilities and develop proposals. This is why continuous engagement with government is important - particularly the agency and bureau level program offices that execute programs and spend the money. (Of the 56 speakers listed in the Ministers and Government Officials category at CERAWeek next week, approximately four of them are at the program level, where it is most effective to have relationships.)

The simplest way to access recent federal incentives for energy infrastructure investment is via production tax credits, such as those outlined in IRS code 45Q and discussed in DOE Launches Loan Program for CO2 Pipelines. Participation in other types of investment, from lending programs to cooperative agreements to direct contracting, has progressively more compliance, accounting, and contractual requirements. Cooperative Agreements (CA), including the Department of Energy’s Cooperative Research and Development Agreements, can be the best way for commercial companies to partner with the U.S. government for technology and infrastructure development.

For example, suppose you had a new material that would slow fatigue crack growth rates in natural gas pipelines being converted to transport hydrogen and needed to commercialize and scale the manufacturing of this novel material. Could you contract directly with the government for this purpose? Probably not. Working with DOE or some other agency would likely take the form of a CA, where the government would be significantly involved, but not wholly directing the investigation and commercialization of the product.

As the for-profit entity in this arrangement, the most important considerations would likely be maintaining the commerciality of the emerging product, such that it would not be considered government unique and could be sold broadly, and, just as importantly, negotiating favorable ownership of the associated intellectual property.

Here is a high level overview of how they differ from contracts and grants:

Data source: https://www.purdue.edu/business/sps/pdf/Grant_vs_Contract.pdf

The bottom line is the size of recent government investments in the energy industry will most certainly impact its evolution. By directly engaging government at the program “working” level, the strategy and business leaders of today’s industry can best position their companies to capture associated investments and opportunities.