Inflation Reduction Act Takes an All of the Above Approach to Climate Crisis

Originally published for customers August 10, 2022

What’s the issue?

At 755 pages, the Inflation Reduction Act, which passed a key Senate vote this past weekend and is now pending before the House, is an ambitious use of the tax code to encourage investment in renewable energy solutions in response to climate change issues. However, because it is a compromise between Senators Schumer and Manchin, it has a bit of something in there for everyone.

Why does it matter?

Understanding the provisions that may allow participation by more traditional energy companies, like pipelines, storage providers and producers, is important so that those companies can maximize the benefits provided in the proposed legislation.

What’s our view?

There are a number of provisions that may be of interest to storage providers and producers, but not nearly as many for pipeline companies as the focus of the bill for more traditional energy seems to be on carbon capture and storage, hydrogen and oil and gas leasing. There is a new fee imposed on oil and gas producers and pipelines if their methane emissions exceed a certain level, but our first look at it shows that it is not likely to have much of an impact on pipeline companies due to a netting provision found in the bill and what appears to be a fairly high threshold for pipelines.

At 755 pages, the Inflation Reduction Act, which passed a key Senate vote this past weekend and is now pending before the House, is an ambitious use of the tax code to encourage investment in renewable energy solutions in response to climate change issues. However, because it is a compromise between Senators Schumer and Manchin, it has a bit of something in there for everyone. Understanding the provisions that may allow participation by more traditional energy companies, like pipelines, storage providers and producers, is important so that those companies can maximize the benefits provided in the proposed legislation.

There are a number of provisions that may be of interest to storage providers and producers, but not nearly as many for pipeline companies as the focus of the bill for more traditional energy seems to be on carbon capture and storage, hydrogen and oil and gas leasing. There is a new fee imposed on oil and gas producers and pipelines if their methane emissions exceed a certain level, but our first look at it shows that it is not likely to have much of an impact on pipeline companies due to a netting provision found in the bill and what appears to be a fairly high threshold for pipelines.

Key Energy Provisions of the Inflation Reduction Act

Late last month, Senators Schumer and Manchin announced that they had reached an agreement on a massive bill titled the Inflation Reduction Act. It is basically a slimmed down version of the Build Back Better bill that Democrats had been negotiating since President Biden took office. The bill addresses a number of contentious issues concerning taxation and drug prices, but the primary focus of the tax incentives found in the bill are being billed by Democrats as “the single biggest climate investment in U.S. history” that will put the U.S. “on a path to roughly 40% emissions reduction by 2030.”

While much of the bill’s incentives are for renewable energy, there are also incentives that could be advantageous for more traditional energy market participants, including an enhancement and extension of existing tax credits for carbon capture utilization and storage (CCUS), a new tax credit for clean hydrogen, and requirements that the federal government hold certain oil and gas lease auctions. There are two revenue streams in the bill, however, that also impact the oil and gas industry. First, the bill increases the royalties owed for oil and gas leases on federal lands. Second, it imposes a methane emissions fee for oil and gas producers and natural gas pipelines if their methane emissions exceed a minimum threshold.

Carbon Capture Utilization and Storage

The bill extends the period for eligibility under the existing tax credit for qualifying CCUS projects that commence construction before 2026 out to 2032. In addition, the bill includes a new feature that is being used for most tax credits it contains. The bill sets forth what is termed a base credit, but also includes an enhanced credit if certain prevailing wage and apprenticeship requirements are met. The enhanced credit is equal to five times the base credit. If a project can meet the wage and apprenticeship standards, the total credit rises from the current rate, which was slowly rising to $50 per ton by 2026 for CO2 captured for geological storage, to $85 per ton and for CO2 used for enhanced oil recovery from the current $35 per ton in 2026 to $60 per ton. Also the provision includes a new credit for direct air capture of CO2. That credit, if the wage and apprenticeship rules are met, would be $180 per ton if the CO2 is geologically stored and $130 per ton if it is used for enhanced oil recovery.

Clean Hydrogen

The bill would add a new section 45V to the tax code to provide a credit for projects that produce what is termed as “clean hydrogen.” Like the CCUS credit, this new credit is available for projects placed into service by the end of 2032. Also, like the CCUS credit, it varies based on whether the project meets the new wage and apprenticeship rules, with the enhanced rate being $3 per kilogram of hydrogen produced, but only $0.60 per kilogram if the wage and apprenticeship rules are not met. There is one additional basis for varying the rate for clean hydrogen based on how “clean” the hydrogen is. The value of the credit varies based on the kilograms of CO2e it takes to produce a kilogram of hydrogen.

The full credit is available only for those methods of producing hydrogen that produce less than 0.45 kilograms of CO2e for each kilogram of hydrogen produced. The rate is reduced to the following percentages based on the kilograms of CO2e produced for each kilogram of hydrogen.

| Kilograms of CO2e Produced to Produce a Kilogram of Hydrogen | Percent of Credit Available | |

|---|---|---|

| >=.45 kg but < 1.5 kg | 33.4% | |

| >=1.5 kg but <2.5 kg | 25% | |

| >=2.5 kg but <4 kg | 20% |

The measurement of the CO2e produced is not just from the actual production of the hydrogen, but is based on a lifecycle calculation. Lifecycle greenhouse gas emissions includes the greenhouse gas emissions (including direct emissions and significant indirect emissions such as significant emissions from land use changes), as determined by the EPA, “related to the full fuel lifecycle, including all stages of fuel and feedstock production and distribution, from feedstock generation or extraction through the distribution and delivery and use of the finished fuel to the ultimate consumer, where the mass values for all greenhouse gases are adjusted to account for their relative global warming potential.”

We have discussed before in Hydrogen Has No Role in the Path to Net-Zero if Environmental Purists Have Their Way that the assumptions used to measure lifecycle emissions have a tremendous impact on calculations like these. It will be significant for the natural gas industry to show that its leakage rates are substantially lower than environmentalists assert, if blue hydrogen, which uses natural gas as a feedstock, has any chance of qualifying for this credit. A key component will be demonstrating that the methane emissions from production through transportation to the hydrogen production facility are as low as possible. This will also be important under the methane fee we discuss below.

Federal Lands Oil and Gas Lease Auctions

In Oil and Gas Leasing on Federal Lands -- When Does a Pause Become a Ban?, we discussed the Biden administration’s “pause” on oil and gas lease auctions and the dispute over whether that was legal under existing statutes. To remedy that dispute, the bill requires that four oil and gas lease auctions that had been paused be completed before the end of September 2023. It also conditions future leases of federal lands for wind and solar to there being certain minimums of oil and gas lease auctions. For any rights of way issued over the next decade for wind or solar development on federal lands, there needs to have been an onshore oil and gas auction within the preceding 120 days and the total area subject to oil and gas lease auctions within the prior year needs to total the lower of two million acres or 50% of the land for which expressions of interest were made. Similarly for offshore wind leases issued over the next decade, there needs to have been at least sixty million acres offered for lease for offshore oil and gas within one year prior to the issuance of the offshore wind lease.

Revenue Enhancements

In addition to the tax credits discussed above, there are two revenue streams in the bill that will impact the oil and gas industry. First, the royalty rate for the oil and gas leases described above will increase from the current 12.5% to a minimum of 16.66% going forward. Also, the bill includes a methane emissions fee that will apply to the oil and gas exploration segment and to the interstate pipeline industry.

Methane Emissions Fee

The Methane Fee in the IRA is assessed against companies that own or operate facilities that report at least 25,000 metric tons of carbon dioxide equivalent greenhouse gas emissions in a given year as required by subpart W of the EPA’s regulations. However, the fee is only assessed against those facilities that exceed a certain threshold. For oil and gas production companies, the fee is assessed if the methane emissions exceed 0.2% of gas sent for sale from the facility or if no gas is sent for sale, then the amount in excess of ten metric tons of methane per million barrels of oil produced. For natural gas pipelines, the threshold is 0.11% of the natural gas sent to sale through the facility. The law applies to each individual facility, but does provide for a netting of the emissions across all facilities under common ownership or control. The netting reduces the total obligation by accounting “for facility emissions levels that are below the applicable thresholds within and across all applicable segments.”

For any facility or group of facilities that on net exceeds the threshold, the fee is imposed at a rate of $900 per ton for emissions reported for calendar year 2024; $1,200 per ton for emissions reported for calendar year 2025; and $1,500 per ton for emissions reported for calendar year 2026 and each year thereafter. Because the EPA considers methane to be twenty-five times more impactful on climate change than carbon dioxide, that means it is essentially putting a fee of $60 per ton of carbon dioxide for 2026 and thereafter.

While the method of netting allowed is not clearly defined, we assume that a company’s wells that are covered by the statute will be considered together and so no facilities will be impacted if all of the facilities under common control, on net, end up below the threshold. In Virginia Passes Legislation to Spur Low-Carbon Gas Blending into Natural Gas Systems, we noted that a recent report showed that the methane intensity of the top 20 U.S. producers varied widely, from a low of .04% for Range Resources, to a high of 1.22% for Hilcorp Energy.

That chart shows that thirteen of the top producers already have an intensity level below the statutory threshold. Presuming that the netting provisions of the statute allow them to aggregate their facilities into one collective pool would seem to indicate that this measure will have no impact on those producers.

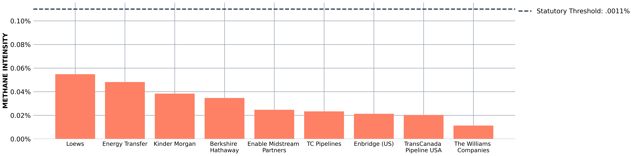

A similar result is expected for the natural gas pipelines. We have combined the methane emissions reported to the EPA for 2020, the most recent available, under subpart W based on the parent company reports to the EPA and grouped those facilities together to get a total methane emissions figure. We then compared that to the total gas transported in 2020 by those same pipelines.

As seen above, none of these major pipeline companies would exceed the 0.11% threshold on a collective basis. Even at the pipeline company level, only two pipelines, Panhandle Eastern and Natural Gas Pipeline Company of America, exceed the threshold. Calculating the tons of methane in excess of the limit shows that Panhandle Eastern would owe a fee of $6 million at the 2026 rate, but that Natural Gas Pipeline Company of America would owe less than $1 million. Therefore, it is not clear how much these fees will impact current operations at the pipelines.

It should be noted that the Congressional Budget Office, in its estimate of the revenue generated by the proposed methane fee, calculated that it would peak in 2028 at $1.4 billion, which would equate to about 933 thousand metric tons of methane. The EPA estimated that in 2020, the oil and gas industry emitted about 8.4 million metric tons of methane. Thus, the CBO estimate is that the fee will be assessed on about eleven percent of the total methane emissions, if nothing at all changes.