Inflation Reduction Act is Really the Energy Expansion Act

Energy Income Partners (EIP) and Arbo joined up to give context to the Energy Provisions in the Inflation Reduction Act (IRA) of 2022, signed by President Biden on August 16. This act incorporates many of the prior “Build Back Better” or BBB energy and climate provisions, but slightly less than half of those are simply extensions of incentives that have been in place for some time, mostly relating to renewables and energy efficiency investments. It’s the new provisions, however, that should be of interest to investors in energy in general and utilities and pipelines in particular.

Utilities and Power Generators:

Flow Through Accounting for Solar Investment Tax Credit

Under existing IRS regulations, utility-owned solar projects were at a disadvantage versus non-utility projects built by renewable developers because they were not able to capture the 30% solar investment tax credit (ITC) up front. The new legislation changes that — leveling the playing field with non-utility owners — and in our view could lead to more growth for the utilities in an area that until now was dominated by renewable developers.

The Nuclear Production Tax Credit (PTC)

This provides up to $15/megawatt-hour (MWh) of price support for nuclear power generation that’s not covered by a regulated utility tariff. The initial credit applies to market power prices below $43.75/MWh, has an inflation adjustor and runs through 2032 with the potential for further extension. This PTC enhances state-level initiatives that recognize the value of the carbon-free, highly reliable energy that nuclear provides but is not rewarded by competitive electricity markets. While forward power prices are above the PTC floor today, the PTC imparts economic certainty and longevity that’s been missing in the past in the highly competitive and cyclical unregulated power markets.

Renewable and “Clean Energy” Developers:

Investment and Production Tax Credits for Electricity Produced with Renewable Resources

While levelling the playing field with utilities in solar development, the IRA extended the solar ITC and wind PTC again, but with a couple of nuances. First, this extension is for ten years, which adds certainty and visibility and addresses the periodic cliffs that lent a boom/bust tenor to renewable capital spending.

More interesting is that while some ~$60 billion should be considered “extensions,” of these existing credits, a roughly equal amount is now also designated for the technology-agnostic “clean energy” category. While renewables clearly qualify, a number of other technologies like zero-carbon gas fired generation would also likely qualify. As we have written extensively over the last year or so, government policy towards clean energy is broadening out dramatically and changing investor perception of the lifespan of conventional energy sources.

Pipelines:

Tax Credits for Carbon Capture and Storage

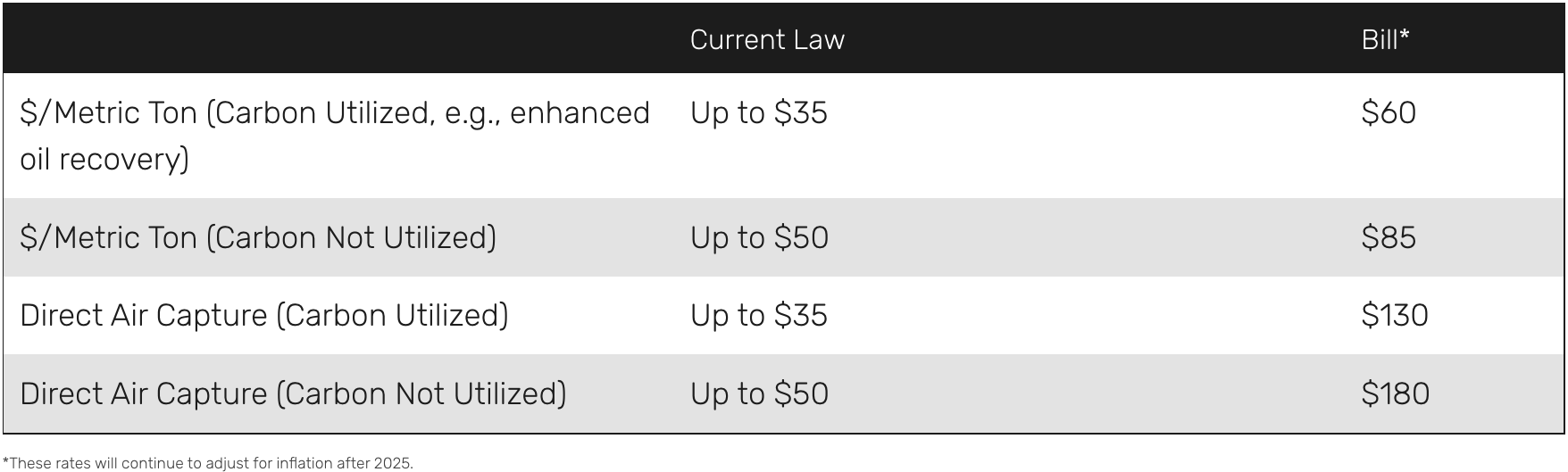

The tax credit for capturing and beneficially re-using or permanently storing carbon dioxide was increased by 70-270% depending on the project. The table below summarizes the changes to section 45Q of the tax code that governs this credit:

In 2021, 37% of U.S. natural gas demand was electric power generation[1]. And while the importance of natural gas continues to grow, pipeline companies that carry natural gas are currently priced at 8x distributable cash flows[2], implying declining demand in the near future. Raising the carbon capture tax credit from $50 per ton of CO2 to $85 per ton for power generators, in our opinion, increases dramatically the ability of natural gas-fired plants to offset the costs to capture and sequester CO2, allowing them to offer zero-carbon “clean” power and significantly extending the life of natural gas pipelines.

Clean Hydrogen Production Tax Credit

Another provision of interest to energy infrastructure investors is the $3.00/kilogram hydrogen (H2) production tax credit. H2 remains a tricky substance to produce and handle (and has its own greenhouse gas baggage) but is getting a lot of attention as a supplemental fuel or as an energy storage medium. A lower cost of hydrogen — albeit with subsidies — could provide additional revenue streams for pipeline and (potentially) salt dome storage companies. The value of pipeline companies is not the steel in the ground but legacy rights-of-way that are increasingly difficult to replicate. It will likely be cheaper to build new pipelines than try to re-purpose old ones, but this new investment will provide an opportunity for more growth from existing rights-of-way.

As with the Bipartisan Infrastructure Act, this legislation widens considerably the types of clean energy solutions being incentivized. Conventional energy companies that drill for natural gas, operate refining, petrochemical and other process industries or own pipeline rights-of-way will all benefit from an increase in the 45Q tax credit for carbon and incentives for producing hydrogen. The legislation is a tacit acknowledgement that the risk to the environment stems from the emission of methane (natural gas) and carbon dioxide, not their production per se. Putting a penalty on methane emissions and a larger tax credit on carbon capture is — whether Congress wants to admit it or not — a pricing scheme for greenhouse gasses which the American Petroleum Institute has advocated for, despite their incessant whining about this new legislation. Once these pollutants are priced, we believe capital can be invested in a way that will lower expenses and increase revenues for conventional energy companies, extending the life of their existing assets.