Haynesville and Permian Projects Continue to Advance, But at a Measured Pace

Originally published for customers October 21, 2022

What’s the issue?

Growth in the production of gas from the Haynesville basin and associated gas in the Permian have led to renewed need for pipeline capacity out of those basins to markets generally along the Gulf Coast.

Why does it matter?

Projects include expansions on the interstate pipeline system, gathering system expansions in the Haynesville, and intrastate transmission expansions from the Permian.

What’s our view?

Each type of project requires a different method for monitoring progress, and each has its own unique challenges to getting approval and going into service. In general, all types of projects seem to be progressing and we will be monitoring them for you as they near completion over the next two years.

Growth in the production of gas from the Haynesville basin and associated gas in the Permian have led to renewed need for pipeline capacity out of those basins to markets generally along the Gulf Coast. Projects include expansions on the interstate pipeline system, gathering system expansions in the Haynesville, and intrastate transmission expansions from the Permian.

Each type of project requires a different method for monitoring progress, and each has its own unique challenges to getting approval and going into service. In general, all types of projects seem to be progressing and we will be monitoring them for you as they near completion over the next two years.

Haynesville Has Been Growing Since 2016

Production from the Haynesville basin, which is located in western Louisiana and eastern Texas, was one of the first shale gas basins and reached a peak in 2011, but then fell back through the end of 2016.

As seen above, after reaching its lowest point in 2016, the growth in production has been astounding, far surpassing even the peaks reached in 2011 and more than doubling the production in 2016. This production growth is spurring renewed interest in both gathering and transmission lines in the region, designed primarily to take this lower-carbon gas and direct it to the LNG export terminals along the Gulf Coast.

Gathering Line Capacity

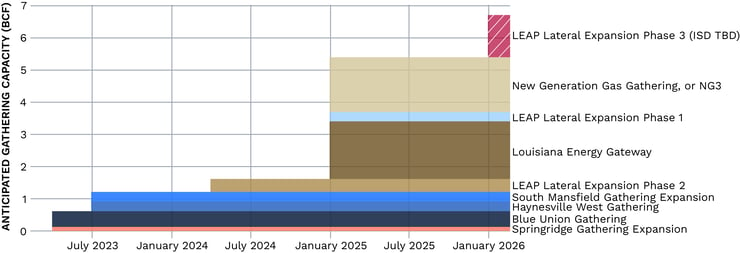

There are a number of companies that have announced gathering line increases for the region, including DT Midstream, Williams and M6 Midstream (aka Momentum Midstream).

As seen above, these three companies all have projects that are designed to increase the gas gathering capacity in the region and connect this increasing production to the interstate pipelines, storage hubs or LNG terminals.

Transmission Capacity Increasing As Well

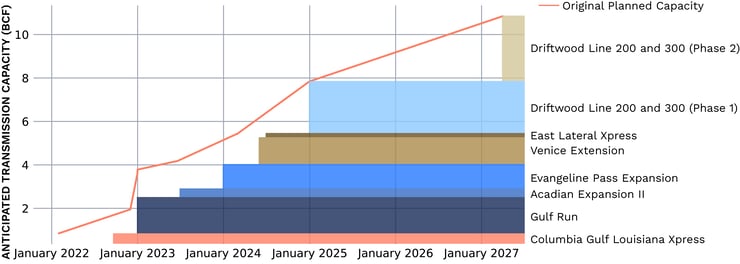

This growth in production typically needs an outlet on a regional transmission pipeline as well, and there are a number of projects that are responding to this need.

Most of the above are FERC-regulated projects and, as we have noted repeatedly, there have been substantial delays in the processing of FERC projects since Chairman Glick issued and then retracted new policies in February and March of this year. Kinder Morgan’s Evangeline Pass Expansion, Enbridge’s Venice Extension and TC Energy’s East Lateral Xpress have all been caught up in those delays and so those projects will not likely be able to meet their original requested in-service dates as reflected above.

Permian Expansion Needed As Well

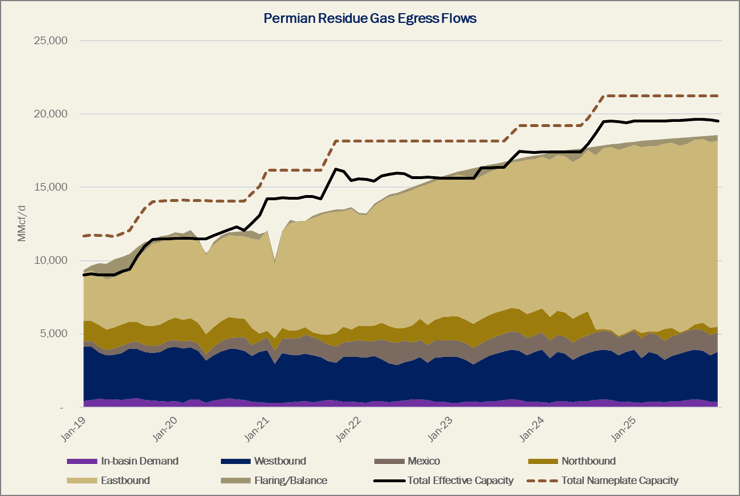

In Permian Pipelines - The Sequel, we noted the need for new expansions from the Permian basin as well. For that basin, our friends at East Daley are already factoring into their projections for additional egress capacity three of the five projects we are following, the Permian Highway Pipeline and Whistler Pipeline expansions and the Matterhorn Pipeline.

In addition to those three, we are also watching one that is regulated by FERC, Williams’s Texas to Louisiana Energy Path project, and one being planned by Energy Transfer, the Warrior Pipeline. As of now, we have no reason to think that any of these projects will be delayed beyond their anticipated timelines. The Permian Highway and Whistler expansions are both being achieved by the addition of compression. We know Whistler already owns the land needed for its additional stations. As for Permian Highway, we have yet to see a public record of the company acquiring the necessary land for the new stations. However, the timeline remains achievable for both because our data shows that the construction of a compressor station can usually be completed within one year. In addition, Kinder Morgan has indicated it has secured the compressor units themselves, which is typically the long lead item.

The two other intrastate projects, Warrior Pipeline and Matterhorn Pipeline, include construction of greenfield 42-inch diameter mainlines. Within just the last month, however, we have seen activity by both projects to begin securing the rights of way for their projects. Our data shows that an in-service date between 18 to 24 months after first land acquisition is achievable for Texas intrastate pipelines. Thus, a November 2024 in-service, as announced by Matterhorn, seems achievable at this point and possible for Warrior once it makes a final investment decision. Finally, Williams’s project has an estimated in-service date of March 31, 2025, which even under the current slow process at FERC is achievable.