Permian Gas Takeaway Looks to Grow This Year and Next

Originally published for customers February 8, 2023

What’s the issue?

Crude oil prices have come off their peaks from just about a year ago, but remain at a level that is higher than they have been since 2018 and are expected to remain at or above current levels for the next couple of years.

Why does it matter?

These price levels have encouraged production growth in the Permian basin and producers like ExxonMobil have pledged to stop routine flaring, which means there appears to be the need for yet another round of gas pipeline expansions to serve the region.

What’s our view?

Looking ahead, we see three mainline expansions moving forward, with the Permian Highway expansion moving into the lead, a fourth one still trying to find its footing, and three other projects, intended to make the current mainline systems more attractive to shippers, all being placed into service by early 2025.

Crude oil prices have come off their peaks from just about a year ago, but remain at a level that is higher than they have been since 2018 and are expected to remain at or above current levels for the next couple of years. These price levels have encouraged production growth in the Permian basin and producers like ExxonMobil have pledged to stop routine flaring, which means there appears to be the need for yet another round of gas pipeline expansions to serve the region.

Looking ahead, we see three mainline expansions moving forward, with the Permian Highway expansion moving into the lead, a fourth one still trying to find its footing, and three other projects, intended to make the current mainline systems more attractive to shippers, all being placed into service by early 2025.

Mainline Transmission Expansions Serving the Permian Basin

In Permian Pipelines - The Sequel, we discussed the potential for five different expansion projects providing additional mainline capacity from the Permian basin to eastern Texas, all of which are intrastate pipelines regulated by the Texas Railroad Commission. Three, Whistler, Permian Highway and Gulf Coast Express, were expansions of existing pipelines, and two, Matterhorn and Warrior, were greenfield pipelines. In the nine months since that article, three of the five projects, Whistler, Permian Highway and Matterhorn, have made substantial progress and would appear to be on track for in-service dates later this year or next. Gulf Coast Express appears to be on hold, and based on property record data, it would appear Warrior may be exploring possible routes but still not in a position to move forward.

Whistler and Permian Highway

In our initial article, we noted that Whistler had a slight advantage over Permian Highway because, while both are just compression-only expansions of existing pipelines, Whistler had obtained the rights for the additional compressor stations at the same time it was acquiring the rights for the original project. This gave Whistler a bit of an advantage and may explain its announcement that it can be the first into service by September 2023, whereas Permian Highway announced its in-service date for just a month later. Since then, however, Permian Highway has closed this gap by acquiring all four locations it needs; filing for the required air permits for all four compressor stations, and receiving the permits for three of them. Meanwhile, Whistler has only filed the permit for one of the three stations we believe they intend to build.

Assuming it takes about ten months for each of the pipelines to construct the required stations, we still think that both of these projects are on track to be in-service by the end of this year.

Matterhorn and Warrior

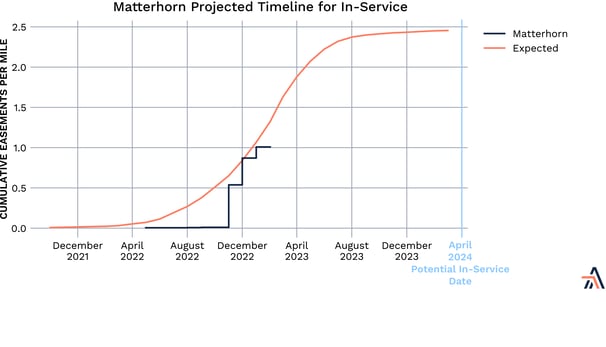

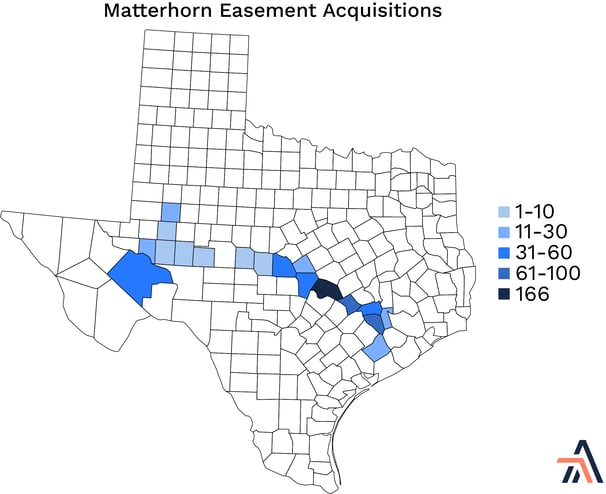

Previously, we also discussed two possible greenfield pipeline projects, Whitewater Midstream’s Matterhorn Pipeline and Energy Transfer’s Warrior Pipeline. Since then, Matterhorn has made substantial progress in acquiring the land rights needed for construction.

As seen above, Matterhorn began serious efforts to acquire land rights in November 2022. Based on past history of similar projects, that would mean commencing service about twenty months from initiation of rights acquisition, indicating an in-service date about the middle of 2024. This is a bit earlier than its announced date of the third quarter of 2024. To date, we see no similar land acquisition activity by Warrior. However, even before land acquisition, pipelines often must file lawsuits to obtain access to land for route planning. Based on our review of Texas court records, Matterhorn commenced such access lawsuits in April 2022. Warrior didn’t commence such suits until about September 2022, which puts it about five months behind Matterhorn. Assuming Warrior is successful in getting shippers to underwrite its project, we may begin seeing land acquisition activity starting in April of this year, or five months after Matterhorn started.

Projects Designed to Make Existing Pipeline Capacity More Valuable to Permian Producers

In addition to the expansion of the mainline capacity out of the Permian basin, there are currently three projects moving forward that are designed to make existing pipelines more attractive to producer shippers on those systems: Transcontinental Pipeline’s (Transco) Texas to Louisiana Energy Pathway, Double E Pipeline’s Red Hills Lateral Project, and Whistler Pipeline’s ADCC extension.

Texas to Louisiana Energy Pathway

Transco’s project will provide 364,400 dth/day of firm capacity to its only shipper to allow for transportation of its natural gas supplies from western and southern Texas to market by converting some interruptible capacity to firm and increasing the overall capacity of its system in Transco’s zones 1 through 3. According to Transco’s application, its shipper’s gas volumes are produced at a relatively uniform rate, are sold to its customers accordingly, and require reliable consistent access to markets. The shipper’s access to markets from its production basins is currently constrained by limited pipeline infrastructure and the low scheduling priority and potential intermittency or unavailability of interruptible transportation. Transco requested that the Commission issue a final order approving the project by the first quarter of 2024 to be in service by the first quarter of 2025.

The requested schedule was put at risk when FERC, under former Chairman Glick, directed the preparation of a full Environmental Impact Statement (EIS) for the project and scheduled the release of that EIS for November 30, 2023. However, as we discussed just last week in Timing of Restarts for Keystone, El Paso and Freeport and Some Good News for MVP, new acting Chairman Phillips allowed FERC staff to reverse Chairman Glick’s directive to require an EIS for three projects, including this one. FERC staff is now planning to prepare an Environmental Assessment for release on June 9, 2023. This would allow the Commission adequate time to prepare its order and even beat the date requested by Transco.

Double E Pipeline’s Red Hills Lateral Project

Double E proposes to construct and operate a 20-mile lateral to provide new Permian Basin supply to its existing system. Double E filed for approval of this project under FERC’s prior notice blanket certificate program. This means if there are no protests filed before February 17, 2023 or all such protests are withdrawn by March 19, 2023, then the project would be automatically approved. According to Double E Pipeline, the project will enhance the reliability and flexibility of natural gas supplies for Double E’s shippers by connecting Double E’s existing interstate transmission system to additional gas supply sources in the Delaware Basin. The project will allow it to deliver up to 600,000 dekatherms per day to Double E’s mainline system. Assuming no protests are filed by the deadline, the project is expected to be in-service by December 1, 2023.

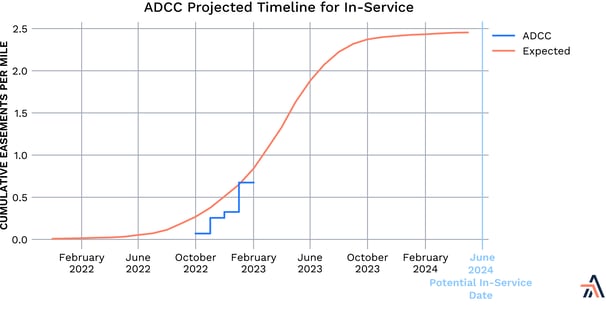

ADCC Extension

The operators of the Whistler Pipeline, WhiteWater Midstream and Cheniere Energy, are working jointly on this new 42-inch pipeline that would run the 43 miles from the terminus of the existing Whistler Pipeline to Cheniere’s Corpus Christi Liquefaction Facility. The pipeline has been designed to transport up to 1.7 billion cubic feet per day (Bcf/d) of natural gas, expandable to 2.5 Bcf/d of natural gas, and is expected to be in service in 2024.

As seen above, based on the pace of land acquisition by the project, it would appear an in-service date by 2024 is certainly reasonable and may be slightly conservative.