Property Records Show Permian Pipelines Moving Forward

Originally published for customers April 28, 2023

What’s the issue?

Tracking the early progress of proposed intrastate pipelines in Texas can be a challenge because there is limited regulatory oversight.

Why does it matter?

Some of the currently proposed pipelines could have a significant impact on pricing in the Permian basin and the markets generally as additional gas supplies are able to reach demand centers and marketing hubs.

What’s our view?

During the prior intrastate pipeline boom in Texas we developed a database of the land acquisition activities for the various projects which proved to be a reliable early indicator about when the project could potentially be online. Based on similar data for the current projects, it appears that ADCC Pipeline and Matterhorn Express Pipeline could be in-service ahead of market expectations.

Tracking the early progress of proposed intrastate pipelines in Texas can be a challenge because there is limited regulatory oversight. Some of the currently proposed pipelines could have a significant impact on pricing in the Permian basin and the markets generally as additional gas supplies are able to reach demand centers and marketing hubs.

During the prior intrastate pipeline boom in Texas we developed a database of the land acquisition activities for the various projects which proved to be a reliable early indicator about when the project could potentially be online. Based on similar data for the current projects, it appears that ADCC Pipeline and Matterhorn Pipeline could be in-service ahead of market expectations.

Pipeline Expansions Along the Gulf Coast

There are two main drivers for pipeline expansions occurring in Texas and Louisiana; first is increasing production in the Permian and Haynesville basins, and the second is the need for supply to LNG terminals that are being built along the coast. There are a number of projects that meet each of these needs, including compression only expansion projects for the Permian Highway Pipeline and the Whistler Pipeline. But there are also greenfield projects that are being built to address these needs. Today we focus on the ones where we have some evidence in state property records that the projects are progressing well, namely the ADCC Pipeline and the Matterhorn Express Pipeline.

Land Acquisition as Early Indicator of a Project’s In-Service Date

Those who follow FERC-regulated pipelines would likely be surprised by how quickly an intrastate project in Texas can move from announcement to in-service. But it is important to remember that there is almost no regulatory approval required for the siting of an intrastate pipeline in Texas. Therefore, the constraints on in-service are namely the acquisition of other permits that may be required, procuring the necessary materials and equipment, and the time to acquire rights of way and actually construct the pipeline.

During the last buildout of intrastate pipelines in Texas, we monitored the land acquisition activity for the projects and were able to create a model based on all of the projects with respect to their acquisition of the property rights needed to construct the pipeline. There were a couple of items to note about the typical pattern. First, the pace of land acquisition as reflected in the county records started out as fairly measured, but then quickly accelerated until the point where a project had acquired about 80% of the overall easements it would ultimately need, at which point the pace of acquisition slowed once again. This is likely because as the project sends its land agents out to start the acquisition process, it takes some time to negotiate and then document the purchases. But the recorded transactions quickly pick up as the landowners have time to consider the offers and then the last twenty percent are likely the reluctant owners who may need the persuasion of an eminent domain proceeding. Second, actual construction begins before all of the easements needed were reflected in the property records and often at about the point where we saw that leveling off of the pace of acquisition. We are seeing a similar pattern for the two projects that are actively acquiring land.

ADCC Pipeline

It was just in September of last year that the primary owner of the Whistler Pipeline, Whitewater Midstream, announced that it had reached an agreement with Cheniere Energy “to move forward with the construction of the ADCC Pipeline, which is a new joint venture 42-inch pipeline that is expected to extend approximately 43 miles from the terminus of the Whistler Pipeline to Cheniere’s Corpus Christi Liquefaction Facility.” The announcement indicated that the sponsors anticipated that the pipeline would be in-service “in 2024.”

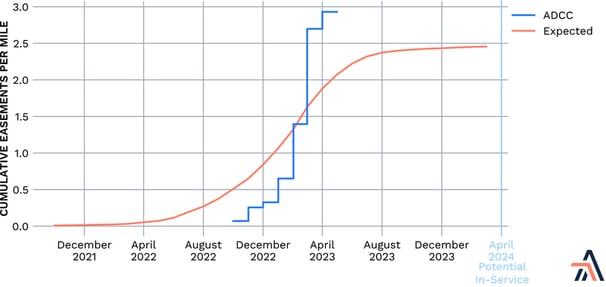

The commitment to the project is demonstrated by the fact that the first easements for the project started appearing in county records beginning in the following month.

As seen above, acquisition began in October 2022 and like the historical trend progressed fairly slowly until January of this year. While we do not yet have all of the records for April, we would anticipate that the pace of acquisition will likely start slowing either this month or next. ADCC may need to acquire a higher number of easements per mile because it is being built in a more populated region. However, if the project follows the pattern of the past, we would expect construction to start this summer and be completed by as early as April 2024, based on the chart above, which would certainly meet the generic 2024 date offered by the project sponsors in the original announcement, and is likely earlier than many may be anticipating.

Matterhorn Express Pipeline

In May 2022, Whitewater Midstream and its joint venture partners, Devon Energy and MPLX, announced the Matterhorn Express Pipeline, which is “designed to transport up to 2.5 billion cubic feet per day (Bcf/d) of natural gas through approximately 490 miles of 42-inch pipeline from Waha, Texas, to the Katy area near Houston, Texas.” The project sponsors indicated that the project was “expected to be in service in the third quarter of 2024.”

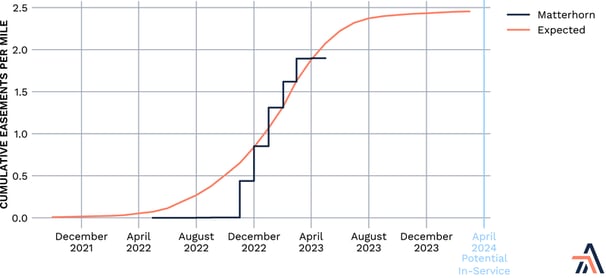

Land acquisition for the project did not start up quite as quickly as it did for ADCC Pipeline.

As seen above, acquisition started in August, but there was almost no activity until November. Since then the project has been extremely active. The project appears to be on a similar track as ADCC at this point, so we would expect that it also could be in service by April 2024, which is one quarter ahead of the project’s announced schedule.

Other Projects’ Property Acquisition Status

Since we last wrote about these projects in Permian Gas Takeaway Looks to Grow This Year and Next, one project we reported on then seems to have stalled and there have been two projects approved by the Texas Railroad Commission (TRRC) that were not the subject of the typical pre-approval public announcements.

First, the Warrior Pipeline had begun some litigation that appeared to be a precursor to land acquisition. But we currently see no evidence in county property records that it is pursuing any land needed for the project. Therefore, it appears that the project is on hold for now.

Second, on March 23, 2023, the TRRC granted approval for Apex Pipeline to construct and operate a 562-mile pipeline from Midland County, Texas all the way to the Golden Pass LNG terminal located on the Louisiana-Texas border in Jefferson County, Texas. While the project appears to be sponsored by Targa Resources, there has not been the typical public announcements about the project. However, the company has already commenced condemnation actions in state courts and acquired one surface lease. This activity started in March even before the TRRC approval was received.

Third, a similarly quiet project, the Blackfin Pipeline, received TRRC approval on March 8, 2023. Like ADCC, which is an extension of the Whistler Pipeline, this is an extension of the not yet completed Matterhorn Express Pipeline. The project is 185 miles long and a mix of 36 and 48 inch pipe. However, we have yet to see any land acquisition or state court litigation filed with respect to this pipeline.