Interstate Pipeline Expansions to Feed Gulf Coast LNG Terminals

Originally published for customers August 24, 2022

What’s the issue?

As we have previously discussed, the LNG terminals along the Gulf Coast typically have a “last-mile” pipeline associated with them that connect the facility to multiple points on the interstate natural gas system.

Why does it matter?

By connecting to the interstate systems, the LNG terminals gain access to a variety of supply pipelines and the gas basins to which they are connected. But many of those pipelines were not designed to flow gas toward the Gulf Coast and may need to be expanded to meet LNG demands in the region.

What’s our view?

There are a number of FERC projects that have been approved or are pending that address this need for additional capacity. In the past, opposition to pipeline construction in the region has been muted compared to other regions, like the Northeast, but that may be changing. The Sierra Club and other opposition groups have taken an interest in these projects and may view blocking these supply pipelines as a way to slow the growth of LNG exports.

As we have previously discussed, the LNG terminals along the Gulf Coast typically have a “last-mile” pipeline associated with them that connect the facility to multiple points on the interstate natural gas system. By connecting to the interstate systems, the LNG terminals gain access to a variety of supply pipelines and the gas basins to which they are connected. But many of those pipelines were not designed to flow gas toward the Gulf Coast and may need to be expanded to meet LNG demands in the region.

There are a number of FERC projects that have been approved or are pending that address this need for additional capacity. In the past, opposition to pipeline construction in the region has been muted compared to other regions, like the Northeast, but that may be changing. The Sierra Club and other opposition groups have taken an interest in these projects and may view blocking these supply pipelines as a way to slow the growth of LNG exports.

Seeking Supply for LNG Exports

In Need for More Pipelines Along the Gulf Coast, we discussed that the explosive growth of LNG terminals along the Gulf Coast may require substantial increases in the interstate pipeline capacity in the region. This has also supported growth in the Haynesville basin, which we discussed in Heating up in the Haynesville - Projects Emerge, with Competition for LNG Growth. Today we look at some of the FERC projects that are already underway or are pending before FERC to address the growing LNG export demand. In particular, Sabine Pass, Venture Global Plaquemines and Golden Pass have all signed anchor shipper agreements on regional pipeline expansions to allow them to reach further upstream on various interstate pipelines.

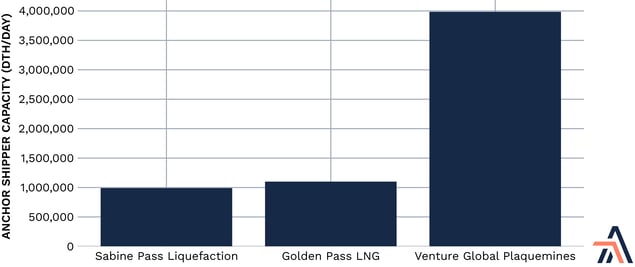

As seen above, these three LNG developers have entered into contracts for substantial capacity on various pipelines that are dependent upon additional facilities being built. Venture Global has signed up for substantial amounts of capacity on three separate interstate systems, Columbia Gulf, Tennessee Gas and Texas Eastern.

Grassroots Opposition is Not as Prevalent

These projects do not generate the type of grassroots opposition that pipelines in other parts of the country experience.

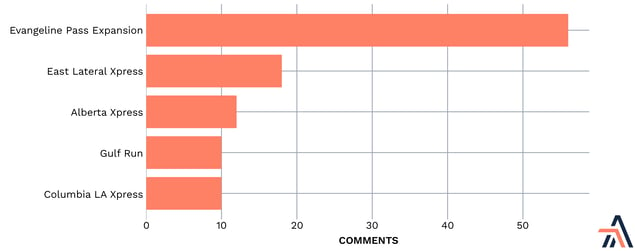

As seen above, for those projects that have moved through the entire process from filing to approval by FERC, the most comments that were filed was 56 in Tennessee Gas’s Evangeline Pass Expansion. For comparison, Mountain Valley Pipeline has received 591 comments in the last sixty days.

However Sierra Club Has Taken an Interest

While the grassroots opposition may not be present in this part of the country, that has not stopped the Sierra Club from becoming involved. They filed comments in a number of cases, but seem to have taken a particular interest in the projects underwritten by contracts with Venture Global Plaquemines LNG, Evangeline Pass Expansion, East Lateral Xpress and Venice Extension Project. Sierra Club has already appealed the certificate order in Evangeline Pass, sought rehearing of the order in East Lateral and is actively participating in the Venice Extension Project. Such activity could slow any or all of those projects as they seek to move forward with construction and seek authority from FERC to do so.

Anticipated In-Service Dates

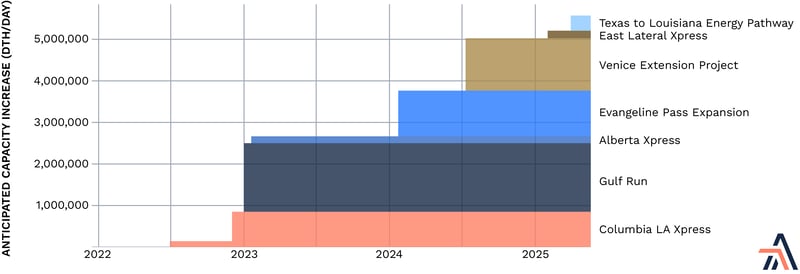

The projects are all in various stages of development. Columbia Louisiana Xpress put part of the project into service on July 1 and expects to have the rest in-service by December 1. The Gulf Run pipeline is also under construction and anticipates being in-service by the end of this year. However, three of the projects, Evangeline Pass Expansion, Alberta Xpress and East Lateral Xpress, were caught up in the delays caused by Chairman Glick’s decision to require a full environmental impact statement purely because of the potential downstream greenhouse gas emissions for the proposed projects. This has substantially delayed all three projects past their requested certificate decision date and will likely impact their originally proposed in-service dates. Based on all of these issues, we have projected out the additional capacity for these projects over the coming years.

As seen above, these projects are expected to increase the interstate pipeline capacity in the region by over 5.5 million dth/day between now and early 2025. However, this capacity is already taken by the subscribing LNG terminals. This likely means that all other terminals in the region will need to fund further expansions if they want to access supply off of the interstate pipeline system.