An LNG Terminal in Philly? EQT Says It May Be a Long Putt

Originally published for customers April 19, 2023

What’s the issue?

Tomorrow, the Philadelphia LNG Export Task Force is set to host its first hearing to take stakeholder comments on potentially developing a liquefied natural gas (LNG) export terminal in or around the Port of Philadelphia. This hearing is one of the first public steps forward since the General Assembly of the Pennsylvania legislature developed a “Taskforce on Exporting LNG from Philadelphia – Decreasing Reliance on Russian Energy,” with a deadline of this November to release a report.

Why does it matter?

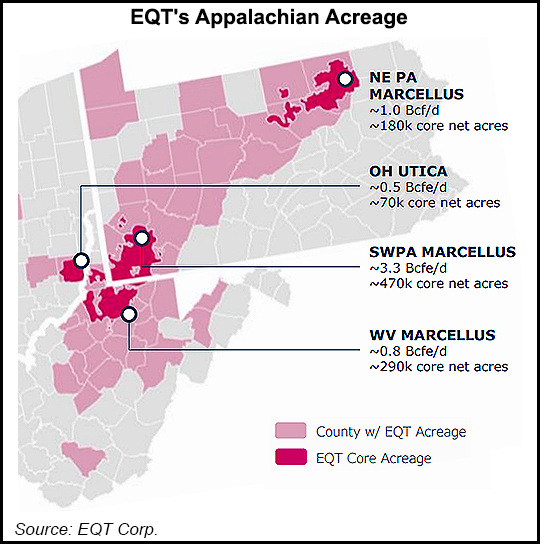

Any future development of an LNG export terminal on the East Coast, specifically in Pennsylvania, will have a major impact on the local and increasingly global gas market. The close proximity to the gas supply would mean that the transportation of the gas would not produce as much carbon as transporting that same gas to the Gulf Coast. Major winners will of course involve those producers, such as EQT, with a significant amount of acreage in the area, as well as pipeline companies in close proximity.

What’s our view?

While the likelihood of success may be a long shot, the approach, which may take the form of a public-private partnership, could improve the odds of success. We expect the hearing to include the typical industry and environmental groups, but we will be paying closer attention to the support of local political leaders, because if they’re not behind a project, the odds of success are slim.

Tomorrow, the Philadelphia LNG Export Task Force is set to host its first hearing to take stakeholder comments on potentially developing a liquefied natural gas (LNG) export terminal in or around the Port of Philadelphia, which could hook into one of many intra and interstate pipelines in the vicinity. This hearing is one of the first public steps forward under a law enacted last year which required the creation of a “Taskforce on Exporting LNG from Philadelphia – Decreasing Reliance on Russian Energy,” with a deadline of this November to release its final report.

Recently, the Task Force announced that EQT’s CEO, Toby Rice, will be one of the two required representatives of the oil and gas industry. As the largest producer of natural gas in Pennsylvania and the second largest in the country, this didn’t come as a surprise. EQT has also been outspoken about its desire to construct its own LNG facilities, which would allow it to move its drilling operations to growth mode. Doing so, however, “would be a long putt,” according to Mr. Rice. Nonetheless, backing from the Pennsylvania legislature could improve those odds and the tenor of next week’s meeting may offer some tea leaves to read.

Pending East Coast LNG Efforts

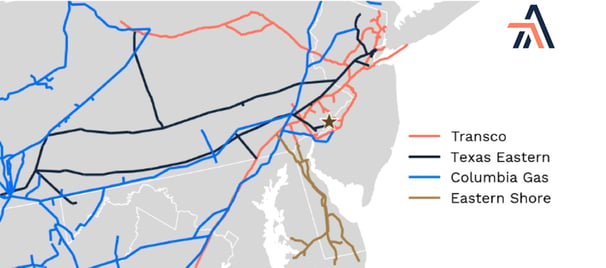

Only two LNG export facilities are operating on the East Coast, Cove Point in Maryland and Elba Island in Georgia. Efforts are underway to get other projects off the ground. A small-scale facility has been proposed by New Fortress in Gibbstown, New Jersey (Gibbstown LNG), and Penn American Energy Holdings LLC (Penn LNG), both along the Delaware River. The multi-billion dollar Penn LNG project’s expectations on a FERC pre-filing continue to get pushed out -- now sometime in 2023. Penn LNG would tap into a robust pipeline network of long haul transportation, including Transco's Marcus Hook Lateral that connects Station 200 and the Penn LNG facility, and the TETCO Philadelphia Lateral that connects the Eagle Compressor Station and the Penn LNG facility via construction of greenfield lateral, with both requiring limited new right of way construction.

Penn LNG project, with its proposed location in Chester City, PA at a former Ford plant along the Delaware River, has been fraught with issues for years. One issue that is of growing concern is that the site is in one of the first communities in the U.S. to use the term “environmental justice” (EJ). The community also has a particularly active organization, Chester Residents Concerned for Quality Living, which has been dedicated for decades to challenging the environmental burdens and has pledged to fight the proposed LNG facility. As we explained in Acting Chairman Phillips Appears to Be Enforcing Key Aspects of the Failed Draft Certificate Policy Statement, EJ is one of Acting Chairman Phillips’s three top priorities. He also appears to have silently adopted the EJ aspects of the failed draft Certificate Policy Statement, which could lead to additional scrutiny of the project at FERC.

Other project siting challenges for Penn LNG appear to be related to its close proximity to Delaware, a state that prohibited the development of LNG terminals, and several miles from the proposed Gibbstown LNG Terminal (Dock 2) project on the New Jersey side of the Delaware River, which has also faced stiff opposition. Gibbstown LNG’s plans to ship LNG by rail has come into the crosshairs recently, given the derailment and chemical spill in East Palestine, Ohio, which may lead the Biden administration to end the Trump administration’s lifting of a ban against LNG by rail. In Push for LNG Exports Grows, but FERC Seems Unable to Make a Decision, we discussed another legal issue relating to whether FERC has authority over a facility that liquefies natural gas that is then moved by truck or rail to a port for export by waterborne vessels. If former FERC Chairman Glick’s actions are prologue, FERC may continue its expansive view of its jurisdiction to the detriment of this project.

Philadelphia LNG

So why will an LNG project in Philadelphia have a different fate? Perhaps the answer lies in timing and the political will to make it happen. As to timing, the Task Force is driven by the desire to have Pennsylvania gas supply support the worldwide desire to reduce dependence on coal-fired generation. As for the political will, the bill that called for the creation of the Task Force was passed with bipartisan support in both the House and Senate of Pennsylvania’s General Assembly and was signed into law by the previous Democratic governor. Although there is a new Democratic majority in the House and a new Democratic governor, it appears that a majority of members in both houses would continue to support the concept.

As we noted in Virginia Passes Legislation to Spur Low-Carbon Gas Blending into Natural Gas Systems, the gas produced by EQT and some of its competitors in Pennsylvania is already some of the lowest methane intensity gas produced in this country. Also, as we discussed in Will Responsibly Sourced Gas Become Economically Viable?, there appears to be a growing demand for low carbon LNG and access to the low carbon gas supplies in Pennsylvania could provide a decided advantage for an LNG terminal that derives its gas supply from such a low carbon basin. In addition, the close proximity to the gas supply would mean that the transportation of the gas would not produce as much carbon as transporting that same gas to the Gulf Coast.

Finally, it certainly helps that the CEO of EQT was recently appointed to the Task Force. EQT is an outspoken advocate for just such a development and has indicated that it is considering putting the company’s capital to work. Given EQT’s acreage footprint within Pennsylvania, you can understand why he’s involved.

While it’s unknown how the political winds will blow, it may help to have political leadership involved in the discovery phase, rather than the more common path of being in a reactive position to established private developer plans. In a way, it feels like the Pennsylvania legislature may be leaning toward a public-private partnership. As such, it’s worth noting the initial success four years ago when the Philadelphia City Council approved a plan to build a $60 million liquefied natural gas facility, the Passyunk Energy Center, in Southwest Philadelphia. The public-private partnership between city-owned Philadelphia Gas Works and Liberty Energy Trust unfortunately became mired in a time consuming dispute that led Liberty to move to other opportunities, and the project was scrapped.

The Philadelphia LNG Task Force, which includes members of the General Assembly, natural gas industry, Philadelphia building trades and other leaders in the region, is expected to produce a report by November 2023, but we expect the likelihood of any future project to be better known in the coming months. Any potential LNG development would certainly benefit the intrastate and interstate pipelines located in close proximity to Philadelphia.