Push for LNG Exports Grows, but FERC Seems Unable to Make a Decision

Originally published for customers September 14, 2022

What’s the issue?

As Europe tries to wean itself from Russian gas and as the rest of the world tries to wean itself from coal-fired power to reduce carbon emissions, a common answer to both problems is U.S. natural gas exports, often in the form of LNG. But FERC seems to be at an impasse on the reach of its authority as a key case has remained pending for over two years now.

Why does it matter?

EQT has called for a quadrupling of U.S. LNG capacity to 55 Bcf/day by 2030 to replace the use of coal internationally, with most of that growth coming on the East Coast. EQT projects that East Coast export capacity can grow from the current 1 Bcf/day to 31 Bcf/day by 2030. Much of that growth would come from major LNG terminals like those along the Gulf Coast. But in the immediate term, smaller projects that rely on other ways for exporting gas are also being proposed, but FERC has appeared indecisive about its authority over these smaller projects.

What’s our view?

FERC needs to confirm the limits of its jurisdiction over export facilities. Currently, there are 67 facilities located in the U.S. that are capable of liquefying natural gas and only 17 are regulated by FERC. Yet, FERC has had a petition pending for over two years for a facility that under past precedent would not be subject to its jurisdiction. But FERC has delayed a decision that would allow it to progress, even while issuing a similar decision for another project that filed later. It is unclear what could be delaying FERC’s decision, but even the environmental opponents to the project are apparently frustrated by the delay because earlier this month, they filed their own petition seeking a decision by FERC.

As Europe tries to wean itself from Russian gas and as the rest of the world tries to wean itself from coal-fired power to reduce carbon emissions, a common answer to both problems is U.S. natural gas exports, often in the form of LNG. But FERC seems to be at an impasse on the reach of its authority as a key case has remained pending for over two years now. EQT has called for a quadrupling of U.S. LNG capacity to 55 Bcf/day by 2030 to replace the use of coal internationally, with most of that growth coming on the East Coast. EQT projects that East Coast export capacity can grow from the current 1 Bcf/day to 31 Bcf/day by 2030. Much of that growth would come from major LNG terminals like those along the Gulf Coast. But in the immediate term, smaller projects that rely on other ways for exporting gas are also being proposed, but FERC has appeared indecisive about its authority over these smaller projects.

FERC needs to confirm the limits of its jurisdiction over export facilities. Currently, there are 67 facilities located in the U.S. that are capable of liquefying natural gas and only 17 are regulated by FERC. Yet, FERC has had a petition pending for over two years for a facility that under past precedent would not be subject to its jurisdiction. But FERC has delayed a decision that would allow it to progress, even while issuing a similar decision for another project that filed later. It is unclear what could be delaying FERC’s decision, but even the environmental opponents to the project are apparently frustrated by the delay because earlier this month they filed their own petition seeking a decision by FERC.

FERC’s Authority Over LNG Exports

FERC has exclusive authority under Section 3 of the Natural Gas Act “to approve or deny an application for the siting, construction, expansion, or operation of an LNG terminal.” The Natural Gas Act goes on to define LNG Terminal as “all natural gas facilities located onshore or in State waters that are used to receive, unload, load, store, transport, gasify, liquefy, or process natural gas that is imported to the United States . . . , exported to a foreign country . . . , or transported in interstate commerce by waterborne vessel. Thus there is little doubt that FERC has the authority to approve major marine LNG terminals like those along the coasts that liquefy natural gas and load it directly on to “waterborne vessels.”

But there are a number of facilities that are “onshore” that both liquefy and store that natural gas which are not regulated by FERC.

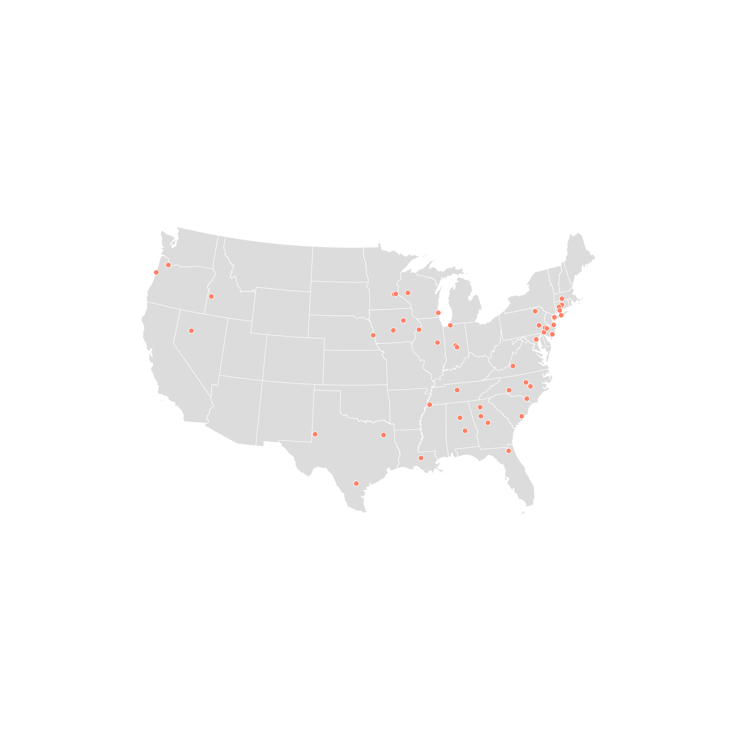

As seen above, there are fifty facilities located throughout the country that liquefy and store LNG for various purposes.

Combining Onshore Liquefaction with Export

In two recent cases presented to FERC, the question has arisen as to whether it has authority over a facility that liquefies natural gas that is then moved by truck or rail to a port for export by waterborne vessels.

In the first case, two affiliates of New Fortress Energy filed separate proceedings in September of 2020 in which they described their intent to construct a liquefaction facility in Wyalusing, Pennsylvania that is located more than 100 miles from the nearest coastal port and from the multi-use port facility in Gibbstown, New Jersey that New Fortress was constructing. New Fortress sought a determination from FERC that neither facility would be subject to FERC’s authority. With regard to the Wyalusing facility, New Fortress noted that the facility would obtain gas through a connection to Stagecoach Pipeline, a FERC-jurisdictional pipeline. But following liquefaction, the LNG would be loaded into either railroad tankcars or ISO containers to be loaded onto flatbed railcars. One possible destination for these railcars would be the multi-fuel port facility in Gibbstown. Once at Gibbstown, the LNG could be directly transferred from the trucking and railcar facilities by means of a vacuum insulated LNG transfer line, which would deliver LNG to a marine vessel. That vessel could then transport the LNG directly to foreign ports or the LNG could be loaded onto a floating storage unit or shuttle vessel that would transport the LNG to a larger ocean-going waterborne vessel for delivery to foreign ports. Finally, if the LNG is received at the port in ISO containers, those containers could simply be loaded onto a vessel for further transport.

In the second case, Nopetro LNG filed a similar petition in April 2021 seeking a determination that FERC had no authority over the facility it was planning to construct at a port facility in Florida. That facility would receive natural gas directly from a local distribution company. It would then liquefy the gas and load it into ISO containers which would be moved about a quarter of a mile to the port and loaded onto vessels for export.

FERC Grants Nopetro’s Request

On March 25, 2022, FERC granted Nopetro’s request over the objection of a number of environmental groups. Following requests for rehearing it affirmed that decision on July 29. In the original order and the order on rehearing, FERC noted that it has reviewed petitions like these on a case by case basis, but has developed a three factor test for determining the export projects over which it has jurisdiction: (1) whether the LNG facility would include facilities dedicated to the import or export of LNG; (2) whether the facility would be located at or near the point of import or export; and (3) whether the facility would receive or send out gas via a pipeline. Under this test, FERC has found it only has authority over coastal LNG facilities that are served by ocean-going, bulk-carrier LNG tankers. Because the Nopetro facilities were located a quarter mile from the point of export and the transfer to the export point would not be pipeline, FERC had no jurisdiction over those facilities.

FERC Has Yet to Act on New Fortress’s Request

The Nopetro decision was unanimous, and yet, FERC has still not ruled on the very similar requests filed by the two affiliates of New Fortress. Under the Nopetro decision, there seems to be no ground for withholding a decision regarding the Wyalusing facility. Not only is that facility much further from the coast than the Nopetro facility, it has no ability to directly load the LNG onto ocean going vessels. There is one difference with respect to the Gibbstown facility, however. That facility is designed to load LNG directly onto ocean going vessels at the point of export. However, as New Fortress has noted, its facility fails the final of FERC’s three factor test because it neither receives nor delivers the gas used at the facility from a pipeline. Thus, it should also be exempt from FERC regulation. Because of the delay by FERC, certain state permits expired and earlier this year New Fortress agreed to halt construction it had begun at Wyalusing, which has called into question the continued viability of the entire project.

Frustration May Be Building with FERC’s Inability to Make a Decision

FERC’s inability to make a decision in this case may be leading to recent actions by both those who favor natural gas infrastructure and those opposed. On September 6, Senator Barrasso, the ranking member of the Senate committee with oversight of FERC, sent all five commissioners a detailed nine-page letter asking for their prompt response to a number of questions. One of those questions was focused on LNG projects and asked whether there are “LNG projects currently pending before FERC that have been awaiting final action for a substantial period of time (e.g., more than 120 days)?” While he may have been talking about applications for approval, clearly taking over two years to respond to a request simply confirming the lack of regulatory authority could also fit comfortably within that request for information.

Similarly, from those opposing the two New Fortress projects, on September 7, the Sierra Club and the Natural Resources Defense Council filed their own petition with FERC asking FERC to find that it has regulatory authority over the New Fortress export project, “including the Wyalusing gas liquefaction facility and Gibbstown LNG export facility, and therefore [both] must apply for a single FERC authorization and undergo a single review under the National Environmental Policy Act.”

FERC Clearly Needs to Define the Path Forward

As the world appears to be seeking access to U.S. natural gas in the form of LNG, either to wean itself from Russian natural gas or for the carbon emission reductions that come from supplanting coal-fired power plants, the use of these smaller LNG facilities may become a crucial short-term fix, especially if they are not subject to an extended FERC review as are the major coastal facilities. Many of the existing facilities may be capable of being expanded and could provide both an outlet for U.S. producers and relief to the world. But first, FERC needs to clearly define the scope of its authority and then let the markets work.