Will a European Shift to LNG Finally Allow U.S. Export Terminals to Reach FID?

Originally published for customers March 25, 2022.

What’s the issue?

Following the invasion of Ukraine by Russia, the European Union has announced its intention to wean itself from Russian fossil fuels by 2030. Then this morning, the European Commission and the Biden administration announced a plan to work with EU members toward the goal of ensuring, until at least 2030, demand for approximately 50 bcm/year of additional U.S. LNG.

Why does it matter?

There are a number of U.S. LNG export terminals that have been approved by FERC and the DOE that have delayed their final investment decision.

What’s our view?

Europe’s growing need for LNG will certainly create additional demand for LNG, but so far it is unclear if any of the approved projects have been able to secure long-term agreements sufficient to reach a final investment decision. But we expect there to be announcements soon and we can help you follow the progress of the projects as they reach that stage and begin construction so that you can anticipate when they might produce their first LNG.

Following the invasion of Ukraine by Russia, the European Union (EU) has announced its intention to wean itself from Russian natural gas by 2030. Then this morning, the European Commission and the Biden administration announced a plan to work with EU members toward the goal of ensuring, until at least 2030, demand for approximately 50 bcm/year of additional U.S. LNG. There are a number of U.S. LNG export terminals that have been approved by FERC and the DOE, but have yet to make a final investment decision, that could serve as a source for the EU’s increased need for LNG.

Europe’s growing need for LNG will certainly create additional demand for LNG, but so far it is unclear if any of the approved U.S. based projects have been able to secure long-term agreements sufficient to reach a final investment decision. But we expect there to be announcements soon, and we can help you follow the progress of the projects as they reach that stage and begin construction so that you can anticipate when they might produce their first LNG.

What Will It Take to Wean Europe from Russian Fossil Fuels?

The International Energy Agency (IEA) issued a report earlier this month that described just how reliant the European Union was on Russian energy. According to that report, in 2021, the European Union imported around 140 billion cubic meters (bcm) of Russian pipeline gas for the year and an additional 15 bcm in the form of liquefied natural gas (LNG). “The total 155 bcm imported from Russia accounted for around 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption.” For those of us in the U.S., a bcm of gas is equal to about 35 bcf of gas. Thus, the total imports from Russia to the EU for 2021 was about 5,500 bcf of gas or 15 bcf/day.

A key determinant on how quickly the EU will be able to wean itself from its reliance on Russia according to the IEA is whether it is willing to prioritize energy security over climate change. If the EU sticks to its climate goals, the most it can hope to achieve is to reduce its reliance on Russian gas by about one-third. But if it is willing to delay some of its emissions targets, it could reduce its reliance by one-half. Over the remainder of this decade, the IEA believes that the EU can completely eliminate its need for Russian gas while still meeting its climate targets, but reducing “reliance on Russian gas will not be simple, requiring a concerted and sustained policy effort across multiple sectors, alongside strong international dialogue on energy markets and security.”

The IEA Details

The IEA report indicates that the EU currently has the capacity to replace 2,100 bcf annually in the form of LNG using existing regasification facilities, but notes that would put extreme pressure in the short term on world LNG prices. Delaying the planned retirement of nuclear facilities and encouraging more use of biogas facilities could generate an additional 70 TWh of power and displace about 455 bcf of gas. Encouraging everyone to turn down thermostats by 1°C would reduce gas demand by some 350 bcf a year. As for accelerating the growth of renewable energy, the IEA estimates that accelerating the deployment of an additional 35 TWh of generation from renewable sources could displace 210 bcf of natural gas.

The IEA suggestions are focused on the near term, but this morning’s announcement by the European Commission and the Biden administration contains both short-term and long-term goals. First, in the agreement, the U.S. commits to work with international partners to ensure the EU market receives at least an additional 525 bcf of LNG volumes during 2022, and the European Commission agrees to work with its members to ensure that U.S. facilities are assured of additional purchases of 1,750 bcf/year through at least 2030.

Previously, Germany had announced it would construct two new LNG regasification terminals, but also indicated these terminals would be designed and built to receive hydrogen in the future. Then, earlier this month, the Italian utility Enel announced it had been asked to dust off its plan to build an LNG terminal in southern Italy, as Italy also looks for alternative supplies to replace Russian gas.

U.S. Projects Seeking FID

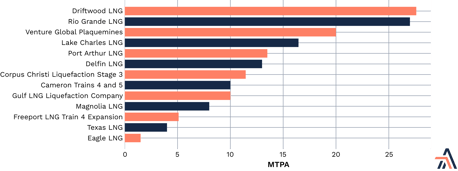

The additional annual imports that the EU has promised to purchase, 1,750 bcf/year, is equivalent to about 34 to 36 million tons per year (MTPA) of LNG, depending on the conversion factor used. There are a number of U.S. LNG terminals that have already received approval and are looking for sufficient offtake contracts to make a final investment decision and move forward with construction.

As seen above, the two largest of these, Venture Global Plaquemines and Tellurian’s Driftwood LNG, are big enough to provide sufficient LNG to fill the new demand that the EU committed to purchase through 2030. The IEA noted in its report that increased European demand will exert upward pressure on LNG prices because buyers of LNG are all “fishing in the same pool for supply.” The same however, could be equally said about the sellers of LNG in that they are trying to hook the same buyers. But with the newest buyers coming on the market in Europe, it would seem that one or more of these already approved LNG terminals would be a good fit for providing Europe with the needed supply.

How Long Will It Take?

If the U.S. LNG terminals can find willing buyers in the EU, the addition of LNG to the world markets will not be immediate. Looking at past projects here in the U.S. indicates that it takes about three to four years from when these projects start construction to when they produce their first LNG.

.png?width=458&name=Blog%2003252022%20(2).png)

As seen above, however, the most recent project, Calcasieu Pass, was able to produce its first LNG in less than three years after it commenced construction. Clearly, the sooner the EU can choose its partner for increasing the world’s supply of LNG, the sooner that LNG can hit the world markets and help lessen the price impact from the EU’s increased need for LNG to replace Russian imports.

In conjunction with the plan by Enel to restart its gasification facility, the Italian government noted that it expected Enel to be able to complete that facility in a time frame consistent with Italy’s plan to become independent of Russian gas imports within 24-30 months. While it may not be possible for any of these approved projects to be producing LNG within 30 months, it could be very close to that if the FID decision can be made shortly.