Haynesville May Soon Need More Pipeline Capacity

What’s the issue?

The headline for a Goldman Sachs research report issued this week was “Haynesville Natural Gas - Takeaway Tightening, New Pipeline Projects Likely Needed by 2023,” and earlier this year Chesapeake Energy announced it was acquiring Vine Energy, which would make Chesapeake the largest producer in the Haynesville basin.

Why does it matter?

In its announcement, Chesapeake noted that Vine has no firm transport in its current portfolio, but that there were projects being explored to take gas away from the Haynesville basin and move it to the LNG terminals along the coast.

What’s our view?

We look at the takeaway capacity of the largest producers in the Louisiana portion of the Haynesville basin and find that Vine is alone in not holding any takeaway. So with the acquisition by Chesapeake and the projected production growth, there certainly seems to be expansion opportunities for pipelines in the region.

The headline for a Goldman Sachs research report issued this week was “Haynesville Natural Gas - Takeaway Tightening, New Pipeline Projects Likely Needed by 2023,” and earlier this year, Chesapeake Energy announced it was acquiring Vine Energy, which would make Chesapeake the largest producer in the Haynesville basin. In its announcement, Chesapeake noted that Vine has no firm transport in its current portfolio, but that there were projects being explored to take gas away from the Haynesville basin and move it to the LNG terminals along the coast.

Today we look at the largest producers in the Louisiana portion of the Haynesville basin and consider the pipeline capacity they hold. We dive a bit deeper into the capacity held by Aethon and show that even when they hold capacity, it is mainly just to reach other interstate pipelines and so the delivery points are all very local. However, Vine Energy’s lack of firm capacity and its acquisition by Chesapeake, which appears to have a very different view on holding capacity, along with the projected production growth, would seem to support the conclusion of the Goldman Sachs headline that there are expansion opportunities for pipelines in the region.

The Producers

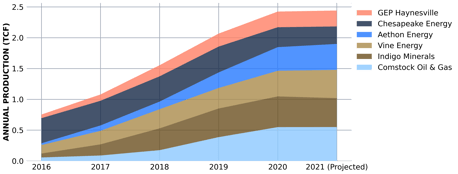

Based on production data from the Louisiana Department of Natural Resources, six producers, and soon-to-be five following Chesapeake’s acquisition of Vine Energy, account for 80% of the production from the Haynesville basin for 2021. Looking back to 2016, it is also easy to see how much growth there has been in the production of these six major producers.

As seen above, these six producers have cumulatively more than tripled their production since 2016.

Pipeline Capacity

One of the huge benefits that the Haynesville basin has is its proximity to a multitude of pipelines and to the growing demand centers of the LNG export terminals along the Gulf coast. That means that there is no need to hold cross-country firm pipeline transportation contracts. However, when we reviewed the contracting practices of these producers, we did find that Vine was the outlier in holding no firm interstate transportation contracts. The other five producers all held capacity on the pipelines in the region, ranging from a low of 300,000 dth/day for Indigo to a high of around 600,000 dth/day held by Chesapeake and Aethon.

Aethon

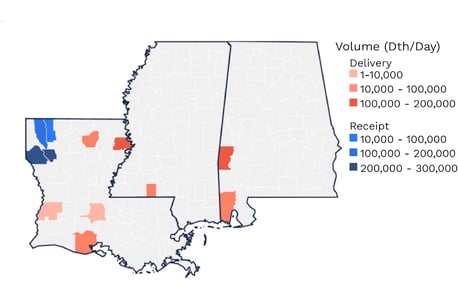

To further understand the needs of these producers, we looked at the capacity held by Aethon to see not only how far they were moving their gas on the interstate system, but also the purpose of that capacity.

As seen above, Aethon’s receipt points naturally are located in close proximity to the production area and are almost exclusively on the Gulf South system. However, it is the delivery points that are interesting in that they are very nearby. When we break that down by the delivery points, we can quickly see that the primary purpose for which Aethon holds capacity is to assure that it can reach other interstate pipelines, but that it does not typically hold capacity on those pipelines.

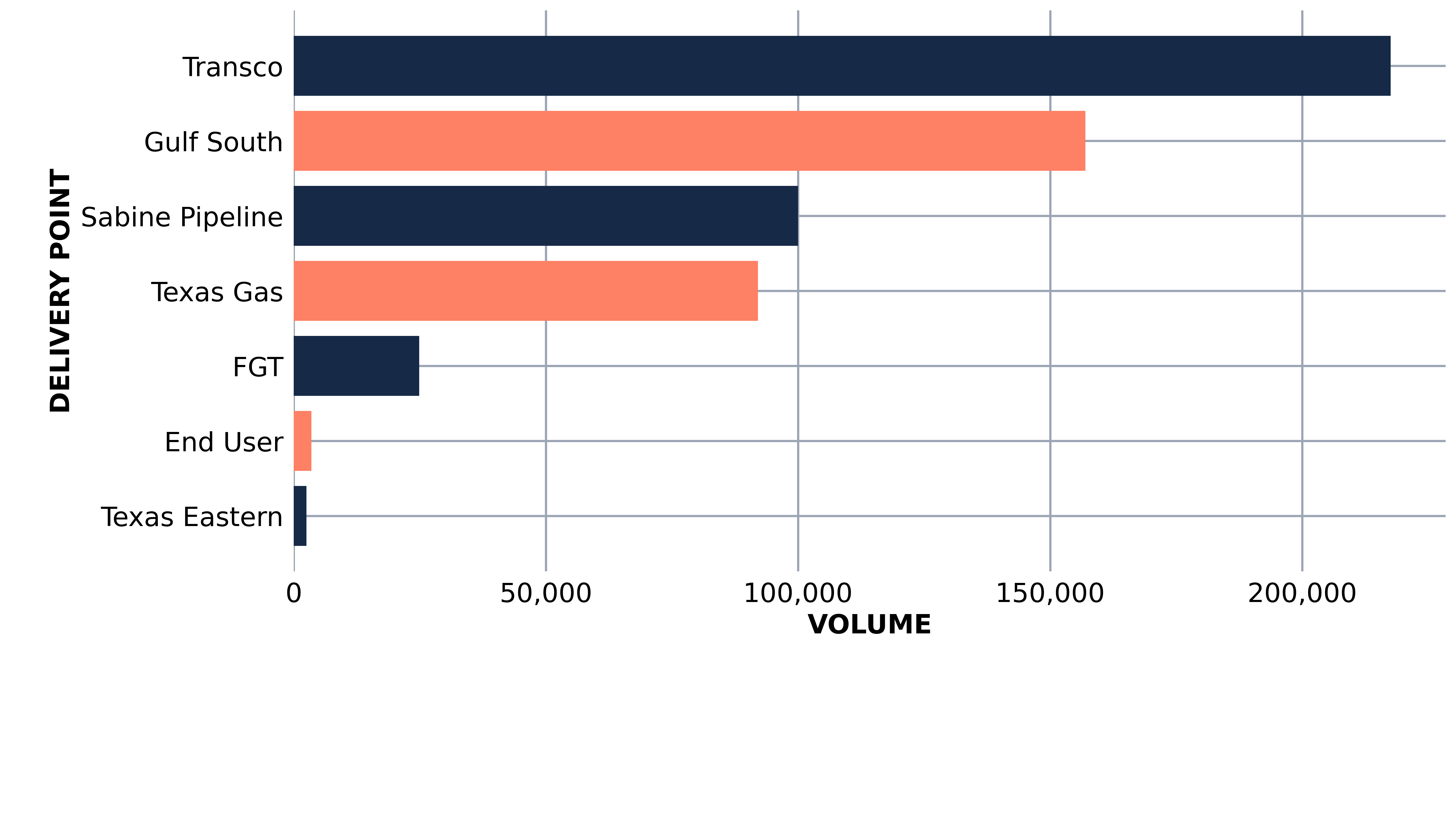

As seen above, almost all of the capacity is for the purpose of reaching other pipelines in the region or a liquid virtual point on Gulf South. Almost 40% of the capacity is designed to reach Transcontinental Pipeline, but Aethon holds no capacity on that pipeline. A similar pattern repeats for the other pipelines, other than Texas Gas.

Expansion Opportunities

If the production from this basin continues to grow at this rate, the headline from the Goldman Sachs research report would certainly seem accurate. In addition, once Chesapeake completes its acquisition of Vine Energy, it may seek to end Vine’s practice of not holding takeaway capacity, which could also present an opportunity for the region’s pipelines to market either existing or potential expansion capacity to Chesapeake. In addition, while Aethon appears to be mainly interested in reaching other interstate pipelines, it may soon need firm capacity on those pipelines to reach the growing Gulf market, or else risk being shut out from that market as other producers take up that capacity.

If you would like us to analyze the pipeline contracts held by other producers, please contact us.