CEOs Agree on Moving Towards Net Zero, But Not How to Get There

Originally published for customers March 8, 2023

What’s the issue?

Emissions reductions continue to remain at the forefront of everyone’s mind, driven by both external policy and internal goals. There are a multitude of methods being explored to help achieve net zero.

Why does it matter?

New state and federal policies further the need for net zero. Companies will need to invest time and money into the exploration and development of different emissions reductions strategies, and soon.

What’s our view?

There isn’t one best path to net zero, and it is unlikely that the goal will be met without encountering several challenges on the way.

The move towards net zero continues to be a top priority for energy industry leaders. New state and federal policies, internal company goals, and investor attitudes are just a few of the many factors driving the industry attempts at reducing carbon emissions. The generally agreed upon goal is “net zero” carbon emissions, but there are many different and uncertain paths to achieving the goal. Natural gas companies are viewed as a critical component of the solution as they navigate the energy evolution.

What Executives Are Saying

Bain and Company (Bain) recently issued its 2022 Global Energy and Natural Resources Report, which surveyed over 1,000 executives in oil and gas, utilities and renewables, mining, agribusiness, and chemical sectors from across the globe. Unsurprisingly, 88% of those surveyed say that reducing Scope one and two emissions is one of their top priorities.Ninety-six percent of respondents believe their respective industry will make progress towards net zero by 2030.

The sentiments on the importance of reducing emissions don’t vary much, but the surveyed executives tend to disagree on how long it will take the world to get to net zero. A little under half think this can occur by 2050. Another quarter believes it will take at least until 2070. Regardless of how long it takes the world, 61% of these industry executives believe that their companies will be able to decarbonize faster than the rest of the world.

A Utility’s Path to Net Zero

Of those surveyed in Bain’s report, 63% of power utility executives expect their core business to grow rapidly in the next ten years due largely in part to increased levels of electrification. In theory, electrification provides a seemingly easy path for utilities to reduce their carbon emissions. In reality, the U.S. still has a long way to go based on the current state of the electric generation fleet.

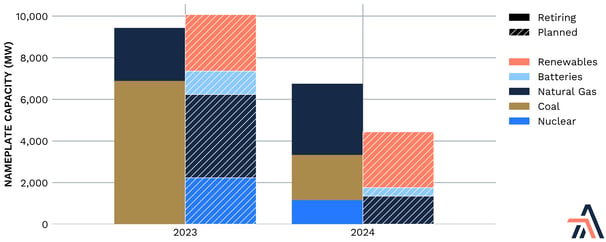

According to the EIA, only 21.5% of the electricity generated in the U.S. last year came from renewable sources. Natural gas generation accounted for just under 40% of that total. The use of coal in the electric power sector has been decreasing steadily in the past several years, but still provided almost 20% of total generation in 2022. As seen in the chart below, there will be significantly more utility-owned coal-fired capacity retiring than coming online by 2025. Many might be surprised to learn that close to 35% of the new utility-owned generation facilities expected to enter into service by 2025 are slated to use natural gas as their primary fuel source.

This isn’t entirely surprising. Natural gas is a reliable source of electricity generation and supply is not an issue here in the U.S. Most of the infrastructure is already in place, with thousands of miles of pipelines in the ground and almost 3,000 utility-owned power plants already connected to the electric grid. In The Path to Net Zero Runs Through the Electric Grid, Which is a Problem and MISO Shows Reforms Are Desperately Needed to Interconnection Queueing, we discussed how the current state of the electric grid and the various interconnection queues are major blockers to the development of renewable generation projects across the country.

Many utilities will continue to utilize natural gas on their path to net zero, especially if the rate of electrification outpaces the renewable generation capacity — a very likely scenario. These utilities are still making significant investments in renewable power projects, which will help them inch closer to their emissions reductions goals. In addition, 75% of the utility executives surveyed by Bain believe that energy storage will have a significant impact on their businesses. Battery storage projects account for about 10% of the utility-owned generation projects planned to go into service in the next two years.

A Natural Gas Company’s Path to Net Zero

At this point, it is clear that natural gas is here to stay and absolutely has a place at the table in the energy evolution, even though half of the executives surveyed by Bain see their core business decreasing in the next ten years. In the near future, natural gas will be necessary to keep up with the increasing demand for electric power as electrification continues to ramp up. Many natural gas companies have set similar net zero goals at this point in time, though each company seems to have different plans as to how to achieve that goal.

Our customers often ask us to research and analyze different low carbon opportunities. Bain’s survey revealed that many natural gas executives are considering how hydrogen and carbon capture use and storage (CCUS) can be integrated into their net zero strategies. Recent legislation has spurred a renewed interest in both of these potential strategies, as we discussed in DOE Launches Loan Program for CO2 Pipelines, But Questions Remain as to Whether Carbon Capture and Storage is a Sustainable Investment.

CCUS could help natural gas companies reduce their emissions from existing assets and also remove other CO2 from the atmosphere, which has the potential to help natural gas companies make significant strides towards their net zero goals. At this point in time, however, it is really just a great theory for lowering emissions rather than an actual strategy that companies can be implementing in the short term. In Legislation Boosts Hydrogen, But Will it Be Enough?, we discussed some of the potential developments in hydrogen technology that could result from recent legislation. Once again, there is still a lot of research and work that needs to be done before hydrogen is a valid opportunity for many companies to pursue as part of their net zero strategy.

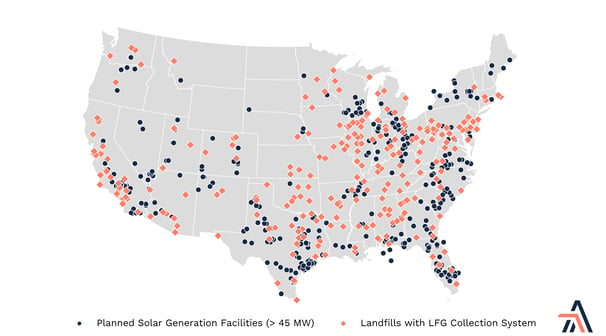

Many of our customers are considering much smaller-scale low carbon opportunities, including utilizing renewable power at their electric compressor stations, acquiring renewable generation facilities close to their footprint, and bringing renewable natural gas into their pipeline system. Here at Arbo, we can provide research and analysis into all of these different strategies. For example, the map below details locations of planned renewable generation projects as well as potential RNG sources, on which we can overlay the specific footprint of our customers to identify opportunities to acquire low carbon opportunities to advance their net zero goals.

Reaching net zero will be a monumental task that many of our customers have the opportunity to play a vital role in, both in North America and across the globe.

Energy Executives at CERAWeek

This week is CERAWeek in Houson and comments from executives so far are consistent with the Bain survey. The consensus is that oil and gas are here to stay and will play a key part in the energy transition.

Yesterday, in an interview with CNBC, Hess CEO John Hess stated that, “Oil and gas are key to having an affordable, just and secure energy transition.” Olivier Le Peuch of Schlumberger echoed this sentiment.

Darren Woods of ExxonMobil noted the potential for the onset of government spending to accelerate his company's efforts and CCS projects underway, but was quick to note the permitting challenges faced by these types of projects which took between six and seven years to receive needed permits.

We’ll be listening closely to see what strategies are emerging and for constructive paths forward on issues, like permitting reform, that need immediate attention.