MISO Shows Reforms are Desperately Needed to Interconnection Queueing

Originally published for customers February 10, 2023

What’s the issue?

There are seven major ISO/RTO regions across the country that govern interconnection and transmission for generation facilities across the country. Every proposed project that is to be constructed in one of these regions must complete their respective ISOs interconnection process in order to ensure the project is viable and can successfully be connected to the grid.

Why does it matter?

Proposed renewable generation facilities must enter the interconnection queue in the region in which they are to be constructed as a key part of the project process. The individual interconnection process varies by ISO/RTO and has not evolved in order to keep up with the growing number of projects being placed in the queues.

What’s our view?

Each interconnection process was meant for a small number of large-scale generation facilities at any given time. As the energy evolution accelerates, large numbers of smaller-scale facilities are being placed into the queues to undergo the interconnection process. Without process reform, the ISO/RTOs will soon be overwhelmed with the number of interconnection requests and lengthy delays are inevitable.

The amount of clean energy generation has increased greatly in recent years. With the passage of the Inflation Reduction Act (IRA) and an increasing number of states making their own clean energy goals, we can only expect the number of renewable energy projects to continue to grow at a never-before-seen pace. As we discuss in The Path to Net Zero Runs Through the Electric Grid, Which is a Problem, there are a number of hurdles that these projects are facing, many of which are related to the electric grid.

Most areas of the country fall under one of the seven major regional electric transmission system operators, which are either an independent system operator (ISO) or a regional transmission organization (RTO). In these areas, each generation project must enter an interconnection queue where it will complete a series of facility and impact studies prior to construction to ensure that these projects are viable and can successfully be connected to the grid.

There are a number of issues facing the queues. More projects are entering the queues than ever before, causing huge project backlogs. The queue process was originally designed to accommodate a small number of large-scale generation projects rather than the large number of small-scale projects that are now being submitted. Additionally, all seven major regional queues have exceptionally high project withdrawal rates, well over 50%. In PJM Seeks to Reform Its Generation Connection Queue and FERC Follows Suit, we discuss some of the proposed changes that both PJM and FERC were considering to help alleviate the bloated interconnection queues. For now, each queue has its own interconnection process. In today’s ArView, we detail the Midcontinent Independent System Operator’s (MISO) current interconnection process and the problems it is facing.

MISO’s Interconnection Process

MISO was the first ISO approved by FERC and is one of the largest today, serving over 45 million people throughout its operating area. MISO covers much of the Midwestern U.S., as well as parts of Canada, Arkansas, Louisiana, Mississippi, and eastern Texas.

The MISO interconnection queue operates with a cluster study model, where projects submitted in the same cluster move through the queue process together in order to speed up the time each project spends in the queue. The process is broken down into three definitive planning phases (DPP) followed by a stage to complete a Generation Interconnection Agreement (GIA).

The first DPP begins approximately 90 days after the cycle application deadline. In between the application deadline and the start of the first DPP, each proposed generating facility will have a Site Control review report issued, undergo a scoping call with MISO, and receive its individual screening analysis results. DPP Phase 1 is estimated to take approximately 100 days, where each project undergoes a Model Review and preliminary System Impact Study (SIS). The project owner, or interconnection customer, will then decide if they wish to proceed to the next phase and make any changes to the proposed project size or withdraw the project.

DPP Phase 2 is estimated to take about 105 days. Each project will undergo a second model review and complete a more in-depth SIS. In this phase, the project must also undergo Affected System, Stability, and Short Circuit Studies. A Facilities Study will begin in this phase, but is often not completed until DPP Phase 3. Following the completion of these studies, the interconnection customer will once again have the chance to adjust the project size, as well as to withdraw from the queue.

DPP Phase 3 can be either the shortest or the longest of the three planning phases, estimated to only take either 60 or 105 days to complete, depending on whether or not a Network Upgrade Facility Study (NUFS) was required for the project. Next, a final model review and SIS are completed. The project then moves on to draft and execute a GIA, which is expected to take 108 days. After the GIA is executed, the project has completed the MISO Interconnection Process and is able to be constructed, synced to the grid, and placed into commercial operation. From the start of DPP phase 1 through the execution of the GIA, MISO states that the entire interconnection process should take about 373 days to complete with no NUFS, and 463 days to complete with an NUFS.

The Current State of MISO’s Queue

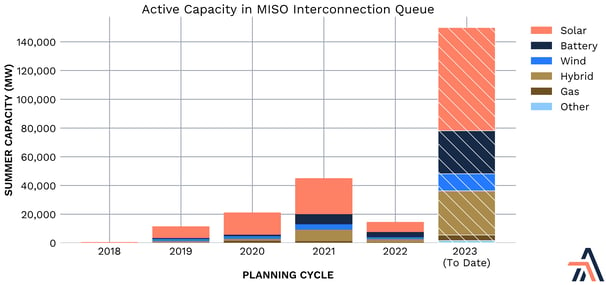

MISO currently has over 1,500 active projects in its queue with over 270,000 MW in planned capacity. The last study cycle, DPP 2022, closed on September 15, 2022. In just under five months since the last cycle application deadline, 800 projects have entered the queue, totaling over 150,000 MW in proposed capacity.

As seen above, well over 80% of active projects in the queue represent clean, renewable power generation, both in terms of the number of projects and the amount of energy the projects are anticipated to generate. If these projects are able to make it through MISO’s interconnection queue and be constructed, MISO would be well on its way to having a large percentage of its generation come from clean energy sources. However, it is unlikely that these projects will complete MISO’s interconnection process in the timely manner MISO advertises.

The 2021 Cycle Should Be Complete

Applications for DPP 2021 closed on July 21, 2021. Based on MISO’s published timeline, these interconnection customers should have expected their projects to begin Phase 1 of the review process in mid-October of 2021. In theory, these projects would have executed a GIA agreement by the end of October 2022 if the project did not require an NUFS or by the end of January 2023 if the project did require an NUFS.

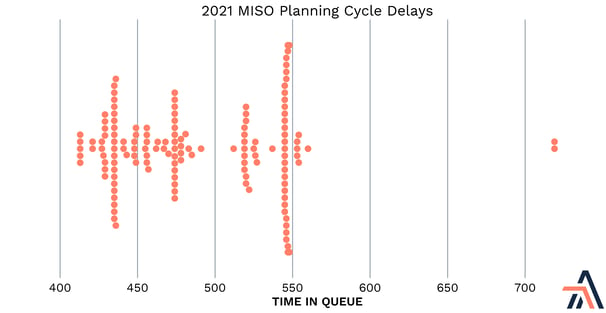

According to MISO’s interconnection queue, there were 477 applications for projects submitted as part of this cycle. Fifty-seven of these projects have already withdrawn their applications. The 420 remaining projects have yet to begin the first planning phase. The chart below shows just how long these projects have already been sitting in the queue.

Delays are Extensive and Likely to Grow

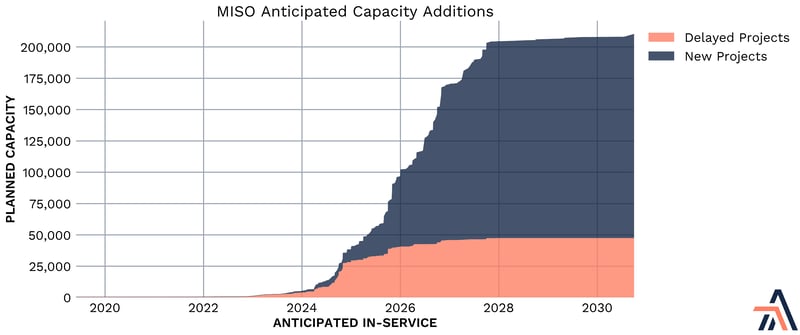

All of the projects that submitted applications before September 15, 2022, the deadline for the DPP 2022 cycle, should have at least started DPP Phase 1 based on MISO’s published interconnection process timeline. However, over 60% of these projects have yet to begin the first phase. It is clear MISO already has a large backlog of projects. With the sheer volume of projects that has been submitted since then, it is all but certain that the backlog will be growing significantly larger in the coming 2023 study cycle. Even if MISO’s deadline for the next study cycle was tomorrow, MISO would be left with well over 1,000 projects that need to go through all three DPP phases and execute a GIA agreement by the middle of May 2024 if their timeline was accurate.

The chart above shows just how dire the situation in MISO’s interconnection queue is. The 47,000 MW worth of capacity placed into the queue prior to the 2022 cycle deadline should have at least entered DPP Phase 1, but has not yet done so. In just under five months since then, over 150,000 MW have been added, nearly quadrupling the amount of queued capacity. MISO desperately needs to start catching up, and quickly.

As we discussed in PJM Seeks to Reform Its Generation Connection Queue and FERC Follows Suit, MISO’s situation is not unique. Interconnection queuing across the country was not meant to handle the large volume of small-scale projects it is currently seeing as a result of the energy evolution.