The Need for Natural Gas in U.S. Government Study’s Path to Net-Zero Electricity by 2035

Originally published for customers September 21, 2022

What’s the issue?

In an executive order issued late last year, President Biden stated that it was the policy of his administration “to achieve a carbon pollution-free electricity sector by 2035.” In late August, the National Renewable Energy Laboratory (NREL) released a study describing four pathways to achieving this goal and we look at the impact of those pathways on the continuing need for natural gas.

Why does it matter?

According to the Energy Information Administration in 2021, the U.S. generated about 4.12 trillion kWh of electricity. “About 61% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases. About 19% was from nuclear energy, and about 20% was from renewable energy sources.” In particular, natural gas was used to produce about 1.57 trillion kWh or 38.3% of the total. In that same year, the U.S. produced about 34 Tcf of natural gas and about one-third of that production was used to produce electricity. Thus, the continued use of gas for electric production is a critical element of demand for U.S. gas production.

What’s our view?

NREL’s study contains both threats and opportunities for the natural gas industry. The ultimate impact from the evolutionary paths identified by NREL will be heavily dependent on the speed with which other forms of energy can be deployed and how flexible the natural gas industry is in responding to the changes that are likely to come in the next decade.

In an executive order issued late last year, President Biden stated that it was the policy of his administration “to achieve a carbon pollution-free electricity sector by 2035.” In late August, the National Renewable Energy Laboratory (NREL) released a study describing four pathways to achieving this goal, and we look at the impact of those pathways on the continuing need for natural gas. According to the Energy Information Administration in 2021, the U.S. generated about 4.12 trillion kWh of electricity. “About 61% of this electricity generation was from fossil fuels—coal, natural gas, petroleum, and other gases. About 19% was from nuclear energy, and about 20% was from renewable energy sources.” In particular, natural gas was used to produce about 1.57 trillion kWh or 38.3% of the total. In that same year, the U.S. produced about 34 Tcf of natural gas and about 37% of total U.S. consumption of natural gas was used to produce electricity. Thus, the continued use of gas for electric production is a critical element of demand for U.S. gas production.

NREL’s study contains both threats and opportunities for the natural gas industry. The ultimate impact from the evolutionary paths identified by NREL will be heavily dependent on the speed with which other forms of energy can be deployed and how flexible the natural gas industry is in responding to the changes that are likely to come in the next decade.

Paths to 100% Clean Electricity by 2035

NREL’s study first sets forth the demand it projects for electricity by 2035. NREL expects the demand for electricity to at least double between now and 2035, primarily due to end-use electrification, including wider adoption of electric vehicles. Demand grows even more depending on the mix of fuel used to generate electricity. NREL looked at a number of different scenarios, but reported on four main ones: the “All Options” path, which allows participation by all fuel sources to generate electricity, including fossil fuels that are combined with carbon capture and storage. It also looked at two variations of that basic path which differed based on the amount of electric transmission infrastructure that would be allowed. The “Infrastructure Renaissance” path allows for transmission lines to grow rapidly throughout the country, wherever and whenever needed. Conversely, the “Constrained” path assumes there will be opposition to the construction of needed transmission lines. The difference in the amount of transmission lines in these two paths is stark.

As seen above, the amount of transmission lines in the U.S. would almost triple under the Infrastructure Renaissance path, but hardly at all under the Constrained path.

The final path NREL analyzed was one where fossil fuels were completely barred and so only those fuels that create no carbon emissions at the point of generation would be allowed — that would primarily mean wind, solar and nuclear.

Impact on Gas Demand

NREL’s assumption concerning a substantial electrification process would have a substantial impact on gas demand. The Energy Information Administration reports that in 2021, the U.S. demand for natural gas was split among the following five major uses.

As seen above, residential and commercial use, both of which would be substantially impacted by electrification of end uses, collectively account for almost 8 Tcf of gas demand annually. If we presume that at least half of that demand would go away through electrification, that would result in a 10% reduction in gas demand. The third major category, industrial use, barely budges between now and 2035 under all four NREL scenarios. However, to reach the ultimate goal of net-zero by 2050, that demand will likely need to fall as well, unless carbon capture and storage becomes readily available.

The biggest demand destruction in the NREL study between now and 2035 occurs with respect to the demand for gas needed to generate electricity. That accounts for 11 Tcf per year currently but would drop precipitously under all four NREL scenarios.

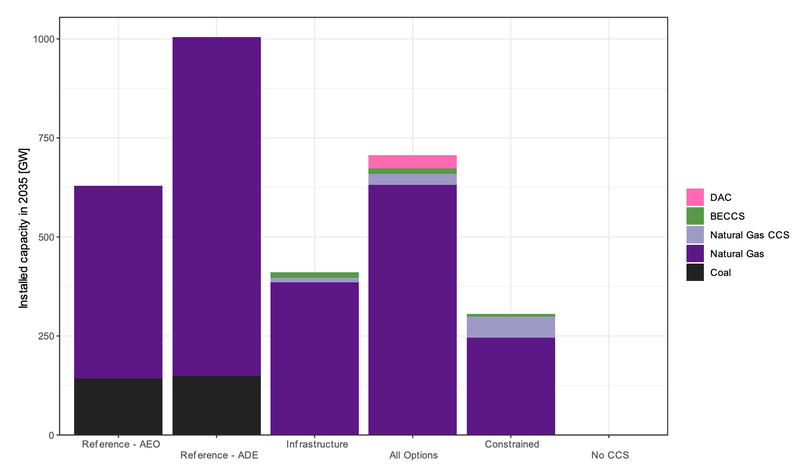

As seen above, in all four scenarios, coal disappears by 2025 and gas falls dramatically even in the “All Options” scenario. Combining the reduction in all categories of current demand, other than industrial, shows that, at a minimum, approximately 11 Tcf of the current 34 Tcf in demand will simply disappear by 2035.

Such a reduction in demand will put a strain on the remaining users of natural gas, as the current pipeline system costs will be spread across fewer and fewer users which could cause even a greater acceleration of conversions to other fuel sources or delivery methods as midstream companies and local distribution companies seek to abandon service.

Other Gas Infrastructure May be Needed

As explained in the report, the main uncertainty in reaching 100% clean electricity is the need to meet peak demand periods or during periods of low wind and solar output. According to the report, NREL’s analysis demonstrates the potentially important role of several technologies that have not yet been deployed at scale, including seasonal storage and several carbon capture and storage technologies. “The mix of these technologies varies significantly across the scenarios.” However, the need to develop seasonal storage on the scale envisioned “requires substantial development of infrastructure, including fuel storage, transportation and pipeline networks, and additional generation capacity needed to produce clean fuels. While natural gas demand falls in all four scenarios, the need for other forms of gas infrastructure increases in all four scenarios with a combination of the need to produce, transport and store hydrogen and carbon dioxide.”

As seen above, the need for hydrogen grows dramatically in the scenario where fossil fuel use is prohibited. The main reason for this is that without natural gas with carbon capture and storage providing a seasonal balancing role, much more hydrogen will need to be produced to provide that same service.

A similar growth in carbon capture and storage technology will also be needed in all paths other than the one that relies solely on wind, solar and nuclear.

As seen above, while the growth is less than currently anticipated by the Energy Information Administration’s base case, there is still a substantial need for such capacity in all three of the paths that rely on natural gas as a short term and seasonal balancing fuel. The growth in infrastructure to support the production, transport and storage of these gasses presents an opportunity for traditional midstream companies if they are flexible enough to enter these growing markets using their existing skill sets for planning and building gas transportation and storage facilities.

LNG May Also Offer Avenue for Growth of the Natural Gas Industry

The NREL study is focused just on the U.S., but as the war in Ukraine has demonstrated, the U.S. is in a unique position of having more natural gas than it needs for its own domestic purposes. Also, as we recently noted in Push for LNG Exports Grows, but FERC Seems Unable to Make a Decision, EQT is advocating for an “unleashing” of U.S. LNG to convert foreign coal plants to natural gas and bring down emissions from those plants in much the same way that natural gas has done here over the last decade. EQT is calling for an additional liquefaction of 55 Bcf/day, or about 20 Tcf of gas annually. That would more than offset the predicted decline in U.S. demand. A further use of LNG, though, may arise from the predicted use of natural gas in all of the NREL pathways that allow for the use of natural gas.

As seen above, NREL anticipates that natural gas-fired power plants would represent about 21% of the total installed capacity, but would only be used to generate 4% of the annual generation. This demonstrates the key function that natural gas plays as a balancing fuel for renewables, but also may mean that power plants will need to have a storable source of fuel to reliably provide that on demand generation. Such uses could create a future demand for onsite LNG rather than relying exclusively on pipeline natural gas, particularly as demand for pipeline gas continues to decrease.

While the NREL study certainly portrays a substantially decreasing need for natural gas in this country, there still could be a continuing need for U.S. production to supply LNG for export or even domestically. Also, the tremendous increase in the need for production, transport and storage of hydrogen and carbon dioxide may create opportunities for incumbent midstream pipeline and storage companies if they are able to transfer their expertise in infrastructure construction of natural gas to other forms of gas that will be needed under all paths in the NREL study.