Permitting Perplexions - Possibilities Persist From Hearings, Bills, and Presidential Priorities.

Originally published for customers May 17, 2023

What’s the issue?

The sustained momentum exhibited by Congress, the White House, and industry for permitting reform is increasing the probability that new legislation will occur and will have an impact on the prospects for all commodities and types of energy projects. Last week’s Senate Energy and Natural Resources (ENR) Committee hearing to “examine opportunities to reform permitting,” as well as the release of new Presidential Priorities highlight the intersecting and divergent political and industry interests addressing the perplexing problem of making meaningful reforms.

Why does it matter?

Assessing the probability of success and timelines for permitting an energy infrastructure project has become increasingly difficult over the past decade and curtailed needed industry investments negatively impacting energy security, reliability, affordability, as well as ecosystem emissions reductions.

What’s our view?

We expect permitting reform, including moderate NEPA reform, minor judicial review limits, additional federal prioritization of projects, transmission, mining and — maybe mandated MVP completion — to pass this year.

About this time last year a deal was struck between “the Joes” for permitting reform. Senator Joe didn’t get his end of that deal, but his persistence might provide for an actual Act of Congress this time around. As we’ve written before, never would we have predicted this much Washington establishment energy sustained on this issue. Last week’s Senate Energy and Natural Resources (ENR) Committee hearing to “examine opportunities to reform permitting” was a must attend for Arbo. Here are the highlights of that hearing and our reflections on the intersecting and divergent political and industry interests addressing the perplexing problem of making meaningful reforms.

The Hearing

Even if you have little interest in congressional hearings and what highly compensated trade association lobbyists say in public to influence legislation, this one might be worth a streaming. Hearings and committee work are a big part of what is wistfully referred to as “regular order.”

In attendance besides staffers, media, some protestors, and Arbo were 13 of 17 Senators on the committee, and the panelists — the CEO/Presidents of American Clean Power Association, AFL-CIO, National Mining Association, and the VP of Jonah Energy, who is a member of the Wyoming Energy Authority Board.

Key takeaways in our view:

- There is now an even larger consensus than last year that something must be done.

- The traditional Democrat/Republican party alignments to underlying issues, such as states’ rights, support for organized labor, environmental protection, and national security, are as scrambled on this issue as they’ve become on many issues this century.

- The probability of MVP completion being successfully legislated has increased.

- An appeal by the Committee to “take names off the Bills” being considered to compel compromise was collegial but unlikely.

- The Committee needs to find 13 more votes on the floor to pass something, so there better be enough projects with direct benefits to the constituents of another 13 Senators.

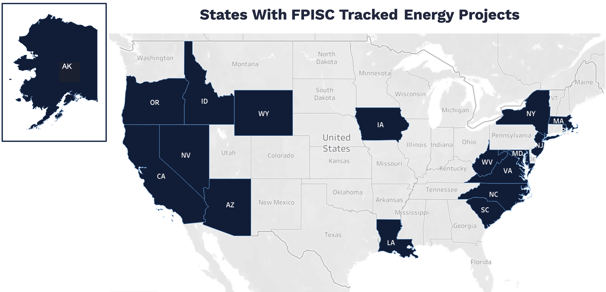

As a starting point to look for votes, we used the Federal Permitting Improvement Steering Council (FPISC) data visualization tool to find “dashboard” energy projects that are in progress, planned, or paused and sorted them by state. States with projects being tracked on the federal dashboard including MA, NJ, NC, SC, VA, WY, IA, ID, LA, OR collectively have 16 senators who didn’t vote or voted against permitting reform in 2022.

Some fun facts from hearing testimony:

- MVP has endured eight NEPA reviews and nine Fourth Circuit court proceedings.

- 2022 had the least amount of gas infrastructure built since 1995.

- Federal “backstop” authority to facilitate electric transmission permitting has never been used in 17 years since established by the Energy Policy Act of 2005.

- It takes 100 metric tons of metallurgical coal to build one wind turbine.

While reluctant to predict Congress doing its job, we expect permitting reform including moderate NEPA reform, minor judicial review limits, additional federal prioritization of projects, transmission, mining and — maybe mandated MVP completion — to pass this year. Chairman Manchin pledged to bring bipartisan “no name” legislation to the floor before the August recess. If that doesn’t happen, we expect another attempt to move the bill as an amendment to the must pass National Defense Authorization Act.

The Bills

Below are high-level summaries with a focus on energy transportation and related infrastructure permitting. (There are many provisions addressing mining and traditional exploration and production.) There are five bills in play for the Committee to source language and ideas from for a “no name” mashup.

- Senator Manchin’s Building American Energy Security Act of 2023 (S. 1399, “Manchin Bill”)

- Ranking Member Barrasso’s Spur Permitting of Underdeveloped Resources (“SPUR”) Act

- Senator Capito’s Revitalizing the Economy by Simplifying Timelines and Assuring Regulatory Transparency (“RESTART”) Act

- Senator Carper’s not yet introduced bill

- The Lower Energy Costs Act passed out of the House (“H.R.1”)

The Manchin bill is the same as what failed to pass in 2022. It includes strong process improvements for environmental reviews. By ensuring there is always a Lead Agency, participating agencies are identified expediently (within 45 days), roles and responsibilities are clear, and deadlines assigned, the bill would ensure an efficient start to permitting. By including reforms and limits on comment periods and judicial review, the bill would also ensure a clear end to the process. For major projects, the limit on Environmental Impact Statements would be two years from the Notice of Intent to a Record of Decision.

This bill also defines categories and numbers of projects to be designated of Strategic National Importance and mandates they receive Presidential attention. As discussed previously in Manchin Reveals Permitting Reform Act – Help May Be on the Way for MVP, Manchin mandates completion of MVP and would remove the Fourth Circuit from any further decisions.

Regarding the FPISC (more on this below), Manchin directs $250 of the $350 million appropriated to the Council in the IRA to be allocated to supporting Agency environmental reviews via the Environmental Review Improvement Fund (ERIF).

Barrasso’s SPUR Act has the most to say about FERC operations. Many will remember his aggressive scrutiny of Chairman Glick and his draft policy statement (see Senator Barrasso Questions Whether FERC Really Withdrew Policies In March). The act prohibits including social cost of carbon calculations in FERC permitting decisions. SPUR is also the bill most focused on maintaining states’ rights with respect to permitting and drilling on federal land. Like the Manchin bill, Barasso includes judicial review time limits and designation of lead agencies. In a nod to Keystone XL, he takes cross-border oil pipeline decisions away from STATE and gives them to FERC.

Capito’s RESTART Act includes some of the strongest NEPA reform language and seeks to prevent “endless legal challenges.” Like Manchin’s bill, it mandates a one-year timeline for EAs and two years for an EIS. It addresses use by states of Section 401 of the Clean Water Act to block projects and weakens EPA review authority under the Clean Air Act. Capito also mandates MVP final permits be issued within 21 days of the Act’s passage.

For an extensive review of H.R. 1 see U.S. House Passes “Statement” Energy Legislation. As a “statement” bill coming out the House, it goes much further and broader to express policy positions and dissatisfaction with the Biden Administration. On narrow and impactful permitting issues, it also includes NEPA reform by legislating Trump administration regulations, and includes aggressive Section 401 CWA changes, but contains nothing to require completion of MVP.

The Report

FPISC was made a permanent agency in 2021 by the Infrastructure Investment and Jobs Act and will be a key agent in implementing any forthcoming permitting reform. It has received good performance reviews and panelists at last week’s hearing credited the additional transparency provided by FPISC as getting the SunZia transmission project permitted. We reviewed FPISC’s annual report to Congress to inform our view on its role and likely future effectiveness. Our key takeaways:

- The Permitting Council is gaining capacity and additional funding will target staffing and systems bottlenecks across the member agencies.

- Projects included on the Permitting Dashboard either as covered FAST-41 projects or at the Council’s discretion will receive all-of-government attention for better or worse.

- Additional sector specific management and action plans are being added to the process.

- The current project portfolio has few natural gas and CCS projects and under reflects the need for pipelines, export terminals, and carbon capture.

- Proposed permitting reform would significantly enhance FPISC’s future effectiveness.

It is encouraging to see FPISC established and expanding its interagency coordination activities. We’ve been wondering where they planned to spend their new appropriations, because in government the appropriation can be the easy part; allocating and expending funds can be very challenging. This is particularly true in the primary expense category FPSIC is targeting — people.

The report identifies shortages of project managers and environmental specialists, as well as vendors with contractable technical expertise. Via the ERIF, FPISC plans to support hiring in these areas to accelerate environmental reviews. Considering the difficulties of hiring and onboarding in the federal government, these workforce shortages will take a long time to fill. However, we’re skeptical that staffing is the root cause of many permitting delays.

Another targeted area for spending is technology to modernize and standardize data systems being used across the interagency permitting enterprise. In this case, we don’t doubt the need. We have federal customers reliant on Arbo to augment their project analytics. But interagency IT projects are extremely difficult to successfully execute, making them the frequent subject of GAO investigations.

So at FPISC, some of the same challenges and waste inherent to most government agencies and programs will likely emerge. Nevertheless, we are optimistic about the opportunity FPISC has to make a big impact on revitalizing America’s ability to build critical infrastructure — much more so if combined with permitting reform legislation.

Presidential Priorities

The day before the Senate hearing, Administration Climate Czar John Podesta rolled out new Biden priorities for Building America’s Energy Infrastructure Faster, Safer, and Cleaner. He called out the essential role of Congress and urged passage of bipartisan permitting reform. Notably, he expressed gratitude to Senator Manchin and announced the White House favored his bill. The priorities emphasize transmission including more interconnection, inter-grid connectivity and cost allocation. Other priorities include CO2 and H2 and mining law reform. Generally, the permitting reform priorities in administration preferred categories, ie. not fossil infrastructure, largely mirror what was discussed above in the legislation reviews. Podesta's remarks did include support for completing MVP.

Reactions

The policy-focused press and energy consultancies were quick to opine on last week’s permitting push, acknowledging the momentum and pointing out the gaps. The major oil and gas trade associates sent a letter of support to the Senate ENR committee. In press releases, the Interstate Natural Gas Association of America expressed support for proposed legislation and disappointment that the Presidential Priorities didn’t call out natural gas.