2022 Rate Case Settlements and the Panhandle Eastern FERC Rate Order

Originally published for customers February 24, 2023

What’s the issue?

The last half of 2022 was a busy time for FERC natural gas pipeline rate case settlements. In addition, at the end of the year, FERC issued a final order in a case involving Panhandle Eastern Pipe Line that had been pending since January 16, 2019.

Why does it matter?

Rate cases have become more frequent in recent years, initially driven primarily by the change in the corporate tax rate instituted by the Tax Cuts and Jobs Act of 2017. But now many of the cases are being brought because of obligations under prior settlements or because FERC has renewed its practice of initiating rate investigations based on the annual financial filings each pipeline is required to file.

What’s our view?

With rate cases becoming more frequent, it is important for pipelines and their shippers to monitor the settlements and consider what that may mean for future cases. Also, the Panhandle case may be a lesson in why these cases most often settle, because the decision in that case seems to have pleased no one and likely is far from being finally resolved.

The last half of 2022 was a busy time for FERC natural gas pipeline rate case settlements. In addition, at the end of the year, FERC issued a final order in a case involving Panhandle Eastern Pipe Line (PEPL) that had been pending since January 16, 2019. Rate cases have become more frequent in recent years, initially driven primarily by the change in the corporate tax rate instituted by the Tax Cuts and Jobs Act of 2017. But now many of the cases are being brought because of obligations under prior settlements or because FERC has renewed its practice of initiating rate investigations based on the annual financial filings each pipeline is required to file.

With rate cases becoming more frequent, it is important for pipelines and their shippers to monitor the settlements and consider what that may mean for future cases. Also the Panhandle case may be a lesson in why these cases most often settle, because the decision in that case seems to have pleased no one and likely is far from being finally resolved.

Settlements of All Varieties in the Last Half of 2022

Following passage of the Tax Cuts and Jobs Act of 2017, FERC instituted a process that required all natural gas pipelines to essentially report what their current return on equity was following the corporate tax reduction. This led to a number of rate case settlements, and many of those settlements either allowed a revision to rates following a moratorium or required a new rate case to be filed at a specific date in the future, a so-called comeback. Many of the dates in prior settlements are now coming due.

In the last half of 2022, there were eight settlements filed by companies with approximately $6 billion in annual revenue for 2021, or about 20 percent of the industry’s total. Three of the settlements, Iroquois Gas Transmission, Northwest Pipeline and Natural Gas Pipeline Company of America, were prepackaged ones in which the pipeline initiates the proceeding by filing a settlement it has reached with its shippers. These settlements are often driven by a comeback or cost of service study required under a prior settlement. Three settlements, Texas Eastern Transmission, Eastern Gas Transmission and Storage and ANR Pipeline, were filed to resolve a Section 4 proceeding commenced by the pipeline. The final two, Guardian Pipeline and El Paso Natural Gas, resolved Section 5 proceedings that FERC had commenced in April 2022.

A New Obligation Is Created

In three of these eight settlements, Iroquois Gas Transmission, Texas Eastern Transmission and Eastern Gas Transmission and Storage, the pipelines all agreed to begin providing their shippers with an annual report that details the pipeline’s greenhouse gas emissions for the prior year. The first year for such reports will cover the year 2022 and will typically be posted on the pipeline’s electronic bulletin board, but all three pipelines reserved the right to require confidential treatment for access to the full report.

Depreciation Rates

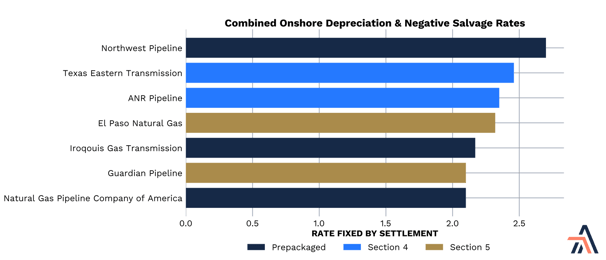

A key component of any pipeline’s cost of service is the rate at which it depreciates the assets it uses to provide services. The largest asset class for most pipelines is the onshore transmission assets it owns. In seven of the eight settlements, the combined depreciation and negative salvage rates for this asset class was fixed by the settlement.

As seen above, the rate fixed in these seven cases fell between 2.1% and 2.7% and provides a useful benchmark for considering what is a fair rate for other pipelines.

FERC Issues Final Order Regarding PEPL

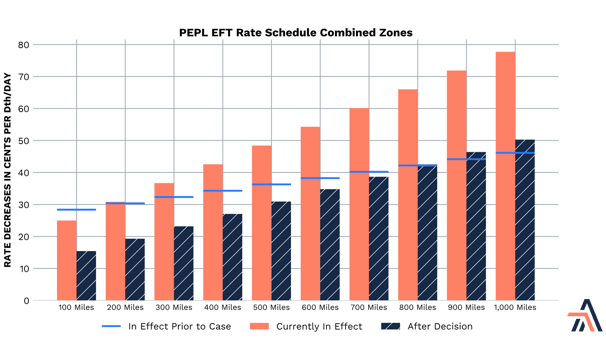

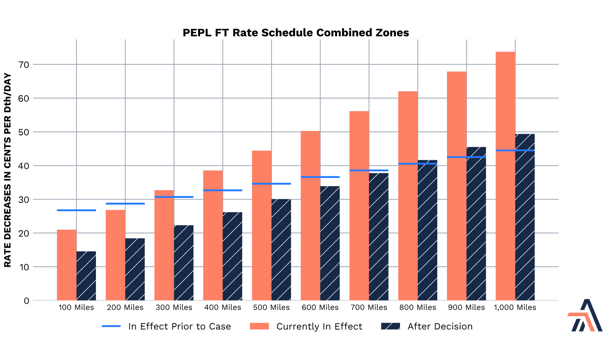

Also at the end of last year, FERC finally issued an order in which it resolved all open issues in the Section 5 investigation it launched in January 2019 into the rates charged by PEPL and in PEPL’s countering Section 4 rate case. PEPL’s rate structure is not as straightforward as most pipelines. It generates the majority of its revenue under two rate schedules, FT and EFT, with the lion’s share being generated under EFT. The reservation rate under both schedules is made up of three components, a field zone charge, a market zone charge and a mileage rate. If a shipper’s receipt and delivery is in only one zone, it only pays the charge for that zone. But if its receipt and delivery points are in different zones, it must pay both reservation charges. Similarly, if a shipper has receipts or deliveries in the market zone, it must pay the mileage rate as well based on the distance between its points of receipt and delivery.

Prior to the rate investigation being filed, PEPL’s reservation rates were primarily recovered through the field zone charge and market zone charge, and the mileage charge was a smaller component. A key change in the countering Section 4 rate case that PEPL filed was that it proposed essentially reducing the two zone charges and allocating more costs to the mileage charge.

Because PEPL countered the Section 5 case with its own Section 4 case, it has been collecting the proposed Section 4 rates since January of 2020. After FERC issued its decision in December, PEPL was given sixty days to file a revised tariff that reflected all of the changes contained in FERC’s order. As a result of those changes, the rates that will go into effect are far lower than what PEPL has been collecting since January 2020 and for some shippers even lower than what PEPL was collecting before the rate investigation began.

As seen above, EFT and FT shippers that incur a mileage charge for transport of 700 miles or less will be paying a lower combined reservation charge under FERC’s order than they were paying before the rate cases were filed, but those above 700 miles will be paying more than they were. All shippers will be paying less than they have been since January 2020 when PEPL’s proposed rates went into effect and they will be due a refund for overpayments since that date. In its fourth quarter earnings report, Energy Transfer, the owner of PEPL, noted that its annual earnings were down by $32 million “due to lower rates on our Panhandle system resulting from developments in an ongoing rate case.”

The use of the word “ongoing” in that sentence is key. While FERC’s order is a final order, neither side of the case seems satisfied with the decision because both PEPL and the Michigan Public Service Commission have asked FERC to reconsider aspects of its decision. In a decision issued on February 17, FERC indicated that the requests for rehearing are technically denied, but that “the requests for rehearing of the above-cited order filed in this proceeding will be addressed in a future order.” Thus, we can expect yet one more order from FERC and a likely appeal of that order by at least one, if not more, of the parties to the courts. This is a good example of why most of these rate cases settle. This proceeding has been active since January of 2019 and here we are, in February of 2023, and the end is nowhere in sight.