Four Rate Cases Settled With Rate Reductions by the Pipelines

Originally published for customers May 12, 2023

What’s the issue?

In our look ahead to the current quarter, we noted that there were four rate cases that had reached an agreement in principle and expected to file a final settlement agreement.

Why does it matter?

All four cases have now settled. Two of them were Section 5 cases initiated by FERC and two of them were Section 4 cases initiated by the pipelines. Typically, you would expect rate decreases in the former and rate increases in the latter. However, all four cases resulted in the pipelines agreeing to a reduction for most of their rates.

What’s our view?

The settlements may be an indicator of the current level of depreciation that other pipelines can expect, but there are also signs elsewhere that a reduction in the Return on Equity that pipelines can expect to receive may also be coming.

In our look ahead to the current quarter, Number of Rate Cases to Be Resolved in the Next Quarter, we noted that there were four rate cases that had reached an agreement in principle and expected to file a final settlement agreement. All four cases have now settled. Two of them were Section 5 cases initiated by FERC and two of them were Section 4 cases initiated by the pipelines. Typically, you would expect rate decreases in the former and rate increases in the latter. However, all four cases resulted in the pipelines agreeing to a reduction for most of their rates.

The settlements may be an indicator of the current level of depreciation that other pipelines can expect, but there are also signs elsewhere that a reduction in the Return on Equity that pipelines can expect to receive may also be coming.

The Four Settlements

The cases that were settled in principle last quarter and have filed the actual settlement agreements are for Stagecoach Pipeline & Storage, MountainWest Overthrust Pipeline, Transwestern Pipeline and Tuscarora Gas Transmission. The first two were Section 5 cases initiated by FERC last September and the last two were Section 4 cases initiated by the pipelines earlier in 2022. The time between the filing of the case and the filing of settlement varied from 218 to 278 days with an average of 238 days for just about eight months.

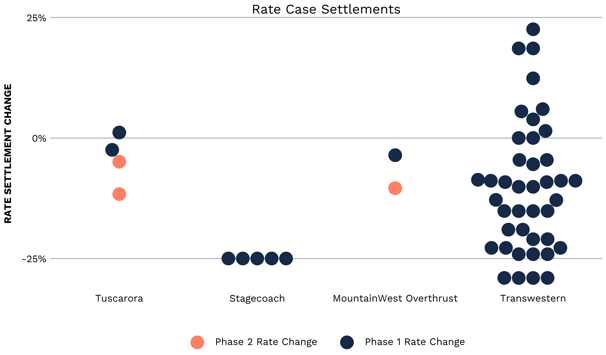

In all four cases, the pipelines agreed to a general reduction in their rates.

As seen above, Stagecoach agreed to a 25% reduction in all of its transportation rates. However, that may not have much of an impact on the company’s revenues. In its Form 2 for 2022, which it filed last month, it reported a total of $145 million in revenue, with $72 million of that being from discounted services and another $52 million being from negotiated services, which leaves only about $21 million in tariff revenue. MountainWest Overthrust agreed to a phased-in reduction of only 3% in the first phase, rising to a total of 10% for the second phase.

Tuscarora and Transwestern’s rate structures and settlements are a bit more complicated, with some of their rates rising and some falling. Like Mountainwest Overthrust, Tuscarora was able to negotiate a phased-in approach to its rate changes, with the first phase extending from February 1, 2023 to January 31, 2025, and the second phase running from February 1, 2025 to December 1, 2028. One rate increases during the first phase, but by the time the second phase kicks in both rates will be lower.

Transwestern’s tariff rates vary by rate schedule but also by the path of the gas, and the settlement percentage varied as well. As seen above, some rates decreased by as much as 29% but others went up by more than 22%.

Not Everything Is a Black Box

When rate cases settle, the settlement agreements almost always state that the terms of the settlement do not dictate the parties’ positions on any methodology for calculating the key rates. As stated in the Tuscarora settlement, the tariff rates established and the depreciation rates and negative salvage percentages agreed to “are ‘black box’ rates in the sense that there is no agreement on any underlying assumptions or methodologies for deriving them.”

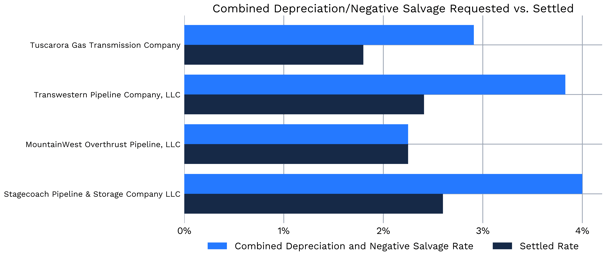

However, as indicated in that terminology, some rates beyond the final tariff rates are specified and that can provide some indication of what shippers and pipelines find agreeable. A key rate we track is the depreciation and negative salvage rates agreed to with respect to a pipeline’s onshore transmission plant.

As seen above, the combined percentage that the pipelines proposed for this key determinant of cost varied far more widely than the final settled percentages. When considering how future rate cases may settle this can be a significant factor for predicting the final cost of service.

ROE Is Often Harder to Judge

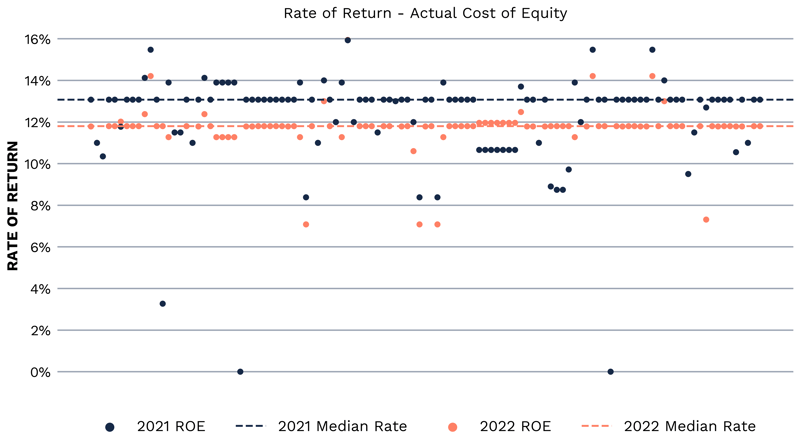

As opposed to the depreciation rates, which are almost always divulged in the settlement agreements, the final return on equity (ROE) that may have been agreeable to all parties is not as commonly set forth in the settlement agreements. Of these four settlement agreements, only the Transwestern agreement specified that for the term of the settlement it would use a 12.25% equity cost rate in calculating its Allowance for Funds Used During Construction. However, there are other sources for gauging what the current expectations are for ROE. First, at the end of last year, FERC issued an order resolving all open issues in the rate case involving Panhandle Eastern Pipe Line (PEPL). In that decision FERC determined that PEPL was “of average risk and its allowed ROE should be set at the median ROE of the proxy group – 11.25%.”

For many that would equate to a floor that any pipeline would agree to with regard to its own ROE. But since then the rate case involving Northern Natural Gas has progressed to the point where expert testimony has been presented and the expert for FERC Staff calculated that the median ROE of the proxy group in that case was only 10.98%.

Also earlier this week, in Neither End of the Pipe Is Immune to Inflation, we noted that the oil pipelines in their annual Form 6 filings generally reported that the ROE to which they were entitled was lower in 2022 than in 2021.

As seen above, the median rate for 2021 was much higher than in 2022, but the median in 2022 was still higher than the ROE from the Panhandle decision at the end of last year. Still, the reduction in the rates between 2021 and 2022 could mean that for cases filed this year, the ROE a pipeline may be able to justify will be lower than in the past.

For now, the only pipelines with comebacks ending this year are Viking Gas Transmission and Tallgrass Interstate Gas Transmission. However, Tennessee Gas Pipeline is required to file a cost and revenue study by November 1 and that may lead to either a pre-arranged settlement or the filing of a rate case either before or after that filing. Also there are five pipelines whose moratoriums end this year: Crossroads Pipeline, Cove Point LNG, Maritimes & Northeast Pipeline, Alliance Pipeline, and Gas Transmission Northwest. Finally, the annual reports for 2022 were just filed last month and last year FERC used those filings as a basis to initiate, in September of last year, the two Section 5 cases that were settled this quarter. Given that acting Chairman Phillips is focused on affordability, we may see even more cases filed this year. We will be reporting on those filings in a few weeks, including our calculation of the ROEs for each pipeline.