Oil Index Still an Open Question

Originally published for customers April 21, 2023

What’s the issue?

The liquids pipeline industry is planning to take another large increase in its annual index rates this July 1. However, the FERC decision that fixed the adder for that rate increase is still the subject of a court appeal that will not be decided until after the new increase takes effect.

Why does it matter?

Part of the appeal is over whether the pipelines that took an increase on July 1, 2021, should have been required to retroactively reduce their rates when FERC changed the adder in January of 2022.

What’s our view?

Ultimately the decision about not only the proper amount of the adder but also its effective date rests with the DC Circuit. Based on the arguments presented so far by the shippers and the pipelines, there appears to be substantial upside opportunity for the pipelines to see a greater increase than what they have taken so far and are scheduled to take this July 1.

The liquids pipeline industry is planning to take another large increase in its annual index rates this July 1. However, the FERC decision that fixed the adder for that rate increase is still the subject of a court appeal that will not be decided until after the new increase takes effect. Part of the appeal is over whether the pipelines that took an increase on July 1, 2021 should have been required to retroactively reduce their rates when FERC changed the adder in January of 2022.

Ultimately the decision about not only the proper amount of the adder but also its effective date rests with the DC Circuit. Based on the arguments presented so far by the shippers and the pipelines, there appears to be substantial upside opportunity for the pipelines to see a greater increase than what they have taken so far and are scheduled to take this July 1.

Liquid Pipeline Rate Increase Coming July 1

In 2023 Rates Look Poised to Be an Uninspired Sequel to 2022, we wrote about the fact that the liquids pipelines regulated by FERC are looking to make a substantial rate increase this July 1, just as they did last year. We noted that each year, for pipelines using indexed rates, FERC sets a percentage by which the pipelines can increase their rates. This cap is made up of two components; one is the Bureau of Labor Statistics’s Producer Price Index’s Finished Goods (PPI-FG) and the second is FERC’s “adder.” That article discussed how high the PPI-FG is expected to be this year. With respect to the adder, we noted that FERC generally calculates the adder every five years using data from the trailing five years. FERC had followed its usual pattern by determining in 2020 that the adder for the next five years would be 0.78%, but then changed its mind and in 2022 reduced the adder to a negative 0.21%.

FERC Adder Is Still Being Appealed

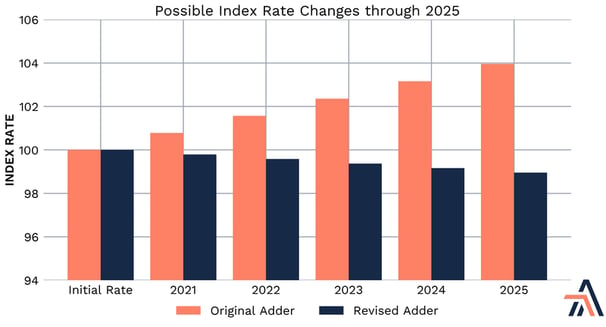

That change in the adder in 2022 is the subject of an appeal to the U.S. Court of Appeals for the District of Columbia Circuit (DC Circuit) and could still be changed even after the pipelines adjust their rates this July. In fact, depending on what the court does in response to the various appeals, the decision could impact the rates charged by pipelines going back to July 2021 through July 2025. The impact is not insignificant.

As seen above, when just considering the adder portion of the cap, the difference in the cap between 2021 and 2025 could be as much as 5% by 2025 in every index rate across the country.

Quick Summary of What FERC Did

To understand the appeals filed by the shipper and pipeline communities, it is necessary to understand what FERC did in 2020 and then in 2022. As it has done every five years since it began allowing pipelines to increase rates by a fixed index, FERC initiated its fifth five-year Index review proceeding on June 18, 2020. It is important to note that this was a “rule-making” proceeding, which as the pipelines’ appeal notes is subject to the notice and comment provisions of the Administrative Procedure Act. FERC received a lot of comments in that process. We noted in Oil Pipelines Press for Major Increase in Rates and the Impact of New Commissioners, a number of issues were contested, but there were two key ones that would drive FERC’s decisions in 2020 and 2022 — whether to limit the data to the middle 50% or expand it to the middle 80% and whether to adjust the index for FERC’s decision to no longer allow pipelines owned by master limited partnerships to claim an income tax allowance in their rates. On these two key issues, in the 2020 order FERC sided with the pipelines, which resulted in an adder of 0.78% and in the 2022 decision FERC sided on both issues with the shippers, which reduced the adder to a negative 0.21%.

How FERC got from the 2020 decision to the 2022 decision will likely be a key determinant of whether the 2022 decision can even withstand the appeals that have been filed. In our article we noted that the presence of two new commissioners, Clements and Christie, could be critical. But in the end, the decision was issued on December 17, 2020, before Commissioner Christie took office, and Commissioner Clements chose to not participate in the decision. Her decision to not participate allowed then Chairman Danly and Commissioner Chatterjee to issue the decision with a 2-1 vote over the scathing dissent of future Chairman Glick, who described the decision as “a complete abdication of the Commission’s responsibility to protect oil pipeline customers.”

Of course by December 2020, it was clear that there would be a change in presidents and thus a change coming in the balance of power at FERC. That change came on December 3, 2021, when Commissioner, now Acting Chairman, Phillips replaced Commissioner Chatterjee. Perhaps anticipating a more receptive audience under the new administration, the shipper community did not appeal the 2020 decision to the courts, but instead submitted rehearing requests with FERC.

FERC sat on those rehearing requests until after Commissioner Phillips took office. Then just about one month later, on January 20, 2022, FERC issued a rehearing order that reversed the two key decisions in the December 2020 order and reduced the adder to the current negative 0.21%. That order, however, did not make the change retroactive. Instead it provided that pipelines were to recompute their ceiling levels for July 1, 2021 through June 30, 2022 at the revised rate and file the new rates effective as of March 1, 2022. This meant that pipelines were able to keep the revenue from the higher rates for the months of July 2021 through February 2022. Since then, the pipelines have only been able to increase their rates in July 2022 using the reduced adder and will likely do the same this July because this appeal will not be concluded before then.

Shippers’ Appeal May Have Missed the Boat

First it is important to note what the shipper community has not appealed and that is the original 2020 FERC decision to set the adder at 0.78%. The shippers have limited their appeal to essentially a single aspect of the FERC rehearing decision, which was allowing the pipelines to keep the revenue earned between July 2021 and March 2022. Substantively, FERC’s decision to expand the data to the middle 80% was highly suspect. But the shippers’ appeal assumes that the rehearing order on that issue will stand and does not challenge the original decision’s use of the expanded data. As we discuss below, the pipelines have a very strong challenge to FERC’s process for issuing the rehearing order. If that rehearing order falls, the shippers have no ground for attacking the original order and will be left with the result of that order. If the court finds that FERC’s rehearing order is valid, we think it will also uphold the decision to make that order prospective only because until that order was issued there was no finding that the rates being charged by the pipelines under the prior order were unjust or unreasonable.

Pipelines Have Very Strong Procedural and Substantive Arguments

The main thrust of the pipeline community’s appeal of the FERC rehearing order is that it was procedurally inappropriate. As noted above, the 2020 order was the result of a rule-making proceeding subject to notice and comment. FERC’s failure to follow that process before issuing the 2022 rehearing order would seem to be a violation of the notice and comment process for changes to previously adopted rules. As such, the pipelines have made a convincing argument that the rehearing order is invalid in its entirety.

If the court were to find that the rehearing order is valid, the pipelines also have a very strong substantive argument on why FERC’s reversal concerning adjusting the rate for FERC’s change in its income tax allowance was not proper. The 2020 order’s use of the middle 80% is far less defensible. Thus, if the rehearing order process is valid, we would expect FERC’s change of heart on that topic to be upheld by the court.

Where Do We Go Next?

FERC is to file a brief defending its actions in this case next Monday. The shippers and pipelines are to file their reply briefs on June 26 and then final versions of all briefs are due on July 6. Following the filing of the briefs, the court will schedule an oral argument, likely sometime this fall and thus a decision will not likely come until late this year. In the meantime, the pipelines will be limited to the current adder. However, if the court decision further changes the adder, including returning it to the original 0.78%, then pipelines will likely be able to retroactively increase their rates. Even the shippers’ brief acknowledges that if the court’s order “results in a higher Index factor,” then the “pipelines may be entitled to surcharges” to collect the increase. Thus, overall, we see these appeals as presenting a substantial upside for the pipelines and very limited downside risk.