2023 Rates Look Poised to Be an Uninspired Sequel to 2022

Originally published for customers April 5, 2023

What’s the issue?

We are just a few months away from the FERC’s yearly indexed rate ceiling calculations, but we have enough data to feel comfortable about how the escalation will look.

Why does it matter?

The increase this year will be a big one (roughly 13%-14%), so shippers and their customers should be prepared for some sticker shock this summer.

What’s our view?

Once we get past the initial shock of its size, at the end of the day, this increase is part of the process the industry is used to. As Form 6 data comes out, many (including Arbo) will pore over it in preparation for potential protests. Time will tell if the shock wears off and we see the same number of protests we are used to seeing on a yearly basis, or if there is an uptick. Pipeline companies do not have to take the full increase, so it will be interesting to see who (if anyone) shows restraint, and whether it’s rooted in strategic commercial decisions to try and capture market share or to simply avoid the risk of a rate case.

June is fast approaching, which means regulatory teams across the energy industry are gearing up for tariff indexing. It’s not out just yet, but based on what we know today, the FERC ceiling is set to increase in a big way this summer. If index rates were a movie, we’re anticipating that 2023 will have a similar storyline to its prequel, 2022, where inflation dramatically drove the FERC ceiling higher, but with fewer plot twists. Based on our calculation, we’re anticipating a rate increase somewhere between 13% and 14%. As a reminder, last year’s increase came in at roughly 8.7%. We are anticipating another large move for indexed rates this summer, so what exactly is going on and what does it mean for the industry?

Every year for pipelines using indexed rates, FERC sets a cap on how much pipeline companies are allowed to increase their indexed tariffs on a percentage basis. Two components go into a FERC escalation ceiling — the Bureau of Labor Statistics’s Producer Price Index’s Finished Goods (PPI-FG) and the FERC “adder.” The PPI-FG is very similar to the Consumer Price Index (CPI) in that it is used to measure inflation — except the PPI is measured from the perspective of the seller instead of the consumer. As of the writing of this article, we have estimates for November and December and should know the final PPI for 2022 in May.

The FERC adder is calculated based on historical pipeline data using the Kahn Methodology. If you would like to learn more about the adder and how it is calculated, you Kahn (get it?!) find more in our ArView from August 2019 titled Anticipating Rate Increases for Oil Pipelines in 2021 through 2025. The FERC adder is generally calculated every five years using data from the trailing five years. Last summer, however, was the first time in the last 30 years that FERC broke that cadence by lowering the adder of 0.78% set in 2020 to -0.21% following elevated inflation and several disputes between various oil pipelines and shippers (more on that here: FERC Reverses Oil Index Rate Decision — Commission Considers Accelerating Inflation and Ire between Pipes and Shippers, but Consumer Savings will be Sparing). At this point in time, we do not expect a repeat of what happened last year around adjusting the adder. So shippers and pipeline companies should prepare for tariff rate hikes starting this summer.

With these two components, FERC comes up with the new calculated ceiling. FERC publishes a Notice of Annual Change in the PPI-FG in mid-May, where it lists the Index plus or minus the FERC adder (PPI-FG +/- adder). From there, regulatory and commercial teams work to publish their new rates which become effective as early as July 1st.

So who does this impact and what does it mean for them? In simple terms, tariff rates, or the price that pipelines charge for shippers to move volumes on their line, can, and likely will, go up. This methodology is designed to only impact indexed rates. It does not directly impact market based or settlement rates, which are other methodologies pipeline companies can use to calculate their tariff rates. It is worth noting that many market based rates will go up in the ballpark of what we see in the indexed world. Also notable is any settlement rates that increased during indexing last year are now subject to indexing.

Shippers and pipelines are the parties directly impacted by tariff rate changes. In 2023, shippers can expect their shipping costs to increase as pipelines look to raise their rates and capture more revenue. For any shippers or marketers negotiating deals that start in or after July, it is vital to factor these escalations into their economics now, and if possible for longterm deals, to add language around FERC escalations into their contracts with customers. Otherwise, they will find that their deals are less profitable than they anticipated. Pipeline companies, meanwhile, will be excited for July, so they can realize an uplift in tariff revenue for the second half of the year.

These changes don’t occur in a vacuum, so you can expect shippers to try and maintain their margins wherever they can. If a producer is selling its volume at the lease, the producer should expect to see its netback impacted as shippers look to push these prices onto the producer. It’s a similar story with any refiners who happen to be purchasing volume on a delivered basis at the other end of the pipe, except shippers will be pushing for any kind of price improvement they can get. Indexing is generally a hectic time, so the last groups impacted by this process worth mentioning are your regulatory teams. It is a mad dash between when FERC publishes their escalation and when these teams have to file updated rates.

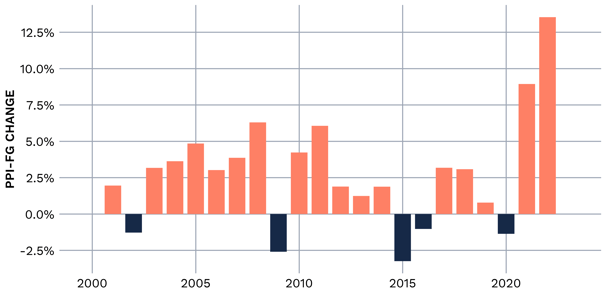

Regarding this summer’s escalations, we can see in the graph below the history of the PPI-FG. Sticking with the movie analogy, 2023 index rates are expected to be a summer blockbuster driven almost entirely by inflation and are poised to handily break the standing record. We project the ceiling will fall between 13% and 14%, with the actual number shaking out closer to 13%.

In the graph above, 2022 stands out as the largest increase in the PPI-FG over the last several years, by far. Knowing that the PPI-FG is a primary driver behind where the ceiling lands, a few other things pop out as well, the first being that shippers are generally getting the short end of the stick with these indexing updates. There have been five years since 2000 in which shippers saw some reprieve from tariff escalations from year-over-year changes in the PPI-FG. That translated into only four years where they actually saw reductions in the ceiling from a percentage standpoint (the adder for 2017-2018 more than offset the PPI-FG’s impact). The other thing to note is that, unlike this chart, the starting point for each year is not zero. So each of these year-over-year increases means that, at least to some degree, producers and ultimately end users are feeling these hikes regardless of what the market is doing to their respective commodity prices.

This can seem unfair at first, but this all makes sense when you think about it. If pipeline companies can’t move their prices as inflation causes their costs to creep up, they would not have any incentive to maintain their assets. All FERC is doing is capping how high pipeline companies can move their indexed rates in a given year.

Although pipelines have plenty of room to increase their rates this summer, they do not have to take the full escalation. We expect many will take the full escalation to get a boost to tariff revenue and help recoup presumably higher operating costs, but there are instances where pipeline companies may be hesitant to take the full increase. With regards to those presumably increasing operating costs, we are eagerly awaiting the latest Form 6’s to come out later this month.

With those in hand, we will have a better sense of whether or not pipeline companies actually saw their operating expenses increase at or above the tariff rate increases they took last summer. This is a good segue into one of the primary reasons a pipeline company may not take the full increase: to avoid the risk of a rate case. If a pipeline company’s expenses were low enough relative to the tariff rate increase they took last year, they risk overshooting a substantial divergence of 10% when comparing the company's cost of service to its jurisdictional revenues and drawing the scrutiny of FERC as well as a potentially lengthy and painful rate case. There may be protests by shippers following these escalations given the expected size, and pipelines with low headroom in their cost of service can expect to draw the most attention. Particularly in today’s political climate, year after year of record high rate increases could draw political ire and attention that pipeline companies historically want to avoid. In our estimation, though, the initial shock of the increase will likely lead to grumblings among the shipper community, but it’s hard to say if that actually leads to more protests than usual this year.

Pipeline companies may also hold off on taking the full rate increase for commercial reasons outside the risk of a rate case. Say, for instance, that a pipeline was in a competitive market and struggling to find volume to fill their line. In anticipation of their competitors taking the full increase, they may only take a partial increase to make their rates more appealing to entice more shippers to use their asset and pickup swing or more spot business where a pipeline's available capacity permits.

Time will tell how sticky or transitory our current inflationary state will be. If companies have a view that inflation will go up again next year based on government spending programs like the Inflation Reduction Act of 2022, there’s a chance pipelines may not take the full escalation in preparation for another potential rate increase next year. This is a gamble, though, since the rate increase is really just a year-over-year comparison of what the PPI-FG did. So if inflation stays roughly where it is today, albeit at historic highs in the U.S., the actual escalation next year would be relatively low. Alternatively, if the Fed’s actions, coupled with a recession, creates a deflationary environment over the next year, we could see the next installment in this series with a twist where the ceiling actually falls.

As you can see, this is a complicated and stressful time for many in the pipeline world and shipper communities. Particularly around the commercial strategy component of tariff increases, many pipelines find themselves in a prisoner's dilemma, the question being “what do I think my competitors will do and how does that impact what I do.” Know that we’re tracking all of this on our end, so you can rest a little easier knowing there is an extra set of eyes on it. We’re more than happy to help you get a better sense of how rate increases shake out this summer, and if necessary, can help you around any kind of necessary course correction. You can also easily track tariff rate changes and pull Form 6 data from our Liquids Commerce Platform (pictured below). Reach out to us if you would like a demo or to learn more!