Interstate Pipeline Vendor Spending Edges Lower

Originally published for customers June 2, 2023

What’s the issue?

Each year the interstate pipelines are required to provide information about the vendors -- from mainline and compressor contractors to legal and environmental service providers -- to which they paid more than $250,000.

Why does it matter?

The data, when aggregated, can show not only the health of the pipeline industry, but can also offer insights into the vendors that are most successful at providing critical services to the interstate pipelines.

What’s our view?

The heyday of spending driven by infrastructure build out came to an end in 2019. Mainline construction contractors have predictively borne the brunt of this decreased spending and other groups are not immune. However, vendors who are able to provide for the needs of the industry as it exists today will recapture some of this spend.

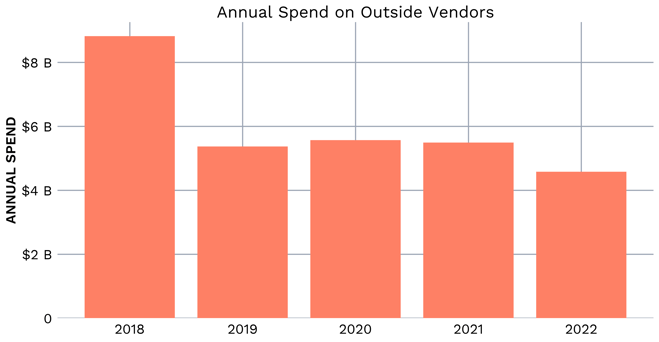

Each year the interstate pipelines are required to provide information about the vendors to which they paid more than $250,000. When aggregated, the data can show not only the health of the pipeline industry, but can also provide insights into the vendors that are most successful at providing critical services to the interstate pipelines. As we discuss today, the heyday of spending in 2018 has come to an end. After spending appeared to stabilize just above $5 billion annually following the sharp drop in 2019, 2022 saw about a 16% drop.

The Big Picture

As part of its annual report to FERC, each interstate pipeline must report by name any vendor that was paid more than $250,000 and which provided services related to rates, management, construction, engineering, research, finance, valuation, legal, accounting, purchasing, advertising, labor relations or public relations. When this data is aggregated across the industry, it provides some key insights into not only the health of the interstate pipeline industry, but also who the major providers of these services are.

Today we look back at the last five years of data for 2018 through 2022 to see what insights we can gain about the overall spending, as well as the leading providers, in four key categories: Mainline Construction, Engineering, Environmental and Legal. In the past five-year period, we see that peak spending in 2017 carried over into 2018 and fell off precipitously in 2019. It stabilized at about $5 billion annually, before finally dropping below $5 billion in 2022.

Trends in Category of Top Vendor Spend

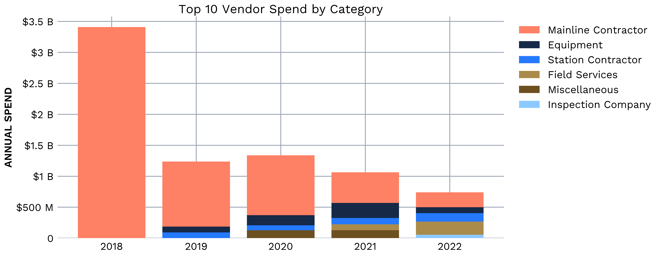

Based on total spend over the five-year period from 2018 through 2022, eight of the ten highest paid vendors are mainline construction contractors; numbers were driven by the high mainline construction costs in years past. However, when we look at the composition of the top ten vendors by category for each individual year, recent years tell a different story.

First of all, it is worth noting that the spend for the top 10 vendors shows a very similar trend to that of the whole, most likely due to the fact that the top 10 vendors are responsible for anywhere from about 16% to about 39% of total vendor spend, depending on the given year.

As it relates to the composition of vendor spend, all top 10 vendors in 2018 were mainline construction contractors, netting about $3.4 billion in spend. These 10 mainline contractors accounted for 39% of all outside vendor spend in 2018, but this is no longer the case. Mainline contractors have not only fallen off of the top 10 list, conceding their spot to a number of vendors in different categories, but they have also experienced a vast decrease in spend across the board.

Mainline Construction Contractors

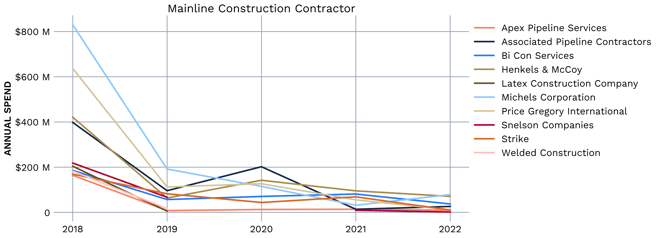

As mentioned above, the top 10 vendors in 2018 were all mainline construction contractors, accounting for a large portion of the total outside vendor spend. Below, we take a look at the reduced revenue each of these contractors have since received from interstate pipelines.

As seen above, all top 10 mainline contractors from 2018 have experienced a significant decrease in spend since 2018 highs. A few, such as the Michels Corporation and Henkels & McCoy, have managed to stay in the $70-80 million range, and are still among the top 10 vendors across all categories in 2022. Others, such as Latex Construction and Welding Construction, have not even been referenced in the 2022 outside vendor spending schedules, meaning neither have received more than $250,000 from any one interstate pipeline.

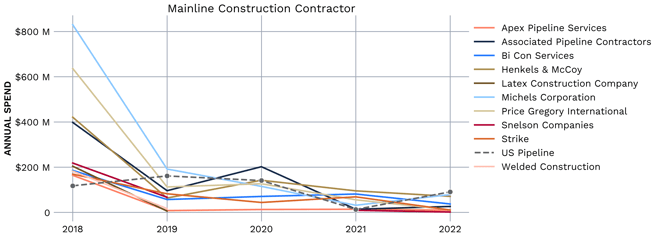

One other mainline contractor worth mentioning is US Pipeline, Inc. While they were not among the top 10 vendors in 2018, they are as of 2022, which is an impressive feat considering the trend for other mainline construction contractors. US Pipeline’s spend is added and emphasized in the same chart below.

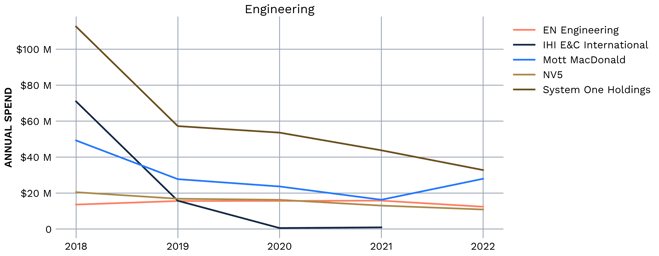

Engineering

Another major area for outside services spending is engineering services. While the spending on such services is far below that for construction services, the top five contractors from 2018 through 2022 all received over $70 million in payments over the last five years.

While this group certainly trended down overall in the past few years, it was not nearly as drastic as the mainline construction group, and a few managed to stay relatively consistent during the downturn. NV5, EN Engineering, and Mott McDonald all seem to be securing a continuous level of work. While System One Holding experienced the sharpest decline from their highs in 2018, they still lead this group in 2022. The last contractor to point out, IHI E&C International, has experienced the worst few years. As of 2022, they’ve completely dropped off of the outside vendor spending schedules, meaning they have not received more than $250,000 from any one interstate pipeline. With that said, they were receiving all of their reported work from LNG pipes: Southern LNG Company and Dominion Cove Point LNG. If there is a resurgence in this specific segment of the industry, we may see an uptick.

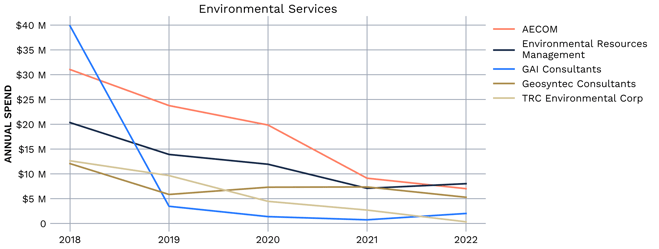

Environmental Services

One of two key services necessary to prepare a project for development is that of outside environmental contractors, and spending in this category may be a warning sign for the other service providers. The chart below shows payments made to those environmental firms that received at least $25 million over the last five years.

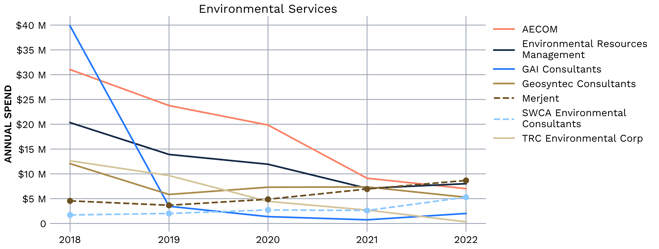

As seen above, spending on environmental services was at an elevated level in 2018, fell in 2019 along with the general trend, and continued its fall into 2021. A few vendors have actually shown a slight rebound in 2022, especially when we factor in some others that may not necessarily have benefitted from the high spending in years past, but have climbed in recent years.

In the preceding chart, Merjent and SWCA are included and emphasized. While they show much lower spend capture in earlier years, and are not among the top vendors in the last five years cumulatively, they are actually showing a positive trend over the five-year period, and are among the top environmental vendors in 2022. This may indicate that environmental spending may be, at least partially, recaptured by different vendors in the coming years, and may be a good leading indicator for general spend by interstate pipelines moving forward.

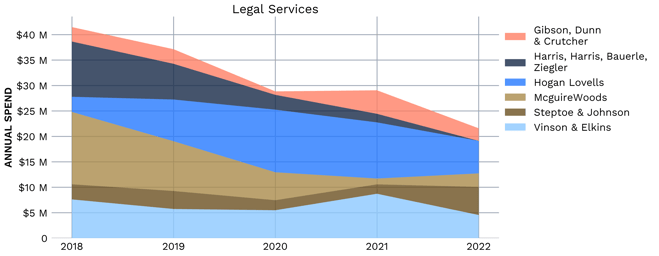

Legal Services

One final area that seems to be resilient across time is the provision of legal services, which can increase during times of project development, but are also required for rate cases that arise as a result of pipelines spending money on routine maintenance which they seek to recoup through rates. The figure below shows the top six legal vendors for the last five years, cumulatively.

Hogan Lovells saw a substantial increase in payments in 2019 and 2020, even as overall spending by the pipelines dropped. That appears to be almost entirely driven by the addition of a new client in 2019 that paid them about $6 million in each of those years. The firm of Harris, Harris, Bauerle, Ziegler’s billings arise from its work for a single client and it advertises itself as a firm specializing in representing property owners in condemnation proceedings. It is unusual to see a firm like that at the top of the list for law firms and it will be interesting to see whether its billings will continue to fall.

Overall, our view is that the leading vendors from years past were attributable to the period of infrastructure build out. Unless they pivot to work relevant in today’s ecosystem, i.e rate cases and maintenance, the downtrend will continue for them, but more relevant vendors will take their place.