Gas Pipelines See Some Uplift in Returns for 2022 as Compared to 2021

Originally published for customers May 26, 2023

What’s the issue?

Each year in April, interstate natural gas pipelines are required to file an annual report with FERC. That form (Form 2) is chock full of information, but one of the key data points is missing and that is the return that pipelines are earning on the assets they have deployed to provide their services.

Why does it matter?

This return on equity (ROE) is a key measure for assessing a management team’s performance in balancing revenues and expenses. The goal is to make that ROE as high as reasonably possible. But because the rates of pipelines are also regulated, an excessively high return does create a risk that FERC may launch an investigation into the rates being charged by a pipeline to determine if they remain “just and reasonable.”

What’s our view?

Our review of the overall rates of return for pipelines shows that, across the industry, 2022 was a slightly better year than 2021, but of course to assess the performance and risk for a particular pipeline the devil is in the details.

Each year in April, interstate natural gas pipelines are required to file an annual report with FERC. That form (Form 2) is chock full of information, but one of the key data points is missing and that is the return that pipelines are earning on the assets they have deployed to provide their services. This return on equity (ROE) is a key measure for assessing a management team’s performance in balancing revenues and expenses. The goal is to make that ROE as high as reasonably possible. But because the rates of pipelines are also regulated, an excessively high return does create a risk that FERC may launch an investigation into the rates being charged by a pipeline to determine if they remain “just and reasonable.”

Our review of the overall rates of return for pipelines shows that, across the industry, 2022 was a slightly better year than 2021, but of course to assess the performance and risk for a particular pipeline the devil is in the details.

The Big Picture

One hundred and thirty-one pipelines filed annual reports in both 2021 and 2022 that allow us to calculate their ROE for each of those years. But not all pipelines are the same. If the pipelines are divided into groups based on the annual transportation revenue they reported in 2022, the top sixteen pipelines (just over ten percent in number), all report revenue in excess of $500 million, which equals almost two-thirds of the industry’s $30 billion in revenue for 2022. There are more than twice as many pipelines, thirty-seven, that reported 2022 revenue between $100 million and $500 million, but in total they represent just about 30% of the industry’s total revenue. Then there are the seventy-eight pipelines (more than half in number) that reported less than $100 million in revenue. Their total revenue represents less than 7% of the industry’s total 2022 revenue. We will look at the ROEs for each of these groups separately.

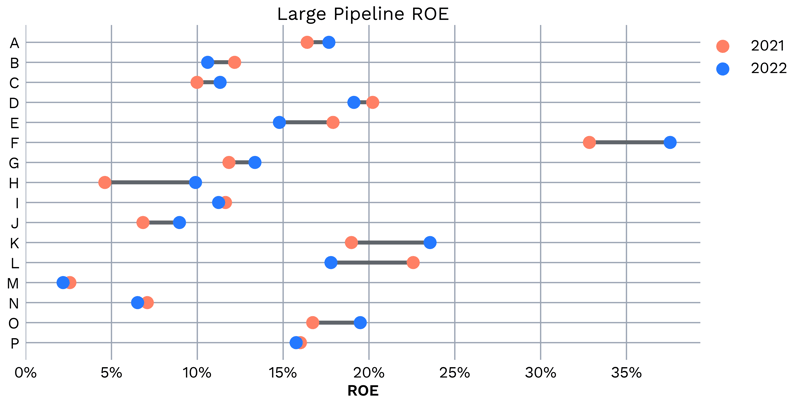

The Large Pipelines

The pipelines with revenues in excess of $500 million are those with which most people are familiar, such as the top four, Transcontinental Gas Pipe Line, Columbia Gas Transmission, Texas Eastern Transmission and Tennessee Gas Pipeline. As a group, the median ROE for this group was just slightly lower in 2022 than it was in 2021, coming in at 14.07% compared to 14.09%. But each pipeline has its own story.

Most of these pipelines are comfortably in the goldilocks zone for ROE, above 10%, which shows a proper management of costs versus revenue, but not so high as to attract attention from FERC with respect to a possible rate case (under about 16 or maybe 17%). In addition, seven of these pipelines are currently in a moratorium, which prohibits them from seeking rate increases and which will generally protect them from FERC filing a rate investigation into their rates. One pipeline in this group that may be worth watching is Tennessee Gas Pipeline. Our ROE calculation for each of its last two years is above 19% and its current rate moratorium ended last year. It is also required to file a cost of service study this November. When its sister pipeline, El Paso Natural Gas, went through a similar process in 2021, FERC launched an investigation in April of 2022. That may encourage Tennessee to meet with its customers and reach an agreement either as part of filing the required cost of service study or in lieu of filing that study.

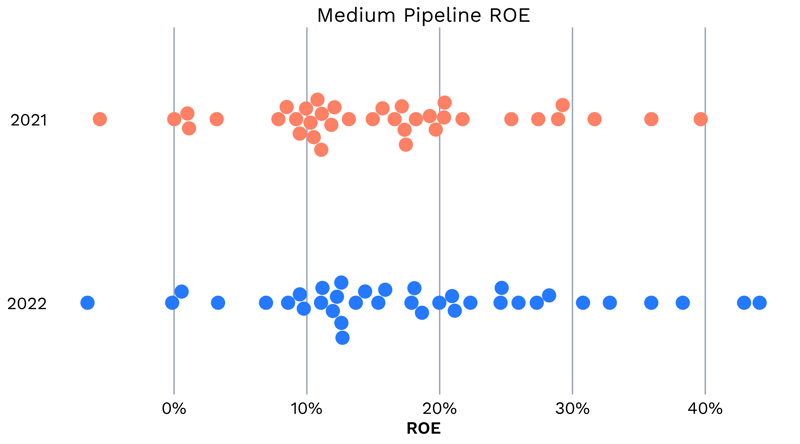

The Medium Pipelines

The pipelines that reported more than $100 million but less than $500 million in revenue for 2022 is a much bigger group.

As seen above, there was some improvement for the group between the ROE we calculated for them in 2022 versus 2021. The median ROE for this group did increase by almost one percent from just under 15% to just under 16%. However, as we noted in FERC Finally Makes a Decision in the Panhandle Eastern Pipe Line Rate Case, the decision in the Panhandle case may give some relief to pipelines that may be slightly over earning. As we noted there, the last fully litigated case prior to Panhandle was in 2011 and the ROE fixed in that case was 10.55%. In the order in Panhandle, FERC fixed the ROE for that case at 11.25%. This may reduce the risk of future Section 5 proceedings. FERC has not typically initiated a rate investigation unless a pipeline’s ROE was above about 16%, or approximately 150% of the 10.55% ROE established in 2011. If that same ratio is applied to the 11.25% in Panhandle, that would mean that the Section 5 threshold may go up to around 17%. That one percent change may be enough room for these pipelines to increase their ROE without incurring additional risk of a rate investigation.

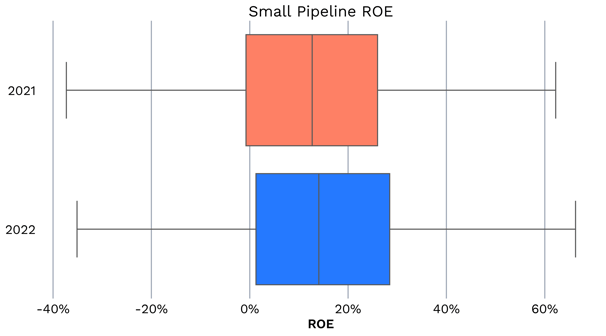

The Smaller Pipelines

Our calculation of the ROEs for the smaller pipelines shows an even larger increase in the median when 2022 is compared to 2021.

As seen above, the median for 2022 is just a bit higher than 14%, or about 1.25% higher than in 2021. However, that median rate is still so low that we would not expect any pipeline earning at that rate to be at risk of a rate case.

The Details

To assess a pipeline’s risk for a rate increase or decrease, it is necessary to dive into more detail. As we have noted above, one key component is whether the pipeline is currently in a moratorium period. But another key question is how much of the pipeline’s revenue comes from negotiated and discounted contracts. We have all of that information for all 132 pipelines and can help assess the rate risk for any pipeline, no matter whether you are a shipper, an investor, or a pipeline trying to benchmark your competition.