EQT and Range Rebuff Senator Warren’s Efforts to Turn Up the Heat on the Gas Industry

What’s the issue?

On November 23, Senator Elizabeth Warren sent a letter to the executives of eleven U.S. natural gas producers. Her press release trumpeted that the letters were designed to “turn up the heat” on those companies for their “greed” from jacking up natural gas to enhance their profits through record exports, all at the expense of the U.S. consumer.

Why does it matter?

The attack is not a surprise. But the forceful response by two of the executives is. Both executives, of EQT and Range Resources, were not impressed with either the senator’s “facts” or her rhetoric and they don’t seem to be sweating from the heat.

What’s our view?

The responses were a forceful defense of the domestic industry but also went on the offensive about how U.S. natural gas exports can accelerate the reduction of global GHGs, not increase them. We think a similar argument will soon find its way into pleadings at FERC and may give the purists on the Commission fits in their effort to regulate GHG emissions.

On November 23, Senator Elizabeth Warren sent a letter to the executives of eleven U.S. natural gas producers. Her press release trumpeted that the letters were designed to “turn up the heat” on those companies for their “greed” from jacking up natural gas prices to enhance their profits through record exports, all at the expense of the U.S. consumer. The attack is not a surprise. But the forceful response by two of the executives is. Both executives, of EQT and Range Resources, were not impressed with either the senator’s “facts” or her rhetoric and they don’t seem to be sweating from the heat.

The responses were a forceful defense of the domestic industry, but also went on the offensive about how U.S. natural gas exports can accelerate the reduction of global greenhouse gas (GHG) emissions, not increase them. We think a similar argument will soon find its way into pleadings at FERC and may give the purists on the Commission fits in their effort to regulate GHG emissions.

The Executives Are Not Impressed with the Senator’s Grasp of the Basic Facts or Analytical Abilities

Senator Warren’s letter demanded responses to eight questions by no later than December 7. Range Resources (Range) responded on December 3, but it was not from its CEO, to whom the letter was addressed, but rather came from its General Counsel. The letter opened by noting some conversations between Range and the senator’s office, where it was made clear that Senator Warren’s demands were not part of any “formal congressional inquiry.” It then acknowledged that the letter correctly identified Range as “a natural gas producer, but that is, unfortunately, where the facts end, and the inaccuracies begin.”

EQT had its CEO respond, but he was equally unimpressed with the analysis in the senator’s letter. The opening paragraph asserted that EQT strongly agrees “with the goal of keeping energy affordable and reliable for citizens of the United States.” But EQT completely disagreed with the senator’s “claims that the increase in natural gas prices relative to 2020 levels is attributable to a combination of ‘corporate greed’ and the export of liquefied natural gas (LNG).”

The Senator’s “Facts” — Prices Are High Because of LNG Exports

Once you get past the senator’s tried and true tropes about greed and the rigged systems, her first real assertion is that “natural gas prices are surging nationwide, and these price increases are being passed on directly to consumers.” For this she references a filing by a Massachusetts utility that estimated that natural gas prices will rise approximately 20% for consumers for the winter of 2021-2022 compared to 2020-2021 and an EIA report that forecasts a 29% higher bill for natural gas consumers nationwide — and perhaps 50% higher if it turns out to be a colder-than-average winter.

Of course, what both companies point out is that the current prices are far from record highs for natural gas and, as Range explains, are far below 2005 highs of $8.69/MMbtu, and, as EQT notes, consumers have benefited tremendously from the shale boom with gas prices declining markedly after 2008.

Using the EIA data Senator Warren references, it becomes clear that annual fluctuations of plus or minus 20% or even 50% are not that unusual.

As seen above, in the winters ending in 2001 and 2003, the prices more than doubled from the prior year, and prices for the winter ending in 2017 were 50% higher than for the winter ending in 2016. It should also be noted that Senator Warren did not write a similar letter for the winter ending in 2020 demanding to know why prices were falling by almost 40%.

LNG Exports Along with Greed Are the Cause of High Prices

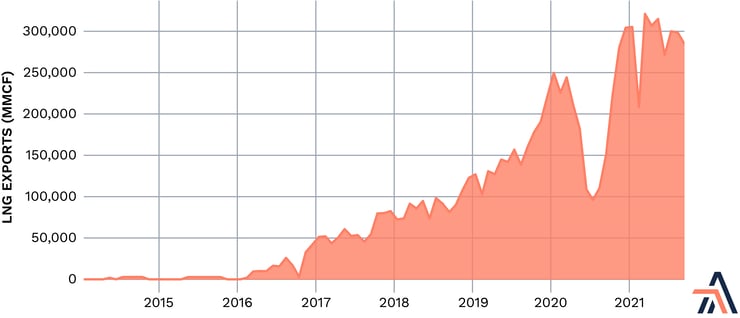

The senator’s second assertion is that these high prices are caused exclusively by the decision of these greedy producers to export their production to foreign countries in the form of liquefied natural gas (LNG). However, all but the most recent year’s price fluctuations were well before any increase in exports.

As seen above, LNG exports were almost non-existent before 2016 and yet prices fluctuated regularly from year to year in ranges very similar to that expected by the EIA for this coming winter.

Both companies go on the offensive over this assertion. Range notes that “while natural gas supply has significantly increased as a whole, delays and cancellations of pipeline infrastructure projects have directly impacted supply to many Americans, including [the senator’s] constituents.” In fact, it notes that Massachusetts has been forced to rely on LNG imports rather than domestic, regional resources of natural gas due to lack of infrastructure. EQT’s CEO makes it personal by noting that he is a native of Massachusetts who lives in the heart of the country where EQT operates and wants to see a world where his Bostonian mother does not have to heat her home in the winter with heating oil.

Both Companies Respond to the Specific Questions

The two companies do respond to the actual questions asked but their responses only highlight the fundamental lack of knowledge exhibited in the questions themselves. As to how much of each company’s gas production is exported, Range notes that it sells in the domestic market and has no way of knowing how much of the natural gas it produces is ultimately exported and sold internationally. EQT similarly notes that until 2018, it only sold in the domestic market and only then began selling less than 3% of its production into Canada. Both companies also state that none of their executive compensation is tied to the export of natural gas. Finally, as for actions they have taken to address “spiking” natural gas prices, Range notes its fundamental disagreement with the premise of the question and both companies note that they have no control over the rise or fall of natural gas prices in this country.

EQT Promotes LNG Exports as a Climate Change Solution

EQT’s response went one step further and challenged Senator Warren to rethink her position on LNG exports. As EQT forcefully explained, LNG exports should not be viewed as harming American consumers, but rather as a critical building block to fighting climate change. EQT not only did not deny climate change but embraced it and natural gas’s role in combating it.

First, in an argument that echoes our view in EPA Urges FERC to Follow Pseudoscience in its Review of Pipeline Applications, EQT noted that the shale revolution has been crucial to the U.S. effort to reduce GHG emissions over the last two decades. EQT noted that the “emissions reduction from coal to gas switching seen in the United States between 2005 and 2019 is the equivalent of actually electrifying approximately 190 million cars, or roughly 70% of the total number of cars in the United States.”

As EQT sees it, this model in the U.S. for quickly slowing the increase in emissions and then actually cutting them needs to be spread around the world and the best way to do that is for the U.S. to markedly increase its production of natural gas by companies like EQT, which is targeting to have its scope 1 and scope 2 emissions to net zero by 2025, and then exporting that gas overseas in the form of LNG. Replicating the U.S. model of displacing coal-fired power would be the quickest way to reduce global emissions. As EQT explains, if the U.S. were to supply natural gas to replace only China’s planned or under construction coal power plants with natural gas plants, that would reduce GHG emissions by approximately 370 million metric tons of carbon dioxide, which is “roughly equivalent to the emissions reduction impact of the entire U.S. renewables sector.”

To do this, though, EQT argues that the U.S. needs to greatly expand production and export capabilities by:

Approving domestic pipelines directed towards U.S. demand centers (including New England) and LNG export facilities;

Approving new LNG export facilities at a pace five times faster than historical norms; and

Coordinating with international communities to encourage the replacement of their coal with U.S. LNG.

We think arguments like this and pipeline-specific ones we outlined in EPA Urges FERC to Follow Pseudoscience in its Review of Pipeline Applications are going to find their way into applications at FERC. As we noted in that article, if the FERC chairman continues down the path of trying to be the GHG regulator for the country, it is these type of arguments that will likely lead to those attempts being reversed by the courts as an arbitrary and capricious regulatory act by an agency not charged with being an environmental regulator.