The Fits and Starts for Responsibly Sourced Gas

Originally published for customers June 29, 2022.

What’s the issue?

Investors, regulators and environmentalists are all focused on the methane emissions that result from the exploration for and the production and transportation of natural gas.

Why does it matter?

Exploration and production companies are promoting the steps they take to reduce the carbon footprint of their production, but would also like to be compensated for the benefits of producing this responsibly sourced gas (RSG), also known as producer certified gas. There have been some announced bi-lateral transactions for RSG, but it is unclear whether there was a financial premium paid. Tennessee Gas Pipeline’s efforts to promote a market for RSG has actually run into opposition by producers, especially those with existing RSG production, who think Tennessee’s standards are too lax.

What’s our view?

We have previously written that the export market would appear to be a likely market for RSG and that has been proven correct, but the Tennessee proposal also shows that local distribution companies may be as well. However, the Tennessee proposal appears to be pitting the producers against these local distribution companies and FERC has been trying to avoid being put in the middle. However, interestingly, the environmentalists who tend to hold sway at FERC have sided with the RSG producers, so we think the Democratic majority at FERC could very well reverse a prior decision where it sided with the local distribution companies and side with the producers.

Investors, regulators and environmentalists are focused on the methane emissions that result from the exploration for and the production and transportation of natural gas. Exploration and production companies are promoting the steps they take to reduce the carbon footprint of their production, but would also like to be compensated for the benefits of producing this responsibly sourced gas (RSG), also known as producer certified gas. There have been some announced bi-lateral transactions for RSG, but it is unclear whether there was a financial premium paid. Tennessee Gas Pipeline’s efforts to promote a market for RSG have actually run into opposition by producers, especially those with existing RSG production, who think Tennessee’s standards are too lax.

We have previously written that the export market would appear to be a likely market for RSG and that has been proven correct, but the Tennessee proposal also shows that local distribution companies may be a potential market as well. However, the Tennessee proposal appears to be pitting the producers against these local distribution companies and FERC has been trying to avoid being put in the middle. Interestingly the environmentalists who tend to hold sway at FERC have sided with the RSG producers, so we think the Democratic majority at FERC could very well reverse a prior decision where it sided with the local distribution companies and side with the producers.

Why the LNG Makes Sense for RSG

In Will Responsibly Sourced Gas Become Economically Viable?, we projected that the most viable market for RSG appeared to be overseas buyers of LNG, who are seeking to reduce the carbon footprint of the LNG they use. Earlier this month, Southwestern Energy announced a multi-year RSG sales agreement with the North American subsidiary of Uniper, one of Germany’s largest publicly listed energy supply companies. The deal was designed to provide Uniper with RSG for domestic distribution to downstream customers as well as natural gas to supply U.S. facilities for liquefaction and export to global LNG markets. However, the terms of the deal were not released and so it is not clear whether Southwestern is being paid a premium for the RSG or whether that is simply the price of admission for Uniper agreeing to the deal.

Domestic Use May be Viable as Well

As the announcement of the Southwestern/Uniper deal makes clear, Uniper’s purchase of RSG is also for domestic distribution. But perhaps the greater indicator of both the promise and problems with developing a domestic market is the fight that has been raging over a proposal by Tennessee Gas Pipeline (TGP) to develop a pooling service that is available only to producers and consumers of RSG, or, as defined in its proposal, Producer Certified Gas. TGP originally proposed this service back in December 2021 and we described its proposal in New Flavors of Natural Gas (Certified and Renewable) are Showing up in Pipeline Tariffs.

Since then, however, the TGP proposal has apparently been caught between the conflicting needs of its shippers, with producers arguing against the proposal or for a substantially modified proposal, and local distribution companies essentially supporting the proposal as originally filed.

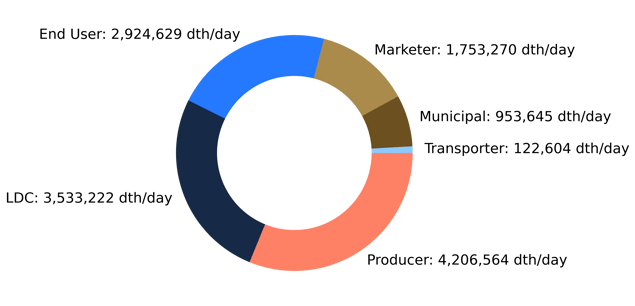

As seen above, the shippers holding the most capacity on TGP are producers, but a close second are the local distribution companies.

TGP original’s proposal was to establish pooling points at five of the twenty existing pooling points on its system that could be used only by producers and consumers of producer certified gas, which TGP proposed would be defined in a posting on its electronic bulletin board (EBB). That proposal was contested by a number of producers, so TGP filed a revised proposal that expanded the service to all twenty of its pooling points and moved the definition of the gas that could qualify from its EBB into its tariff, and expanded the companies that could provide the required certifications from two to three. These changes generally satisfied the shippers, but one non-shipper, the Environmental Defense Fund (EDF), intervened and opposed both the original proposal and the revised proposal. EDF was adamant that FERC needed to hold a technical conference to address the proposal.

Despite the fact that shippers had been the ones that insisted TGP include the RSG standard in its tariff, that was the portion of the proposal that FERC found faulty. In an order issued on April 29, a unanimous FERC said it could approve the entire proposal except for the part that moved the definition of RSG from the EBB to the TGP’s tariff. FERC acknowledged that putting the definition in the tariff was done to address shippers’ “concerns that having the [RSG] Criteria on Tennessee’s website rather than in its tariff would allow Tennessee to have complete and unreviewable discretion to modify these criteria and RSG standards.” However, FERC wanted to duck the issue entirely because it did not know how to evaluate any “specific proposed criteria.” In particular TGP’s criteria “establishes a specific methane emission intensity level that must be met” but FERC found that there is no “federal regulation for methane emissions” and rather than develop one, it left that development to “market-driven initiatives” supposedly by moving it from the tariff to TGP’s EBB. FERC indicated that TGP could refile the proposal by removing the RSG criteria from the tariff and leaving it on its EBB and TGP did just that in a new filing dated May 11.

This solution did not satisfy every one, and primarily those who remained unsatisfied were the producers, Antero Resources and Coterra Energy, who collectively hold about 7% of the total contracted capacity on TGP. Another producer, EQT Energy, while not opposing the final proposal, did express concern that it was essentially too lax because it established a threshold of .20% of methane emissions to qualify as RSG and it noted that there was no incentive to beat that standard even though EQT was already well below that level for its production. A non-shipper, EDF has been objecting to all versions of the proposal and, in addition to insisting that FERC hold a technical conference, has requested that FERC undertake what EDF asserts is its statutory obligation to fix the terms on which services may be provided by pipelines to assure that they are just and reasonable.

All three protestors have not only objected to the revised filing by TGP, but have also sought rehearing of the order from April 29. By statute FERC should rule this week on both the tariff filing and the rehearing requests, but it can delay both by suspending the tariff change and by issuing an order indicating that it is reconsidering the April 29 order. With respect to certificate proceedings, the Democratic majority on FERC professes a desire to make its rulings more legally durable in the face of legal appeals, and so we would expect it to revisit the April 29 order because as currently drafted it is highly susceptible to not only being appealed but to being reversed.

The current order provides almost no basis for why FERC can simply avoid ruling on the key facet of the proposal by simply ordering that it be removed from the tariff. All three rehearing requests note that the Natural Gas Act requires a pipeline’s tariff to include all “classifications, practices, and regulations affecting” a pipeline’s services. All three assert that FERC cannot simply refuse to do so because it is hard.

TGP, in response to the objections to its revised proposal, does put forth a reasonable textual argument for why the RSG criteria need not be regulated by FERC. But that argument is essentially premised on the fact that the whole pooling point proposal is meaningless. TGP says that the pooling service is a “free service” that “does not require anyone to do anything” and is ultimately “irrelevant to the transportation service a shipper receives, because [TGP] will provide the same service for any gas transported using Rate Schedule SA,” whether or not it meets the RSG criteria. Given that statement, one has to wonder what value the whole proposal might have.

It appears that FERC is faced with either reversing its prior decision and requiring the RSG criteria to be included in the tariff, to which no one seems to object, or to stick by its prior decision and risk being reversed if one of the three objectors chooses to appeal FERC’s denial of rehearing. We think FERC may ultimately take the path of least resistance and reverse its prior decision. Whether all of this ultimately helps the RSG market advance is an open question.