Pipelines Might Overcome Opposition to Expansions

New England’s lack of gas supply may be most directly linked to one day in June 2013 when Constitution Pipeline filed its application to build a 650,000 dth/day project from the Marcellus Shale to New England. That project — which was never built — was the first of many FERC-approved pipelines that would ultimately be blocked by opposition groups intent on “keeping gas in the ground,” by ensuring it can’t be delivered to demand centers.

As Mountain Valley Pipeline struggles to reach completion and New York continues to block all paths north, many are saying if MVP ever gets completed, it might be the last pipe out of the Marcellus/Utica. If that were to happen, current egress capacity for the region would become a permanent limit on the annual production from the largest natural gas basin in the country. And just 600 miles away, its neighbors in New England would continue to rely heavily on LNG imports to heat homes.

For comparison, Transcontinental Pipeline’s Regional Energy Access (REA) project may offer a path for other developers to follow. By limiting the new construction to welcoming states and otherwise using compression, it may have found a way out of the region… with one caveat.

New England Needs Gas, and “Actionable Solutions”

In September, the Federal Energy Regulatory Commission (FERC) hosted a forum to discuss the state of New England’s gas and electric energy grid. In anticipation, ISO New England and the region’s gas and electric distribution companies issued a joint “problem statement and call to action” to “help inform the discussions” at that forum. It noted the transition to a cleaner energy future requires the region to reduce its reliance on imported LNG. It also noted that until the region develops renewable sources of generation and the related long duration resources needed to balance variable production, it will remain dependent on natural gas and imported LNG to ensure the reliable provision of heat and electricity. “Without adequate gas, the region may not be able to meet the demand for home heating and electricity – and, when reliability suffers, the clean energy transition suffers.”

That news shouldn’t shock anyone, although it seemed to surprise one FERC commissioner; after the forum, Commissioner Clements tweeted she was “struck by how long this conversation has been going on,” and said FERC should chart a course toward “actionable solutions.”

New England’s lack of gas supply may be most directly linked to one day in June 2013 when Constitution Pipeline filed its application to build a 650,000 dth/day project from the Marcellus Shale to New England. That project — which was never built — was the first of many FERC-approved pipelines that would ultimately be blocked by opposition groups intent on “keeping gas in the ground,” by ensuring it can’t be delivered to demand centers.

In a curiously similar sentiment, FERC — particularly Commissioner Clements and Chairman Glick — has recently sought to become an environmental regulator, intent on rejecting any pipeline expansion solely because the end-use of the transported gas will emit greenhouse gasses. This position was most forcefully asserted in two policies FERC issued in February and quickly withdrew in March following substantial blowback from Congress. At least for now, there appears to be a working majority, including the two Republicans and other Democrat, Commissioner Phillips. The record of these three commissioners shows they will continue to approve projects based on the policy in place prior to February 2022. But even under that policy, first adopted in 1999, pipeline developers may need to get creative to provide their projects the highest probability of completion.

Canceled and Delayed Projects — and the Methods Used to Block Them

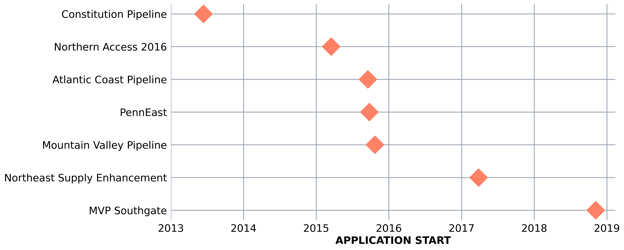

While the Constitution project is a poster child for FERC-approved pipelines ultimately canceled due to opposition, it is not alone. Since its application was filed in 2013, the other projects shown in Figure 1 met a similar fate.

The tactics used to delay these projects were varied; some were employed by the states and others by environmental groups. The particular methods used to challenge projects, even after FERC determined they were in the public interest, include:

Water Quality

Under the Clean Water Act, a state has the right to review any project crossing its wetlands and waterbodies to determine whether the proposed activity will violate its established water quality standards. States like New York and New Jersey have used this as both a delaying tactic — by extending the review period beyond the one-year limit imposed in the statute — and as grounds to deny an approved project by finding it would be in violation. Opposition groups have similarly challenged states’ decisions to approve projects, by claiming the approval didn’t follow the state’s own procedures or improperly found the project compliant.

Senator Manchin proposed language to correct some of these issues in a permitting reform bill he proposed titled the Energy Independence and Security Act of 2022. However, that provision was struck from a version proposed as a rider to a must pass bill for funding the government that passed in September. Purportedly, negotiations continue to include some version of the bill as a rider to the defense appropriations bill, which needs to be approved in December. For now, it’s unclear whether any changes to the Clean Water Act will be included in any permitting reform measure that could receive enough support to be passed this year.

Need

States are not supposed to reassess a FERC determination that a project is in the “public convenience and necessity;” however several states have used their authority under the Clean Water Act to reject projects for which they openly questioned the need.

State Lands

Almost every state owns many acres of land outright, and some states have taken conservation easements over non-state owned land. States have used this power as a landowner to block or delay the routing of a project — both by denying access to the land needed by the project to conduct environmental studies and by prohibiting use of the land for facilities FERC has approved. In a case involving the PennEast pipeline (one of the canceled projects in Figure 1), the Supreme Court held pipelines can condemn state-owned land, but as landowners, states can still substantially delay projects.

Federal Lands

Large areas of land are owned by the federal government in the designation of national parks and national forests. While national parks are essentially off-limits to pipelines, this isn’t the case for national forests. Crossing them has recently and repeatedly become an obstacle for project developers. Opposition groups challenge the federal government’s decisions to approve the use of such lands, thereby slowing authorizations. This could become an even larger issue if the federal government itself becomes more hostile to pipeline development.

Endangered Species

Even on privately owned land, activities must comply with the Endangered Species Act. Sometimes opposition groups have challenged federal approvals as not being sufficiently protective. These challenges, like those to grants over federal lands, have slowed reviews and have led to approvals being reversed and the process starting over.

Tribal Lands and Historical Preservation

Developers must demonstrate their project causes no harm to any land or historical locations in which a recognized Native American tribe has an interest, even if the project’s route doesn’t cross that land. Similarly, non tribal land or objects of historical importance may not be adversely affected by a project. Both of these stipulations have delayed projects, although not as significantly as the previously discussed issues.

Environmental Justice

Environmental justice has always been a concern of FERC project reviews. This consideration has become more prominent as several federal agencies have begun to recognize historical development typically disfavored low-income and minority populations. Thus, planned projects traversing the same areas may perpetuate the disparate impact on those communities. This concern has already led to project delays and its attention in the review process is expected to increase.

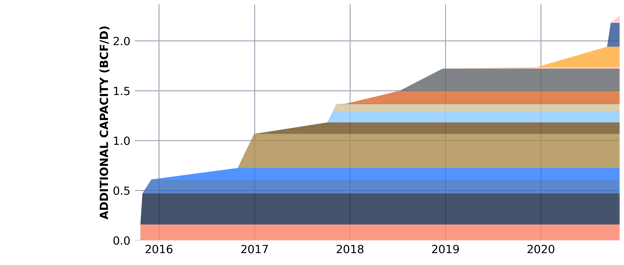

Not All Projects to the Northeast Have Failed

As shown in Figure 2, a number of projects were able to be permitted and built during and after the Constitution pipeline saga. Over 2 Bcf/day in capacity was added to various areas from New York through New England. But even for those that have gone forward, the path is not short. For the projects in Figure 2, the time from when they first approached FERC to when they were placed into service ranged from a low of 20 months to a high of 67 months, with the median being right at three years. Surely, it’s been difficult to build new projects in the region — but not impossible.

Possible Paths Forward

Limiting the Type of Expansion in Hostile States

Williams’ Transcontinental Pipeline has a project currently pending at FERC called Regional Energy Access (REA). REA would provide an additional 820,000 dth/day of capacity from the Marcellus/Utica region with deliveries along the East Coast to its list of anchor shippers — primarily local distribution companies. That additional capacity is created through a combination of new pipeline (about 36 miles), and installation of one new electric-driven compressor, plus increasing the horsepower at five existing compressor stations. Critically, the pipeline additions are being made in Pennsylvania, a state that has not yet joined its neighbors in using the water quality certificate process as a way to block projects. For REA, Pennsylvania took the full year available under the Clean Water Act to make its decision, but ultimately approved the project — even prior to a FERC ruling.

But Proving Need Could Still be a Problem

While REA hasn’t yet received FERC approval, its strategy may be replicable for projects into the New England region. One concern, though, is FERC consideration of a key change to its Certificate Policy Statement — introduced in February and then quickly withdrawn upon Congressional scrutiny. While Chairman Glick regularly asserts the revised policy statement was a refinement of the 1999 policy, it was effectively a wholesale rejection of a key component of that policy. Specifically, in the 1999 policy, FERC generally removed itself from the role of determining project need. While FERC didn’t foreclose considering other evidence, the 1999 policy statement made it clear: if a project was supported by binding precedent agreements — particularly with unaffiliated shippers — FERC would accept that as conclusive evidence that the project was needed.

The revised policy adopted by FERC in February completely abandoned this concept and restored FERC to the role of omniscient predictor of the future, by installing it as the ultimate judge of need — based on its own view of reports by “experts'' about the future demand for gas in a region. The risk of this drastic change in FERC’s perspective is already playing out with respect to REA because the New Jersey Board of Public Utilities (BPU) and the New Jersey Division of Rate Counsel have argued that there simply is no need for the additional capacity the project is creating. However, SJI Utilities, the company that owns two of New Jersey’s gas utilities, filed a response on behalf of its subsidiaries, Elizabethtown Gas and South Jersey Gas. That filing noted a key fact: it is the utilities themselves under New Jersey law — not the BPU — that are charged with being the “providers of last resort” and must “ensure the adequacy of gas supply and associated pipeline capacity to serve the full needs of their customers.” As stated in the filing, the two subsidiaries have “entered into a binding precedent agreement with Transco to meet approximately 25 percent and 34 percent, respectively, of their projected increases in demand over the next 10 years.” Although the letter doesn’t go so far as to say that should end the discussion on need, it does note the utilities’ assessments are “not based on speculation — they are based on a market-driven need.”

Lift and Lay and Electric Compression

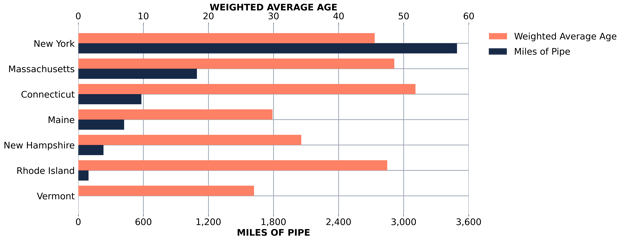

Another strategy that could be deployed in New England is to replace older pipelines in the region with newer, larger-diameter pipelines and combine that with the retirement of older gas-driven compressors in favor of electric-driven compressors.

As shown in Figure 3, states with the most pipe in the region — New York, Connecticut and Massachusetts — also have some of the oldest pipelines. This creates an opportunity for growth projects that would replace the aging pipelines, through a lift and lay process with newer larger-diameter pipelines. This would improve the safety and reliability of the existing infrastructure, which may be more acceptable in the region than new greenfield pipelines like Constitution. Also because existing compressor stations are likely to be gas-fired, replacing them with electric-driven compressors would reduce pollution and may promote environmental justice, if the stations being replaced are located in such communities.

Whether these development strategies can prevail remains to be proven. But both methods are ones with the best chance for success in such a difficult area of the country — one in desperate need of increased gas supplies.

Permitting Reform May Help, but Passage is Far From Certain

Senator Manchin’s permitting reform bill, the Energy Independence and Security Act of 2022, addresses a number of issues facing energy infrastructure projects, including natural gas pipelines. While some of these provisions may be helpful, none of them are a silver bullet, so creativity by developers to overcome these obstacles would still be needed. The key provisions in his bill, other than changes to the Clean Water Act, mentioned above, that may be helpful to the gas sector include:

- Establish timelines for FERC’s preparation of Environmental Assessments and Environmental Impact Statements (but the timelines set are ones that FERC has historically met, prior to the current Commission).

- Require the President to (1) establish a list of projects with strategic national importance — of which “5 shall be projects to produce, process, transport, or store fossil fuel products, or biofuels, including projects to export or import those products;” and (2) direct federal agencies to prioritize the completion of environmental reviews and authorizations for such projects, including those remanded or vacated by courts.

- Direct federal agencies to issue biological opinions, incidental take statements, rights-of-way, amendments, permits, leases, verifications, and other authorizations for the completion of Mountain Valley Pipeline; declare these actions exempt from judicial review and give the D.C. Circuit jurisdiction over any challenges to the statute.

Democratic leaders ultimately stripped permitting reform from the continuing resolution after it became clear the measure lacked the needed votes. Senator Schumer has apparently agreed, however, to attach it to the defense appropriations bill expected to be approved in December. There have been encouraging signs that some Republicans may be willing to vote for a modified, “bipartisan” version of the bill in December — which will likely be necessary to overcome progressive Democrats’ opposition. All of these machinations just mean the renewable industry, the fossil fuel industry, and especially Mountain Valley Pipeline will likely remain on pins and needles for another couple of months.