Pipeline Projects Should Soon Begin Transporting Permian Gas

Crude oil prices may no longer be at the peaks we saw early last year, but they remain higher than they have been since 2018 and are expected to stay above $65 for the next couple years. These price levels have encouraged crude oil production in the Permian Basin, spurring increases in associated gas production.

Crude oil prices may no longer be at the peaks we saw early last year, but they remain higher than they have been since 2018 and are expected to stay above $65 for the next couple years. These price levels have encouraged crude oil production in the Permian Basin, spurring increases in associated gas production. With producers such as ExxonMobil pledging to stop routine flaring, that associated production is creating a need for yet another round of gas pipeline expansions to serve the region.

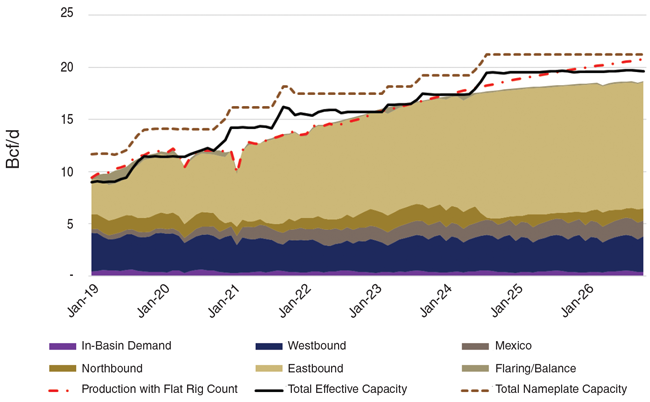

Seven projects that will help address this need could enter service by early 2025: four mainline projects and three other projects intended to make existing mainline systems more attractive to shippers.

The first two mainline projects involve compression-only expansions of the existing Whistler and Permian Highway pipelines. The other two, Matterhorn and Warrior, are greenfield pipelines. Based on data from legal and regulatory filings, all four appear to be making progress, and it is likely that both the compression-only projects will go into service this year.

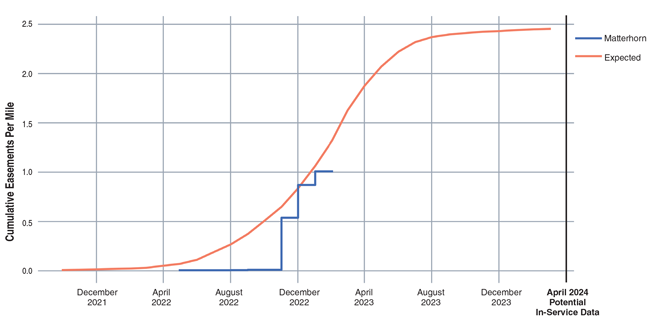

As for the two greenfield projects, Matterhorn, which has successfully reached a final investment decision, is acquiring rights of way, while the Warrior pipeline appears to be exploring routing alternatives. Based on Matterhorn’s land acquisition activity, it looks to be on track for an in service date in 2024. Warrior, however, may need to wait until further demand develops.

Mainline Projects Timeline

Whistler’s expansion got off to a strong start because Whistler obtained the rights for the additional compressor stations it needed to install at the same time it was acquiring the rights for the original project. The expansion has secured air permits for all three of the stations it involves.

The Permian Highway has closed the gap that once existed between it and the Whistler expansion, acquiring all four locations it needs, filing for the required air permits for all four compressor stations, and receiving the permits for three of them.

Assuming it takes about 10 months for each of the pipelines to construct the required stations, we still think both projects are on track to be in service by the end of this year.

With respect to the two greenfield pipeline projects, based on court and land records, Whitewater Midstream’s Matterhorn Pipeline seems to be moving quickly to acquire the land rights needed to construct the project. By comparing the project’s activity with the land acquisition activity for more than 10 large diameter pipeline projects in Texas that have been completed, we can estimate how far along Matterhorn is in that process and what the in service date may look like.

As shown in Figure 1, Matterhorn began serious efforts to acquire land rights in November 2022. Based on similar projects, the pipeline could be in service by the middle of 2024, which is a bit earlier than its announced date of the third quarter of 2024.

We have yet to see similar land acquisition activity for Energy Transfer’s Warrior project, but that is not surprising. On its most recent earnings call, Energy Transfer noted that the timing for that project may need to await additional supply coming on line over the next few years.

Also, even before they acquire land, pipelines often must file lawsuits to obtain access to land for environmental studies and route planning. According to Texas court records, Warrior began filing access suits in September 2022. Assuming Warrior succeeds at getting shippers to underwrite its project, it may be in a very good position to move forward quickly.

A Positive Sign

Alongside the four expansions to mainline capacity out of the Permian, there are three projects moving forward that are designed to make existing pipelines more attractive to producers: Transcontinental Pipeline’s (Transco) Texas to Louisiana Energy Pathway, Double E Pipeline’s Red Hills Lateral and Whistler Pipeline’s ADCC extension.

Transco’s Texas to Louisiana Energy Pathway project will provide 364,400 dekatherms a day of firm capacity to its only shipper to allow for transportation to market of its natural gas supplies from western and southern Texas. The project involves converting some interruptible capacity to firm and increasing the system’s overall capacity in Transco’s first, second and third zones.

According to Transco’s application, the shipper’s gas volumes are produced at a relatively uniform rate, are sold to its customers accordingly, and require reliable, consistent access to markets. The shipper’s access to markets from its production basins has been constrained by limited pipeline infrastructure and the low scheduling priority and potential intermittency or unavailability of interruptible transportation. Transco has requested that the Federal Energy Regulatory Commission issue a final order approving the project by the first quarter of 2024 so it can be in service by the first quarter of 2025.

Last year, we would have considered that request to be at risk, primarily because under former Chairman Glick, FERC staff apparently had been directed to prepare a full environmental impact statement for all pipeline expansion projects. Based on that requirement, FERC staff released an environmental review schedule that projected the EIS would not be issued until Nov. 30, 2023. However, Chairman Glick’s renomination was never brought to the floor of the Senate. Thus, when the new Congress convened on Jan. 3, his term at FERC ended.

At Arbo, we remain cautiously optimistic that Chairman Glick’s replacement, Acting Chairman Willie Phillips, will return FERC to a sense of normalcy not seen since the end of the Obama administration. One key indicator he may be doing so is that he seems to be allowing career FERC staff to decide the appropriate level of environmental review required for a project. In fact, he even has allowed FERC staff to reverse environmental review decisions made under Chairman Glick, including the one to prepare an EIS for this Transco project.

Instead, FERC announced plans to prepare an environmental assessment for the project, which it anticipates it will complete by June 9, almost six months earlier than the date for an EIS. If the assessment gets finished on schedule, the commission would have adequate time to prepare its order and even beat the date requested by Transco.

Red Hills Lateral

In its Red Hills Lateral project, Double E Pipeline proposes to construct and operate a 20-mile lateral to provide new Permian Basin supply to its existing system. Double E filed for approval of this project under FERC’s prior notice blanket certificate program, which automatically approves qualifying projects if no objections are filed by a specific date.

For the Red Hills Lateral, that date was Feb. 17. No protests were filed against the project, so FERC staff issued an environmental review concluding that the lateral “would result in minimal environmental impacts.”

According to Double E, the project will enhance the reliability and flexibility of natural gas supplies for Double E’s shippers by connecting Double E’s existing interstate transmission system to additional gas supply sources in the Delaware Basin. The lateral will deliver up to 600,000 dekatherms a day to Double E’s mainline system. Double E has indicated it plans to begin construction activities this June, complete the project by October and bring it into service by Dec. 1.

ADCC Extension

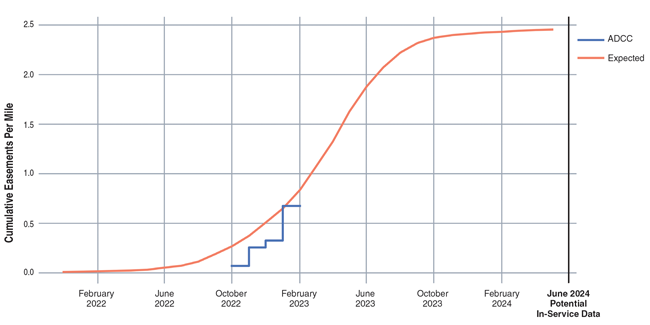

The Whistler Pipeline’s operators, WhiteWater Midstream and Cheniere Energy, are working jointly on the ADCC Extension, a new 42-inch pipeline that will run the 43 miles from the terminus of the existing Whistler Pipeline to Cheniere’s liquefaction facility in Corpus Christi, Tx. The pipeline has been designed to transport as much as 1.7 billion cubic feet a day of natural gas, with the potential to expand to 2.5 Bcf/d.

As shown in Figure 2, the ADCC Extension reasonably could enter service in 2024. The projected date even may be a bit conservative.

Analysis by East Daley Analytics suggests that if producers maintain the rig count, that could easily drive the additional interest needed to secure the commitments necessary for future expansions, such as Warrior. But for now, Figure 3 shows how the three other mainline projects will impact flows out of the Permian in the coming years.