Data Suggests Permian Gas Pipeline Will Enter Service Early

As one of the first producing shale gas basins, the Haynesville’s production reached an initial peak in 2011 and fell through the end of 2016. Since then, it has had an astounding rebound, with output far surpassing even the peaks reached in 2011 and more than doubling that of 2016. This production growth is spurring renewed interest in expanding the region’s gathering and transmission lines, primarily to direct gas to liquefied natural gas export terminals along the Gulf Coast.

Eleven projects at various stages are slated to provide more than 14 billion cubic feet of capacity. Most of that capacity should come on line next year.

Thanks to associated gas, the Permian Basin also needs more takeaway capacity. There are five projects vying to meet that need, and at least one of them is on track to enter service earlier than expected.

That project is the Matterhorn Express, a 42-inch pipeline running 490 miles from Waha, Tx., to the Katy area near Houston. As a greenfield pipeline designed to transport as much as 2.5 billion cubic feet of gas a day from the Permian to the Gulf Coast, its early arrival could be significant for pricing.

Progress So Far

On May 19, 2022, when WhiteWater Midstream, EnLink Midstream, Devon Energy and MPLX announced that they had reached a final investment decision to move forward with the pipeline’s construction, they projected it would enter service in the third quarter of 2024. Our analysis suggests that target is conservative, and that there is a much greater chance the project will finish early rather than late. In the best case, the Matterhorn Express could be on line in May.

It's worth acknowledging that predicting when pipelines will enter service can be tricky. Each type of project faces unique challenges from approval to in-service and therefore requires different methods for monitoring progress.

Also, because of unstandardized reporting requirements and enforcement, the amount of publicly available data varies by state, and it is always disaggregated and unstructured. In Texas and Louisiana, the data sources we monitor for indications of progress ranges from regulatory, permitting and land record documents at local government agencies and public records departments, to SEC filings and press releases originating from project developers. While some information is easy to find online, getting other key data points requires public information requests, for which the process varies by state.

In Matterhorn’s case, there are two strong indicators it’s ahead of schedule: land acquisitions and compressor station construction.

Positive Signs

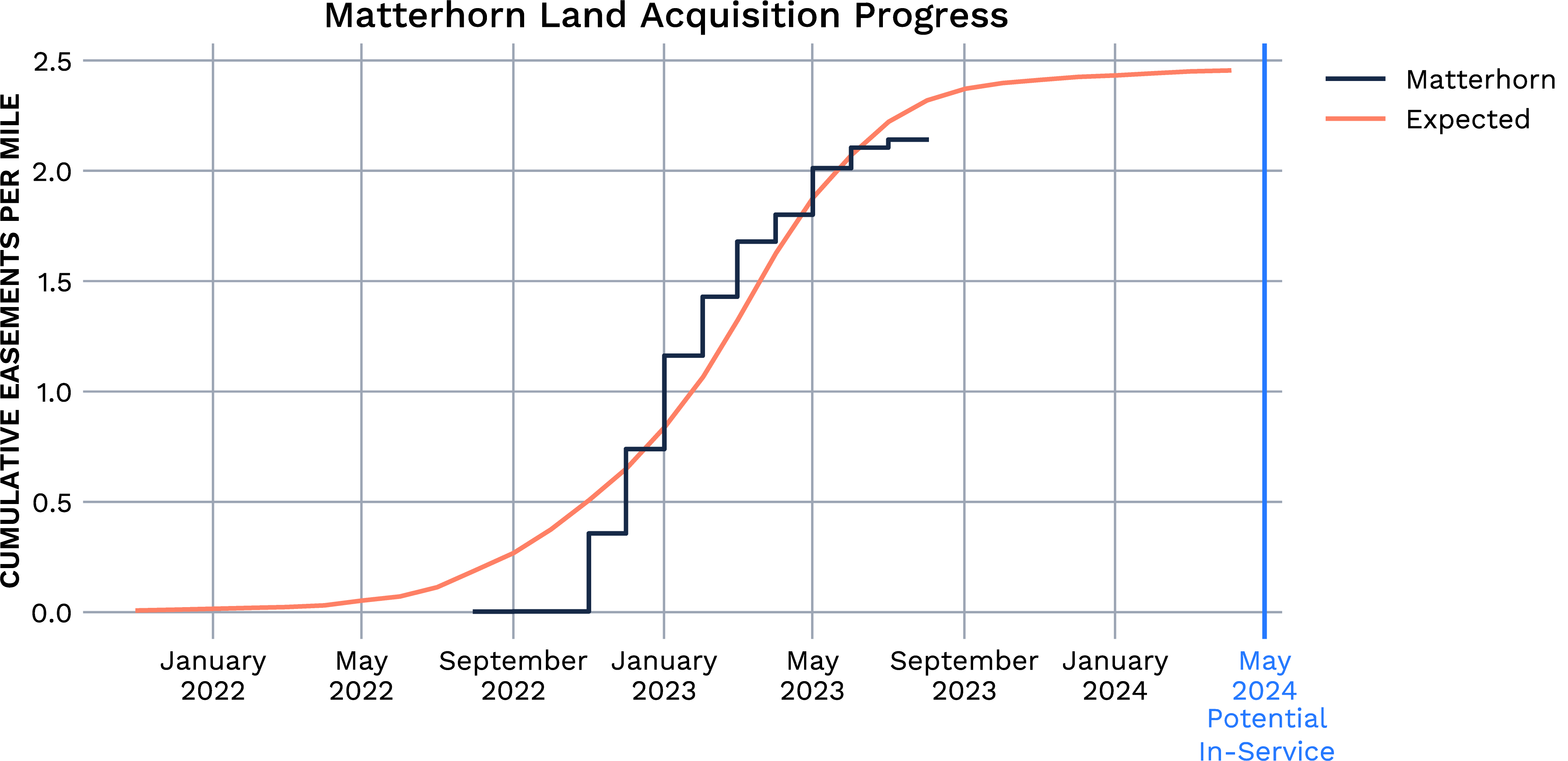

Typically, the first financial commitment a project developer makes is to acquire the rights of way for the pipeline. Arbo monitored land acquisition during the previous Permian buildout and established a curve for the timing of a typical project, with the curve running from the first indication of acquisition to the project’s actual in-service date.

Land acquisition for Matterhorn is progressing in line with the historical projects in the dataset. Most importantly, the highest-growth portion of the curve seems to be complete, which means Matterhorn is close to if not already finished with land acquisition.

The analysis indicates Matterhorn could be planning an in-service date as early as May 1, 2024.

Other activity reinforces this prediction. Because pipeline developers will not send out crews until they have contiguous rights of way for the work, construction of the pipeline itself usually needs to wait until all land is acquired. However, compressor station construction often can start sooner, as the associated land typically is purchased outright and acquisition can be completed much more quickly.

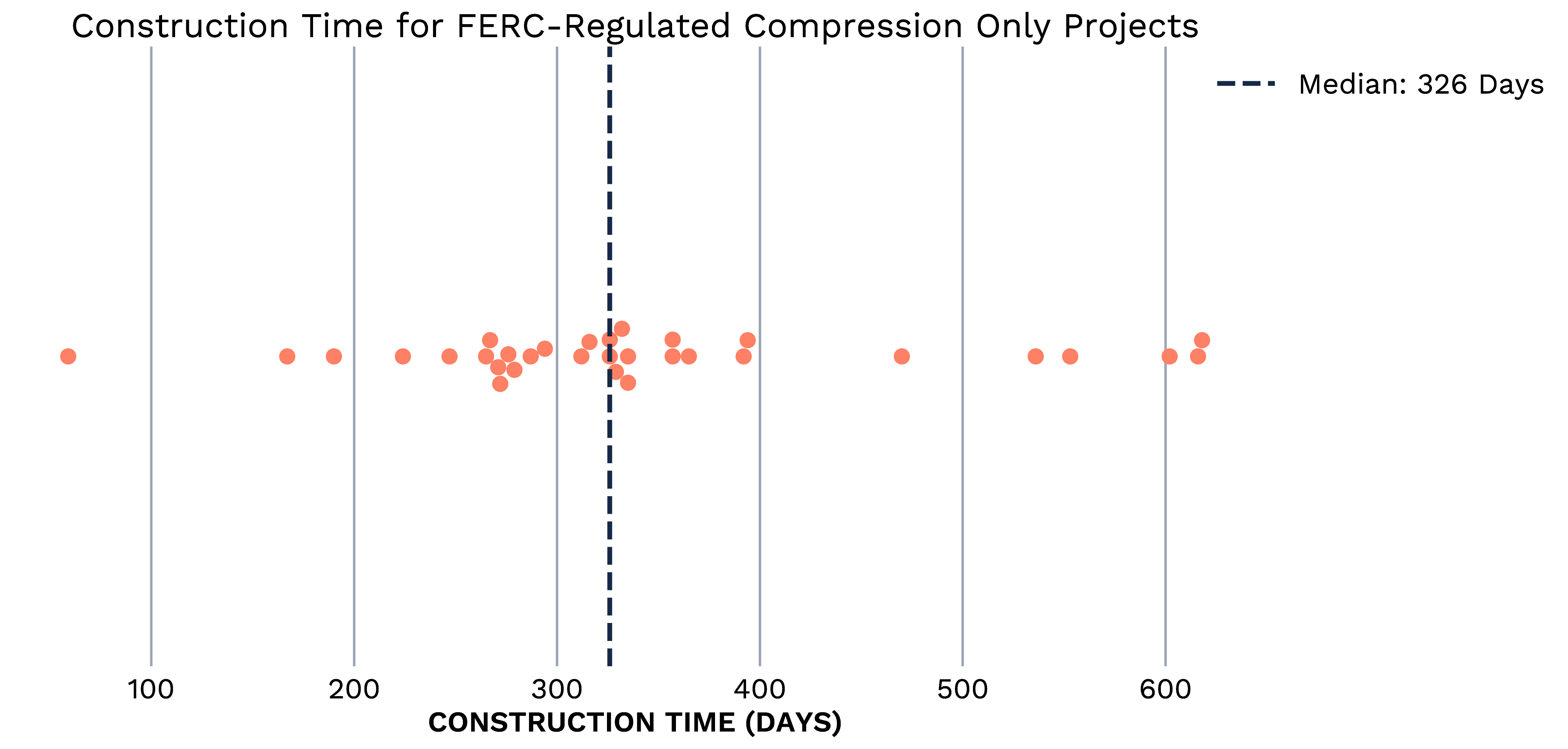

Based on the air permits Matterhorn has received, we know the physical location of the project’s four compressor stations, at least for initial operation. Satellite imagery for two of those locations shows construction began at both stations by the end of April.

A review of data for FERC-regulated compression-only projects with construction beginning after January 1, 2015 shows eleven months is a typical duration between construction start to in-service. Thus, Matterhorn’s compressor stations could be operable around May 1.

Hydrostatic Test Records

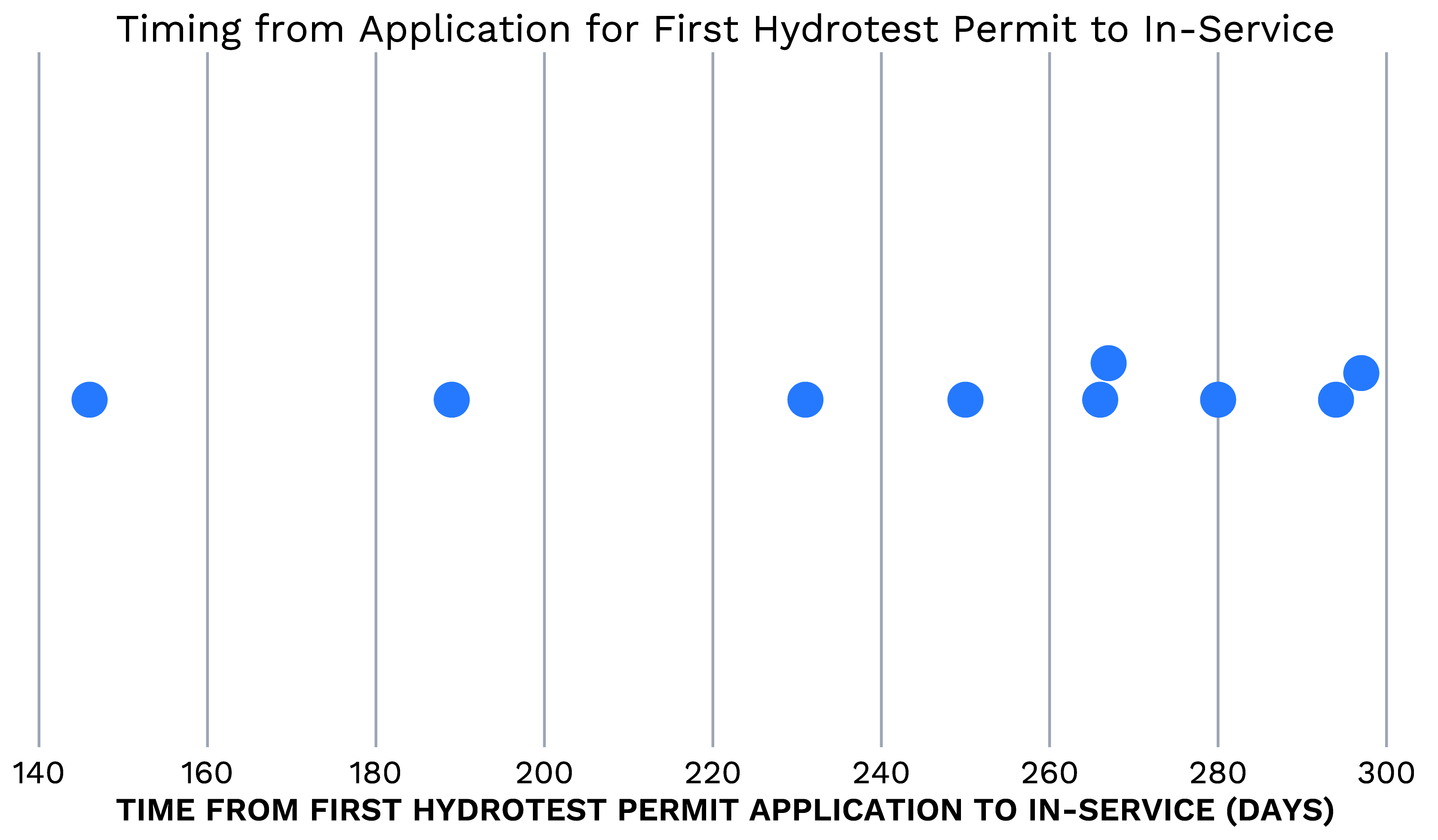

Historical data from the Permian shows that while the shortest time from a first hydrostatic test application to in-service was only 146 days, it usually takes closer to eight or nine months. As of late August, no hydrostatic test applications have been filed by Matterhorn, which is not surprising given our in-service projection of May 1. If that date is to hold, we should begin to see applications filed soon after Labor Day. Once these applications start, they will be the best indicator of the expected in-service date.

For now, we believe the developers may be quietly targeting an in-service date a bit earlier than officially announced. Our current expectation is the project could be in-service somewhere between May 1 and the end of the second quarter.

Other Updates

August saw several significant developments for other projects in Louisiana and Texas. For example, CP2 LNG, a Venture Global LNG terminal in Cameron Parish, La., received its final environmental impact statement. CP2 now awaits its full certificate approval before the Federal Energy Regulatory Commission.

The Venice Extension Project, a Louisiana expansion of Williams’ Texas Eastern Pipeline, was on the meeting agenda for the FERC August Open Commission Meeting but was pulled at the last minute. The pull could indicate potential delays on the horizon for all pending FERC projects, including CP2 LNG.

The Permian Highway, a Texas expansion project by Kinder Morgan, pushed back its expected in-service date one month, to December 2023.

On a brighter note, Evangeline Pass, another Kinder Morgan expansion in Louisiana, requested a full notice to proceed with construction on August 15. The project could add as much 2 Bcf/d of natural gas capacity to Kinder Morgan’s Tennessee Gas Pipeline and Southern Natural Gas systems in Louisiana and Mississippi.