SPECIAL REPORT | November 2021

How can the Shale Revolution inform America's next energy transition?

For the U.S. to stay independent and be a leader in decarbonization, we’ll need five big “I”s — imperative, improvement, innovation, investment and infrastructure.

Download PDF or view the full report text below.

Provide your email address to download a PDF.

The full report text is available below.

Energy independence,

innovation and infrastructure

The imperative for (more) investments and regulatory evolution

November 24, 2021

What's the issue?

The International Energy Agency (IEA) projects global spending on clean energy technologies will need to jump from $1 trillion dollars per year to $5 trillion per year by the end of this decade for the world to reach net zero by 2050 (NZ50). The U.S. represents 15% of global emissions; if the spending needed to zero out emissions were simply correlated to their origin, the annual U.S. share of global spending would be $750 billion. Recently, the much heralded bipartisan infrastructure bill was signed into law. The Infrastructure Investment and Jobs Act (the Act) includes just $73 billion of funds for energy over the next five years; over $60 billion of which is specifically directed toward what we call the energy evolution. In order for these and future investments to be effective, they need large accompanying changes that yield: 1) sustained enabling political, legal and regulatory regimes; 2) immense industrial innovation; and 3) efficient evolution of energy commerce.

Why does it matter?

Today’s energy evolution imperative is focusing on decarbonization by large-scale electrification of transportation that requires orders of magnitude more renewables-based capacity and robust expansion and modernization of transmission grid infrastructure. The recent history of the “Shale Revolution” provides insight into big changes and issues that may ultimately determine the speed and extent of the coming decarbonization and renewables revolution.

What's our view?

The Shale Revolution involved the deployment of innovation, investment and infrastructure primarily based on an existing legal and regulatory framework that was generally functioning. The renewables revolution will need even more innovation, investment and infrastructure, but it currently lacks an existing framework to support explosive growth. This is exhibited in the contrast between the siting and permitting of electrical transmission infrastructure and interstate pipeline infrastructure. Lasting legal and regulatory changes require political consensus that is now very rare in Congress and increasingly rare in relevant regulatory agencies. That needs to change now to increase the chances of meeting aggressive long-term infrastructure goals, as well as underpin and evolve the capital and commodity markets, so they stay accessible and efficient.

In the United States, independence is an identity and a prized possession — cherished as individuals and as a citizenry. We’ve spent a lot of time this year thinking about how to protect the energy independence we reclaimed in the last century. Doing so will depend on interconnected geopolitical and economic dynamics that pit global cooperation to combat climate change against global competition for economic might.

For the U.S. to stay independent and be a leader in decarbonization, we’ll need five big “I”s — imperative, improvement, innovation, investment and infrastructure. All five of these enabled the last energy transition, referred to as the Shale Revolution. Reviewing that recent history can help frame what is needed for the coming evolution referred to herein as “net zero (NZ) electrification.”

Imperative & Improvement

Global energy production and consumption is complex and can be divisive, but the imperative to reduce emissions and slow global warming is clear. And the passage of the Act has driven some momentum for the U.S. specifically.

Congressional consensus for action is much more important now than it was for the shale infrastructure scale-up, because the inherent challenges to permitting, siting and constructing electrical transmission infrastructure will, in our view, require substantial legislative action. Discussion of these challenges and the need for regulatory improvement has been ongoing for well over a decade, as stated in this excerpt from a 2009 Congressional Research Service report:

“One criticism of current regulation is that it takes many years to permit a project. Expanding federal authority over permitting is viewed as a means of accelerating the process. The underlying assumption is that it is indeed important to build transmission lines faster. For example, if national priorities include quickly putting low carbon generating plants on line to reduce greenhouse gas emissions and to speed the introduction of electric vehicles, then a rapid permitting process may be critical.”

Looking forward and assuming the “imperative” is established, systemic improvement will need to follow. Transmission permitting is still a state-by-state patchwork that must navigate inevitable and intractable interstate disagreements on environmental impacts, consumer cost allocations, land use and eminent domain acquisition. This is explored in depth in a 2020 report requested by Congress from the Federal Energy Regulatory Commission (FERC).

“In our exploration of ‘the barriers and opportunities for high voltage transmission, including over the nation’s transportation corridors,’ staff found that while opportunities exist, there are also barriers which make development of high voltage transmission challenging. For instance, siting of high voltage transmission, generally an area of state jurisdiction, requires navigating each state process or multiple state processes for an interstate high voltage transmission facility…. Additionally, the time required to develop a high voltage transmission facility that meets mandatory Reliability Standards, maximizes system benefits, and strikes a balance among interested stakeholders (including states) can be in excess of a decade.”

CASE STUDY: TRANSWEST EXPRESS

The TransWest Express Transmission Project (TWE) is an overhead high-voltage transmission system that will extend 732 miles from Wyoming to Nevada and will interconnect to existing bulk power system facilities in Wyoming, in Utah, and at two locations in Nevada. The project consists of three linked segments and is designed to reliably and cost-effectively deliver approximately 20,000 GWh/year of clean and sustainable electric energy generated in Wyoming to Arizona, Nevada and Southern California.

The project was first proposed in 2005 and had a projected in-service date of 2013. The current projected in-service date is now 2025, a full two decades later. The path it has followed is a perfect demonstration of why any plan that relies on the construction of 5.3 times the current grid within the next 30 years is fraught with political and regulatory risk under the U.S.’s existing permitting regime.

The project entered the rating process with the Western Electricity Coordinating Council (WECC) on September 7, 2007, submitted a study on October 5, 2009 and was moved to phase two by WECC on February 2, 2010. WECC did not formally approve the project until November 17, 2017 — more than ten years after the project first began the process at WECC.

On a somewhat parallel path, TWE submitted an application to both the U.S. Bureau of Land Management (BLM) and the Western Area Power Authority (WAPA) for permission to cross lands owned by them. Those two agencies announced their intent to prepare an EIS on January 4, 2011. Despite inclusion in a pilot program to “expedite” the review process for needed transmission lines, the draft EIS was not issued until July 13, 2013 and the final EIS was not issued until April 30, 2015. The approval of the two agencies didn’t come until December 13, 2016 for the BLM and January 17, 2017 for the WAPA. Notably, all of these milestones occurred under the jurisdiction of an administration that favored such projects. In 2018 and 2019, the project received needed approval from local and state agencies, fourteen years after it was first conceived, and more than six years after its original projected in-service date.

An application filed on December 11, 2020 sought approval from FERC to allow the company to sell transmission capacity at negotiated rates based on the results of an open and transparent bidding process. TWE stated that it intended to conduct that process as early as March 1, 2021 and asked FERC to issue its order by February 15, 2021. In a unanimous decision, FERC approved that request on February 26, 2021 and the bidding process commenced on June 7, 2021. However, according to that solicitation for bids, the expected in-service date is now 2025, a full two decades after the project was first conceived.

Interstate Gas Pipeline Paradigm

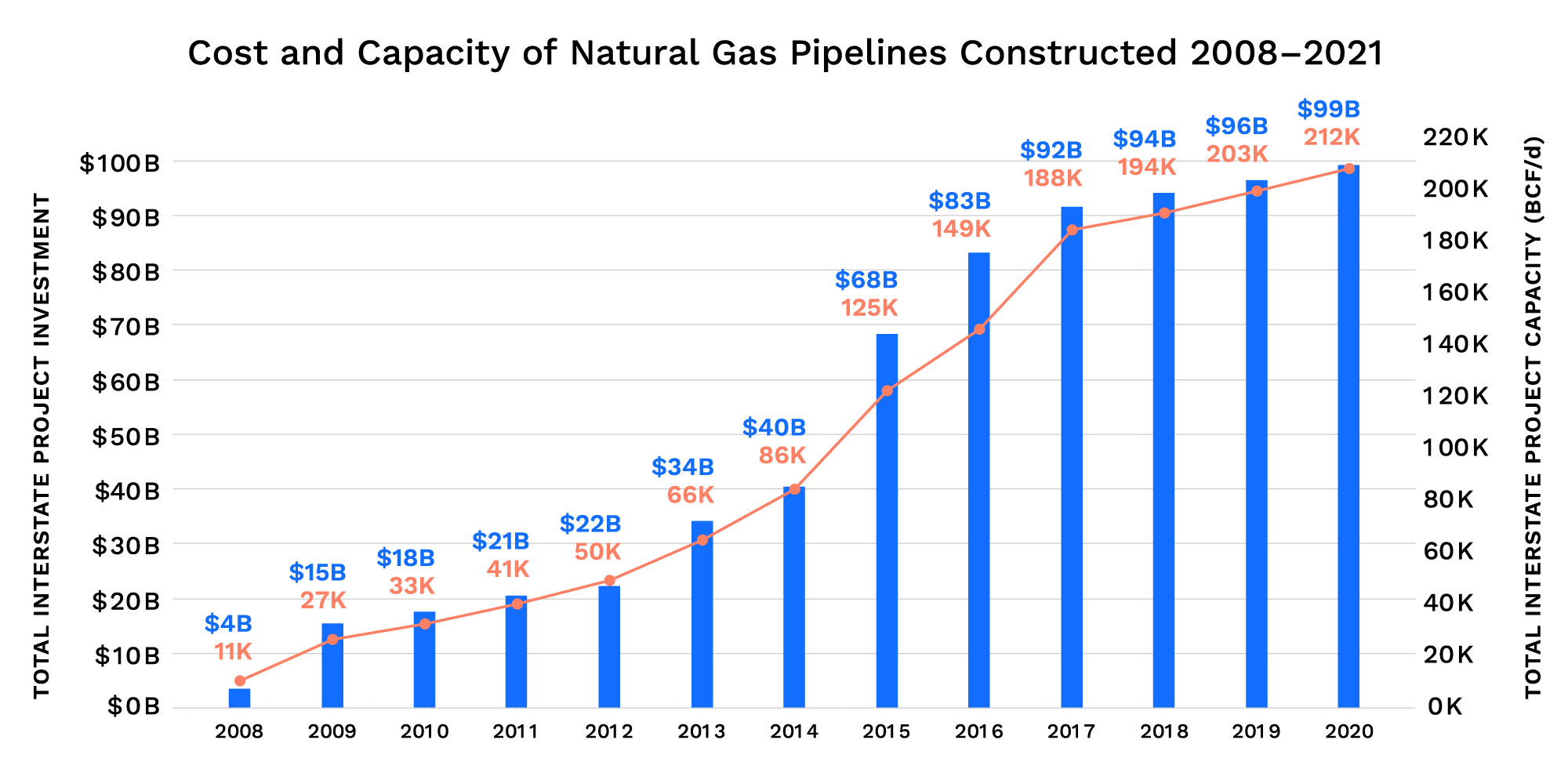

This is in stark contrast to the regulatory and legal paradigm that supported the building of pipeline infrastructure to support the Shale Revolution. That paradigm — based on the 1938 Natural Gas Act and its 1947 amendments — supported the construction of $100 billion dollars and 18,195 miles of interstate natural gas pipelines between 2008 and 2020 that, together, equate to approximately 223 BCF/d of capacity.

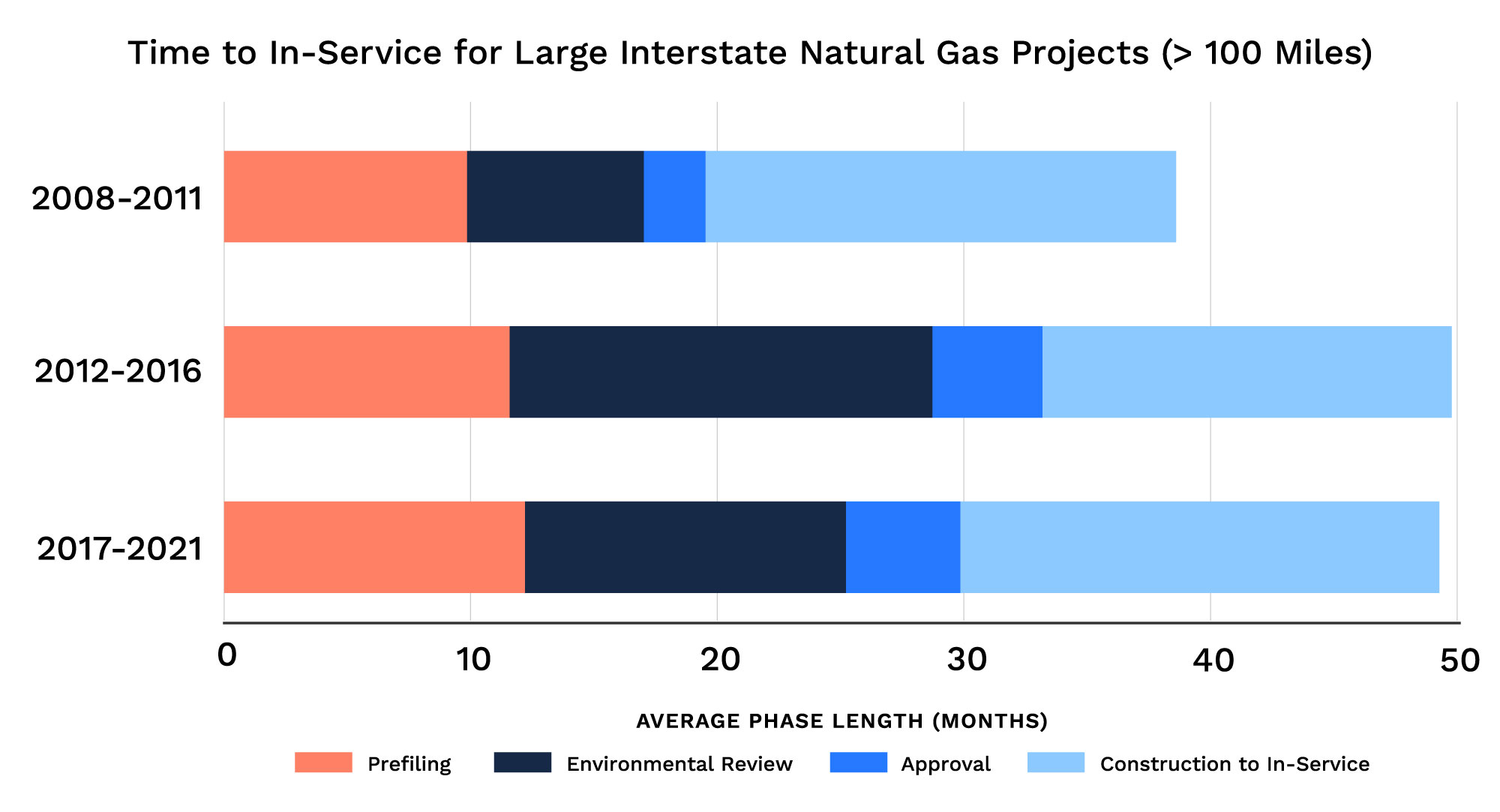

Ninety-seven percent of projects approved under the NGA during that time were approved within two years. The average time for constructing a large (>100 miles) interstate pipeline project from approval to in-service was 3.48 years — well less than a decade for what could be considered linear infrastructure development comparable to electric transmission.

After approval, many projects ran into strong opposition and litigation which dramatically impacted their cost and schedules — and for some, led to cancellation. Two projects, Atlantic Coast Pipeline and PennEast, were litigated all the way to the U.S. Supreme Court, and their cases contain examples of the type of land use and regulatory jurisdictional issues that will most certainly impact future infrastructure projects.

Further reading on gas pipeline opposition and litigation:

Gas Pipeline Industry Dodges a Bullet with PennEast Win, But Spire STL May Lose Certificate →

PennEast to Supreme Court: Constitution Did Not Make the U.S. a Junior Varsity Sovereign →

ACP Wins at the Supreme Court — Necessary But Not Sufficient for ACP and MVP →

Tangled Transmission

In stark contrast to the timelines depicted for interstate gas pipelines in the graph is the TransWest Express transmission case study provided above — initiated in 2005 and just recently having completed environmental and permitting reviews.

In The Electric Grids at a Crossroads, Professor Alexandra Klass of the University of Minnesota Law School conducted an extensive analysis of the historical evolution of energy infrastructure permitting and future needs to develop three recommendations for feasible regulatory frameworks when considering legal and state versus federal political dynamics. While recognizing the success of centralized federal regulation of interstate projects, as exists for pipelines, Klass did not view that as a possibility for transmission and recommended any of the following regional approaches:

First, states could enter into interstate compacts under the Energy Policy Act of 2005 to create regional siting agencies with permitting authority over interstate transmission lines within those states.

Second, Congress could transfer siting authority to RTOs in areas where RTOs exist. Although RTOs are non-governmental organizations and are thus not traditional siting authorities, there is precedent both within and outside of the electricity realm for granting siting authority with federal oversight to such entities where appropriate.

Third, Congress could leave siting authority with the states but require state PUCs and state courts to expressly consider regional transmission needs and regional energy needs in making siting and eminent domain decisions.

The Act includes a few provisions to help mitigate state-to-state constraints on approvals of transmission projects, but they are not enough to significantly impact en masse project feasibilities and schedules. Efforts center on creating regional frameworks (not to the extent Klass recommends) for collaboration and utilizing existing federal lands and rights-of-way as corridors for development. According to the Niskanen Center, the Act gives the Department of Energy authority to conduct more frequent transmission congestion studies and expands the criteria for projects that can qualify as “national interest electric transmission corridors” — previously based on current congestion, and now based on current and projected congestion, with additional consideration of both energy security and the ability of generators to connect to the grid as reasons for declaration.

On the regulatory front, the Act gives the Federal Energy Regulatory Commission the authority to approve transmission projects that are blocked by state inaction or rejection if they occupy these national interest transmission corridors. However, FERC Chairman Richard Glick doubts the backstop siting authority will have much practical effect. “I think it’s going to be somewhat limited in terms of its deployment,” Glick said Oct. 27 during a webinar hosted by the Niskanen Center and the Clean Air Task Force. It remains to be seen how aggressively DOE and FERC will implement their new authority, which is likely to become politically fraught.

In addition to the need for today’s energy industry to evolve rapidly, the imperative for reform of the relevant regulatory regimes is becoming increasingly visible to policy makers. Success will be determined by their ability to make the changes to laws and rules at all levels needed to build new interstate electric transmission infrastructure. And the Act itself likely doesn’t go far enough.

Innovation

The innovation story leading to the Shale Revolution contains many pillars of American industrial progress — including entrepreneurship, engineering, and financiering. Depending on exactly when one dates the maturation of fracking innovation and the start of the resultant “revolution,” it took over 30 years to unfold.

In comparison to what’s needed to realize NZ electrification in 29 more years, shale drilling innovation was mainly based in exploration and production process technology. The fundamental fossil energy sources and plant and equipment needed to transform them to fuel and power were the same, excepting the generation turbines needed to convert power plants from coal to natural gas.

Innovation for electrification is focused on the litany of renewable source technologies as well as new grid transmission, reliability and power conversion technologies. The focus of innovation is on matching “non-dispatchable” or intermittent renewable sources, such as wind and solar, to constant and peaking demand — and the transmission of that energy over long distances. This problem was not prominent with “dispatchable” or on-demand energy sources such as natural gas, coal, nuclear and hydro. A more comprehensive review of technology focus areas and scenario modeling can be found in CapX2020, a study by 10 Midwest utilities. They identify the following as needed technologies:

- Flexible alternating current transmission systems (FACTS)

- Advanced inverter technologies

- Distributed energy resources

- Storage

“Technologies, like FACTS devices, advanced inverters, DER, and storage may all be viable solutions in maintaining system strength, stability, and energy sufficiency with the increased use of non-dispatchable resources. Improvements in today’s technology, as well as new technologies that we can’t even name today, are expected over the next several decades that will assist in the development of the future electric grid.”

The Act has allocated grant funding for several innovation and research project areas, including rare earth elements, critical minerals and metals, energy storage, nuclear, and carbon use.

Infrastructure (Construction and Utilization)

Existing

Existing pipeline infrastructure — particularly for natural gas — is not a component of any new investment in the Act, and any associated imperative to continue utilizing natural gas as a “bridge fuel” is not even mentioned. However, four of the larger expenditures in the Act promote programs that incumbent owner-operators may be especially qualified to participate in: Regional Direct Air Capture Hubs, Large Scale Carbon Storage Commercialization, Open Access Carbon Dioxide Transport Loan Program, and Regional Clean Hydrogen Hubs.

Further reading on natural gas assets and the energy transition.

It’s Infrastructure Week and Money is on the Table for Existing Pipeline Companies →

ACP Wins at the Supreme Court — Necessary But Not Sufficient for ACP and MVP →

Under the IEA’s proposed path to NZ50, global hydrogen use expands from less than 90 Mt in 2020 to more than 200 Mt in 2030 and to more than 500 Mt in 2050. The most cost-effective way to support this growth by transporting hydrogen is via pipeline, and unlike Europe, the U.S. does not have a plan for the development of a robust hydrogen pipeline network.

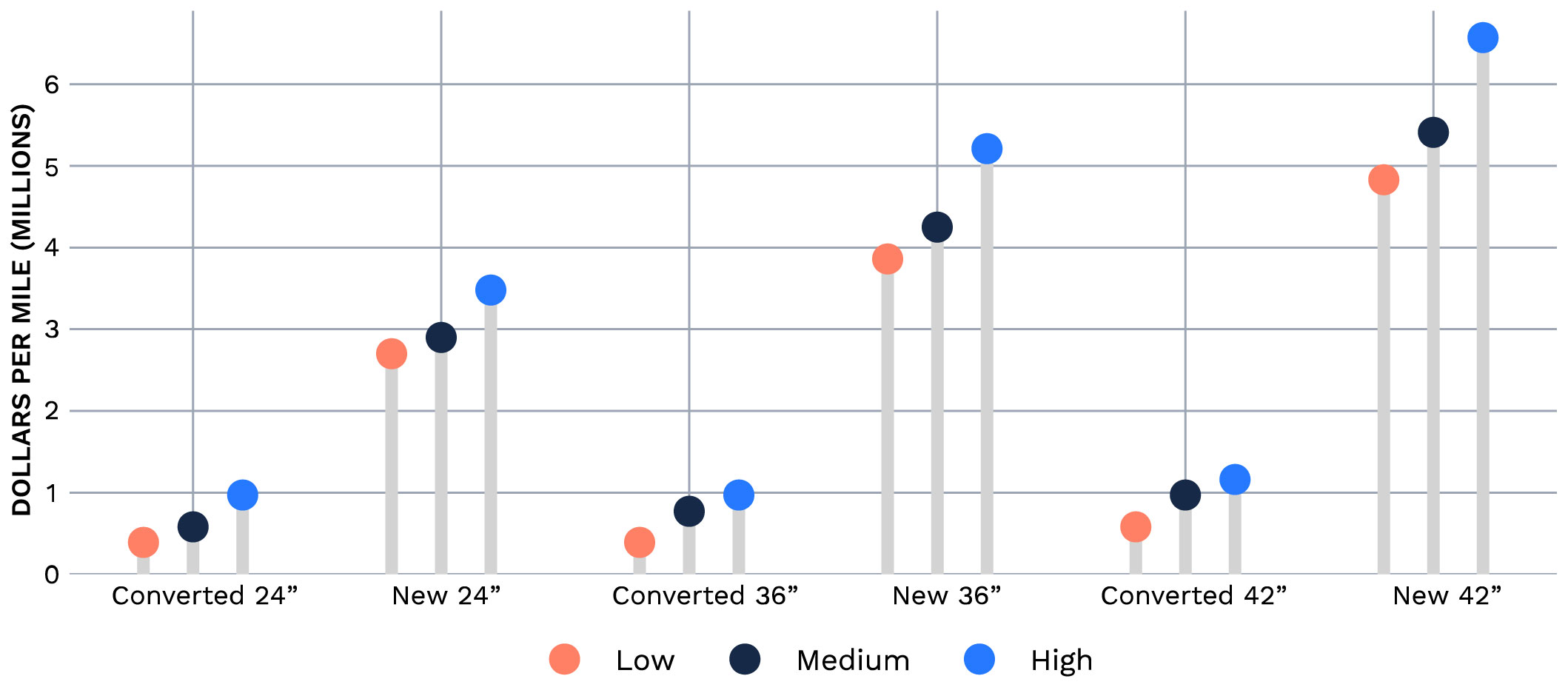

Converting existing natural gas pipelines for hydrogen use presents substantial cost savings versus building new pipelines, ranging from about 10% to as high as 30%. In the European plan, the total cost estimate assumes that 69% of the pipeline network will be repurposed natural gas pipelines and 31% will be new construction.

But here in the U.S., environmental purists are pushing, as the only viable path to net-zero emissions, a plan that requires deep electrification of the entire economy and an almost exclusive reliance on wind and solar to generate that power. By insisting on a single solution and rejecting all other paths, the purists would foreclose participation by existing incumbents in the natural gas industry and the existing gas infrastructure in the transportation and storage of hydrogen as fuel. But more importantly, the insistence on a single solution puts the achievement of the stated goal at risk.

New

Most new generation being built in the U.S. right now is wind and solar, and the bulk of these facilities are fairly small compared to traditional thermal power plants, like natural gas and nuclear.

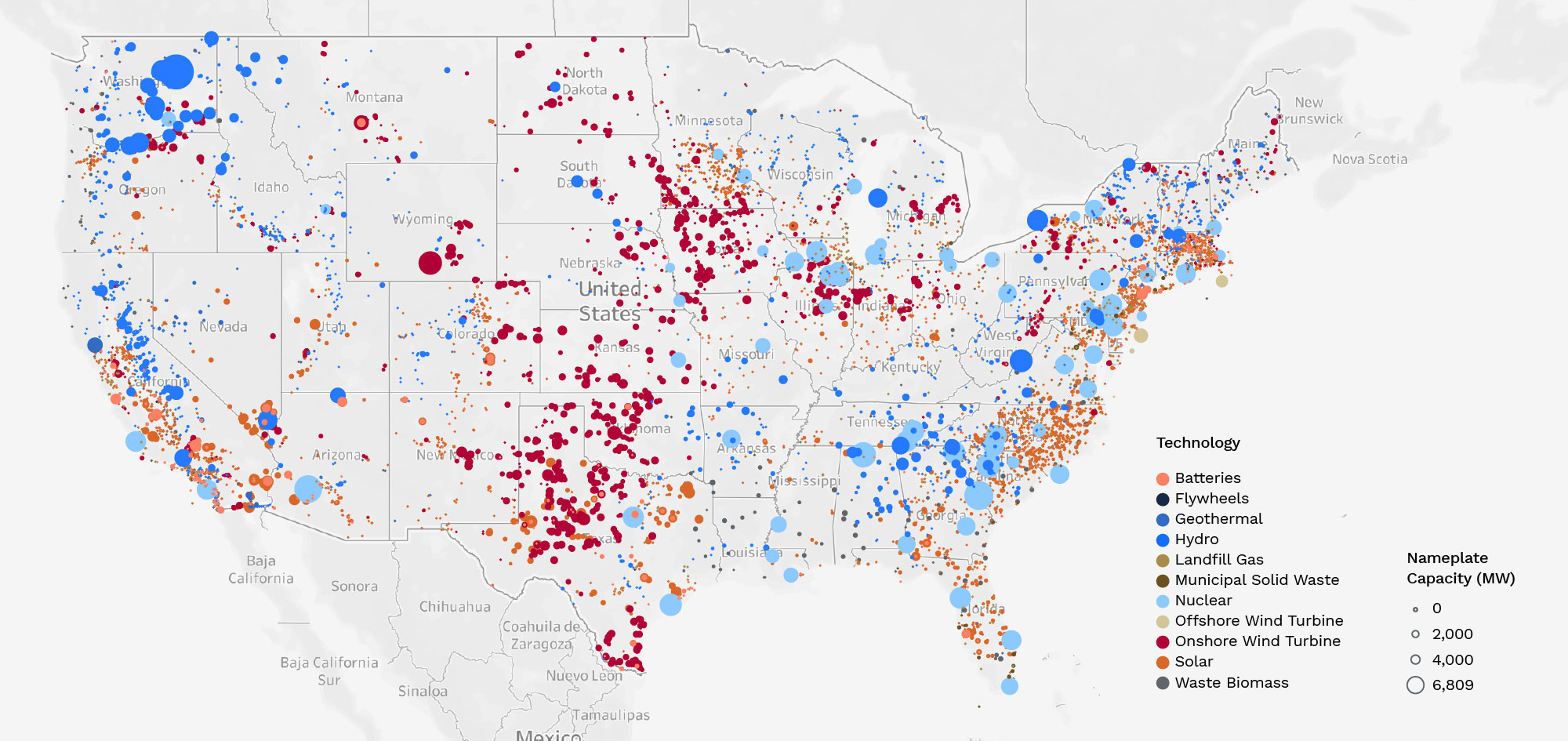

So where are we today on renewable projects useful for electricity generation? We aggregated all the renewable capacity currently in-service and planned projects through 2027 on the map below (an excerpt from Arbo's Renewables Dashboard) — everything from wind to landfill gas. Together it equates to 0.39 terawatts of generation capacity.

The U.S. electric grid delivers more than 3,800 terawatt-hours of electricity to roughly 159 million residential, commercial and industrial end-users each year. So, even if everything on the above map was operational, and could miraculously be running 24 hours a day, 365 days a year, at 2050’s forecasted usage we have 28.2% of the generation capacity needed. Therefore, one can extrapolate that this map needs to be totally filled with colored bubbles to get to NZ50.

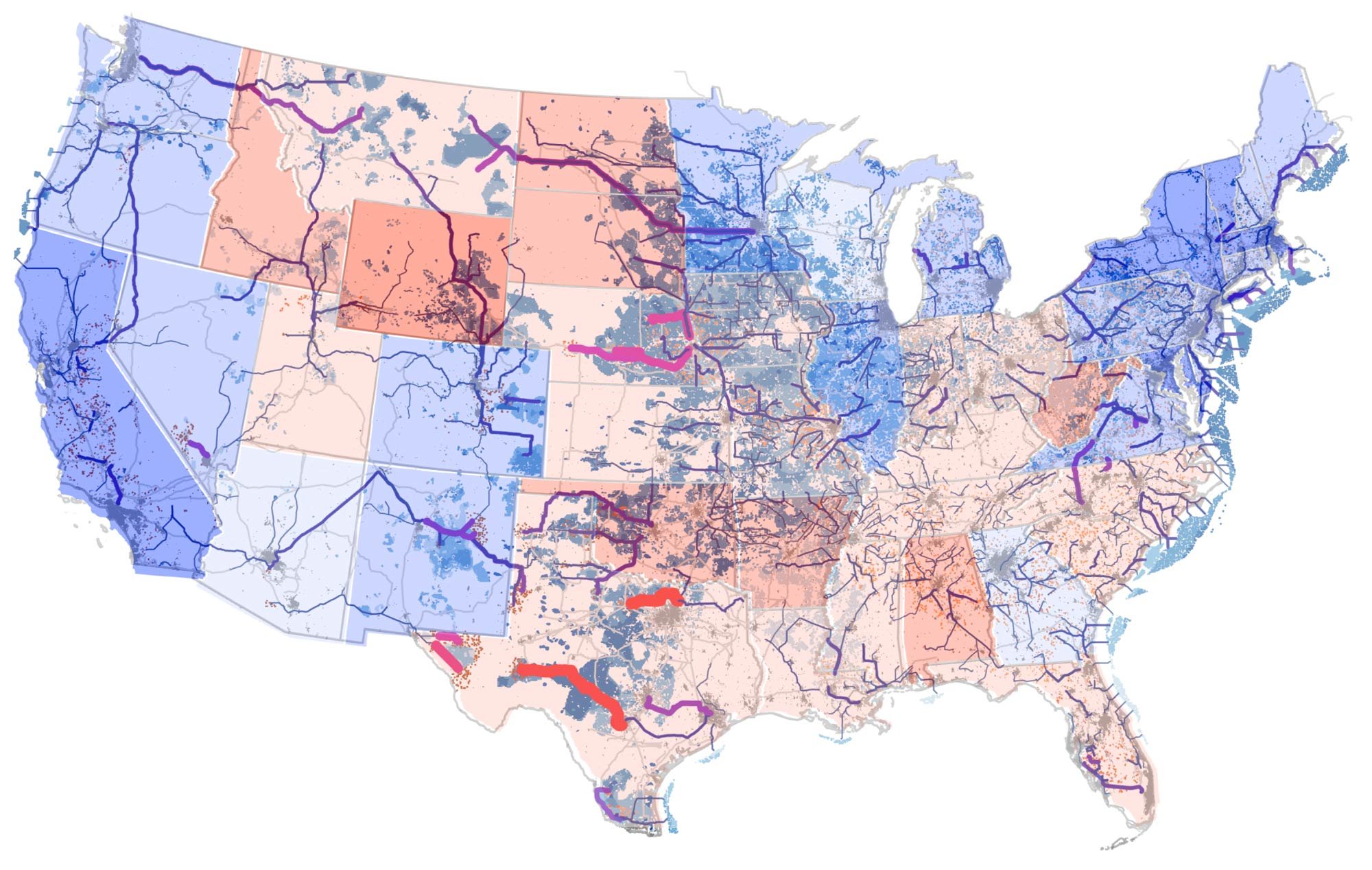

Even if we achieve enough renewable generation, we still need to expand our grid by 5.3 times between now and 2050, according to Princeton University’s Net Zero Report. As seen below, this grid will need to be designed to bring wind and solar power from red states to blue states, and must cross a number of states that neither benefit from the new wind and solar construction nor need the power requiring construction of this huge high-voltage grid. The level of polarization in U.S. politics combined with a lack of federal siting authority present potentially insurmountable challenges to achieving this plan by 2050.

Alternatively, there is an opportunity for entities supporting paths to NZ50 that incorporate robust use of blue and green hydrogen to demonstrate that they can more realistically achieve the goal of net-zero by 2050 in a manner that the International Energy Agency has identified as being the “most technically feasible, cost‐effective and socially acceptable” alternative. The Act’s funding for various hydrogen initiatives is a starting point for the U.S.

Unfortunately for deep electrification proponents, none of the Act’s total $70 billion in energy investment is directed specifically toward increasing renewable capacity or new transmission — just a $2.5 billion loan program for which eligible projects include, but are not limited to, construction of new transmission lines.

Investment & Commerce

Public and Private

Innovation and technologies that create and change industries and markets can require massive investments backed by private capital markets in addition to government financing. Historically, government-funded basic research and development investments — like some set forth in the Act — have led to technology commercialization and associated market development. Sometimes this is a result of serendipitous discovery and sometimes more deliberate industrial policy. The internet is a famous example of this public-private partnership generating innovation, investment and infrastructure.

Notably, Shale Revolution investments were almost entirely comprised of private dollars. Given market dynamics, unit cost economics, and policy-driven origins, this doesn’t seem as likely for “electrification.” Government-directed spending and incentives will be a big part of the required investment, which

has not been addressed in the Act.

Investment Size and Access to Capital

What actually needs to be spent annually and in total to get to NZ50 is not easily or accurately estimable, but here are a few reference numbers from the Business Roundtable:

PJM Interconnection (a Regional Transmission Organization operating from parts of Illinois and Tennessee in the West to the Mid-Atlantic in the East) calculated that reaching 30 percent renewable penetration would require 1,000–3,000 miles of additional transmission lines, at a total cost of $5.0 billion–$13.7 billion.

An estimated $25 billion–$40 billion in additional transmission infrastructure investment is needed through 2025 just to comply with requirements associated with existing state-level renewable portfolio standards.

According to the U.S. Energy Information Administration, U.S. utilities spent $40 billion on transmission in 2019, with about half of that dedicated to new transmission investment. And according to S&P Global, the reconciliation bill currently under Congressional consideration would authorize only $1.5 billion in U.S. Department of Energy grants for new high-voltage transmission projects.

The current landscape finds private capital markets becoming more restrictive. American capitalism historically allocated investments primarily on potential for profitable returns. Now our capital markets have broader stakeholder-driven objectives in areas such as ESG, and activist shareholders significantly influence capital and strategy. There are indications that systemic change is happening and will affect the most needed and impactful investments in innovation and infrastructure.

Larry Fink, CEO of the world’s largest asset manager, Blackrock, made headlines with his 2020 investor letter announcing intentions to exit companies viewed to have high sustainability risks and to require not just those in the energy sphere — but all companies — to disclose their sustainability plans. His 2021 letter expands on these new policies:

“Given how central the energy transition will be to every company’s growth prospects, we are asking companies to disclose a plan for how their business model will be compatible with a net zero economy – that is, one where global warming is limited to well below 2ºC, consistent with a global aspiration of net zero greenhouse gas emissions by 2050.”

The data and methodologies for allocating capital based on NZ50 will likely be problematic. For example, if a diversified energy company has large non-renewables and renewables based businesses and under one public listing, then it may have more difficulty accessing capital markets.

Retail Prices

More restrictive capital markets and the allocation of federal spending are only one constraint or enabler of energy evolution success. A big determinant will be the individual consumer’s willingness to pay a “green premium” and the facilitation of that willingness by rate governing regulators, such as the public utility commissions.

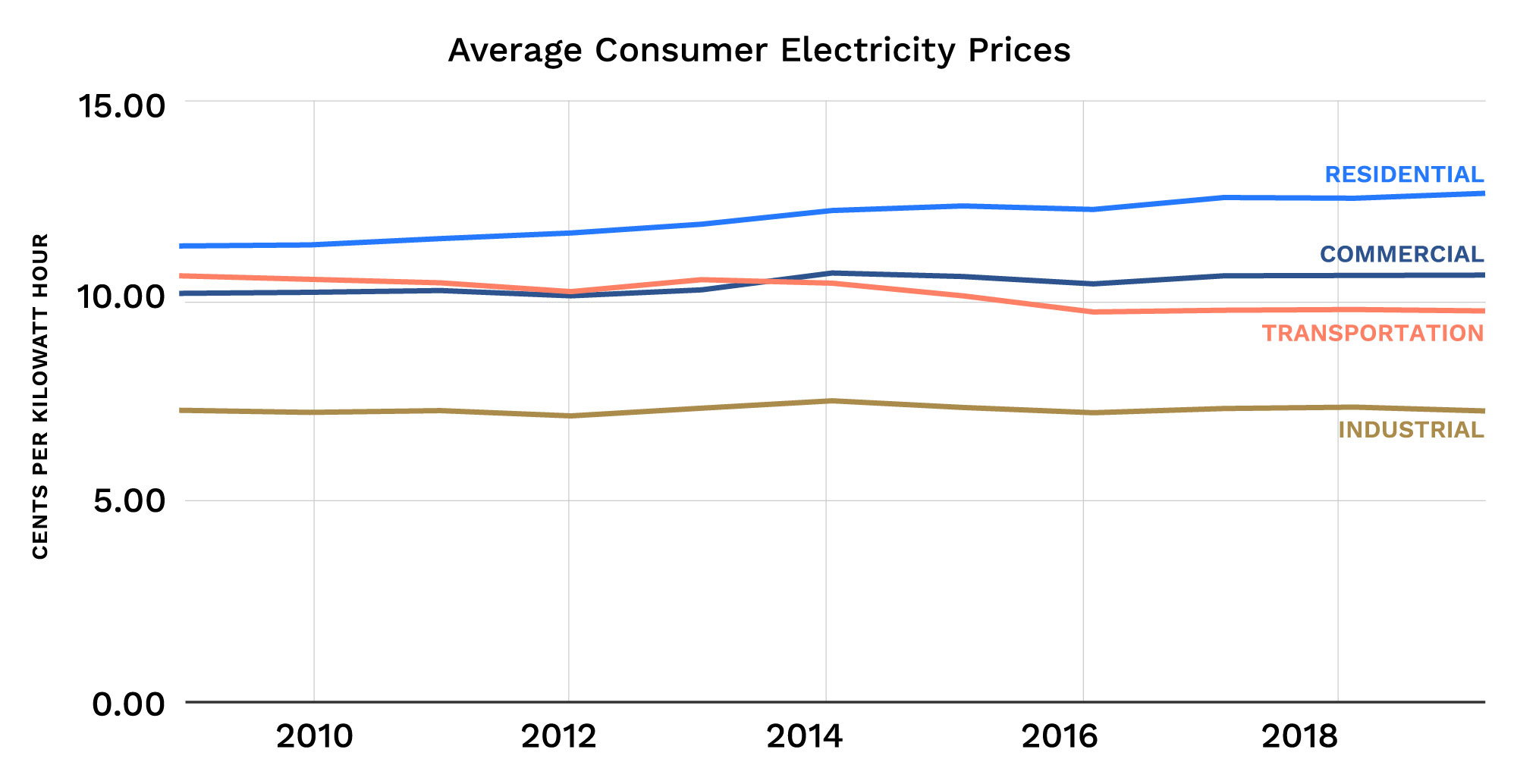

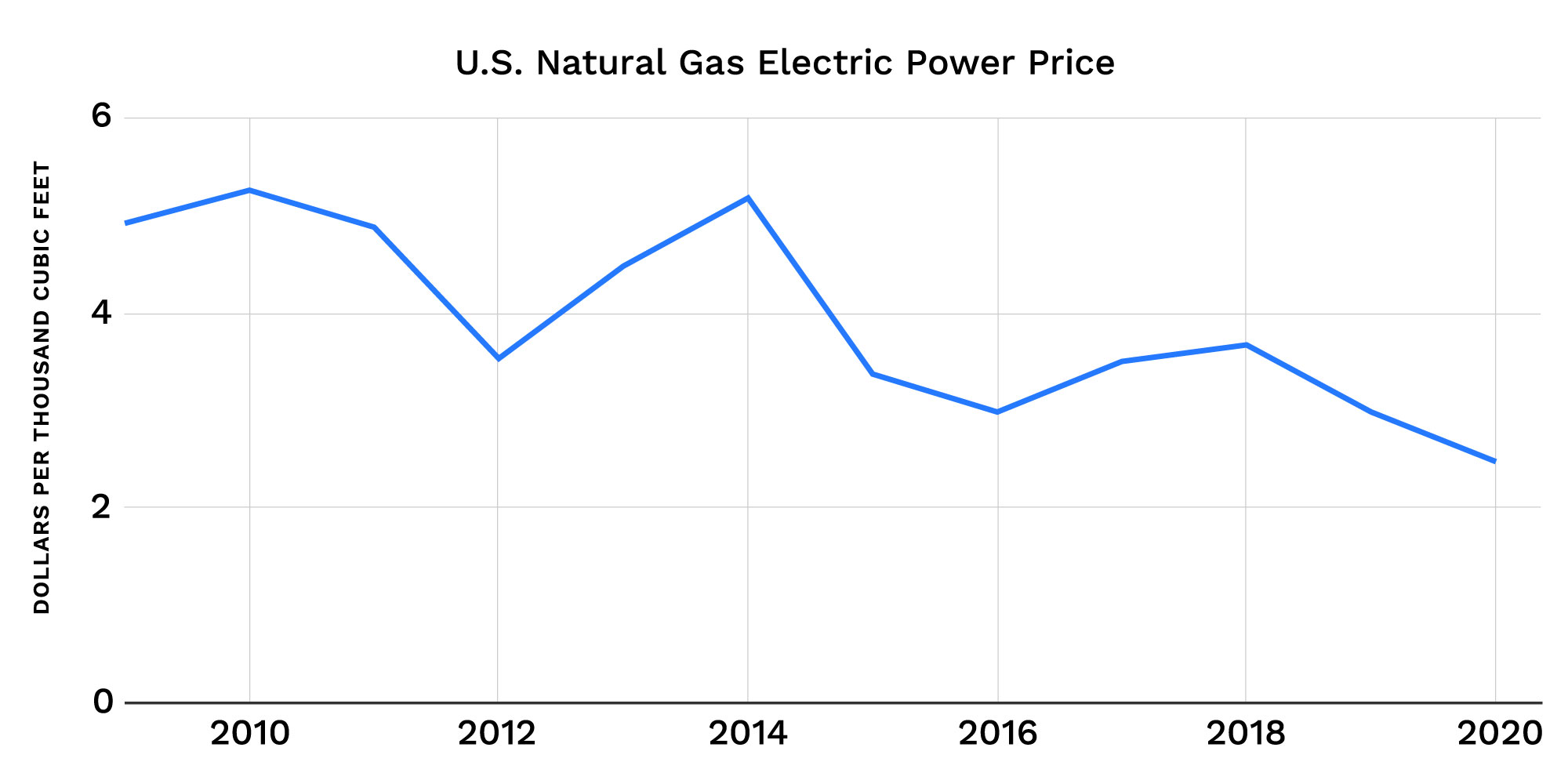

During the Shale Revolution, the U.S. retail consumer did not experience increased prices. As seen in the charts below, electricity prices stayed flat, and natural gas prices for electricity decreased due to abundant supply.

Wholesale Transactions

Most of this report concerns facilitation of the interconnectivity of electrical transmission infrastructure and transportation of energy between supply and demand centers, but facilitation of related commerce will also play a critical role on the road to NZ50. Transactions between wholesale buyers and sellers will need increased efficiency and transparency. Commodities markets include all manner of buyers and sellers from the industrial consumer to large trading houses and brokers to purely financial market makers and speculators.

The complexity of energy commerce is increasing in concert with the expanding number and distribution of energy sources, as well as the need for new pricing mechanisms and markets for instruments such as carbon offsets and products such as responsibly sourced natural gas. This dynamic will challenge wholesale participants’ ability to continuously and transparently access evolving value chains and markets.

Conclusion

The imperative for the world to evolve its production and consumption of energy to combat climate change is clear. Change to the generation, transmission, distribution and consumption of electricity must be a foundation of the energy evolution.

For the U.S. to lead this massive decarbonization effort while maintaining energy independence, it will need to improve its regulatory regimes, foster innovation, make big (bigger) investments, and harness both new and existing infrastructure.

If you enjoyed this article, subscribe to Arbo’s blog — developed and delivered with data and actionable POV.

Our data-driven analyses are relied upon by c-suites, commercial teams, traders, fundamental analysts, and marketers.