Demystifying LNG Terminal Timelines

Originally published for customers November 29, 2023.

What’s the issue?

Building LNG terminals is a complex process involving overlapping federal and state permitting authorities, with FERC authorizing siting and construction. Although subscribing to a FERC docket is relatively simple, gauging construction progress is challenging due to the heavily redacted or privileged nature of LNG project filings.

Why does it matter?

LNG exports are expected to be the fastest growing source of demand in an increasingly intricate natural gas market. Coal retirements are also intensifying the need for natural gas as a base-load generator and the integration of renewables into the grid is increasing peak demand for natural gas. Navigating this dynamic terrain necessitates well-informed business decisions founded on comprehensive historical data-driven analyses and expert insights into intricate permitting procedures, regulatory developments, and ongoing litigation.

What’s our view?

To demystify LNG terminal construction, in addition to federal and state permitting and related litigation, we assess ten key FERC orders commonly shared across most projects that typically follow a pattern — a prolonged construction phase followed by a cluster of orders that are issued about a year before a terminal goes into service. Leveraging historical data from existing terminals, we can forecast the projected range for a project's in-service date, beginning with the initial order authorizing site preparation. Currently, there are five associated LNG projects that have secured final investment decisions, obtained all necessary permits, and are in the construction phase. However, based on available data, the majority of this capacity is not anticipated to come into service until 2026.

Building LNG terminals is a complex process involving overlapping federal and state permitting authorities, with FERC authorizing siting and construction. Although subscribing to a FERC docket is relatively simple, gauging construction progress is challenging due to the heavily redacted or privileged nature of LNG project filings.

LNG exports are expected to be the fastest growing source of demand in an increasingly intricate natural gas market. Coal retirements are also intensifying the need for natural gas as a base-load generator and the integration of renewables into the grid is increasing peak demand for natural gas. Navigating this dynamic terrain necessitates well-informed business decisions founded on comprehensive historical data-driven analyses and expert insights into intricate permitting procedures, regulatory developments, and ongoing litigation.

To demystify LNG terminal construction, in addition to federal and state permitting and related litigation, we assess ten key FERC orders commonly shared across most projects that typically follow a pattern — a prolonged construction phase followed by a cluster of orders that are issued about a year before a terminal goes into service. Leveraging historical data from existing terminals, we can forecast the projected range for a project's in-service date, beginning with the initial order authorizing site preparation. Currently, there are five associated LNG projects that have secured final investment decisions, obtained all necessary permits, and are in the construction phase. However, based on available data, the majority of this capacity is not anticipated to come into service until 2026.

Common FERC LNG Orders

In an effort to add some certainty to LNG project progress timelines, we reviewed related FERC filings. We found ten orders that are present in most LNG projects, but it is important to note that each one is different, so not all of these orders are present for every terminal, and they do not strictly follow this sequence. It is also important to view this data within the context of sample size. While we have looked for these orders in all projects that have been constructed, that amounts to seven projects in total. Finally, these orders do not always have the same title, so we focus on the activity the order authorizes.

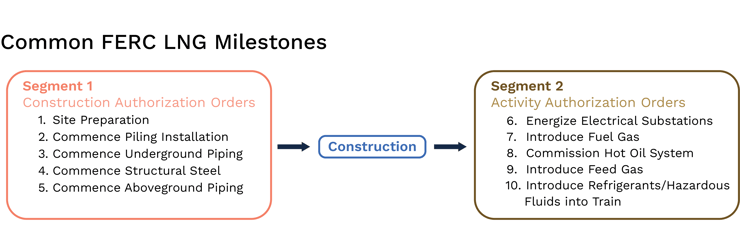

The orders we selected authorize the project developer to conduct some sort of construction, but they do not forecast how long that construction will take. So, we have divided the orders into two segments as shown below — the first phase focuses on orders authorizing construction of key components common to most LNG terminals, while the second phase generally focuses on orders that authorize actions a project developer can take once the majority of the construction is completed. The lull between these two segments is how long the actual construction takes.

For the purposes of this article, we focus on segment 1 timelines as there are currently five projects under construction that have not entered into segment 2 yet — meaning they have yet to receive any of the below segment 2 orders. Receiving any authorization in segment 2 generally signifies significant progress with construction, and a fast approaching in-service date.

Segment 1 LNG Construction Authorization Orders

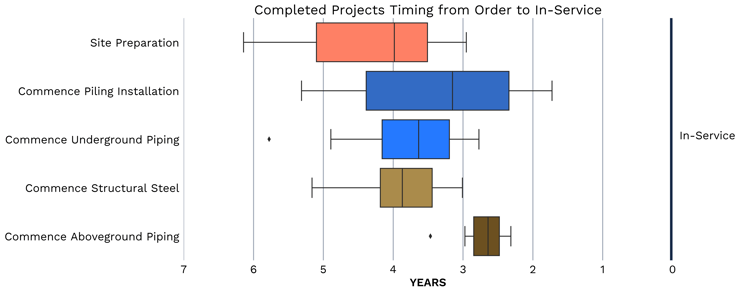

For this segment we show the median segment 1 construction time across all projects and highlight the median construction time of each activity authorized by these five orders. Due to the largely privileged nature of most filings for LNG terminals, the only way to really know that these major construction activities are complete is when a project produces first gas or enters into service. Therefore, to estimate the time it takes to actually build these segments we must measure from the time each construction authorization is granted to the date a terminal has produced first gas or entered service. As shown below, we can calculate the median construction time of each authorization, and the overall median total construction time starting from site preparation to in-service is just under four years. The middle 50% of projects takes between 3.5 and 5.1 years to reach in-service.

Additional Context and Unique Circumstances

We also track the unique circumstances associated with each LNG Project, including whether a project is being built from scratch, or is taking advantage of pre-existing infrastructure, the number of trains and unique train designs (e.g. modular), related filings in other dockets, associated pipelines, DOE commodity time extension authorizations or denials (see DOE Changes Rules on LNG Export Licenses, But Will It Matter? ) and litigation.

For example, the U.S. Court of Appeals for the Fifth Circuit recently invalidated an emissions permit for Sempra's Port Arthur LNG export terminal in Texas. The court found that the Texas Commission on Environmental Quality (TCEQ) didn't enforce the same emissions limits on Port Arthur as it had on other similar projects, such as the Rio Grande LNG project. Despite this, Sempra mentioned that construction is ongoing based on existing permits and that they are collaborating with TCEQ.

In Texas, most air permits aren't required for construction but are necessary before operation. However, the invalidated permit in question is a "Prevention of Significant Deterioration" (PSD) permit under the Clean Air Act. Under the PSD program, specific pre-construction activities for projects like the Port Arthur LNG terminal can commence before receiving the permit, albeit with limitations. These activities typically include preparatory tasks like land clearing or initial infrastructure setup, subject to stringent guidelines to prevent significant environmental impact. While we view Sempra's construction as signaling a potential resolution, we are monitoring the situation closely to see if something more material will be required that could impact the timeline.