EPA Proposes Applying Good Neighbor Rule to Certain Compressor Stations

Originally published for customers on December 14, 2022

What’s the issue?

Earlier this year the EPA issued a proposed rule under its “Transport Rule” to ensure that the 26 states identified in the proposal do not significantly contribute to the National Ambient Air Quality Standards (NAAQS) in downwind states, which are the “good neighbor” obligations of the states under that regulatory regime. For the first time, this rule would apply to facilities other than power plants, including certain internal combustion engines used in compressor stations in the natural gas transportation sector.

Why does it matter?

The rule is currently a proposal and compliance will not be required until 2026. But because it only applies in certain states and because it applies to only certain types of engines, its impact across the industry will be very company specific.

What’s our view?

While a complete analysis would require very specific information on the actual types of units used at each compressor station owned by a company, the impact of the new rule appears to fall most heavily on National Fuel Gas Supply and Texas Gas Transmission.

Earlier this year the EPA issued a proposed rule under its “Transport Rule” to ensure that the 26 states identified in the proposal do not significantly contribute to the National Ambient Air Quality Standards (NAAQS) in downwind states, which are the “good neighbor” obligations of the states under that regulatory regime. For the first time, this rule would apply to facilities other than power plants, including certain internal combustion engines used in compressor stations in the natural gas transportation sector. The rule is currently a proposal and compliance will not be required until 2026. But because it only applies in certain states and because it applies to only certain types of engines, its impact across the industry will be very company specific.

While a complete analysis would require very specific information on the actual types of units used at each compressor station owned by a company, the impact of the new rule appears to fall most heavily on National Fuel Gas Supply and Texas Gas Transmission.

The EPA Proposal

In a proposed rule issued in February 2022, the EPA for the first time proposed to impose enforceable emissions standards that will apply during the ozone season (annually from May to September) for seven non-electric generating industries in 23 states in 2026. One of those seven industries is the pipeline transportation of natural gas. The proposed rule would impose enforceable limits on stationary, natural gas-fired, spark ignited reciprocating internal combustion engines that have a maximum rated capacity of 1,000 horsepower (hp) or greater. The rules provides specific limits with respect to engine type and fuel:

Impact on Industry

The enforcement of these new rules will require the operators of these types of engines to either retrofit them with pollution controls to meet the new limits or to replace them with a different type of drive that is not subject to the new rules, such as a gas turbine or electric drive motor. The cost of either alternative could be substantial depending on the extent of the use of these types of engines. In addition, the costs for making these changes would typically need to be included in the maintenance capital budget of the pipeline because there will be no increase in throughput that arises from either the installation of pollution controls or the replacement of the covered engines with similar horsepower alternatives. Thus, the ability to recover such costs will generally be deferred until the pipeline’s next rate case.

The Impact Will Vary by Company

A detailed assessment of the impact on a specific company would require a detailed analysis of the units used in each of its compressor stations. We can get a general understanding of how varied the impact might be across companies by using generalized information about the location and size of the compressor stations that each company operates.

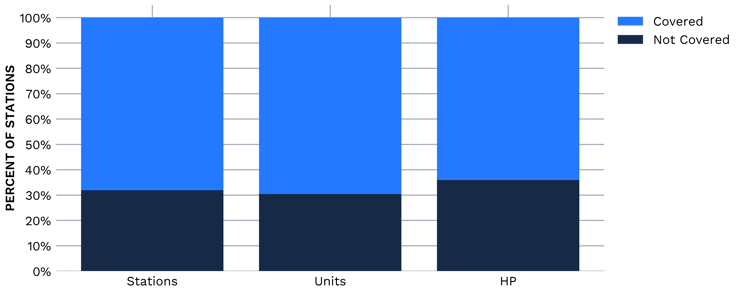

Because of the limited number of states that are to be covered by the proposed rules, there is a large percentage of interstate pipeline compressor stations that will be exempt from the new rule.

As seen above, based on data maintained by Oak Ridge National Laboratory, about one-third of the compressor stations, whether measured by stations, number of compressor units, or horsepower, will be completely exempt from the proposed regulation.

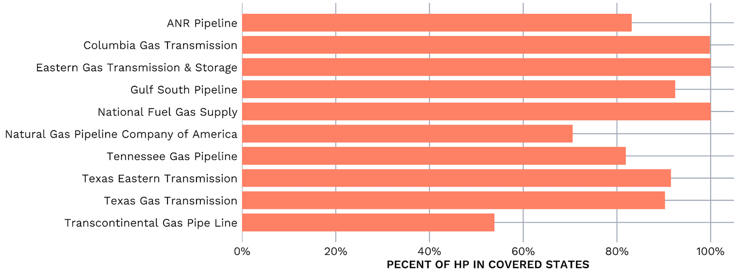

When we look at the stations located in the covered states, we find that ten pipelines report having over thirty compressor stations in those states and those ten pipelines own about half of the stations in the entire industry, whether measured by stations, units or horsepower.

But Not All Stations Owned by the Largest Pipelines Will Be Impacted

The impact on these top ten pipelines will also be varied, however.

As seen above, most, if not all, of the compressors these top ten pipelines own are located in covered states, but Transcontinental Gas Pipe Line has only about half of its total installed horsepower in states that are covered by the new regulation.

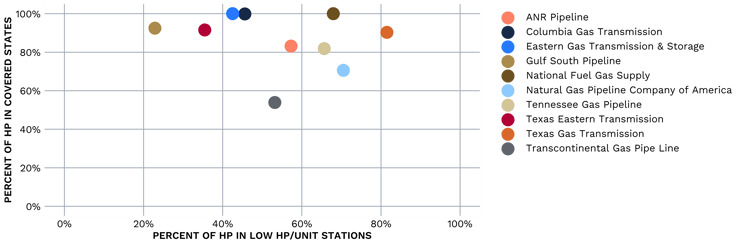

Also, the regulation only applies to certain types of compressor units, namely internal combustion engines. While not a perfect match for determining the applicability of the new regulation, horsepower per unit can act as a reasonable proxy for stations that might be covered because the other energy sources like gas turbines and electric motor drives tend to be higher in horsepower per unit.

Using 5,000 horsepower per unit as a demarcation point between stations with a low and high horsepower per unit, we see that the stations of these pipelines also vary greatly on this measure.

.png?width=740&height=282&name=Untitled%20design%20(1).png)

As seen above, Texas Gas Pipeline has more than 80% of its installed horsepower in stations with an average horsepower per unit below 5,000. Whereas, less than 25% of Gulf South’s installed horsepower is in these smaller horsepower per unit types of stations. Therefore, Gulf South may not have as much exposure to the regulations as Texas Gas because its stations may not contain the type of engine that is subject to the regulations.

By combining these two measures, percentage of horsepower in states subject to the regulation and percentage of horsepower in stations with less than 5,000 horsepower, we can begin to see how the proposed regulation may impact these large pipelines.

As seen above, it would appear that National Fuel Gas Supply and Texas Gas are most likely to be heavily impacted by these new regulations. National Fuel appears to have all of its stations in states covered by the new regulation and more than two-thirds of its horsepower in these smaller per unit compressor stations. Texas Gas, meanwhile, has over 90% of its stations in covered states and an even greater percentage in these smaller horsepower per unit stations.

As we stated at the beginning, these regulations will not likely impact any pipeline before 2026, but they may start taking the proposals into account as they consider any replacement projects that they have slated for the interim.