SEC-Proposed GHG Disclosure Rules Are Likely Coming — And Soon

Originally published for customers April 27, 2022.

What’s the issue?

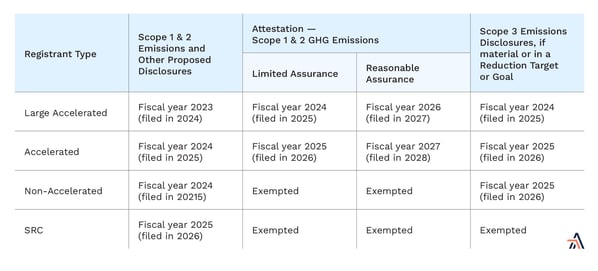

On March 21, 2022, the U.S. Securities and Exchange Commission (SEC) issued a proposed rule that would require public companies to disclose extensive climate-related information in their SEC filings. Depending on the company’s size, the required disclosures would begin between 2024 and 2025, for the prior fiscal year. In addition to general disclosures, all Scope 1 and 2 greenhouse gas (GHG) emissions would be reported. Scope 3 emissions would be required between 2025 and 2026.

Why does it matter?

Gathering the data for the required disclosures will be challenging, but especially so under the currently proposed timelines. Large companies would need to begin accumulating the necessary data in January 2023, less than eight months from now. The GHG emissions reported go beyond those reported to the U.S. Environmental Protection Agency and use of the data may further increase the cost of both debt and equity capital for fossil fuel-related entities, at a time when the government is insisting that such entities produce more to support Europe in its effort to wean itself from Russian energy.

What’s our view?

Comments on the proposed rule are due on May 20, 2022, and the SEC may have proposed the aggressive timelines as a means to limit comments or required changes in the actual disclosure requirements. It appears that a majority of investors, representing trillions of dollars of assets, support the proposed rule. This will strengthen the SEC’s hand because under Supreme Court precedent if most investors say they want specific data or information to make a decision, then by definition “a reasonable investor would consider the item important when making an investment or voting decision.”

On March 21, 2022, the U.S. Securities and Exchange Commission (SEC) issued a proposed rule that would require public companies to disclose extensive climate-related information in their SEC filings. Depending on the company’s size, the required disclosures would begin between 2024 and 2025, for the prior fiscal year. In addition to general disclosures, all Scope 1 and 2 greenhouse gas (GHG) emissions would be reported. Scope 3 emissions would be reported if material, which, for oil and gas producers, they will be. Gathering the data for the required disclosures will be challenging, but especially so under the currently proposed timelines. Large companies would need to begin accumulating the necessary data in January 2023, less than eight months from now. The GHG emissions reported go beyond those reported to the U.S. Environmental Protection Agency, and use of the data may further increase the cost of both debt and equity capital for fossil fuel-related entities at a time when the government is insisting that such entities produce more to support Europe in its effort to wean itself from Russian energy.

Comments on the proposed rule are due on May 20, 2022; the SEC may have proposed the aggressive timelines as a means to limit comments or required changes in the actual disclosure requirements. It appears that a majority of investors, representing trillions of dollars of assets, support the proposed rule. This will strengthen the SEC’s hand because under Supreme Court precedent if most investors say they want specific data or information to make a decision, then by definition “a reasonable investor would consider the item important when making an investment or voting decision.”

SEC’s Proposal

The proposed rule is 490 pages long, and so, by necessity, we can only provide an overview and really only of one aspect of the rule, which is the GHG disclosure portion. In addition, because of the complexity of the rules and standards incorporated, we prepared this summary with the help of Dirk Cockrum, ESG national practice leader for BKD, a national CPA and advisory firm with clients in a wide range of industries, but especially in the energy industry, where its clients include companies in the oil and gas industry, as well as power utility and alternative energy industries.

The proposed timelines for the GHG disclosures required under the proposed rule depend on the filing status of the company and the category of the emissions being disclosed. Filing status is dependent on public float (the number of outstanding shares in the hands of public investors as opposed to company officers, directors, or controlling-interest investors) and annual revenues, and companies report their filing status on the first page of their annual 10-K reports.

Scope 1, 2 & 3 Emissions for Energy Companies

Generically, Scope 1 emissions are the direct emissions from facilities owned or controlled by the reporting company. Scope 2 emissions include indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the company to operate its business. Scope 3 emissions expand to include all other indirect emissions that result from the production and use of the company’s products.

For pipelines, energy producers, and energy users, the following are typical examples of Scope 1, 2 and 3 emission sources:

.jpg?width=1024&name=Blog%2004272022%20(2).jpg)

As seen above, what is considered within the Scope 3 emissions can turn on how a business is run. If a pipeline takes ownership of the product that is transported on the pipeline, as some intrastate pipelines do, then the emissions from the use of that product will be included in the pipeline’s Scope 3 emissions. Conversely, if the pipeline never takes ownership of the product transported, like interstate gas pipelines that can only transport gas for shippers that hold the title to the gas, then the emissions from that gas will not be counted at all in the pipeline’s emissions. This difference in treatment may have a significant impact on how a pipeline is viewed by the investment community. Pipelines that do not take title to the product transported would reflect zero downstream emissions, and pipelines that do take title may need to report the emissions associated with use of the gas twice, once as a purchased good and a second time as a sold good.

There may be other differences in how emissions are calculated as well from one company to another as the proposed rule is rooted in the World Resource Institute’s GHG Protocol, but the SEC does not require the use of the GHG Protocol standards and guidance when calculating GHG emissions. Instead, the SEC rule allows for some flexibility in the choice of GHG emissions methodologies to permit companies to adapt to new approaches as they emerge.

In addition, like financial accounting, accounting for GHG emissions requires significant estimates and assumptions. Financial estimates and assumptions include revenue recognition, income taxes, useful lives and depreciation rates, fair values, and reserves for rate cases, environmental claims, and litigation. Emissions are typically estimated using emissions factors coupled with measurements of activity. Most emissions are not directly measured. For each type of emissions source, there also is often a variety of choices available for emissions factors and activity measures. The proposed rule does require disclosure of emission calculation method changes, so there will be greater transparency on this topic.

FERC GHG Policy Goes Far Beyond the SEC’s Rule

In FERC’s New Rule on GHG Ignores the Precedent It Relied On, we discussed the Federal Energy Regulatory Commission’s (FERC) recently issued, then more recently retracted, GHG policy that considers the downstream GHG impacts of a gas pipeline’s project, at least for determining the scope of FERC’s environmental review, and further encourages the pipelines to propose mitigation for such downstream impacts. Unlike FERC, which seems to want to hold the pipeline accountable for such impacts as if all the gas a project could potentially deliver is burned, under the SEC proposal, these emissions would not even be reported by the pipeline companies transporting the natural gas, but instead would be reported as emissions only by the entities that produce, sell, and buy the natural gas.

The New Rule Will Require Significant Organizational Changes at Companies

For Scope 1 emissions, the accounting, financial reporting, and GHG reporting functions inside companies will need to start working together at a level not necessary before. Before the proposed SEC rule, these departments generally did not need to interact much. The groups prepare reports for different agencies, on different schedules, and with different organizational boundaries, using different accounting systems and methodologies. Environmental departments’ GHG reporting functions will have the data, systems, and calculations necessary for the Scope 1 GHG emissions metrics. However, the GHG emissions reporting process for SEC filings will be driven by how entities are consolidated on the financial statements, the financial reporting schedule, and accounting attestation standards. For Scope 2 emissions, quantities and locations of electricity purchases will be required along with information about the sources of that electricity. Scope 3 emissions will require a variety of data from a variety of sources, including the pipelines that may transport gas for both producers and end-users.

To achieve the rigor of financial accounting and attestation standards, GHG emissions reporting departments are sure to grow, as are necessary investments in GHG accounting and internal control systems. Given the increasing importance and inherent complexity of GHG emissions calculation methodologies, it’s not unreasonable to expect that companies large and complex enough to warrant having a controller overseeing their financial accounting may someday have a GHG emissions accounting controller.

Further, joint ventures (JV) that are consolidated on any of a JV partner’s financial statements will need to start sharing emissions data as they currently do financial data. It’s common for midstream energy companies to use JVs, often to mitigate the risk of the large capital outlays required for pipeline projects. Some of these JVs’ financial data are consolidated on the financial statements of partners who do not control the GHG emissions data. Under the proposed rule, those partners who consolidate the JV’s financials also will need to consolidate the JV’s emissions. JV agreements typically specify who creates the entity’s financial statements and how and when those financial statements are distributed to the other JV partners. JV agreements will need to be updated to address how and when emissions data are shared.

Pipeline companies also may receive inquiries for emission data from customers and shippers reporting their Scope 3 emissions. Scope 3 emissions include the emissions associated with the transportation and distribution of purchased and sold goods, raw materials, and other inputs.

We have barely scratched the surface of what this all may mean, but clearly firms like BKD will be able to help clients adjust to this new reporting regime, which is almost certain to be imposed at some point in the not-too-distant future.

If you would like to discuss this issue in depth, please contact Arbo or Dirk Cockrum with BKD.

This article is for general information purposes only and is not to be considered as legal advice. This information was written by qualified, experienced BKD professionals, but applying this information to your particular situation requires careful consideration of your specific facts and circumstances. Consult your BKD advisor or legal counsel before acting on any matter covered in this update.

Article reprinted with permission from BKD CPAs & Advisors, bkd.com. All rights reserved.