PJM Performance During Winter Storm Elliot Shows Many Flaws

Originally published for customers May 19, 2023

What’s the issue?

Natural gas-fired power plants are often promoted as the perfect match for reliable power to offset the intermittency of renewables. But the most recent performance by such plants during Winter Storm Elliot in the PJM region shows that there are still issues that must be addressed to make that case.

Why does it matter?

The ability of a natural gas plant to quickly ramp up and down its production of electricity is a key characteristic that almost no other power source can match. However, during Winter Storm Elliot many gas-fired plants in the PJM region failed to perform when called upon.

What’s our view?

The ability of a natural gas plant to ramp up its production can only be realized, however, when there is a matching fuel supply that can also be ramped up and down to match the output of the generator. While there is plenty of blame to be shared for the failure of natural gas to perform in the PJM region, the industry needs to address this issue now if it wants to be perceived as a key component of grid reliability going forward.

Natural gas-fired power plants are often promoted as the perfect match for reliable power to offset the intermittency of renewables. But the most recent performance by such plants during Winter Storm Elliot in the PJM region shows that there are still issues that must be addressed to make that case. The ability of a natural gas plant to quickly ramp up and down its production of electricity is a key characteristic that almost no other power source can match. However, during Winter Storm Elliot many gas-fired plants in the PJM region failed to perform when called upon.

The ability of a natural gas plant to ramp up its production can only be realized when there is a matching fuel supply that can also be ramped up and down to match the output of the generator. While there is plenty of blame to be shared for the failure of natural gas to perform in the PJM region, the industry needs to address this issue now if it wants natural gas to be perceived as a key component of grid reliability going forward.

Market Constructs for Reliability

We wrote a number of articles about the failure of ERCOT, the bulk power manager for Texas, to properly prepare for and respond to the stress on its system during Winter Storm Uri. We noted in Texas Winter Blackouts -- There Are Winners and Losers, But the Fight Is Far from Over, that the market mechanism chosen in Texas to ensure sufficient supply was to just boost prices as high as possible when the crisis hit and hope that there would be enough power to cover the demand, sort of the Uber surge pricing model for electricity. As we noted then, that model failed miserably during Winter Storm Uri and the financial impacts will likely take years to resolve.

Following the Polar Vortex in 2014, PJM, the bulk power manager for most of the Mid-Atlantic, chose a different path. It created a capacity market, where power providers are given an annual amount to ensure that their capacity will be available in emergency situations. However, a failure to perform when called upon in an emergency can result in substantial penalties designed to equal or exceed the annual payment received. Since PJM implemented this capacity market construct, Winter Storm Elliot was the first time the system has been tested. While it performed better than ERCOT, such that there were no rolling blackouts and it actually was able to support neighboring regions, it was far from perfect and, in particular, the performance of gas-fired plants was not particularly impressive.

Who Failed to Produce?

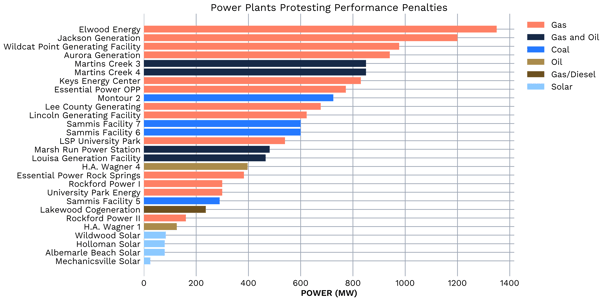

PJM has indicated in an FAQ it produced concerning the performance of its system during the storm that the main problem was not the transmission system, but the ability to produce sufficient electricity to meet the demand for power. PJM notes that the unexpected outages over the course of the two days of the storm were primarily from natural gas plants, at 63%, coal at 28%, and 4% oil, 2% nuclear, 1% hydro, and about 1% other. Not only that, but PJM also noted that over the course of the two days of the storm, 95 to 96% of units that experienced unplanned outages were from resources that had received capacity payments under its capacity market construct. PJM did not release the identity of the plants that failed to operate, but a number of them have identified themselves by filing complaints at FERC about the performance penalties that PJM is attempting to collect from them, which PJM has estimated to be between $1 and $2 billion across all power producers. One power plant has indicated that its penalty is three times its annual capacity payment, but Constellation Energy Generation, in a filing at FERC, noted that the penalties are less than 5% of the $40 billion in capacity payments made to power producers since the capacity construct was adopted following the 2014 Polar Vortex.

As seen above, the power plants that have contested PJM’s proposed penalties total almost 15,000 MW of capacity.

Enough Blame to Share

While there are always at least two sides to every story, PJM’s ability to anticipate the demands on its system appears to be a key failure, much as it was for ERCOT, which we noted in Texas: A Failure of Imagination. Most agree that PJM was properly anticipating the extent of the cold weather. But of course it had days to prepare as it watched the storm progress across the country. However, many of the gas plants that failed to perform have noted in their FERC complaints that the gas pipelines were far more proactive than PJM and began instituting emergency measures as early as for the gas day on December 21, while PJM seemed to be asleep at the switch.

In its FAQ, PJM admits that its models for demand just one day before the event “under-forecast the peak load by about approximately 8% on December 23, and 9% on December 24.” PJM also notes, however, that the PJM load forecast is not an input into the PJM Day-Ahead Market, which determines which power producers are awarded energy contracts for the following day. Instead, the Day-Ahead Market clears based on bids for demand that are received.

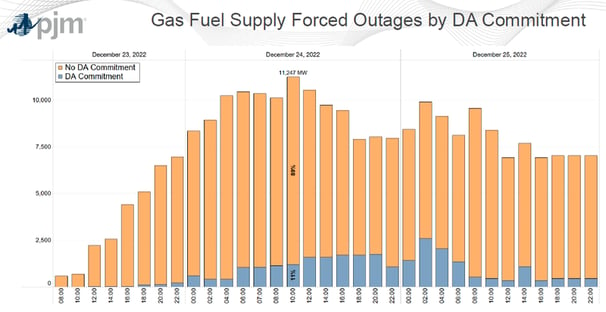

In a complaint filed with FERC contesting PJM’s proposed penalties, a coalition of power producers provided the following chart that shows those producers that were awarded bids in the Day-Ahead Market were not the primary problem, but that the forced outages for gas-fired power plants were primarily by those that had not been awarded a bid.

This distinction creates the crux of the fight between power producers and PJM. A common scenario is repeated throughout the many complaints filed by gas-fired power plants.

The gas-fired plants note that the pipelines serving PJM in anticipation of the coming storm had generally implemented operational flow orders as early as December 20, which required shippers to closely match on an hourly basis the receipts and deliveries onto their systems and to not draw in a single hour more than 1/24 of the gas that was scheduled to be delivered for that day. Because of this ratable take requirement imposed by the pipelines, power producers notified PJM that if they were going to be needed for any part of the electric day, they would need to run for the entire 24-hour gas day. Based on some of the complaints filed by the power producers, the PJM control center seemed incapable of factoring this requirement into their plans without “directing” the power plant to note in PJM’s system that the power plant was in unplanned forced outage for the day, even though the plants maintained that they could get gas even in the middle of the day, if they were given adequate notice of the need to run before the gas nomination cycles ended.

This mismatch between the gas day nomination cycle and the planning capabilities of the PJM control center appears to be the key factor that drives the disputes between PJM and the gas-fired power producers about whether they should be subjected to penalties. PJM maintains that because they failed to run when called on, the plants are subject to the penalties. Conversely, the power plants maintain they should not be subject to penalties if they were not directed to run sufficiently in advance of the gas day nomination deadlines to allow them to acquire gas.

This conflict between the gas day and electric day was identified as a key problem during the 2014 Polar Vortex, but has clearly not been resolved by FERC which regulates both the gas pipelines and the bulk power system.

The Need to Fix the Problem

As the electric grid relies more on renewable sources of energy that produce power on an intermittent basis, a key demand is a source of power that can ramp up and down quickly to fill the gaps between demand and this intermittent supply. Among the three traditional sources of energy, nuclear, coal and gas, only gas turbines have this capability. However, this capability, which is often touted by the natural gas industry, is truly a feature only if the gas supply to the power plants can also be ramped up and down as easily as the gas turbines can. As demonstrated by these disputes between PJM and its gas-fired power plants, that flexibility is still not here. If the natural gas industry and gas-fired power plants want to be seriously considered as a critical component of grid reliability, this failing needs to be fixed. Otherwise, solutions like battery or pumped storage will be able outperform gas in providing this critical role going forward.