Germany Intervenes in Natural Gas Storage Markets; Will Biden Follow Suit?

Originally published for customers June 22, 2022.

What’s the issue?

On June 19, 2022, Germany’s Federal Ministry for Economic Affairs and Climate Action announced new measures that the country was taking in response to Russia’s invasion of Ukraine and the resulting throttling of gas supplies from Russia.

Why does it matter?

One key step announced was an intervention in the regular natural gas storage markets to ensure that the country’s gas storage facilities were 65 percent full by August 1, 80 percent full by October 1 and at least 90 percent full by December 1, 2022.

What’s our view?

A key concern of the Biden administration is the risk of inflation, which in large part is being driven by higher energy costs. By the end of this year, it likely will have completed its withdrawals from the Strategic Petroleum Reserve. Given the current volatility in natural gas prices, ordinary market forces may not result in gas storage being fully utilized, which could lead to higher natural gas prices this winter. Thus, intervening in the gas storage markets to limit the risk of much higher natural gas prices this winter may be irresistible.

On June 19, 2022, Germany’s Federal Ministry for Economic Affairs and Climate Action announced new measures that the country was taking in response to Russia’s invasion of Ukraine and the resulting throttling of gas supplies from Russia. One key step announced was an intervention in the regular natural gas storage markets to ensure that the country’s gas storage facilities were 65 percent full by August 1, 80 percent full by October 1 and at least 90 percent full by December 1, 2022.

A key concern of the Biden administration is the risk of inflation, which in large part is being driven by higher energy costs. By the end of this year, it likely will have completed its withdrawals from the Strategic Petroleum Reserve. Given the current volatility in natural gas prices, ordinary market forces may not result in gas storage being fully utilized, which could lead to higher natural gas prices this winter. Thus, intervening in the gas storage markets to limit the risk of much higher natural gas prices this winter may be irresistible.

Germany’s Plans

In an announcement on June 19, 2022, Germany’s Federal Ministry for Economic Affairs and Climate Change announced a number of measures in response to the reduction in Russian gas as a result of Russia’s invasion of Ukraine. The steps are designed to reduce the use of gas for power generation and industrial purposes and ensure that storage assets for gas will be fully utilized going into the winter. The part of the announcement that drew the most attention was that to reduce use of natural gas for power generation, the country would rely more on coal-fired power plants. To achieve this, the country intends to upgrade coal plants that were being held in reserve to allow them to immediately return to the market and squeeze natural gas plants out.

The country also announced a demand-side management plan for industrial uses which will encourage those who can use other fuels or generally reduce their use of natural gas to do so. Finally, the Ministry announced that it was implementing a plan to make sure that all gas storage in the country was fully utilized this winter. Those holding contracts for gas storage are required to have filled their storage allotments to 65 percent by August 1, 80 percent by October 1 and 90 percent by December 1. If the current contract holders for gas storage facilities fail to reach these levels, the government has announced it will reallocate the storage rights to the market area manager, who will be obligated to have the storage filled by other market players by way of a special tender or to actually buy the gas itself and put it in storage.

Will the Biden Administration Do Something Similar Here?

While Germany’s focus is on energy security for the coming winter, the Biden administration has been focused on inflation and, particularly, energy inflation. In November 2021, the administration launched a program to release crude oil held in the Strategic Petroleum Reserve in an effort to lower prices and address a lack of supply. That program is expected to wind down by the end of this year. To date, the administration has taken little action with respect to natural gas prices even though they have been flirting with ten-year highs for months.

As the U.S. Energy Information Administration (EIA) explains on its website, the price of natural gas is driven by three main factors on the supply side: (1) U.S. natural gas production, (2) amount of natural gas in storage, and (3) net exports; and three main factors on the demand side: (1) weather, (2) economic growth, and (3) the availability and prices of other fuels. While the industry has been calling for actions to increase natural gas production, others have been calling for limits on exports, particularly LNG exports. However, we don’t see much political gain for the Biden administration in doing either of these, because increasing production would anger his environmentalist base and limiting exports would seem to be particularly harmful to our European allies who are struggling to meet their energy needs given the Russian invasion of Ukraine. A key lever that could be used to ensure that prices are moderated this winter would be to take steps like those that Germany announced to ensure that natural gas storage is fully utilized going into winter.

Market Forces May Not Result in Full Utilization of Natural Gas Storage

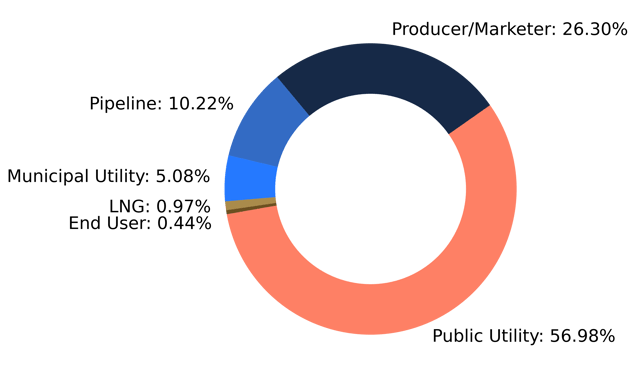

Based on data from the current quarter for contracts held by the customers of the major interstate storage companies, we see that the primary holders of that storage capacity are public utilities and producers/marketers.

As seen above, over eighty percent of the storage capacity available on the interstate system is held by public utilities and producers/marketers of natural gas. The typical market incentives for each of these two classes of storage users may not naturally lead to them fully utilizing storage for this winter.

Public utilities typically use storage as a way to reduce the average cost of gas during the winter by purchasing gas in the summer months, when it has historically been lower in price, and drawing it out for use during the higher priced winter months. However, given the fact that current prices are some of the highest we have seen in ten years, risk-averse public utilities may fear buying at today’s high prices and then seeing those prices fall this winter. Because a public utility’s purchasing program is subject to prudency reviews, a utility risks being second-guessed by its state regulator if that were to occur, which could result in it not being able to fully recover the costs of those purchases.

Producers and marketers are typically trying to lock in a temporal spread between the current price for gas and its anticipated price at some future date. But again, due to the current volatility and how the amount of gas in storage can impact future prices, the current price signals to the market could lead to reduced use of storage for this winter.

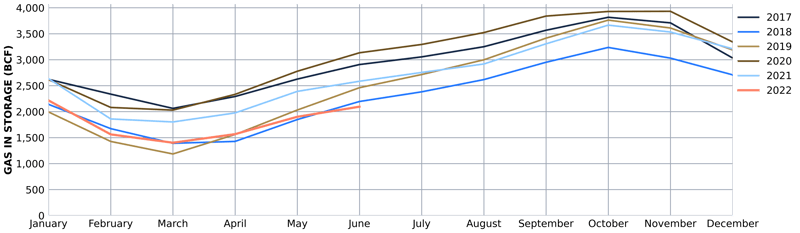

As seen above, based on EIA data, the amount in storage at the end of May is one of the lowest levels over the last five years as of that point in the year and is almost 30 percent lower than the amount in storage in May 2017.

Will Biden Act?

It is very hard to project what any administration will do to respond to a problem, especially one as politically-charged as energy prices. But as we describe above, the administration has limited levers over natural gas prices, but is certainly concerned about the impact inflation is having on the public’s perception of its job performance. However, we think it is prudent for those in the markets to at least consider the possibility that the administration will follow Germany’s lead and seek to ensure that the country’s storage facilities are being fully utilized this winter. We think it would be possible for the administration to use the Defense Production Act and enter into contracts with those holding capacity in the country’s storage fields that require those entities to fully utilize their capacity, while simultaneously ensuring that they will not suffer any losses from the sale of the gas during the winter.