Freeport LNG Enters Into Consent Order with PHMSA That Could Permit Initial Restart of Operations by Early October

Originally published for customers August 5, 2022

What’s the issue?

The Freeport LNG terminal experienced an incident on June 8 that forced the facility offline and it has remained offline since then. On August 3, Freeport issued a press release indicating that it had entered into a Consent Order with the Pipeline Hazardous Materials Safety Administration (PHMSA) related to the June 8 incident. Freeport indicated that it believes that it can complete the steps set forth in that order quickly enough to allow a resumption of initial operations in early October. It said those initial operations would allow it to deliver approximately 2 Bcf per day of LNG, which it said was enough to support its existing long-term customer agreements.

Why does it matter?

Natural gas prices in the U.S. were dramatically impacted when Freeport was forced offline on June 8 and its resumption of service will likely impact prices here and may impact the ability of Europe to prepare for winter without Russian natural gas.

What’s our view?

While a restart of the facility by early October is not out of the question, the timelines set forth in the Consent Order lead us to believe a restart of initial operations to the extent indicated is a very aggressive timeline. A more reasonable timeline would put such a restart at the end of this year or the beginning of next.

The Freeport LNG terminal experienced an incident on June 8 that forced the facility offline and it has remained offline since then. On August 3, Freeport issued a press release indicating that it had entered into a Consent Order with the Pipeline and Hazardous Materials Safety Administration (PHMSA) related to the June 8 incident. Freeport indicated that it believes that it can complete the steps set forth in that order quickly enough to allow a resumption of initial operations in early October. It said those initial operations would allow it to deliver approximately 2 Bcf per day of LNG, which it said was enough to support its existing long-term customer agreements. Natural gas prices in the U.S. were dramatically impacted when Freeport was forced offline on June 8, and its resumption of service will likely impact prices here and may impact the ability of Europe to prepare for winter without Russian natural gas.

While a restart of the facility by early October is not out of the question, the timelines set forth in the Consent Order lead us to believe a restart of initial operations to the extent indicated is a very aggressive timeline. A more reasonable timeline would put such a restart at the end of this year or the beginning of next.

Incident on June 8 at Freeport LNG and the Consent Order

We discussed the facts underlying the incident on June 8 in Freeport LNG is Offline For At Least 90 Days and Gas Will Need to Go Somewhere. As we noted then, Freeport initially indicated that it would be shut down for just three weeks, but revised that to ninety days or perhaps until the end of this year. On June 30, PHMSA issued a Notice of Proposed Safety Order that was based on its preliminary investigation of the June 8 incident. Based on that preliminary investigation, PHMSA found that the “continued operation of Freeport’s LNG export facility without corrective measures may pose an integrity risk to public safety, property, or the environment” and proposed certain measures that Freeport should take to address the potential risks.

Rather than contesting the proposed safety order, on July 1, 2022, Freeport requested an informal consultation with PHMSA, which was held virtually on July 6, 2022. As a result of the informal consultation, PHMSA and Freeport entered into a Consent Agreement on August 2, which was incorporated by PHMSA into the Consent Order dated August 3.

Impact on U.S. Natural Gas Prices

While attributing the market price moves of a commodity to a particular event is often a fraught endeavor, the general perception with regard to the Freeport incident is that it caused prices here in the U.S. to fall because gas which would have been exported was stuck here at home, which led to a temporary oversupply of gas. The prices at the Henry Hub would seem to support this view.

As seen above, prices for natural gas had been on a steady climb from January 1, 2022 to June 8, from 3.74/MMBtu to 9.43/MMBtu, but fell by over ten percent the next day and continued to slide, reaching a low of 5.65/MMBtu on July 6, a drop of 40% from the day before the incident at Freeport.

Timing of the Freeport Restart

As we mentioned, Freeport initially said it expected to restart within three weeks following the incident, but then modified that to three months or perhaps until the end of this year. In the press release it issued on Wednesday, it reaffirmed its belief that it can “complete the necessary corrective measures, along with the applicable repair and restoration activities, in order to resume initial operations in early October.”

While Freeport undoubtedly has far more knowledge about how quickly it can complete the tasks set forth in the Consent Order, the timelines in that order would indicate this is a very aggressive schedule.

Plan the Work

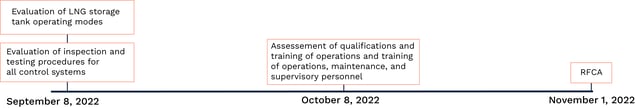

There are a number of key dates under the consent order between PHMSA and Freeport. The first of these is the date on which PHMSA approves Freeport’s choice of a qualified independent third-party consultant that is required to perform three evaluations and assessments under the order: an evaluation of the LNG storage tanks operating modes; an evaluation of inspection and testing procedures for all control systems; and an assessment of the qualifications and training of operations, maintenance, and supervisory personnel. Another independent third party, already retained by Freeport, the IFO Group, is required to provide a root cause and failure analysis (RCFA).

The timeline for these four events are measured either from the date PHMSA approves the independent third party, which had not occurred as of August 2, or the date on which the order was issued, August 3. Assuming that the approval of the third-party consultant occurs by August 9, the due dates for these reviews are as follows:

There are other deadlines in the Consent Order but they require action by Freeport and so we assume that they can be accelerated, but these four deadlines apply to independent third parties and are therefore not necessarily under Freeport’s control. The fact that two of these deadlines occur in or after October makes the purported start of interim operations by early October somewhat suspect.

Work the Plan

This is further complicated by the fact that the RCFA must be given to Freeport and PHMSA simultaneously, so that Freeport will likely have little advance knowledge of the final report’s contents. Also, Freeport will not be able to prepare its remedial work plan (RWP), which is essentially the restart plan for the facility, until all four of these independent reviews are complete, and then Freeport has 30 days to complete that RWP. Even if we assume all of the independent reports are completed by October 8 and that Freeport takes two weeks to prepare its RWP, that would mean PHMSA will not even have a plan to review for approval until October 22. There is no time limit placed on PHMSA’s time to review the plan but, once again, this activity is beyond Freeport’s control. As stated in the Consent Order, PHMSA is allowed to: (1) approve, in whole or in part any plan; (2) approve the plan on specified, reasonable conditions; (3) disapprove, in whole or in part, the plan; or (4) any combination of the foregoing.

If we assume it will take PHMSA thirty days to review and approve the plan submitted by Freeport on October 22, that would put the approval of the restart plan for the facility off until November 22, and then Freeport would still need to implement the approved plan. While PHMSA may approve the restart of portions of the facility without approving a full restart, Freeport has indicated that it needs three liquefaction trains, two LNG storage tanks and one LNG loading dock to meet the 2 Bcf/day goal mentioned in its press release. This seems like more than just a small portion of the facility. Finally, FERC will also need to approve the restart of the facility. While we fully expect that FERC will let PHMSA lead the process, that is yet another approval that must be obtained before the facility can be restarted.

If we string all of the timelines together and assume they are all completed on the dates called for and no extensions of time, as permitted under the Consent Order, are needed, the submission of the restart plan for approval by PHMSA would not occur until December 1. Assuming PHMSA takes thirty days to approve the plan and Freeport takes thirty days to implement the plan needed to restart three liquefaction trains, two LNG storage tanks and one LNG loading dock, that initial restart would not occur until January 30, 2023, far later than early October.