FERC Reverses Course, But Some Celebrate Prematurely

Originally published for customers March 30, 2022.

What’s the issue?

At February’s open meeting, FERC, on a straight party-line vote, issued two new policies that were designed to reform its review processes for the issuances of certificates for the siting of interstate gas pipelines. After receiving substantial blowback, including having to answer to the Senate committee with oversight over FERC, the Commission withdrew both of those policies at its open meeting held last week. In addition, FERC approved four pipeline expansion projects at last week’s meeting, which it had not done since Chairman Glick became chairman in January 2021.

Why does it matter?

Purportedly, Chairman Glick was waiting to issue the revised policies before approving any pending projects, but that was put to the test when the Commission unanimously approved the four projects under the original 1999 policy that was reinstated when it withdrew the policies it had issued in February.

What’s our view?

While many in the industry celebrated this victory of forcing the withdrawal of the policies, the risk to the industry is far from over. Chairman Glick has been following the greenhouse gas policy for the past year and there is nothing to stop him from continuing to do so while the policy is sent out for public comments. Issuance of the policies could be designed to put them on hold until Chairman Glick can be renominated, and then, following comments, FERC could just adopt them. The only current commissioner that stands in the way of such a result appears to be Commissioner Phillips, who reversed his vote. Therefore, the risk to the industry will not end until the policies are completely withdrawn and Chairman Glick is forced to abandon his use of the environmental review process to slow the application process for even minor projects to a crawl.

At February’s open meeting, FERC, on a straight party-line vote, issued two new policies that were designed to reform its review process for the issuance of certificates for the siting of interstate gas pipelines. After receiving substantial blowback, including having to answer to the Senate committee with oversight over FERC, the Commission voted unanimously to withdraw both of those policies at its open meeting held last week. In addition, FERC approved four pipeline expansion projects at last week’s meeting, which were the first expansion projects approved since Chairman Glick became chairman in January 2021.

Purportedly, Chairman Glick was waiting to issue the revised policies before approving any pending projects, but that was clearly not required as the Commission went ahead and unanimously approved four projects under the original 1999 policy that it reinstated when it withdrew the policies it had issued in February.

While many in the industry celebrated this victory of forcing the withdrawal of the policies, the risk to the industry is far from over because Chairman Glick has been following the greenhouse gas policy for the past year and there is nothing to stop him from continuing to do so while that policy is sent out for comments. The risk to the industry will not end until the policies are completely withdrawn and Chairman Glick is forced to abandon his use of the environmental review process to slow the application process for even minor projects to a crawl.

The Issued Policies are Revoked and Converted to Drafts

We discussed the policies adopted at FERC’s February meeting in FERC Majority Blocks the Path Forward for Pipeline Projects, where we noted our belief that the policies were so flawed that they would eventually be overturned by the courts. However, we anticipated that the application of the policies to pending projects could doom one or more projects with delays and costs that were simply not expected when the projects were originally filed. Following the February open meeting, the United States Senate Committee on Energy and Natural Resources, which is responsible for overseeing FERC, held hearings on the new policies and the Republicans and Chairman Manchin delivered a pretty harsh assessment of the policies.

Some are giving Chairman Glick credit for listening to the complaints from the senators and the industry in voting to pull the policies back at this month’s open meeting. But a careful reading of the statements that accompanied the decision to revoke the policies leads us to the conclusion that neither Chairman Glick nor Commissioner Clements would have done so if they had not been forced by the reversal of Commissioner Phillips’s vote in favor of the policies. Commissioner Phillips’s statement was the only one of the three Democratic statements that expressed any true misgivings about the substance of the policies, as opposed to the process that had been followed to issue them without the opportunity for comment. Therefore, the issuance of the policies for comment should not give anyone in the industry reason to celebrate as it could just be a calculated effort to put the policies on hold until Chairman Glick can be renominated. Then, following yet another round of comments, FERC could essentially adopt the same flawed policies. The only current commissioner that stands in the way of such a result appears to be Commissioner Phillips.

Mandatory Use of EIS Unlikely to Change

As we discussed in FERC’s New Rule on GHG Ignores the Precedent It Relied On, the only mandatory part of FERC’s GHG policy that it enacted in February was the requirement that staff prepare a full Environmental Impact Statement (EIS) for every project that proposes to increase the capacity of a pipeline by more than 5,200 dth/day. This requirement, however, had already been imposed by Chairman Glick since he became chairman and is unlikely to change merely because the policy was revoked and reissued for comments. In fact, just the day before the policies were put on the monthly meeting agenda for repeal, FERC staff issued a notice of intent to prepare an EIS for Texas Eastern Transmission’s Venice Lateral Project, a $360 million project. Our data from 2008 forward shows that for all prior projects that were expected to cost between $180 and $540 million, or 50% more or less than this project, about 25% of such projects would have been subjected to an EIS as opposed to an EA — yet FERC staff has determined that an EIS is required for this project.

Looking more broadly at the projects that were pending when Chairman Glick became chairman or have since been filed, every single expansion project has been determined to require the preparation of an EIS. This is far from the norm based on our data.

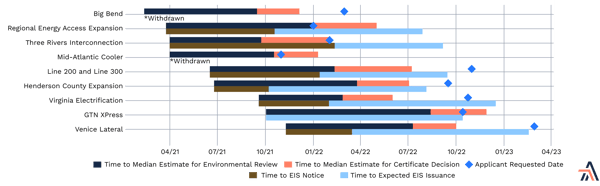

.png?width=600&name=Blog%2003302022%20(2).png)

As seen above, using the estimated cost as an indicator of the complexity of a project shows that for the projects that have come up for environmental review during Chairman Glick’s tenure, all but one of them would have had less than a 50% chance of requiring an EIS and a majority of them would have had less than a 10% chance of requiring an EIS and yet every single one has been subjected to this level of scrutiny. This was done before the issuance of the GHG policy and therefore it is unlikely to change with the revocation of that same policy.

Overly Burdensome Reviews Likely Achieve Many Goals

This intentional decision to require the preparation of an EIS imposes a substantial delay in the timeline of projects. Again, if we compare the same list of projects that were pending at the time Chairman Glick became chairman or that have been filed since, we see this decision to subject the projects to the burden of an EIS, which creates a substantial delay in the timeline a project faces. Using our data for projects since 2008, we can compare the historically expected timeline for similar projects to those currently under review with the actual timelines for those same projects.

As seen above, all of these projects have experienced, and most continue to experience, a substantial delay in the review timeline for apparently no other reason than the capacity they are providing exceeds some level the chairman established long before the issuance of the GHG policy.

This decision also imposes additional costs on a project because when FERC staff determines it will prepare an EIS, it almost always requires the applicant to provide and pay for a consultant to assist staff in the preparation of that document. While this cost may not be significant for a project estimated to cost $1.5 billion like the Line 200 and Line 300 project, it can be a significant unexpected expense for a $75 million project like GTN Xpress.

The delay caused by this review can also simply lead to projects being canceled. Two of the smaller projects caught in this new burdensome review, the Big Bend project and the Mid-Atlantic Cooler project, simply chose to withdraw their applications. BHE Energy’s Eastern Gas Transmission and Storage actually referenced the inordinate delay in its withdrawal, noting that despite the limited scope of the project and only a $29.2 million estimated cost, FERC had taken no action to prepare an EA for the project even five months after it had been filed. Based on our historic norms, that five months should have been almost enough time to complete the review for such a project and not simply start the review.

What is an Applicant to Do?

Former Chairman Chatterjee has tweeted that he is urging every pipeline to rush their projects to FERC while the policies are out for comments because in the revocation notice FERC indicated that it would not apply the policies to any applications pending at the time they are reissued. We wish we could be equally optimistic, but much of what the policies sought to do can be done under the existing 1999 policy by a majority of the Commission. In addition, as we outline above, the delays and costs imposed by an overly burdensome environmental review remain firmly within the chairman’s control with or without the policies.

While FERC approved four projects at the open meeting in March, it is somewhat unclear whether we will see any other approvals in the near term. The language contained in the orders granting the certificates in all of the cases was not endorsed by a single commissioner, as all five wrote concurring opinions. In addition, three of the four projects were designed to provide supply to export terminals, and the decisions in those cases essentially asserted that such a purpose precluded FERC from even considering the climate impacts of the downstream GHGs. In the fourth project, Iroquois’s ExC project, the state of New York had required Iroquois to conduct a life-cycle analysis of the expected GHG impacts from the project under various scenarios. The FERC decision found that one scenario, the “Heat Pumps and Oil Scenario” was “on balance, the best estimate of the project’s climate change impacts.” Because under that scenario, the project would result in a net reduction of GHG emissions, FERC decided it did not need to assess “whether the project has a significant impact on climate change.”

Clearly not every project that is pending or being considered for filing with FERC would fall within these two limited categories, and it remains very unclear how FERC will split on some of the remaining projects. Until that is known, it would seem premature to “rush” a project’s application simply to meet an arbitrary deadline. Instead, the industry would likely be better served by remaining focused on taking all steps necessary to ensure that the ill-advised policies are formally withdrawn and that the continued implementation of many aspects of those policies is terminated.