Examining the FERC Backlog and Looming Large Diameter Projects

Originally published for customers June 14, 2023

What’s the issue?

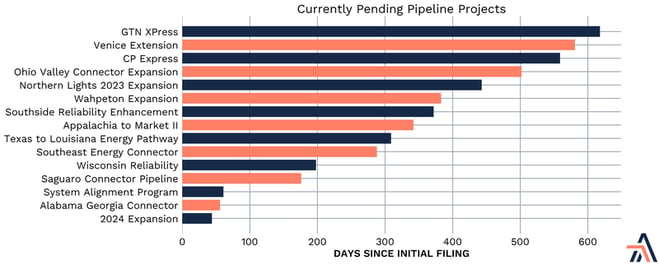

Ahead of this month’s FERC meeting, there are 15 projects pending before the Commission, with the average time at well over a year.

Why does it matter?

Project delays continue to result in cost overruns and increased financial burdens for developers. Delays will lead to lost revenue opportunities and increased project costs, negatively impacting project viability and economic growth. The prolonged delays associated with natural gas projects can perpetuate reliance on less clean fuel sources, such as coal, impeding the transition to cleaner and more sustainable energy sources.

What’s our view?

Acting Chairman Phillips has taken significant steps during his tenure as acting chairman to unwind some of the actions as a result of the Glick era FERC, but there is still more to be done to achieve an efficient and effective FERC. By clearing the backlog, a significant amount of capacity can become available by the end of 2025.

The development of natural gas projects continues to face delays due to a variety of factors, ranging from environmental concerns to regulatory challenges. There are several major FERC-regulated natural gas projects currently pending approval, as well as several under construction that have the potential to come into service by the end of 2025.

Ahead of this month’s Commission meeting, Arbo analyzed FERC's publicly available project data to examine what's currently pending in the backlog. We define a project as backlogged if its environmental review has been completed but the Commission has not issued a certificate or a denial. There are 15 backlogged pipelines today, with the average backlog time at well over a year (465 days at the time of this article).

First, we'll take a look at the 15 projects. The graph below shows all the major pipeline projects pending before the Commission, and how many days since their initial application was filed.

GTN Xpress and other projects encountering delays have significant implications for the industry and broader society. Project delays continue to result in cost overruns and increased financial burdens for developers, and can lead to lost revenue opportunities, negatively impacting project viability. The prolonged delays associated with natural gas projects can perpetuate reliance on less clean fuel sources such as coal, impeding the transition to cleaner and more sustainable energy sources.

With GTN XPress’s application pending the longest at 618 days at the time of this article, we still have not seen any indication of a certificate by the Commission. Recently, there have been two data requests, one discussing energy markets and engineering requests, and another relating to engineering.

Three natural gas projects are set for this Thursday’s FERC Open Meeting — Equitrans Ohio Valley Connector Expansion Project, Stingray Pipeline Company’s abandonment of an existing offshore project, and an order on a rehearing request for NEXUS Gas Transmission’s NEXUS project. Noticeably absent is GTN XPress, which was filed almost a full year before Ohio Valley Connector Expansion. Over the coming weeks, we’ll be closely monitoring the GTN XPress docket for updates and perhaps a clue into the reason behind FERC’s noticeable inaction.

How Does the Current Backlog Compare?

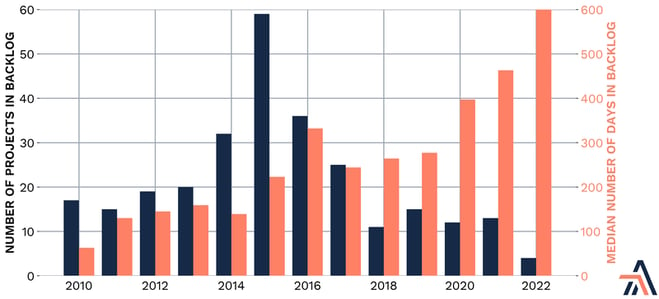

To measure the extent of a backlog, one needs to know how many cases are pending at a particular time and for how long on average. We used FERC data to calculate this for each of the years beginning at the end of 2010 and at the end of each year after that.

The chart above shows the number of projects waiting for a FERC decision at the end of each year and provides the median for how long those cases had been pending as of December 31 of each year. The data demonstrate that the current number of projects awaiting a decision is among the lowest numbers seen in almost a decade. The median time for the projects in the backlog has certainly significantly increased even compared to the large project buildout back in 2016.

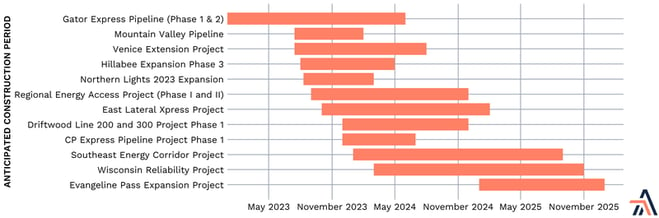

Pipeline Projects as a Proxy

In the coming years, several significant gas pipeline projects are set to be completed. To analyze these FERC projects, we relied on data from Arbo’s platform and research into the status of the pending and approved projects. Today, we look closely at the eleven large diameter (30 inch or more) pipeline projects with potential to go into service by 2025 and their anticipated construction periods.

As can be seen above, 18.2 BCF/d capacity will likely come online in 2024, with another 2.9 BCF/d coming online in 2025. As FERC looks to clear the backlog, including compression only projects, that number could be as high as 25 BCF/d by 2025. It is important now more than ever for FERC to act on clearing the backlog of projects pending before the Commission to enable the transport of natural gas, expanding access to clean energy and reducing reliance on more carbon-intensive fuels.

Acting Chairman Phillips has taken significant steps during his tenure as acting chairman to unwind some of the actions taken by the Glick era FERC, but still more can be done to achieve an efficient and effective Commission.