What’s the issue?

Every five years, FERC sets a rate that is used by almost all of the liquids pipelines it regulates to increase their rates for the next five years.

Why does it matter?

The level set by FERC is a good barometer of the potential growth in revenue for these liquids pipelines for the next five years.

What’s our view?

We expect that Chairman Glick will be able to bring Commissioner Clements and Commissioner Christie on board with his dissent to FERC’s original order, and that the index for the coming five-year period will be closer to the negative 0.12% we projected last August, rather than the positive 0.82% sought by the pipeline industry.

In Change in FERC Leadership Could Impact Oil Pipelines First, we anticipated the elevation of Commissioner Glick to the chair at FERC and noted his vehement dissent last December from FERC’s order that fixed the index to be used for the next five years to determine the tariff rates for most liquids pipelines throughout the country. Since then, the expected requests for rehearing have been filed by the usual parties to this proceeding, and the realm of likely outcomes has narrowed. FERC was supposed to issue its order in this case last Thursday, but instead issued a tolling order that simply delayed a final decision to some undetermined date in the future.

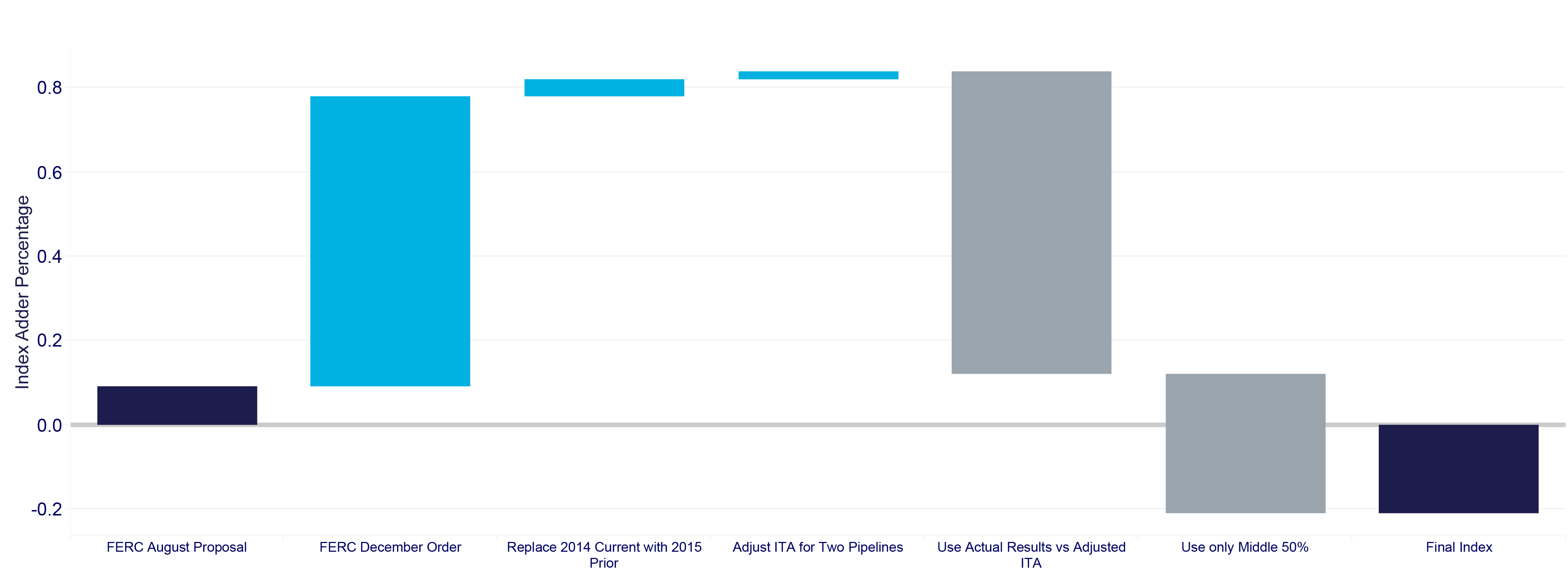

Today we look at how the change in the composition of the Commission may impact the decision on those rehearing requests and then analyze what the result might ultimately be with respect to the actual index to be used. For those keeping score, FERC’s original proposal last summer was to set the index at 0.09% above the Consumer Price Index for Finished Goods (CPI+FG). In its order last December, FERC determined that the rate should, in fact, be 0.78% above CPI+FG. As we discuss in more detail below, we expect that this proposed rate will not hold through the rehearing process and anticipate that the final approved rate, which will likely be appealed to the courts, will be about 0.21% below CPI+FG .

Time Flies

When FERC issued its order at the December open meeting fixing the oil index rate, only three commissioners voted on that order, and the vote was 2-1 with then-Chairman Danly, joined by Commissioner Chatterjee, in favor of the decision, with Commissioner Glick vehemently dissenting, and Commissioner Clements not participating. Since then, Commissioner Christie has joined the Commission, Chairman Danly was demoted and Commissioner Glick was made the chairman. The parties filed their requests for rehearing on January 19, 2021, and last Thursday, rather than issue an actual decision, FERC issued an order that simply gives it more time to reach that decision. As we discuss more fully below, we see the following as the range of possible outcomes, but think that Chairman Glick will be able to persuade the two newest members to join him at the lower end of the range.

The Range of Possible Outcomes

Despite getting almost everything it asked for from FERC in the December order, the liquids pipelines industry is seeking two additional changes to the rate to be fixed by the final order.

First, both the Association of Oil Pipelines and a group of pipelines consisting of Buckeye Partners, L.P., Colonial Pipeline Company, Energy Transfer LP, Enterprise Products Partners L.P. and Plains All American Pipeline, L.P. (calling themselves the “Designated Carriers”) believe that FERC used the wrong data for its calculations for approximately thirty pipelines. FERC relies on the data that is filed in the Form 6 reports that each pipeline files on an annual basis. That form provides the data for the current year and for the past year. The base year for the current calculation is 2014, but the question is whether FERC should use the current year amounts reported in the 2014 Form 6 or the prior year amounts reported in the 2015 Form 6. The parties are right that FERC has generally used the prior year numbers, presuming that they are the most accurate. However, FERC modified the actual numbers that were filed this time to adjust for its change in income tax policy, which we discuss below. It is unclear, therefore, whether its use of 2014 current year data was unintentional or not. However, we think it is likely that it was inadvertent, and FERC will now choose to use the 2015 prior year data instead. This one change would result in the index increasing from 0.78% to 0.82%.

The Designated Carriers also seek an additional change concerning the adjustments made by FERC to account for its change in its income tax allowance policy. In the December order, FERC adopted a change requested by the Designated Carriers to adjust the as-filed data for 2014 to eliminate the income tax allowance that had been reflected in those numbers for pipelines that were owned by a master limited partnership. As we discussed in Oil Pipelines Press for Major Increase in Rates and the Impact of New Commissioners, the industry had argued that this was necessary because of FERC’s policy change to no longer allow an income tax allowance for such pipelines. FERC accepted this argument in the December order and adjusted the 2014 numbers by eliminating the income tax allowance reported in 2014 and removing an “estimated amount” of Accumulated Deferred Income Taxes from each pipeline’s balance sheet. The Designated Carriers asserted in their rehearing request that FERC didn’t properly adjust the numbers for two pipelines, MPLX Ozark Pipe Line LLC and Lambda Energy Gathering LLC. Adjusting the 2014 numbers for these two pipelines would further increase the index from 0.82%, resulting from the first adjustment discussed above, to 0.84%.

Shippers’ Reactions

The shippers were far less pleased by FERC’s December order and instead rely heavily on Commissioner Glick’s dissent in arguing that the index should be greatly reduced in the final order. We do not think the shippers would object to the first change suggested by the pipelines above because they appear to agree with the use of 2015 Form 6 prior year numbers for 2014. However, the shipper groups would object to the second change because they fundamentally disagree with any adjustment to the 2014 data. The shippers argue that the FERC decision to adjust the as-filed numbers to eliminate the tax allowance for pipelines owned by master limited partnerships denies them the benefit that shippers on gas pipelines received from that change in FERC policy. In addition, the shippers fundamentally disagree with FERC abandoning its historic practice of relying on the middle 50% of the pipelines to derive the index rate and instead using the middle 80%, which included a number of pipelines with substantially higher changes in their costs.

The first argument made by the shipper groups was described by Chairman Glick in his dissent as FERC “break[ing] its promise” to make sure that the change in income tax policy accrues to the benefit of shippers when the index was calculated this year. We expect that Chairman Glick will be able to bring Commissioners Clements and Christie on board to his view and the views expressed in 2018, when FERC stated that the “effects of the post-United Airlines’ policy changes (as well as the Tax Cuts and Jobs Act of 2017)” would be included in the industry-wide oil pipeline costs in the 2020 five-year review. Making this one adjustment in the calculation eliminates almost all of the increase in the index that arose from the August FERC staff proposal and the December order, causing the index to fall from 0.78% to only 0.12%.

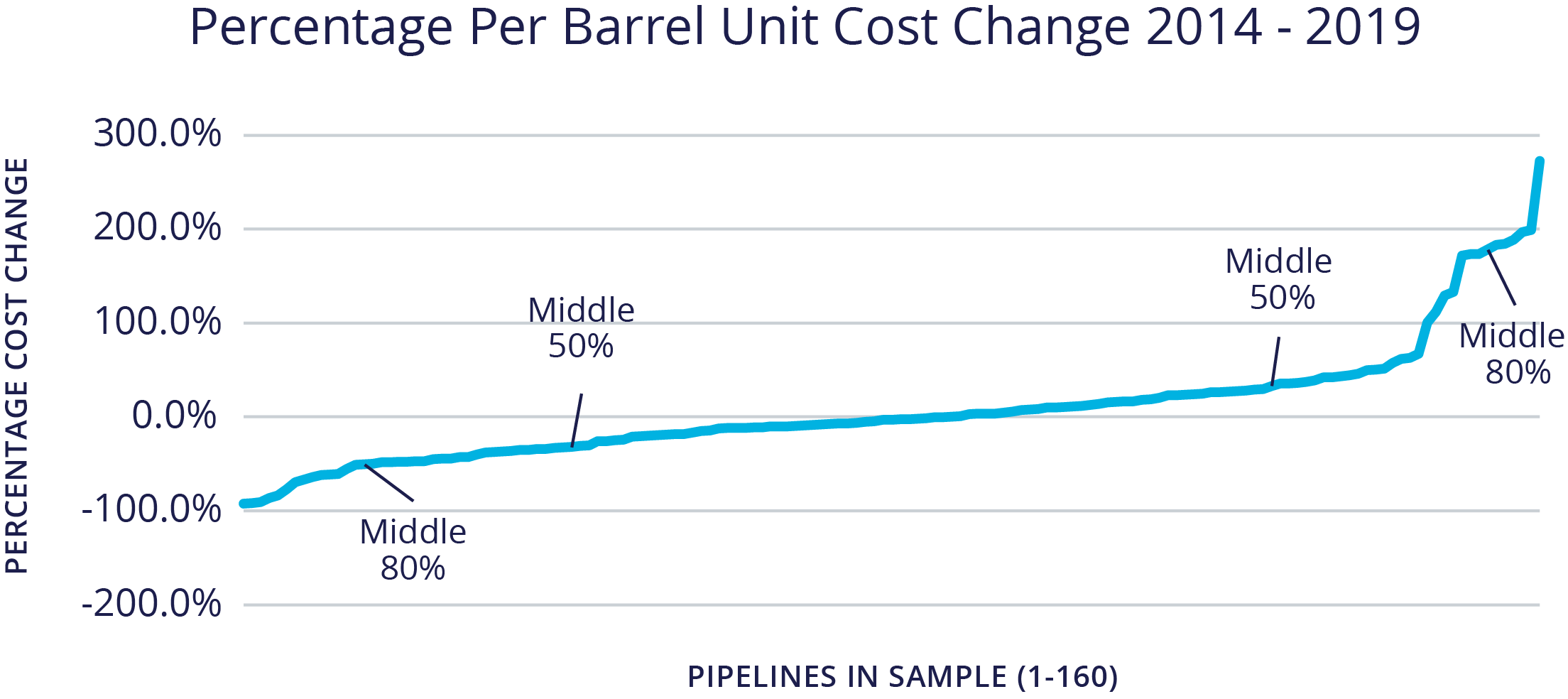

FERC’s decision to expand the data set from the middle 50% to the middle 80% was also a key concern raised by Chairman Glick’s dissent, and Chairman Glick’s objection seems to be well-founded. Since taking office, Commissioner Christie has explained in his press interviews that he understands the limited role of the regulator and that he will support decisions that are best able to be sustained if challenged in court. We expect that he and Commissioner Clements would support reverting to the middle 50%, which has been sustained on appeal in the past. The visual provided by the Liquids Shipper Group, a group consisting of Apache Corporation, Cenovus Energy Marketing, ConocoPhillips, Devon Gas Services, Equinor Marketing & Trading, Fieldwood Energy, Marathon Oil, Murphy Exploration and Production, Ovintiv Marketing, and Pioneer Natural Resources, shows how expanding the data set skews the results much higher than results obtained by using the traditional middle 50%.

If FERC were to adopt the first suggested change of the pipelines, to use the prior year numbers from the 2015 Form 6, but also adopt these two changes advocated by the shippers as suggested by Chairman Glick in his dissent, the index would drop from a positive 0.78% in the order to a negative 0.21%. This would mean that for each of the next five years, most oil pipelines would have to adjust their rates on an annual basis by 21 basis points below the CPI+FG. We fully expect that these two revisions will be made in the final order, and that the index will end up being negative as requested by the shippers, as opposed to the positive 0.82% requested by the pipelines. No matter where FERC ends up on these issues, we fully expect the decision to be appealed. However, by hewing closer to its previously approved positions, FERC would more likely be able to sustain its order in such an appeal, and that may be the reason Commissioner Christie can be convinced to join his Democratic colleagues.